Southwest Airlines is cutting more than 100 routes from its 'full' schedule this winter

Southwest Airlines may be among the first U.S. carrier to resume nearly its entire schedule with plans to operate a full complement of flights this winter after deep cuts during the coronavirus pandemic.

The Dallas-based carrier loaded a schedule of 226,446 flights in November and December on Saturday, according to Cirium schedules. That is only 1.5% fewer flights than it flew during the same period in 2019, and an impressive recovery after cutting nearly two-thirds of its schedule in May.

"As we've seen in past downturns, we've been able to capture substantial demand post the downturn," said Southwest commercial chief Andrew Watterson in an interview on the schedule on May 28. "We'd expect no different this time."

Get Coronavirus travel updates. Stay on top of industry impacts, flight cancellations, and more.

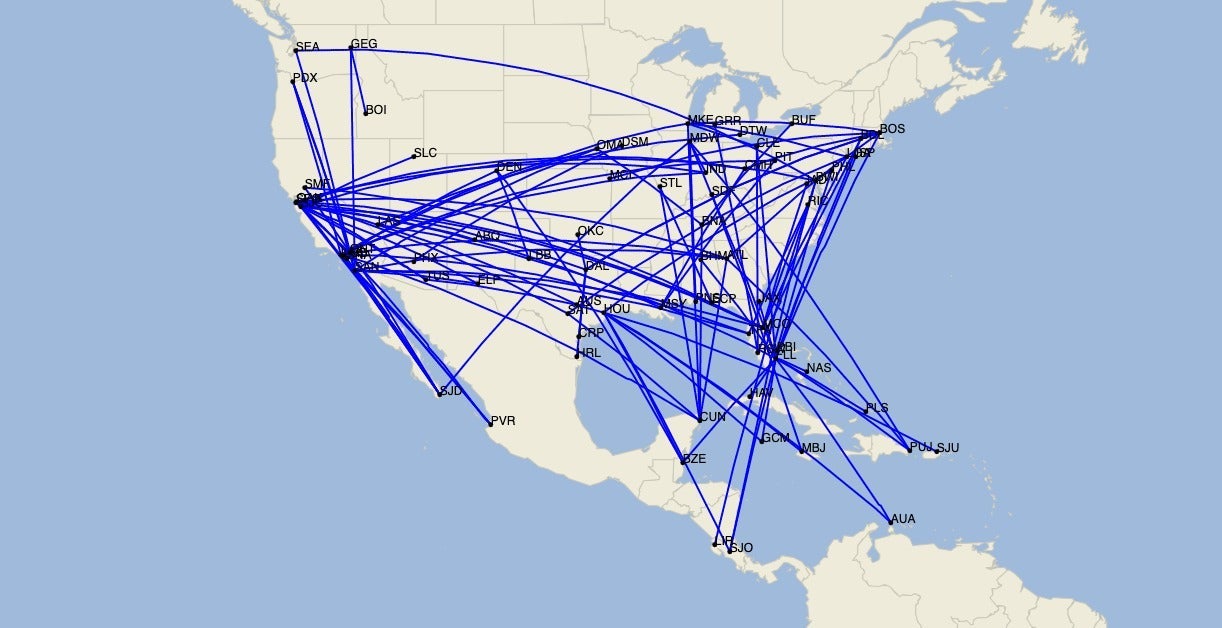

But a full complement of flights does not mean Southwest will resume all of the routes it flew before COVID-19. The airline's schedule includes roughly 111 fewer routes this November and December than it flew during the same period in 2019, Cirium shows. The numbers do not include routes to Newark Liberty (EWR) where the airline ended service on Nov. 3, 2019.

In addition to the suspended routes, Southwest plans to launch 11 new routes beginning in November. It also maintains plans to add Steamboat Springs, Colorado (HDN) this winter.

While 111 is a high number of suspended routes, operations remain in flux and Southwest can adjust its November and December schedule -- either adding back routes or taking more away -- over the next five months.

Related: Southwest Airlines adds 11 new routes, plans to resume a full schedule by year's end

The published cuts cleave a wide swath across the carrier's route map with few markets spared. International destinations Belize City (BZE), Grand Cayman (GCM) and Providenciales (PLS) remain completely suspended though that could change as local arrival restrictions ease.

Internationally, Southwest will operate 35 fewer routes this winter than it did at the end of 2019.

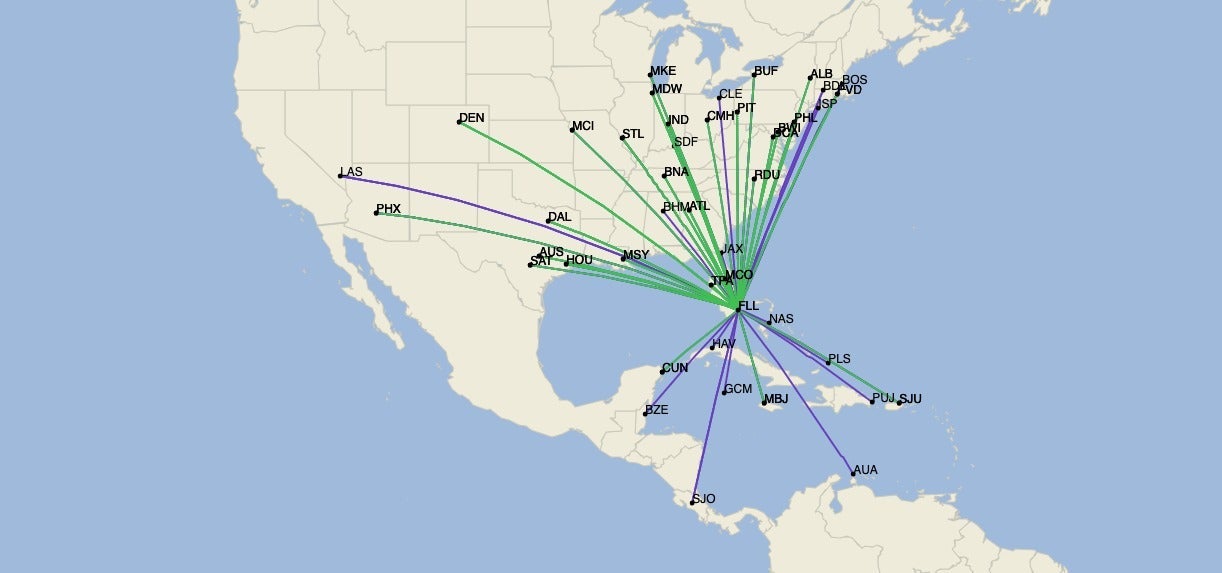

The city most affected by Southwest's route cuts is Fort Lauderdale (FLL). The airline will end all but two international routes -- to Cancun (CUN) and Montego Bay (MBJ) -- as well as nonstop service to Birmingham (BHM), Boston (BOS), Cleveland (CLE), Jacksonville (JAX), Hartford (BDL), Las Vegas (LAS), Long Island MacArthur (ISP) and Louisville (SDF).

Southwest faces stiff competition in Fort Lauderdale. The airport is also a base for JetBlue Airways and the headquarters of Spirit Airlines. Neither JetBlue nor Spirit have published a full schedule for the end of the year yet.

Related: State-by-state guide to coronavirus reopening

Transcontinental routes are also adversely impacted by Southwest's route adjustments. Los Angeles (LAX) loses nonstop flights to Atlanta (ATL), Pittsburgh (PIT) and Tampa (TPA); Oakland (OAK) to Atlanta and Orlando (MCO); San Diego (SAN) to Atlanta, Orlando and Tampa; and San Jose, California (SJC) to Baltimore/Washington (BWI) and Orlando.

Connectivity, something that briefly became a hallmark of Southwest's schedule in May and June, remains high at the end of the year. The airline is boosting its schedule at its large bases in Denver (DEN) and Phoenix (PHX), where it also offers travelers numerous flight connections, in November and December.

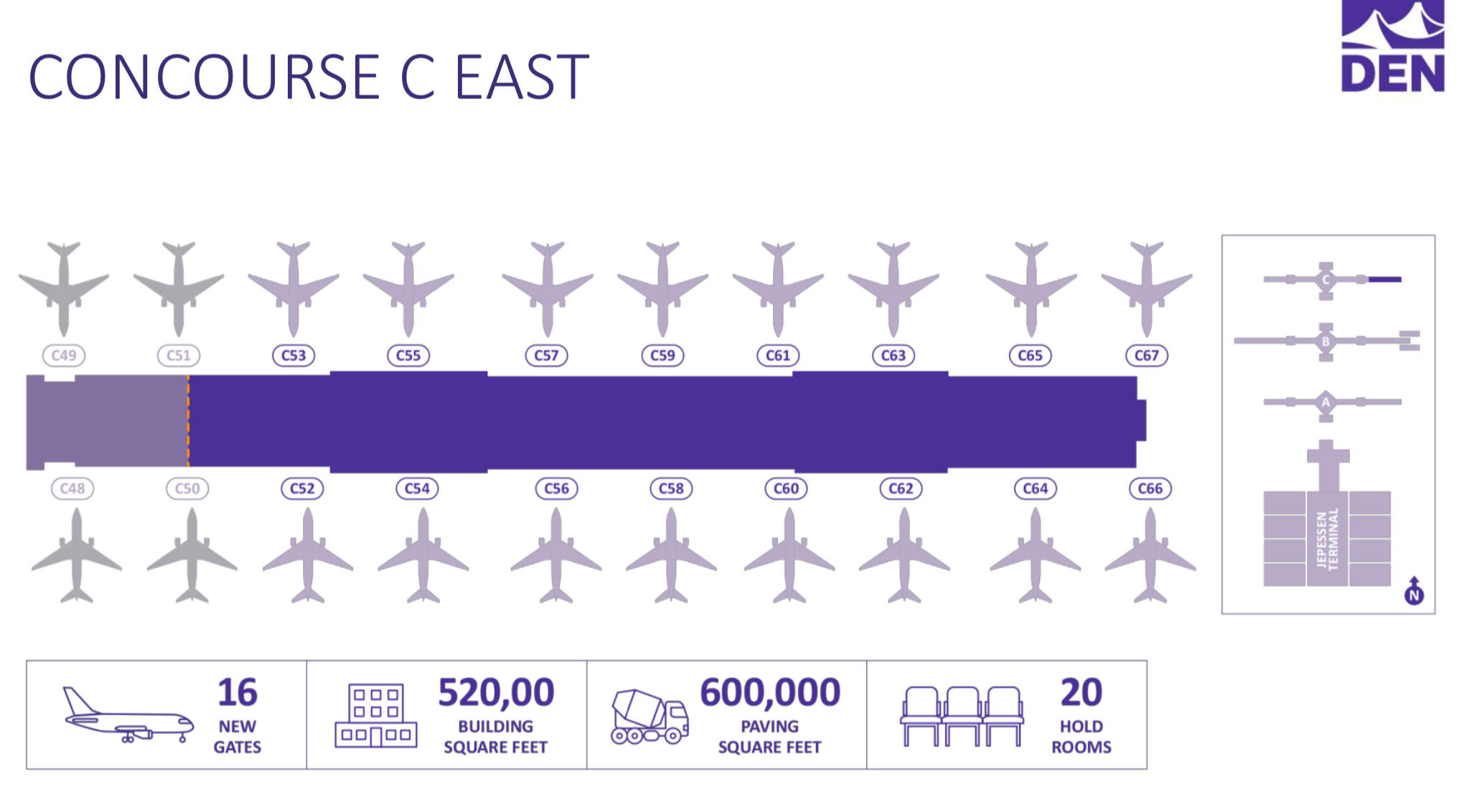

The carrier will operate nearly 16% more flights, or up to 263 departures a day, from Denver at the end of the year compared to 2019, Cirium shows. Southwest flew up to just 214 departures from the Mile High City last December.

The expansion in Denver is an acceleration of a strategy outlined earlier this year. In comments to the Denver City Council in February, Southwest managing director of airport affairs Steve Sisneros said the airline planned to add "depth and breadth" to its schedule with 16 new gates at the airport. However, those new gates were not scheduled to come online until 2022.

Related: Southwest Airlines has big plans for its new gates in Denver

Earlier in May, Denver airport CEO Kim Day told TPG that the airport hoped to accelerate work on the expansion of its three concourses with passenger traffic numbers down due to the pandemic. The works are scheduled for completion in 2022.

Keeping with its connectivity theme, Southwest is also pulling some routes along the West Coast where it competes with Alaska Airlines. These include between Portland, Oregon (PDX) -- one of Alaska's core bases -- and Los Angeles, Ontario (ONT) and San Diego in southern California. Southwest flyers will still be able to fly between these cities with a connection, for example over Oakland in northern California.

Southwest's map changes are likely only the beginning as U.S. carriers adjust to fewer flyers over the next few years. For the big 3 -- American Airlines, Delta Air Lines and United Airlines -- that could mean eliminating anything that's not "core" and doubling down on their big hubs in places like Dallas/Fort Worth (DFW), Atlanta (ATL) and Chicago O'Hare (ORD).

Related: How will airlines rebuild their route maps after the coronavirus?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app