Should I Reduce My High Credit Limit If I Don't Use It?

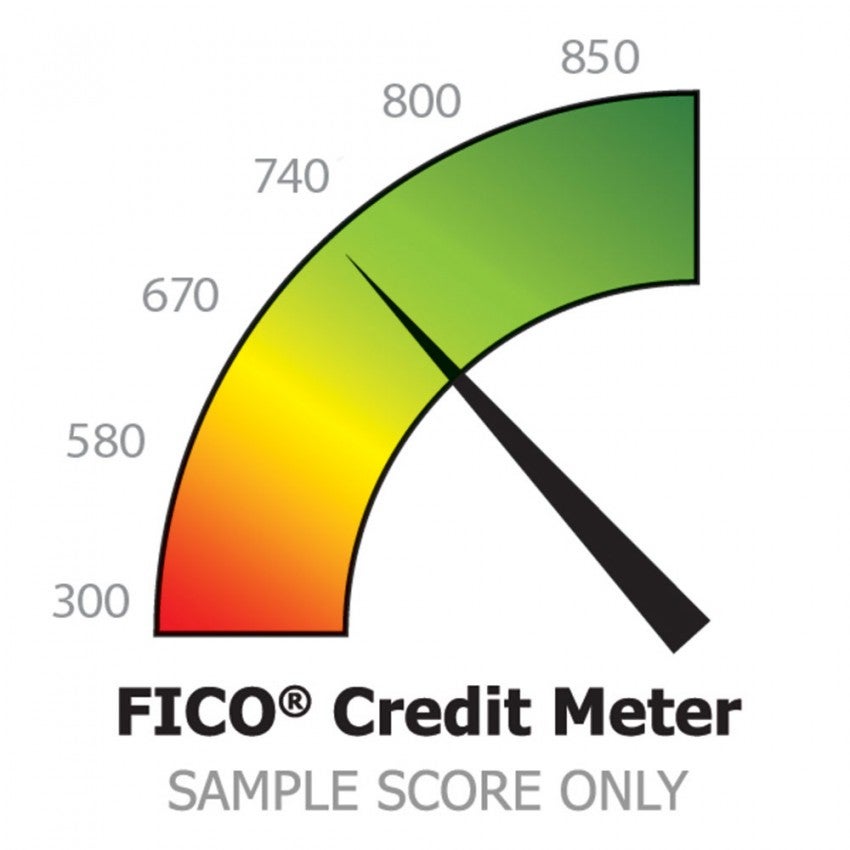

There are a lot of different factors that influence your credit score, the biggest ones being paying your bills on time, and the amount of credit that you're utilizing. For example, if you've got $20,000 of available credit between all your accounts, and you're running a combined balance of $17,000, that represents a high credit utilization, and tells credit card companies that you're spending outside of your means. If you apply for new credit, chances are that you're going to continue spending similarly, so a lot of companies will decline applicants who have high utilization.

TPG reader Mikhail tweeted me:

"@thepointsguy I have a high credit limit that I don't need. Can I lower it without impacting my credit score? I pay the balance in full."

First, Mikhail, good job for paying your balance in full! You should also try to pay it as early as possible, because even if you pay in full, credit card companies report at different times, and can even report your balance before they receive your payment. That's one aspect of credit that I hate; it's not right that even if you pay your bill on time, you can still have that balance reported as utilization.

At any rate, given that a low utilization is better, there's really no benefit to reducing your credit limit, even if you don't plan on using it. Your score will not go up if you have less credit. If the credit card company reports your credit mid-month (before you've paid), and you have less overall credit available, your utilization will appear higher and your score could drop. So, preemptively slicing your available credit will probably just hurt your score.

I'd say keep your credit in case you ever need it. You might get a new job and have the ability to pay for a large company expense out of pocket; you'll be reimbursed and you can keep those points. I think having the available credit just in case of a situation like that is useful, and to make sure whatever credit you do use results in a lower utilization.

If for some reason you apply for a new card and are declined or are put in pending because you have too much available credit, you can always call up and request to move credit around. Most banks will allow you to take existing credit and apply it towards the opening of a new account.

Again, my advice is that you don't reduce your credit limit, as doing so will probably hurt your score.

Check out these related posts for more info:

How Card Applications Affect Your Score

When to Cancel a Card

How to Get a Free FICO Credit Score from Certain Credit Cards

How Many Credit Cards Do You Have Open at Once?

If you have any additional questions, please message me on Facebook, tweet me @ThePointsGuy, or send me an email at info@thepointsguy.com.

[card card-name='Barclaycard Arrival™ World MasterCard®' card-id='22089566' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app