Answering your burning points and miles questions

We're taking a break from using this weekly column to answer France- or trusted traveler-related questions, and instead zeroing in on the heart of what TPG does — providing our points and miles expertise to empower you in your own trip planning.

In order to answer this week's top questions, I had to phone a few friends — my savvy colleagues.

1. I live in Chicago and am planning a trip to Australia and New Zealand. What's the best way to use these points for me and my daughter?

Current points stash: 130,000 British Airways Avios.

"One hundred and thirty thousand Avios won't do much for a trip to Australia if they want to fly business class," TPG Points and Miles editor Andrew Kunesh told me. "Flights via LAX cost 60,000 Avios one-way and business class is 180,000. So, they have enough for two one-ways in coach or one round-trip if award space is open."

2. What is the best way to use points to fly business class round-trip from NYC to Singapore? I prefer to fly nonstop on Singapore Airlines.

Current points stash: Large cache of points — Chase Ultimate Rewards points, Citi ThankYou points, American Express Memberhsip Rewards points and Marriott Bonvoy points.

"I'd say Singapore Airlines' nonstop is the best way unless they want to do the New York City (JFK)-Frankfurt, Germany (FRA)-Singapore (SIN) route and have a stopover in Frankfurt for a couple of days," says Kunesh. "Chase, Amex, Citi, Capital One and Marriott transfer to Singapore Airlines and a round-trip business-class fare costs 198,000 KrisFlyer miles for a nonstop flight. They should also remember that Star Alliance partners cannot book Singapore award tickets in premium cabins."

3. Do I need to establish an account with specific airlines to transfer alliance points, such as Japan Airlines points?

"To answer the first part of the question, you can't transfer to Japan Airlines from any of the major programs," said TPG strategic travel reporter Benji Stawski. Bummer! "In order to transfer points [of any kind], you need a frequent flyer account with the program to which you are transferring. Because otherwise where will you transfer the points to?"

I hate to say it but he makes a good point.

Moving on to a couple of general points and miles questions:

4.How do you determine when it makes sense to use cash vs. miles for airfares?

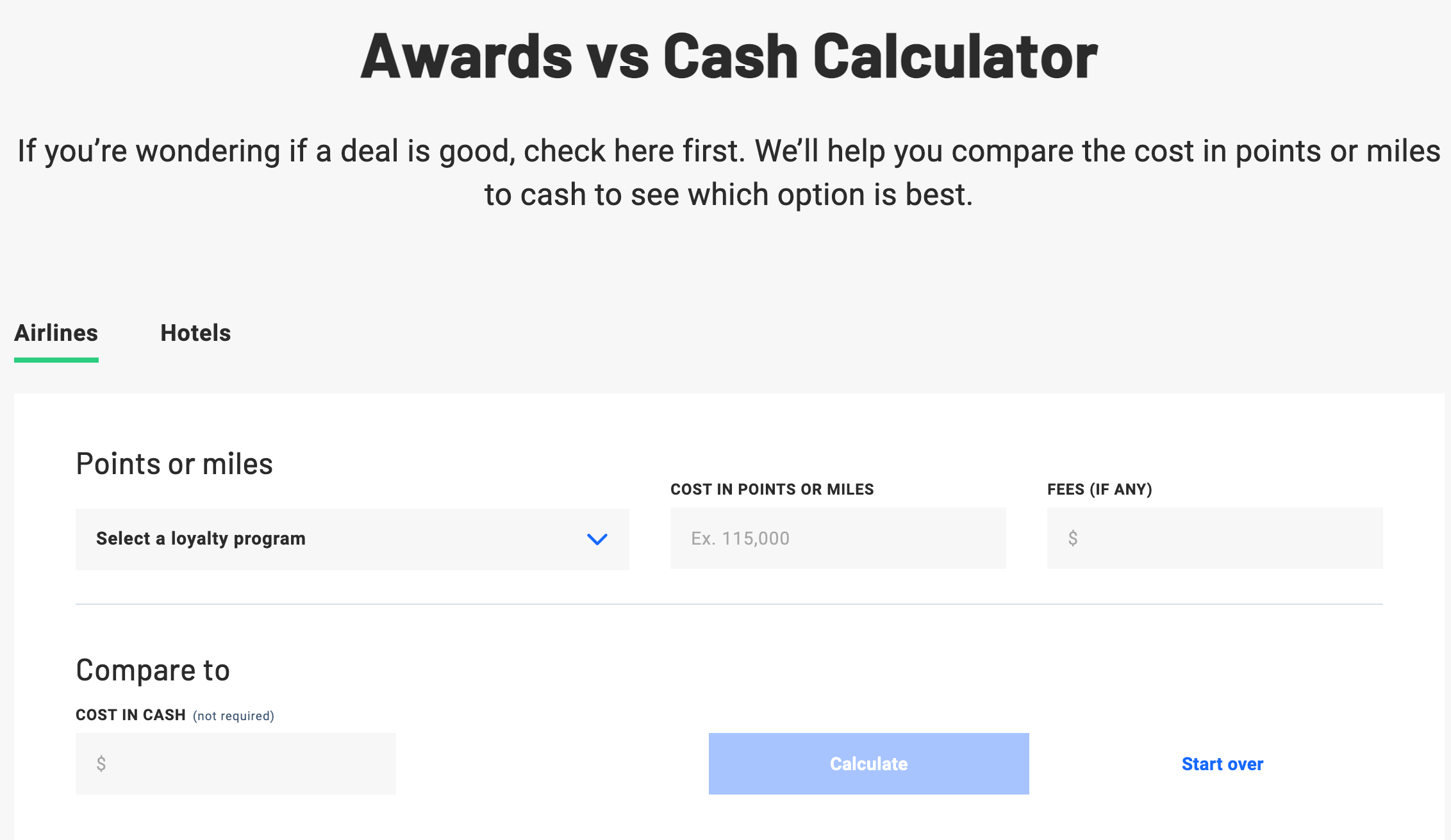

Ah, finally a question I can answer. Luckily for you (and me), TPG developed a points calculator to complement our monthly valuations for the most popular travel loyalty programs.

The TPG points calculator is actually a very cool and easy-to-use tool that helps determine the value of a cash redemption versus an awards redemption to further value reward currency.

If you are a journalist like me (and thereby not a fan of math) or just want to save some time, do yourself a favor and bookmark our calculator and use it anytime you are interested in booking a deal.

5. What is the best approach to figure this out myself without expert advice?

"My main tip would be to always compare the cash cost of an award to the cost in points to make sure you're getting maximum value from your points," advises Stawski. "Remember, TPG publishes monthly valuations for points and miles, which can give you a general idea of how much value you should be getting. And use the calculator!"

In determining whether you're getting that maximum value Stawksi references, you may find yourself "digging through award charts," says TPG senior writer Katie Genter, who encourages points and miles newbies to "get curious about the programs for which you have points."

To calculate a prospective redemption value, she says you should consider two things:

- Are you getting at least TPG's valuation?

- Is there a different use for those rewards that you'd value more?

"If you're flying to a particular destination, check to see if TPG has a guide on how to redeem points and miles for that destination — and make sure your redemption isn't going to cost significantly more than the redemptions highlighted in that guide," she told me. "You can also use the TPG app or a tool like AwardHacker to get an idea of what types of flight redemptions you might be able to get on particular routes."

For what it's worth, I came to TPG last summer with zero points and although I am still very much a points and miles newbie, I am slowly but surely learning as I go thanks to my TPG expert colleagues like Andrew, Benji and Katie, who I must thank for being so willing to help field questions from you and me.

In the meantime, a few reading suggestions:

- Beginners guide to points, miles, airlines and credit cards

- What are points and miles worth? TPG's January 2022 monthly valuations

- How to redeem American Express Membership Rewards points for maximum value

- How to redeem Chase Ultimate Rewards points for maximum value

- How to redeem Citi ThankYou points for maximum value

Have a question for next week? Email me at caroline.tanner@thepointsguy.com or tips@thepointsguy.com.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app