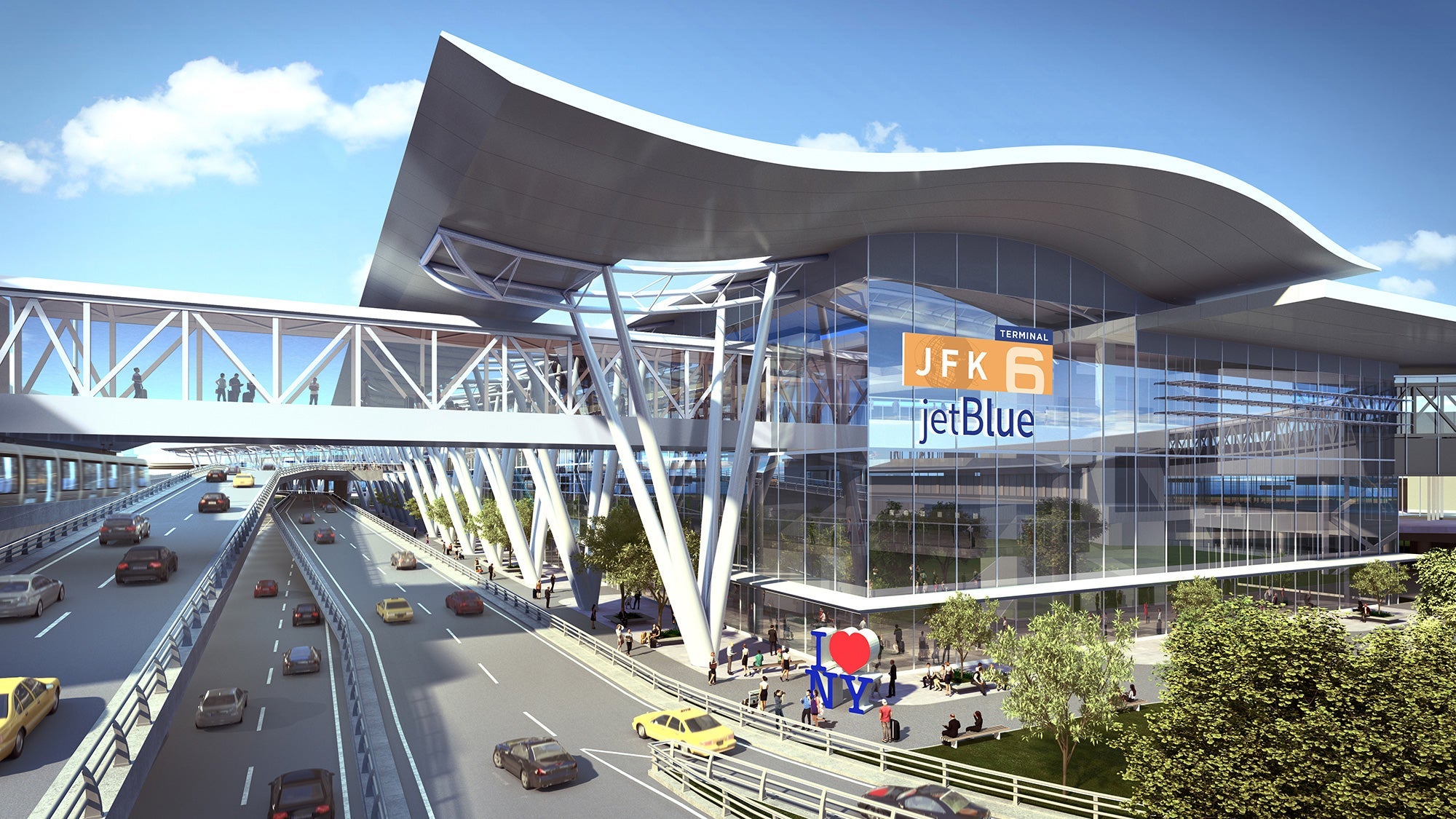

JFK’s new Terminal 6 just hit key redevelopment milestone amid major airport makeover

An overhauled John F. Kennedy International Airport (JFK) in New York is well on its way to becoming a reality.

New York Gov. Kathy Hochul, along with the Port Authority of New York and New Jersey, which oversees the region's major airports, announced on Thursday that the new Terminal 6 project at JFK has secured the necessary funding to move forward with construction.

The agency worked to secure $4.2 billion in funding to construct the first phase of the new Terminal 6 project from four private companies: JFK Millennium Partners, American Triple I, RXR and JetBlue Airways.

The lease for the new Terminal 6 was approved last year by the Port Authority Board of Commissioners, but the agency hadn't finalized the funding for the new construction. Now that it secured the funds, the lease has been signed and construction is expected to begin early next year.

The first phase is expected to open in 2026, followed by a full completion in 2028.

"This will be a state-of-the-art, truly extraordinary facility, and at all three airports, the Port Authority is committed to 21st-century quality, state-of-the-art airports for the region," said Rick Cotton, the executive director of the Port Authority, at the agency's Thursday board meeting.

The new 1.2-million-square-foot Terminal 6 at JFK will be located on the north side of the airport between the existing Terminal 5 and 7 facilities. It'll feature 10 gates, 9 of which will be capable of handling wide-body aircraft.

Terminal 6 will connect seamlessly to JetBlue's existing home in Terminal 5. Construction will begin without any impact on JFK operations, as it'll be largely contained to an area that's currently used as aircraft parking spaces.

When Terminal 6 is complete, the existing Terminal 7 will be demolished. British Airways, the current anchor tenant in Terminal 7, is moving to American's Terminal 8 later this year, while the other airlines in the existing Terminal 7 are expected to move to other terminals in the coming years.

The Port Authority is teasing a host of passenger-focused improvements in the new Terminal 6, including a bright-and-airy arrivals and departures hall with floor-to-ceiling windows, a robust public art program, automated TSA security lanes and over 100,000 square feet of space dedicated to shopping and dining outlets.

JetBlue will share space in Terminal 6 with the Lufthansa Group, which will relocate to Terminal 6 once it opens in 2026. This includes flights operated by Lufthansa, Swiss, Austrian Airlines and Brussels Airlines, which currently operate out of Terminal 1.

With Lufthansa consolidating to Terminal 6, the Port Authority is teasing a "world-class lounge experience" for Terminal 6 flyers. I'd expect that this will include dedicated Lufthansa first-, business- and Senator-lounges.

The Terminal 6 project is the final piece of the major $18 billion "JFK Vision" transformation plan. While all JFK projects were put on hold at the outset of the pandemic, those days are now firmly in the rear-view mirror.

The new, $9.5 billion Terminal One at JFK broke ground in September 2022. This 2.4-million-square-foot international terminal will anchor the south side of the airport. The project is estimated to cost $9.5 billion and will create at least 10,000 jobs, according to the Port Authority.

To make way for the new Terminal One, the existing Terminal 2 will be demolished. When complete, the new terminal will be the largest at JFK — nearly the same size as LaGuardia Airport's two new terminals combined.

When fully complete in 2030, the new Terminal One will feature 23 gates, a redesigned check-in hall and overhauled arrival spaces. (The existing terminals 1 and 2 have 12 and 11 gates, respectively.)

Delta's Terminal 4 is undergoing a major expansion, which includes additional gates for Delta's operation, along with $100 million in renovations for the existing check-in areas, as well as a modified arrivals-level curb to aid congestion.

Finally, American is leading a $400 million modernization of its JFK home, Terminal 8. This work includes new gates, premium lounges and other amenities that are expected to open in the coming weeks.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app