This New Biometric Travel Test Will Help You Plan Your Next Vacation

Where should you go on your next pleasure trip? An online biometric travel test, the first of its kind, may have an answer.

Seeker, which launched on Monday, July 2, is a product of AccorHotels' loyalty program, Le Club AccorHotels. And it promises to help you find the perfect destination for your unique travel preferences.

Last month, I was invited to try out a more elaborate variant of the test — a three-dimensional installation in a Jersey City warehouse across the Hudson River from lower Manhattan.

"Both experiences incorporate behavior tracking and biometrics to build a psychographic profile and predict dream destinations," said Siobhan Mitchell, director of loyalty marketing for AccorHotels.

Of course, the in-person exam — a series of five interactive stations — was a bit more, well, thorough.

The in-person experience

Upon arrival, I had a wristband monitor attached to my right arm and a brainwave sensor placed around my forehead, which would stream data on my heart rate, galvanic skin responses, and alpha and gamma brain waves.

I followed a curving corridor to a round, darkened room with flat-screen monitors on the walls. At the "Ferrofluid Station," I was directed to place a magnetic magnifier onto a screen and move it around. Magnetized liquid under the screen began to shift shapes and change colors, but I had no idea what it meant. (Apparently, this station was there to help me familiarize myself with the space.)

Next came the Motion Tracking Station, where my body's movements caused a wild array of formless colors on the screen in front of me to leap about. The more forcefully I swung my arms, the farther I could "push" the colors onto the other screens that encircled me. Here, I was being tested on how quickly and "intensely" I interacted with the LED panels.

At the Waterfall Station, I waved my arms over a large basin, causing water to trickle from above. As I moved my arms with greater urgency, the trickle became a downpour, with a roar like a mountain cascade. The speed with which I interacted with the water, my proximity to the water and the amount of time I spent there were all factors taken into consideration.

The Pillar Station, my next stop, featured five columns (wood, glass, stone, ceramic and brass), each about 18 inches tall. Grasping the various columns triggered sounds and images — trees and mountains for this pillar, clanging railroad bells and trestle bridges for that one, humming sounds and splashes of color for another.

Lastly, I stood in the center of a so-called "Video Moodboard" as a changing variety of images were projected around me. A pretty girl, smiling. A mountaintop forest. Surfers, children playing, young adults at a nightclub, urban skylines, pristine lakes, sunsets, motorcycles and so on.

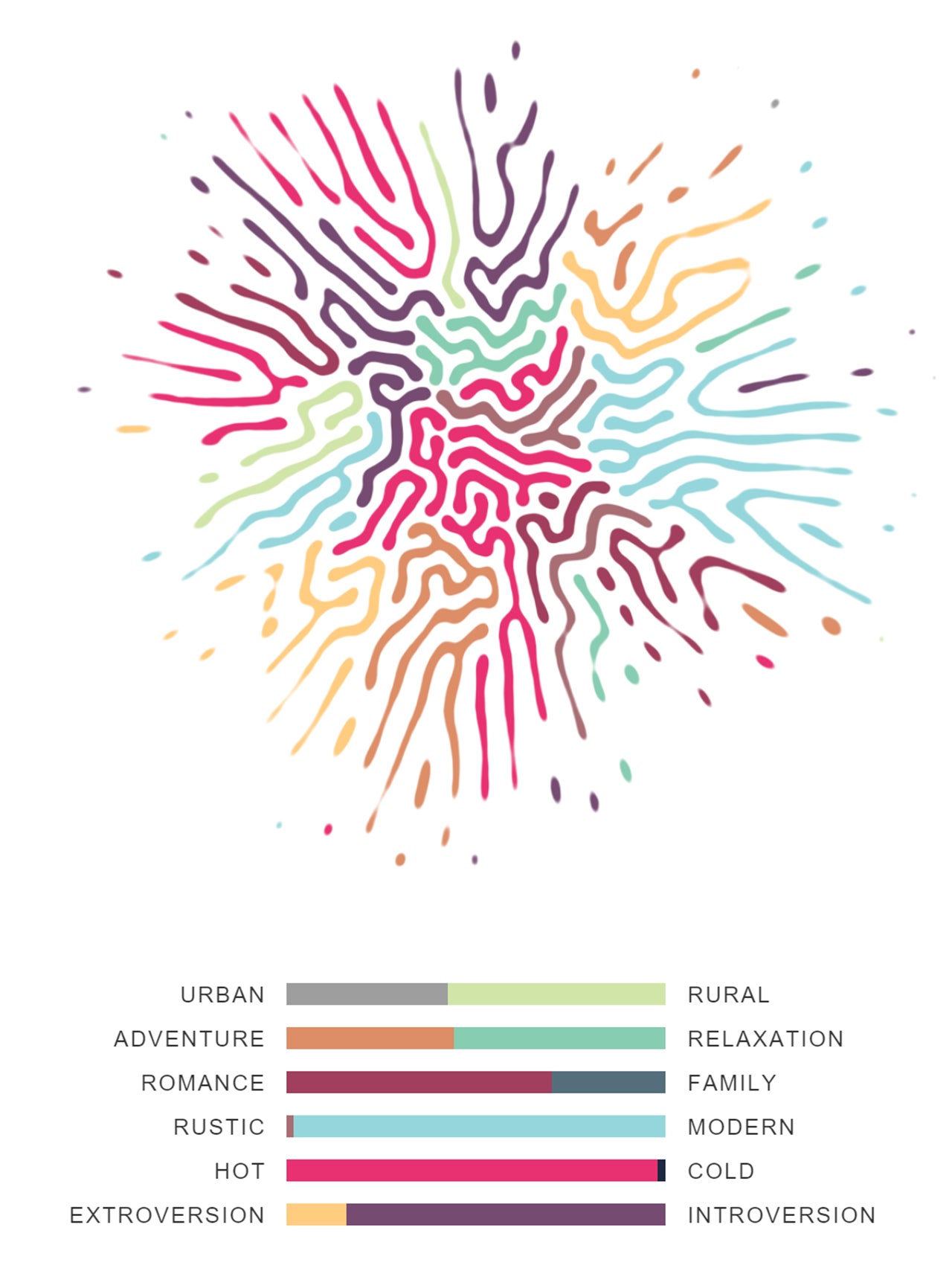

And then darkness. The names of three destinations appeared on the screens. After a minute, I returned to the entrance and received a printed "psychograph" (a colorful representation of my personality traits) and a score sheet on the six criteria being measured: Rustic/Modern, Introversion/Extroversion, Rural/Urban, Relaxation/Adventure, Family/Romance and Cold/Hot.

Jake Bundock, associate creative director of the Toronto-based creative agency Cossette, is a co-designer of Seeker along with The Mill, a creative technology company. I asked him about his own results from taking the test. "Accurate," he said. "My results said I liked rural destinations more than cities. It said I like cold more than warm. It said I'm adventurous. It was correct on every point."

The online test

Because online users won't be able to visit the temporary Jersey City installation, their experiences will differ. "The online version will be a series of tests," Rosie Gentile, Cossette's senior vice president of strategy, told TPG. "We want to get users' gut reactions, not calculated ones. That's how we'll get accurate readings."

Both the mobile and desktop versions will be "immersive" visual and audio experiences. Each image will have a predefined attributable score for its related category. A user's actual score for each image will be defined not just by his or her choice, but by how quickly a choice is made (a faster selection equals a stronger attraction), using a mechanism inspired by the Harvard Bias Test, according to the developer. A custom algorithm is then used to match responses with six key psychological, personality, destination and style metrics.

Here's where it gets even more interesting: The desktop version will use a computer's webcam to detect blood flow in a user's face to measure heart rate and give a value to the bodily response to each stimulus, a so-called "biometric multiplier."

"It sounds like we made this up, but we didn't," said Rachel Abrams, associate creative director at Cossette. "There's science behind this," her colleague, Gentile, added.

"To our knowledge, this is the first time biometrics and behavioral analysis are being used in this manner in the travel space," said Nicole Lierheimer, a spokesperson for AccorHotels, which is launching Seeker to coincide with the integration of Le Club AccorHotels with Fairmont President's Club, Raffles Ambassadors and Swissôtel Circle, also taking place on Monday.

The online test, however, is available to everyone — not just Le Club members. And hotel kiosks capable of evoking the in-person experience I had in Jersey City will be installed in select hotel properties by the end of July. Like the online test, the kiosks will be able to measure estimated heart rate using a camera.

The results

My results ranked high in Adventure, Extroversion (being around others) and Family. I was right in the middle of Rustic/Modern, Rural/Urban and Hot/Cold. Not bad.

"You are drawn to old-world charm…" said my results summary. "You draw energy from your surroundings and are seeking an escape full of adventure where you will be immersed in culture. You place great value on your family relationships."

Yep, that's me, all right.

Those three destinations that came up on the screen at the end of my test? Germany, Northern California and central China — right up my alley. Though I can't predict what your suggested destinations will be, I wouldn't be surprised if they happen to be home to an AccorHotels property.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app