Flying internationally? Here’s what you need to know about the Mobile Passport Control app

Editor’s note: This story has been updated with new information.

Whether you're waiting for Global Entry approval or don't want to shell out $100 (or more) for an application fee, don't worry: There's still a convenient way to avoid the longest lines at U.S. Customs and Border Protection.

CBP offers a service called Mobile Passport Control. It's been around for about a decade but remains a relatively unknown option for travelers.

Best of all, it's fast, free and doesn't require a lengthy screening process or interview.

All you have to do to use the service is download an app, fill out some personal information, snap a selfie and then proceed to a designated (usually much shorter) line once you reach passport control.

Mobile Passport Control is a great alternative if you're waiting on Global Entry approval or if you don't travel enough internationally to warrant the program's $100 (soon to be $120) application fee. It's also available to tons of travelers — many of whom may not know about it.

Count TPG contributor Melissa Klurman among the fans (and loyal users) of this entry-expediting program, which helps her regularly save time at customs.

Here's everything you need to know about Mobile Passport Control:

What's the difference between Global Entry and Mobile Passport Control?

Generally speaking, Mobile Passport Control isn't as fast as Global Entry — but it's faster than the regular lanes at customs. And, unlike Global Entry, it's free.

Global Entry

Global Entry is a paid program that allows travelers to expedite their trip through U.S. Customs and Border Protection ports of entry. Members submit an application and pay a fee, then undergo a screening interview. Once approved, they can proceed to blue kiosks at customs for identity verification. The process often takes mere seconds.

Global Entry members also get a Known Traveler Number that provides them access to the TSA PreCheck lanes.

Applying for a five-year Global Entry membership comes with a $100 application fee — though numerous travel credit cards will help offset the cost. The application fee for Global Entry will rise to $120 in October 2024.

Mobile Passport Control

Mobile Passport Control, on the other hand, is free and available to a wide range of travelers. After an international flight, you'll fill out your personal information and snap a selfie on the app. By submitting this information in advance, you'll be able to use a special, designated lane at customs once you're off the plane.

Though users won't fly through customs as fast as Global Entry members, it's still a surefire way to save time — particularly when the standard passport control lines are crowded.

Who can use Mobile Passport Control?

Mobile Passport Control is available to scores of travelers entering the U.S., according to CBP. This includes:

- U.S. citizens

- Lawful Permanent Residents

- Canadian B1/B2 visa holders

- Travelers from the 41 "visa-waiver" countries who have previously visited the U.S.

Which airports have Mobile Passport control?

The service is available at 51 sites, and you can use the service at 33 international airports in the U.S. It's also available at each of the 15 international preclearance facilities, such as Abu Dhabi's Zayed International Airport (AUH), Dublin Airport (DUB) and Toronto Pearson International Airport (YYZ).

You'll even find the service available as an option at four seaports: Miami, Palm Beach, Port Everglades and San Juan.

How to use Mobile Passport Control

The first step to using Mobile Passport Control is to download the CBP MPC app from the Google Play Store or Apple App Store. Do this when you have Wi-Fi.

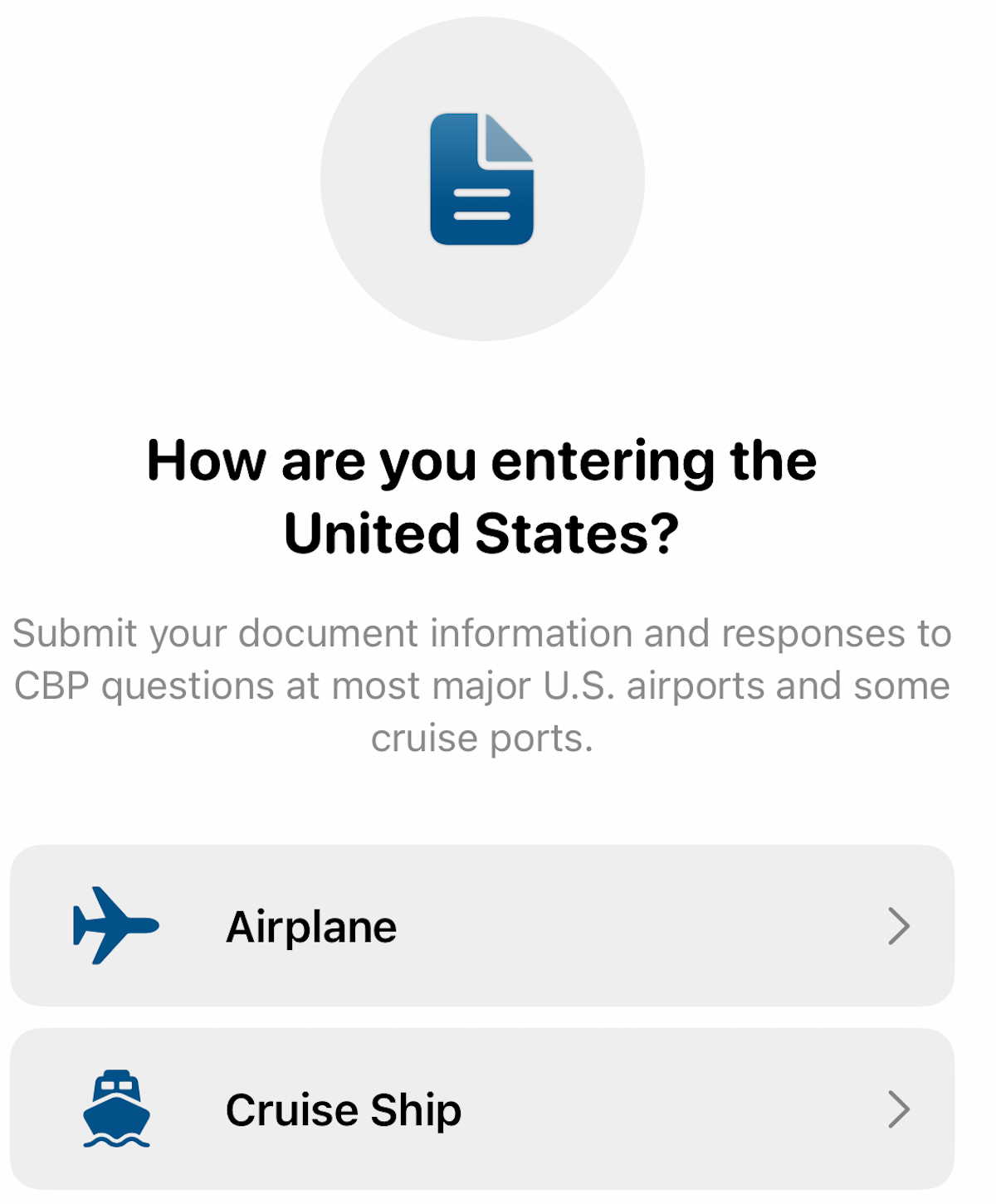

First, the app will ask you how you're entering the U.S. In most cases, that'll be by airplane.

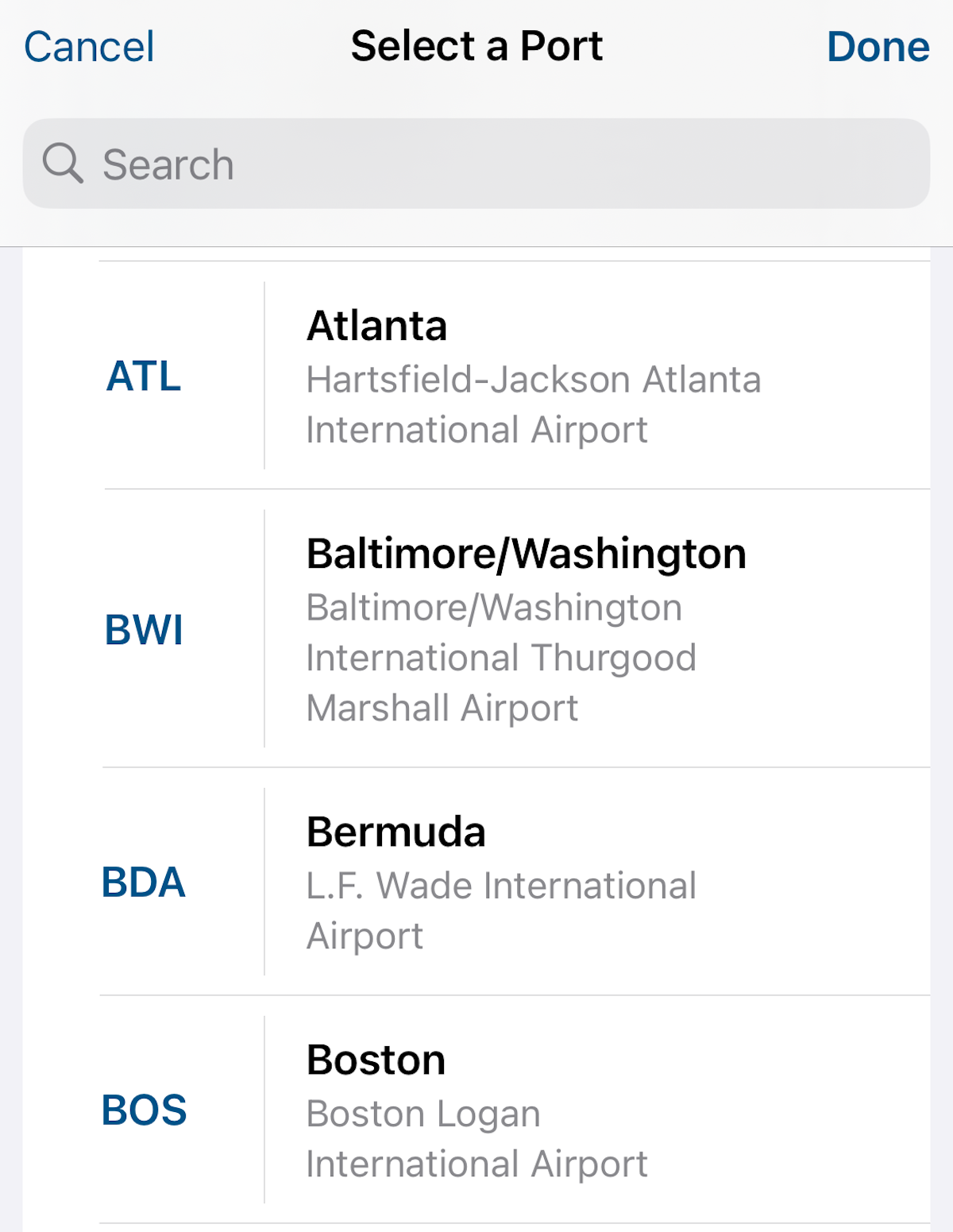

Next up: What is your CBP port? That will be your arrival airport. Let's say you're flying into Boston Logan International Airport (BOS).

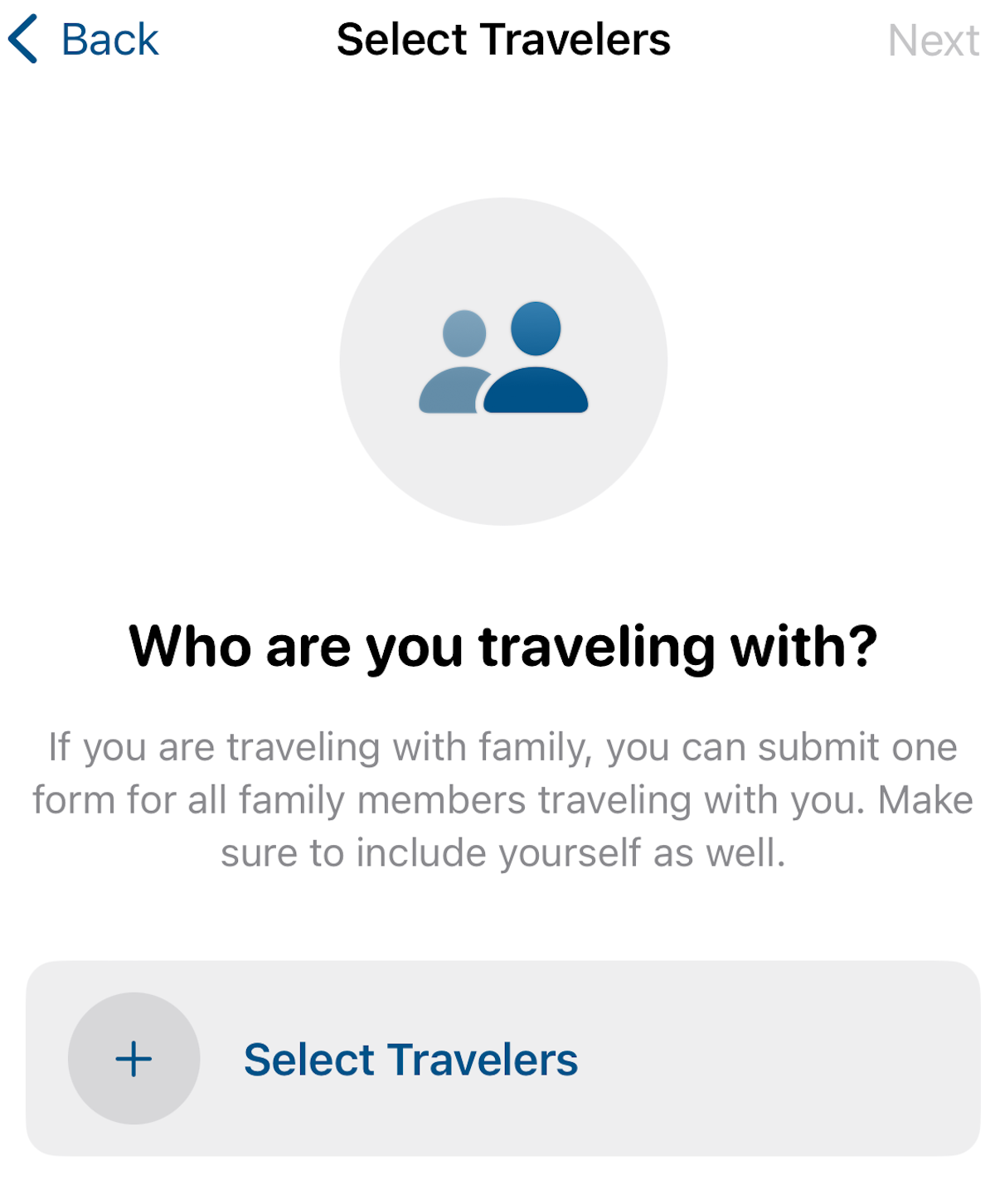

From there, you'll add travelers to your submission. The app now allows you to add up to 12 family members who are returning to the same household. Your best bet is to fill out your information and add each member of your family to your submission. You can do this all on one phone.

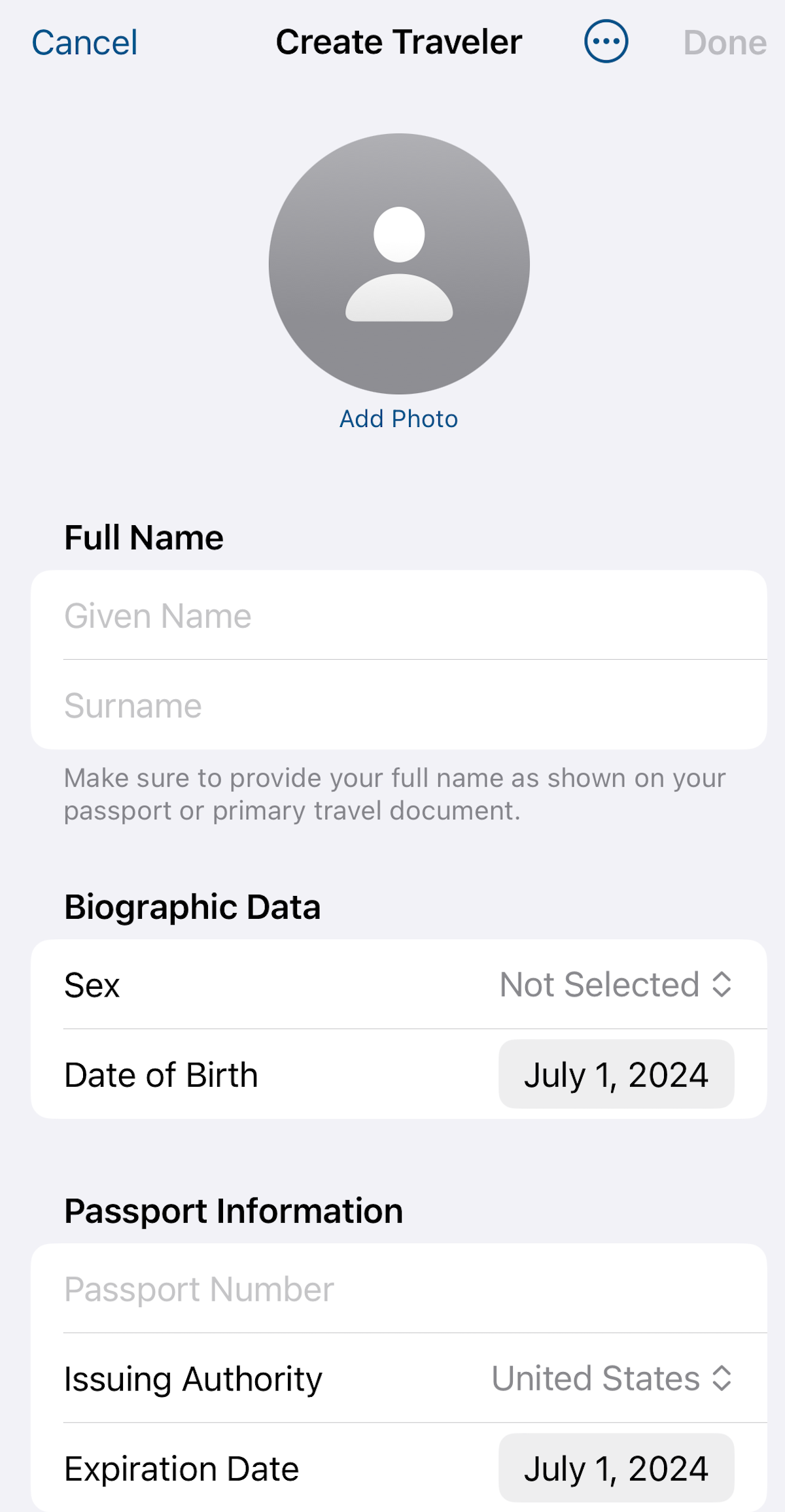

Next, you'll need to upload your travel documentation; oftentimes, for U.S. citizens, this will be a passport. You can scan it or enter the information manually.

After filling out the information, you'll add a selfie and repeat the process for each member of your family.

Once your application is submitted and you're off the plane, head to the designated MPC lanes at CBP facilities. When you reach an officer, one family member will need to step forward to have their photo taken. CBP uses this photo to pull up and process the application for every member of your traveling party for facial comparison purposes.

The agency says it typically deletes photos taken at its passport control facilities within a couple of days. Photos taken on your smartphone will remain on your device locally, the agency adds; they're not stored on CBP servers.

Is Mobile Passport Control better than Global Entry?

Global Entry is generally a faster option than Mobile Passport Control. However, its soon-to-be $120 fee isn't inconsequential, especially if you take into account the fact that Mobile Passport Control is completely free.

Plus, if you don't travel enough to warrant Global Entry, aren't eligible for the program, or are still awaiting conditional approval for the program, Mobile Passport Control is a great option to expedite your reentry into the U.S.

It's also a fantastic way to save time for families traveling together, since you can now add up to a dozen family members to one application.

Related reading:

- Key travel tips you need to know — whether you’re a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can’t travel without

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.