Miami International Airport 101: The best ways to get to or from MIA

Miami International Airport (MIA) is the third-busiest airport in the U.S. for international travel. In all, it accommodates more than 100 airlines flying to more than 150 destinations, including more flights to Latin America and the Caribbean than any other U.S. airport. With all that air traffic comes notoriously bad congestion on the ground.

On the plus side, the airport is only a short distance away from downtown Miami and the city's beaches. To get there, you can take public transportation, rent your own car or book an airport shuttle.

Public transportation

In recent years Miami-Dade Public Transit has added buses and trains at almost all hours to make the airport more accessible, but it's still hard to connect to other parts of the city on public transportation.

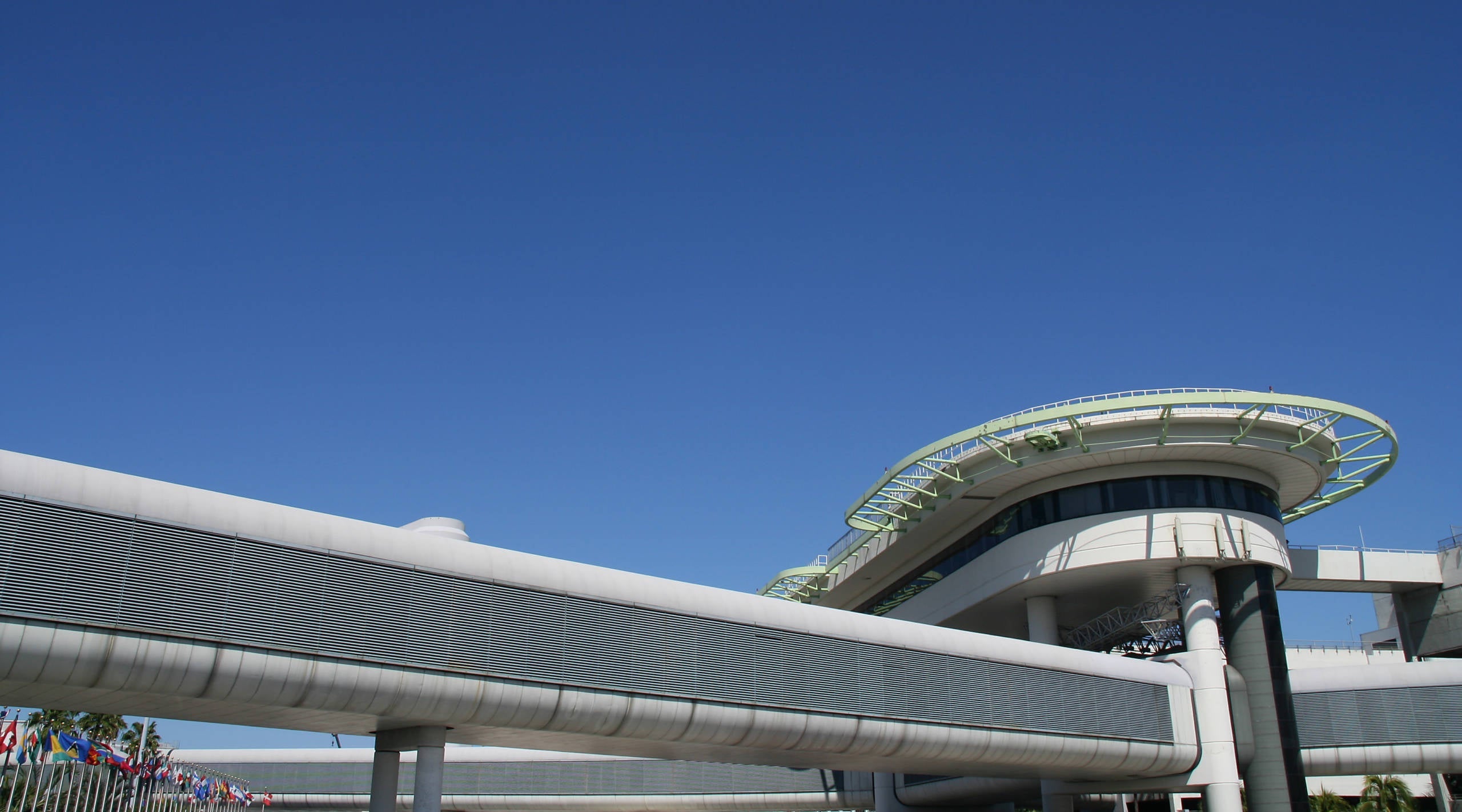

The easiest way to get to most transportation into the city is the MIA Mover, an automated train from the airport to the Miami Intermodal Center. The MIA Mover station at the airport is on the third level between the Dolphin and Flamingo parking garages. Use the third-level Skyride (moving walkway) to reach the MIA Mover station. Then it's about a four-minute ride to the Miami Intermodal Center.

Once you get to the Intermodal Center, you can take the Metrorail Orange Line ($2.25 per person each way) to the Government Center stop in Downtown and jump on the free people-mover tram that loops through the popular Downtown Miami areas.

If your final destination is Miami Beach, Miami-Dade Transit's Airport Flyer -- commonly referred to as "The Miami Beach Bus" -- offers daily express bus service between MIA and Miami Beach. Buses run approximately every 30 minutes, from 6 a.m. to 11 p.m., seven days a week. Passengers ride 40-foot buses with air-conditioning, comfortable seating and luggage racks at a cost of $2.65 each way. The trip takes about one hour since it stops along the way, yet it is the most cost-effective choice for reaching South Beach using public transportation.

Transit time: 60-90 minutes

Cost: $2.65 each way

Related: The best credit cards for commuting

Ride-hailing

Ride-hailing is a valuable form of transportation if you are coming to Miami for a weekend to hang out on the beach or experience the exciting Downtown neighborhoods. Cars from services like Uber and Lyft are plentiful and usually more economical than renting a car because parking and gas are expensive in popular neighborhoods like South Beach and Brickell.

Ride-hailing services at Miami International Airport can drop you off at the departure level in the terminal where your airline is located. For pickups, there is no designated space so once passengers land at MIA, they can pick up their luggage at baggage claim and step outside to request an Uber or Lyft. All airport pickups are subject to a $2 surcharge but ride-sharing is a better option than hailing a cab.

Commute time: 15-30 minutes, depending on traffic and outside of rush hour times.

Cost: $20 to $30 to Downtown Miami and Miami Beach.

Related: The best credit cards for Uber and Lyft

Taxi

Taxis in Miami are notoriously expensive. If you are adamant about taking one or you're in town for work and your employer requires it for reimbursement, taxis charge a flat rate of $35 to South Beach and $21.70 to Downtown Miami hotels from MIA. Designated taxi stands are on the airport's ground level (Arrivals), outside of the baggage claim area. There is no fee for sharing a taxi so you can always split the cost with another person or three. Many cabs now accept credit cards but check with the driver before starting your ride.

Commute time: 20-30 minutes, depending on traffic and outside of rush hour.

Cost: $21 to $90. The flat rate to South Beach is $35 and Downtown Miami is $21.70. Taxis have flat rates to certain zones in the urban metro-area. Outside of these zones, metered fares are charged at $4.50 for the first 1/6 mile and $.40 each additional 1/6 mile, which equals to $6.90 for the first mile and $2.40 for each additional mile.

Hotel Shuttle Service

There are dozens of airport hotels surrounding MIA and the tourist areas aren't far away, so many hotels in Miami offer complimentary or low-cost shuttle service to and from the airport for their guests. Check with your hotel to see if this is available. Effective Dec. 11, 2019, hotel shuttle buses pick up/drop off at MIA on the ground level (Arrivals) at designated zones outside of baggage claim. Across from doors 1, 2, 3, 4, 7, 15, 20 & 23, passengers can be picked up and driven to their hotel with no stops in between.

Commute time: 5 - 35 minutes, depending on hotel distance.

Cost: Complimentary or at a reduced rate for hotel guests.

Related: Best ways to use your hotel points in Miami

Rental Car

If you want to explore the sprawling city and its surrounding areas, your best mode of transportation is renting a vehicle at MIA. Upon arrival, passengers can connect to the MIA Rental Car Center using the MIA Mover, located on the 3rd level between the Dolphin and Flamingo garages. The Rental Car Center provides direct access to and from the airport via the MIA Mover elevated train.

The Rental Car Center is located next to the Miami Intermodal Center. Take the MIA Mover from the airport to the Miami Intermodal Center and you are also at your rental pickup location.

If your car rental agency is not at the Miami Intermodal Center, check the agency's website or call them for pickup service, which is readily available as a courtesy just outside the lobby of the Rental Car Center.

Commute time: 15 - 30 minutes, depending on traffic and outside of rush hour times.

Cost: $15 - $125 per day, depending on vehicle type.

Related: Credit cards that offer elite status for car rentals

Bottom line

There are numerous ways to get to and from Miami International Airport, but your plans will determine what's best for you. If you plan on exploring Miami and its surrounding cities or venturing to Fort Lauderdale, a rental car is an absolute must. If you plan to stay put on the beach or enjoy the downtown urban core of Brickell, Port of Miami and the Design District, ride-hailing services will make more sense.

Further Reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app