Exclusive: How to maximize points, miles and coverage with Apple’s new iPhone 16, Watch, AirPods

The annual "iPhone day" has come and gone.

Apple on Friday launched the latest generation of its most popular devices: the iPhone 16 family, Watch Series 10 and AirPods. The new models hit store shelves Sept. 20, and as it always seems to do, the tech giant brought lots of hype to the launch.

At its Fifth Avenue flagship store in New York, Apple's top brass, including CEO Tim Cook, greeted excited customers, many of whom waited hours in line to be the first to get their hands on these new devices.

One executive, Deirdre O'Brien, Apple's senior vice president of retail, was especially excited on Friday.

"We live for today, we really do. And you can just feel the energy, and it's hard to sleep the night before," she told TPG in an exclusive interview on launch day. (She slept about four hours on Thursday night, she told TPG.)

Preorders for the new devices began Friday, Sept. 13, just a few days after the company's special keynote event, during which the tech giant unveiled its latest products, including a brand-new model of AirPods.

From upgrades to the cameras, battery and durability to noise cancellation in the entry-level AirPods, the latest devices will likely appeal to many consumers, especially those who are always on the road.

And if you're thinking about splurging for some new tech, O'Brien shared some tips for maximizing the expense. Here's everything you need to know.

Making the purchase

When it's time to buy a new Apple device, O'Brien says no store is better equipped than Apple's proprietary retail stores.

Apple employees know all the ins and outs of the new products, and it's that "connection" and "ability to educate our customers" that makes the buying experience better, she said. O'Brien highlighted that the stores offer an end-to-end experience that she believes is better than what's offered by third-party resellers.

Apple store employees (or specialists, as they're called) will answer questions, set up your device (including activating your cell service) and even offer helpful tips and tricks at what the company brands "Today at Apple" sessions.

Since iPhone demand usually seems to outstrip supply when a new product rolls out, O'Brien suggests customers can tip the odds in their favor by monitoring online availability for their preferred devices and then place an in-store pickup to reserve the device they want.

Of course, many other stores sell Apple tech; for instance, you can pick up an iPhone from the carrier of your choice (AT&T, Verizon or T-Mobile) or through third-party vendors such as Best Buy and Walmart.

Sometimes, buying an iPhone through a third party can be a better deal than going directly through Apple, especially during limited-time promotions, so you'll want to compare your options before pulling the trigger.

Trade-in options

The new iPhones certainly aren't cheap, and O'Brien's top tip for making the purchase much more affordable is to trade in your current device.

"Number one, you've got that value," O'Brien said of the Apple Trade-In program, which recycles used phones. "Number two, it's great for the environment, and the environment is such a key value of ours at Apple."

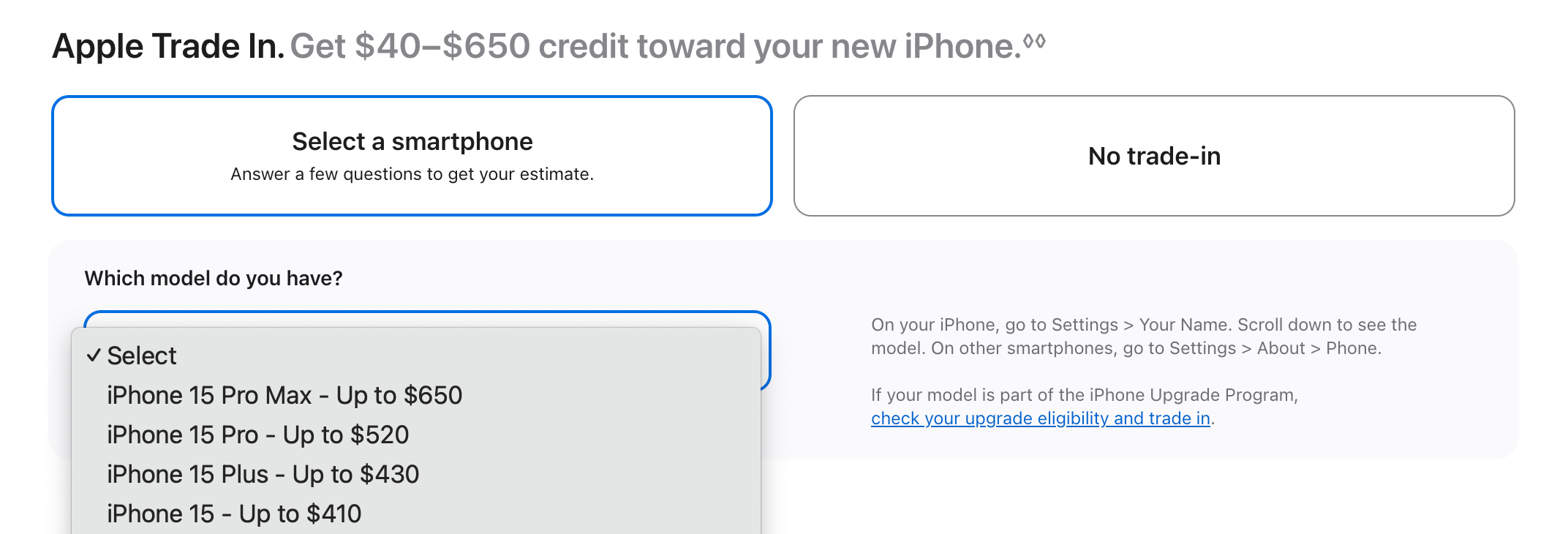

If you have any spare devices lying around, Apple will offer you credit (or a gift card) toward the purchase of a new phone. Credits range from $40 for the iPhone 7 Plus (2016) to as much as $650 if you hand over last year's iPhone 15 Pro Max.

You'll need to make your purchase directly through Apple to take advantage of this particular trade-in offer, though some third-party sellers have similar promotions available.

Of course, you'll always want to read the terms and conditions of any trade-in offers.

Shopping portal bonuses

While O'Brien shared some tips, there are other things to consider when buying new devices to maximize your value.

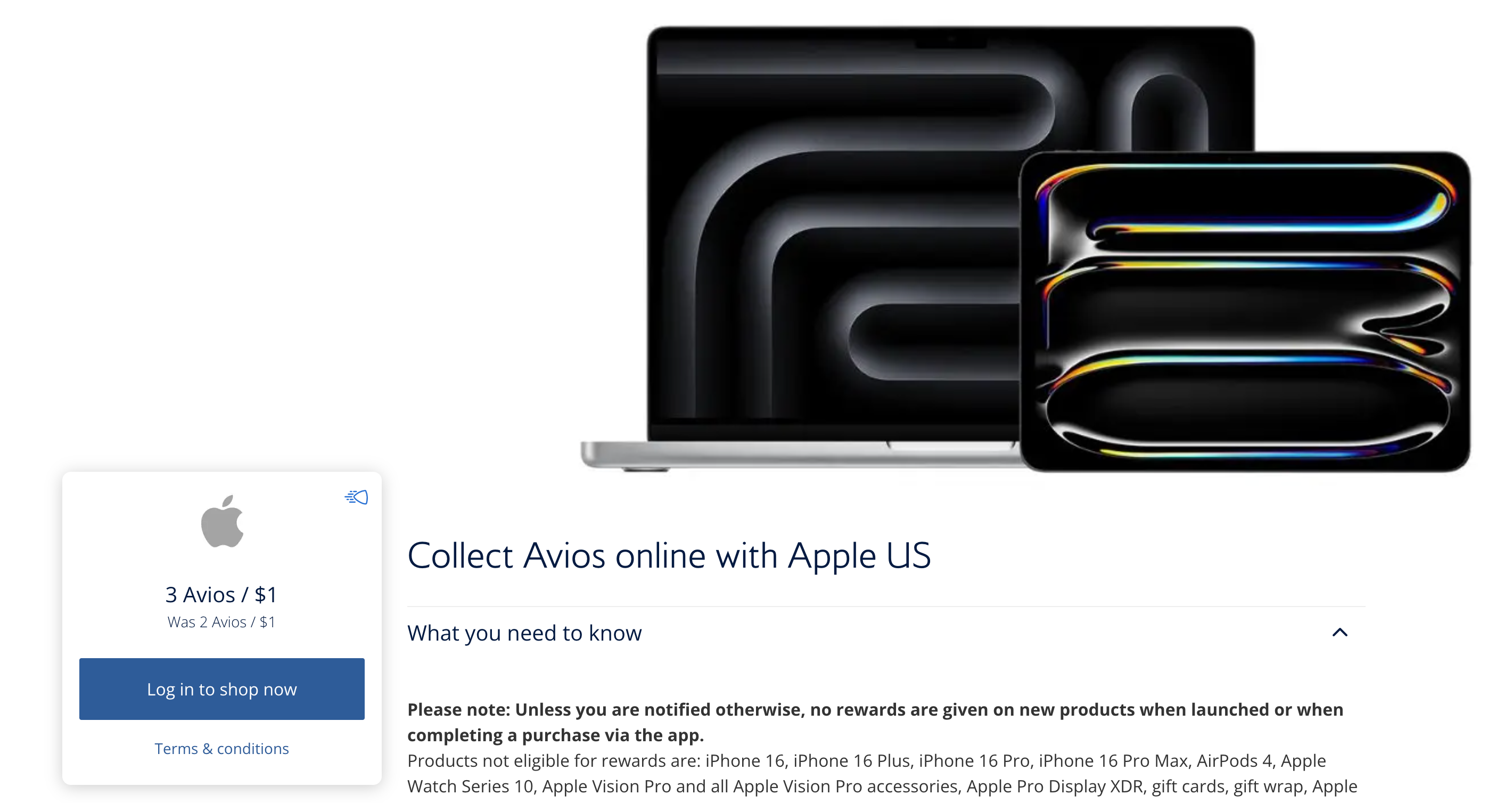

For one, check for shopping portal bonuses. If you start your shopping journey at one of these portals, you'll still be redirected to buy the device directly from Apple, but you'll earn more points or miles. Some devices are restricted from portal bonuses right after launch, though this is certainly something to look for if you decide to make your purchase at a later date.

I'd recommend using a shopping portal aggregator like Cashback Monitor to easily identify the largest return.

Which cards to use

The next big question is which credit card to use for your purchase.

In O'Brien's mind, that's the Apple Card.

"You can always use an Apple Card, and there's lots of great features that come with the card," she said.

The Apple Card isn't the worst option since you can take advantage of an interest-free monthly installment plan and earn 3% back if you purchase directly through Apple. The information for the Apple Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

But it's not necessarily your best pick to maximize rewards and extended warranty coverage.

Historically, I've made my Apple purchases with The Platinum Card® from American Express. Though you'll earn just 1 American Express Membership Rewards point (which is worth 2 cents, according to TPG's September 2024 valuations) per dollar spent, the card's included purchase protection is a great insurance policy if I end up breaking or losing my iPhone.

Plus, Amex offers ongoing cellphone protection with the Platinum Card, making this card my top pick for iPhone purchases.

Ultimately, given the high cost of Apple's latest devices, I'd focus on cards that offer purchase protection and extended warranty benefits rather than those that offer the greatest return. Other top purchase-protection picks include:

| Card | Maximum coverage amount (per item or claim) | Maximum coverage amount (per card or account) | Coverage duration (days) | Earning rate on Apple purchases | Annual fee |

|---|---|---|---|---|---|

$10,000 per item (or $500 per event for natural disasters) | $50,000 per card, per calendar year | 90 | 1 Membership Rewards point per dollar | $325 (see rates and fees) | |

$10,000 per claim | $50,000 per account | 90 | 2 Capital One miles per dollar | $395 | |

$10,000 per claim | $50,000 per account | 120 | 1% cash back | $0 (see rates and fees) | |

$1,000 per item (or $500 per event for natural disasters) | $50,000 per card, per year | 90 | 3% cash back on U.S. online retail purchases, on up to $6,000 in purchases per year (then 1%)** | $0 annual fee (see rates and fees) | |

$500 per claim | $50,000 per account | 120 | 1% cash back | $0 (see rates and fees) |

* Eligibility and benefit levels vary by card. Terms, conditions, and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

** Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

Protect your investment

Apple and other third-party retailers sell AppleCare+ and other proprietary warranties. These could be worth considering, especially for accidental damage on non-iPhone devices, but savvy spenders who have the right credit card may be covered for damage to their iPhones.

These days, some of our top recommended credit cards also offer ongoing cellphone protection, as long as you pay your carrier bill with an eligible card that offers loss and damage protection. That in and of itself could cover an annual fee if you end up damaging your device.

Personally, I'd recommend using either the Amex Platinum, the Chase Freedom Flex or the Capital One Venture X, all of which offer both purchase protection and cellphone protection benefits.

| Card | Coverage/deductible | Notable exclusions | Earning rate on cellphone bill | Annual fee |

|---|---|---|---|---|

Up to $1,000 per claim, with a maximum of three claims per 12-month period (with a $100 deductible per claim) | Cosmetic damage that doesn't affect the phone's ability to function; lost phones | 3 Chase Ultimate Rewards points per dollar* | $95 | |

The Platinum Card from American Express** | Up to $800 per claim, with a maximum of two claims per 12-month period (with a $50 deductible) | Cosmetic damage that doesn't affect the phone's ability to function; lost phones | 1 Amex Membership Rewards point per dollar | $895 (see rates and fees) |

Chase Freedom Flex | Up to $800 per claim, with a maximum of two claims worth $1,000 per 12-month period (with a $50 deductible) | Cosmetic damage that doesn't affect the phone's ability to function; lost phones | 1 Chase Ultimate Rewards point per dollar | $0 |

Capital One Venture X Rewards Credit Card | Up to $800 per claim, with a maximum of two claims worth $1,600 per 12-month period (with $50 deductible) | Cosmetic damage that doesn't affect the phone's ability to function; lost phones | 2 Capital One miles per dollar | $395 |

*Earn 3 Ultimate Rewards points per dollar on the first $150,000 in combined purchases each account anniversary year in the categories of travel, shipping purchases, internet, cable and phone services, and advertising purchases with social media sites and search engines.

**Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Meeting minimum spending

Finally, another consideration would be to time your splurge with the opening of a new card. This way, you'd be much closer to meeting the minimum spending requirement to earn a significant sign-up bonus. One of our top picks is the Chase Sapphire Preferred® Card (see rates and fees), which offers 75,000 bonus points after you spend $5,000 on purchases in the first three months of account opening.

You can find a full list of top offers here. Just note that not all of these cards include purchase protection and extended warranty perks, so if you're looking to prioritize coverage over points, refer to the chart above.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Related reading:

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

For rates and fees for the Amex Platinum Card, click here.

For rates and fees for the Amex Gold Card, click here.

For rates and fees for the Blue Cash Everyday, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app