Preparing for dynamic pricing: Marriott's Lowest Rates Calendar is now visible in search results

Marriott Bonvoy will drop its award charts sometime next month. Although nightly award rates for 97% of properties will stay within their existing off-peak to peak award chart bounds through the end of 2022, we'll still see a lot more fluctuation and possible rates within these ranges. Further, rates will presumably fluctuate more significantly for the 3% of properties that will soon have unbounded award rates.

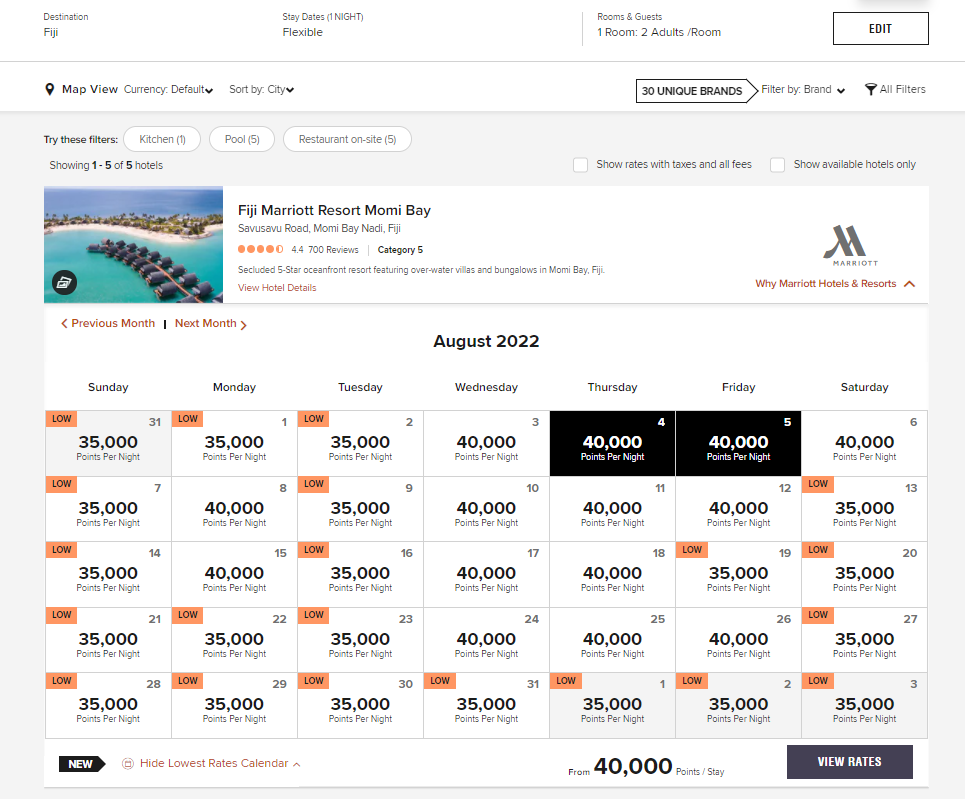

Alongside the impending switch to dynamic pricing, there is some positive Marriott Bonvoy news, though: you can now check a Lowest Rates Calendar for multiple properties from one results page (as first noticed by Frequent Miler).

Marriott has offered a calendar search for individual properties for a while now, but this new functionality lets you quickly compare paid or award pricing across multiple properties and dates. And that will become increasingly important for flexible travelers once Marriott removes its award charts.

Here's how it works.

[table-of-contents /]

Using Marriott's Lowest Rates Calendar for paid stays

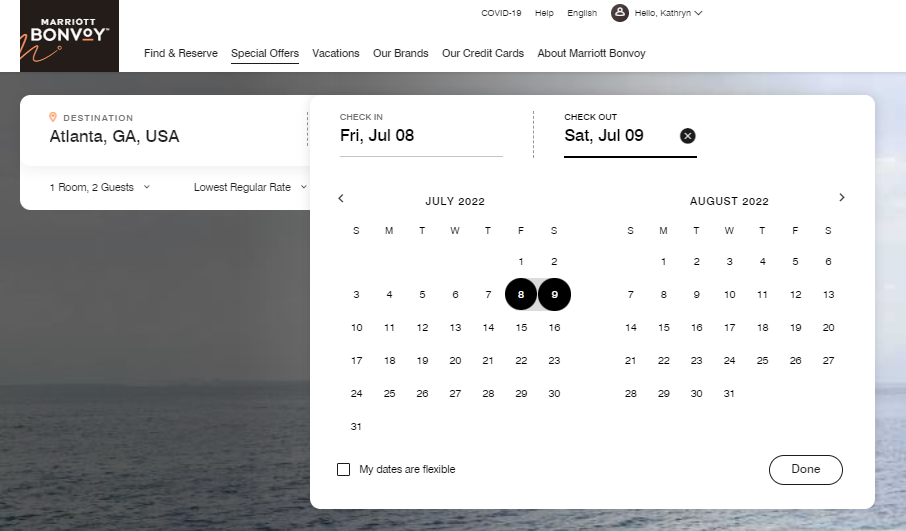

Start at marriott.com as normal. Select dates, click the "My dates are flexible" box and then click "Find hotels."

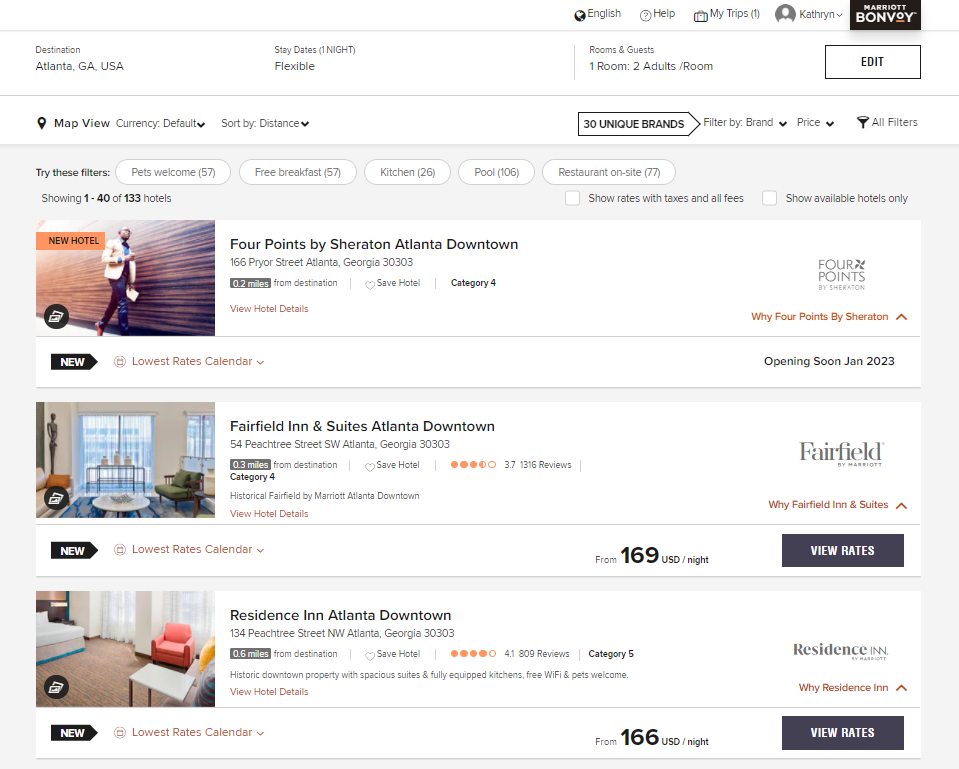

You'll see a new Lowest Rates Calendar drop-down option for each result on the next page.

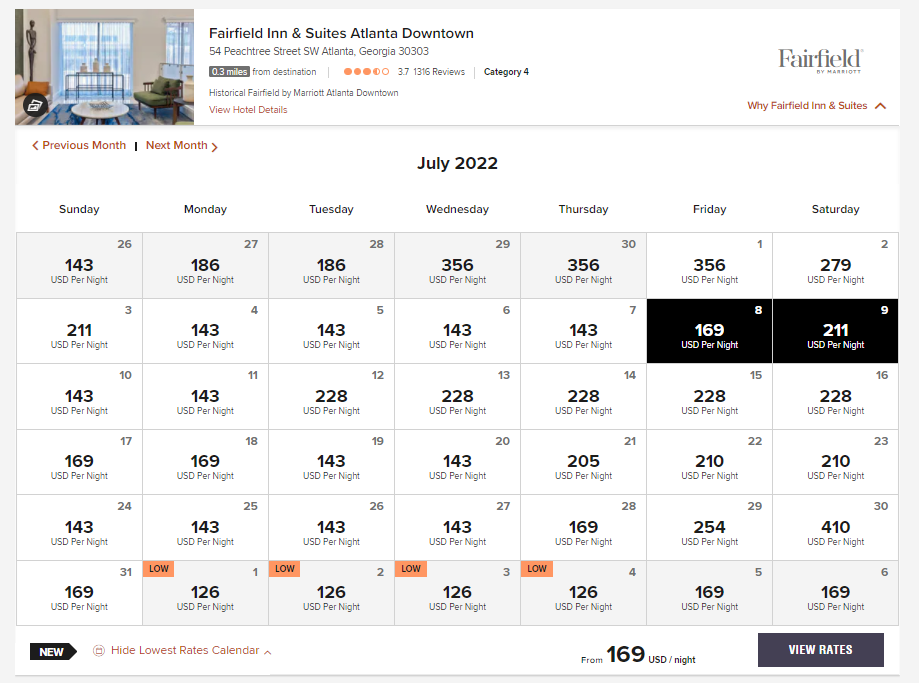

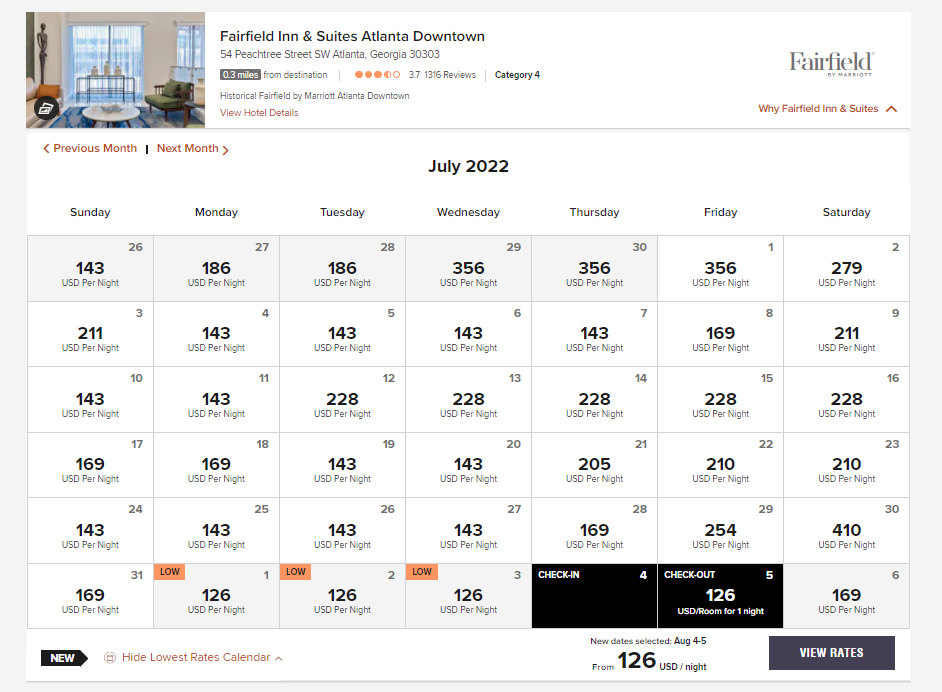

Click on the Lowest Rates Calendar drop-down for any hotels you're interested in. You'll see a price calendar for the hotel as follows:

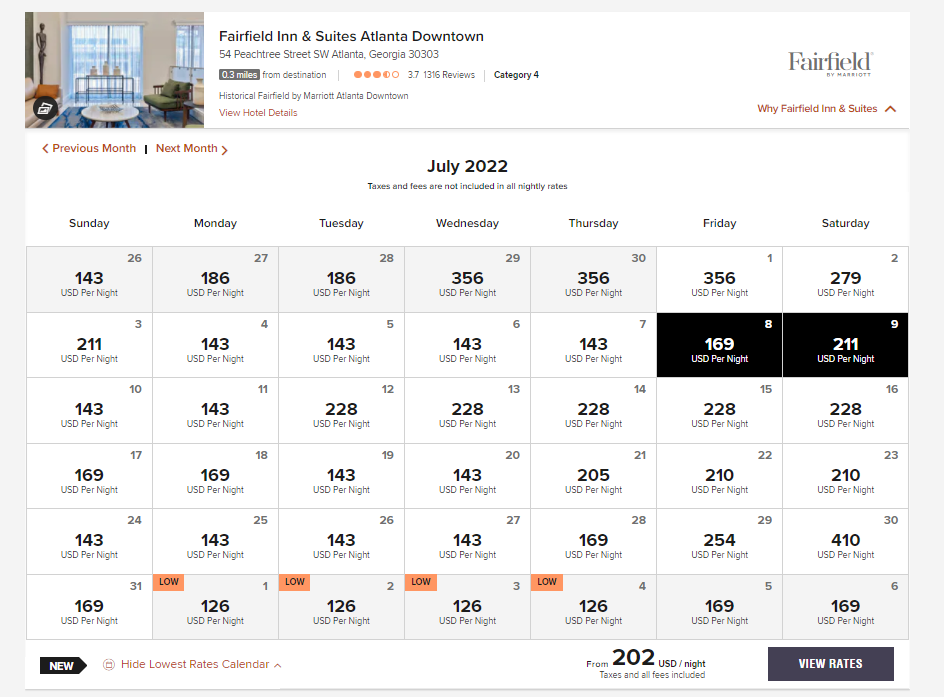

Sadly, this calendar doesn't show all taxes and fees even when "Show rates with taxes and all fees" is checked. For example, here's the same Lowest Rates Calendar with this box checked.

You can click through to other months in a hotel's Lowest Rates Calendar. If you decide you want to stay on a different date, click on your new check-in and check-out dates in the Lowest Rates Calendar and then click "View rates."

Then, go through the rest of the booking process as you typically would.

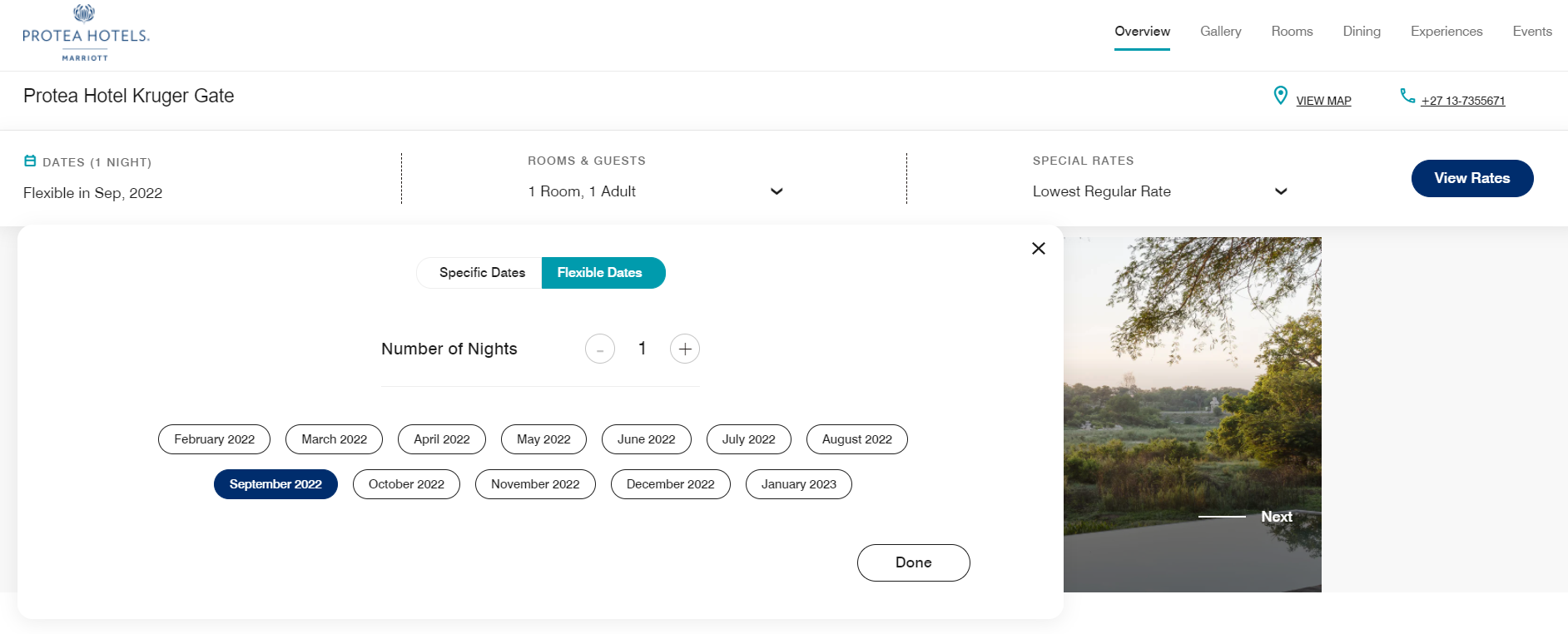

You can also see the Lowest Rates Calendar for a specific property from its main page. Just toggle from "Specific dates" to "Flexible dates," enter the other relevant information and click "View rates."

Related: Possible impending Marriott devaluation: What dynamic pricing could mean for travelers

Using Marriott's Lowest Rates Calendar when redeeming points

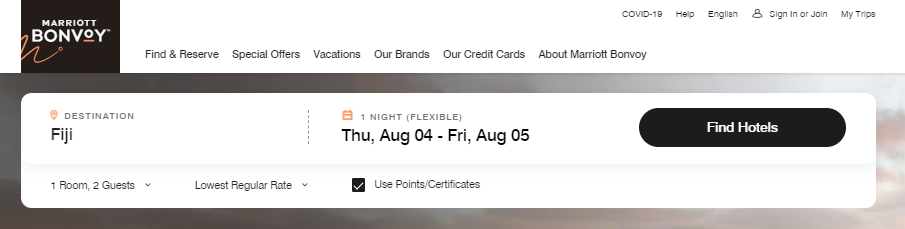

Best of all, this new feature also works when redeeming Marriott Bonvoy points. Follow the same steps as above, but check "Use points/certificates" on the first search page before clicking "Find hotels."

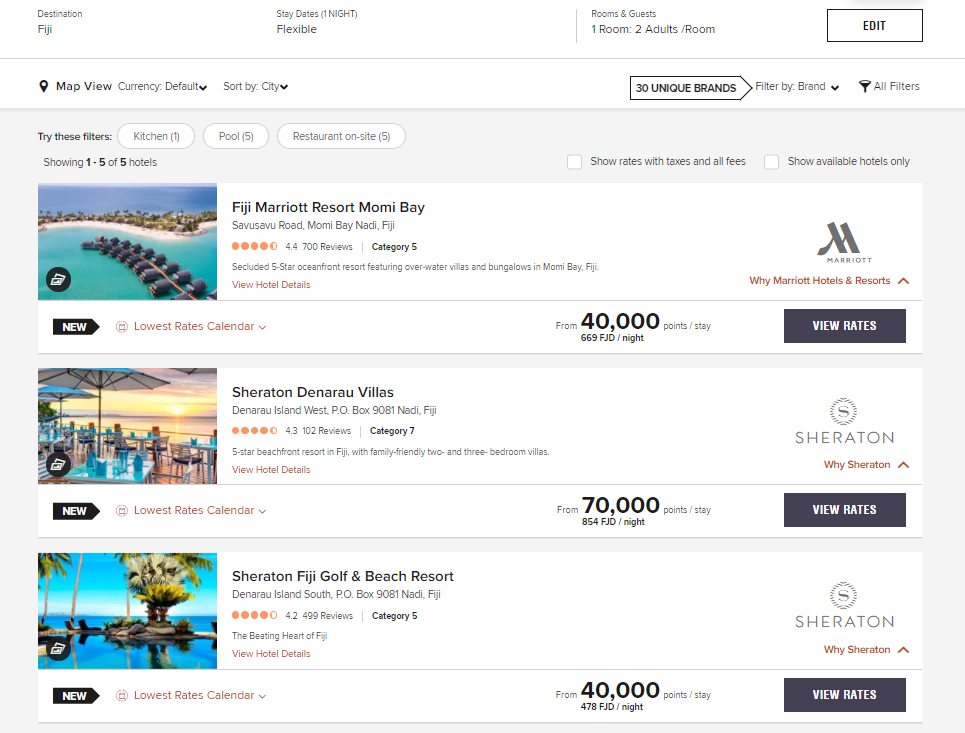

As with paid rates, you'll see a Lowest Rates Calendar drop-down option for each result on the next page.

Click on the Lowest Rates Calendar drop-down for a result. You'll see a price calendar as follows:

If you want to check the Lowest Rates Calendar for a different hotel in your search results, click that property's drop-down. Doing so will make the calendar disappear for the previous property.

If you're looking to earn more Marriott Bonvoy points for your next award, consider applying for a Marriott Bonvoy credit card. Alternatively, you can transfer American Express Membership Rewards points or Chase Ultimate Rewards points to Marriott Bonvoy, both at a 1:1 ratio.

Related: Why I'm not so nervous about Marriott's upcoming switch to dynamic award pricing

Limitations and issues with Marriott's Lowest Rates Calendar

Unfortunately, some aspects are still lacking in Marriott Bonvoy's Lowest Rates Calendar. For example, I'd like to exclude particular rates, such as rates that don't allow for free cancellation until shortly before my stay. I'd also like the Lowest Rates Calendar to include all taxes and fees when I check the appropriate box.

Additionally, note that you may experience some issues when using the Lowest Rates Calendar. For example, I ran into the following issues while writing this article:

- Results in which every Lowest Rates Calendar showed no availability (there was availability when I searched on a different device).

- A search that likely would have never completed but didn't time out.

- A search where the Lowest Rates Calendar drop-down disappeared after I selected it.

If you run into issues, open a new window and start a new search. If this fails, log out of your account and try searching while logged out. I didn't have any persistent issues when using these techniques.

Related: 10 Marriott properties to book now before the award chart disappears

Bottom line

Marriott's Lowest Rates Calendar can now help you compare paid rates and award rates across hotels and dates at your destination with ease. There's nothing new about the data and information you can see. Instead, the win here is that you can now quickly check rates on surrounding dates for multiple Marriott hotels in the search results for a destination.

I expect this will be extremely useful once Marriott's dynamic pricing starts next month and I want to quickly decide when to visit a destination and where to stay.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app