JetBlue launches TrueBlue redemptions on Japan Airlines flights to Tokyo and beyond

There's a new way to redeem JetBlue TrueBlue points on long-haul international flights — specifically, to Japan and beyond.

JetBlue on Wednesday announced it's stepping up its partnership with Japan Airlines.

Going forward, JAL will become a "redeem" partner of JetBlue — meaning, you can redeem your TrueBlue points for flights on the Tokyo-based carrier.

That's certainly good news for JetBlue loyalists. While the airline has a more limited partnership with Singapore Airlines and additional tie-ups with two Persian Gulf-based carriers, this marks the first time TrueBlue members will have the chance to redeem their points on an airline based in East Asia.

And there's plenty of reason to fly on JAL, which last year inaugurated its first U.S. service on its brand-new Airbus A350-1000 aircraft, featuring stunning first-class suites and an overall impressive product throughout its cabins.

Read more: New first class, business class and the rest: Flying the Japan Airlines A350-1000 in all 4 cabins

Keep in mind that JetBlue is a transfer partner of several major credit card issuers, so even if you don't frequently fly the carrier on its East Coast-heavy route network, there are ways to quickly accrue a large sum of TrueBlue points to fly nonstop from the U.S. to destinations like Tokyo and Osaka, Japan.

"We're excited to expand the TrueBlue experience by growing our network of trusted airline partners, giving our members even more ways to redeem points," JetBlue Vice President of Loyalty and Personalization Edward Pouthier said in a statement Wednesday.

Read more: At one with its historic surroundings, Park Hyatt Kyoto is one of the best Park Hyatts in the world

What this news means for travelers

As part of the deeper partnership between JetBlue and Japan Airlines, you can now redeem TrueBlue points through JetBlue's website on JAL-operated flights.

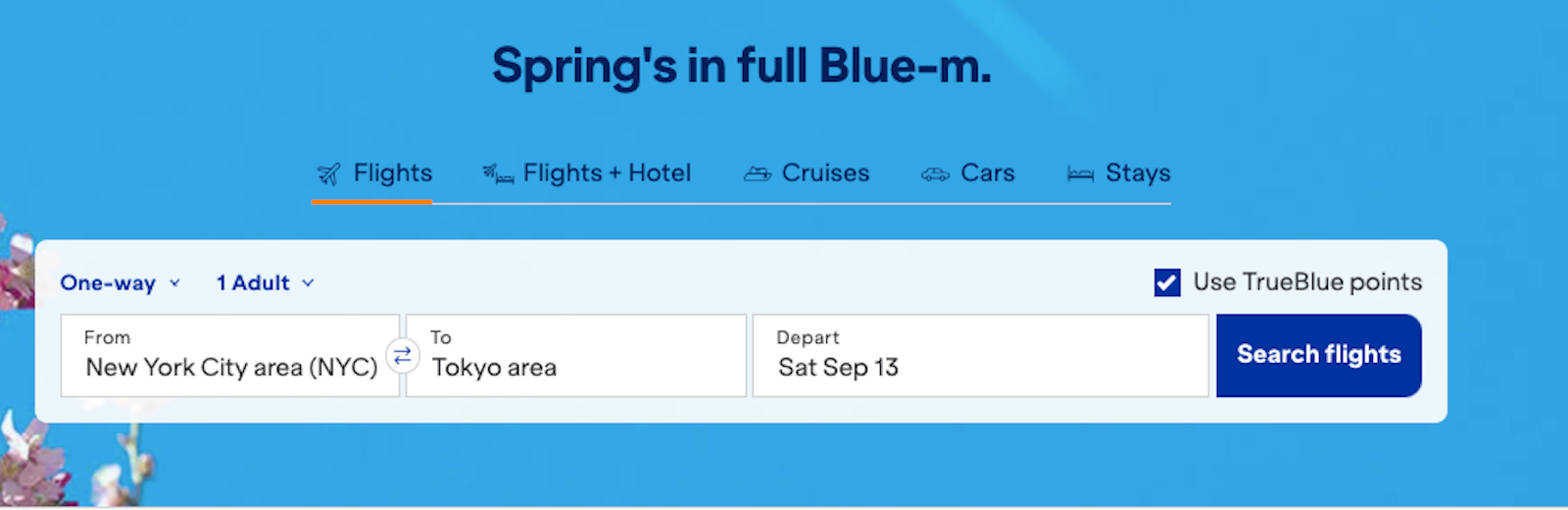

You'll want to book your flight on JAL just as you would any JetBlue flight, by plugging in your cities and dates and checking the box to "Use TrueBlue points."

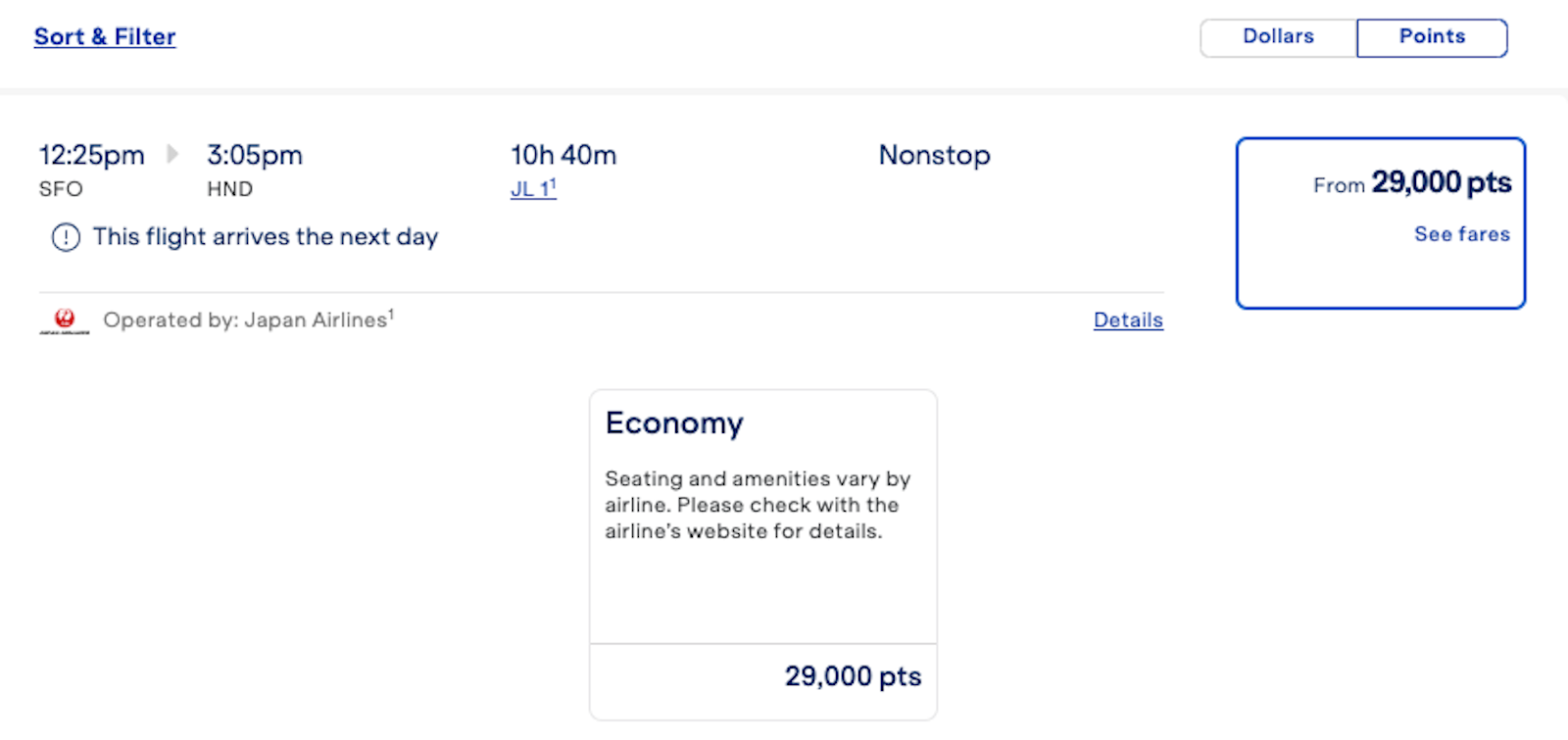

A few examples of TrueBlue redemptions on Japan Airlines flights I found: this summer itinerary from San Francisco International Airport (SFO) to Tokyo's Haneda Airport (HND) for 29,000 points in economy.

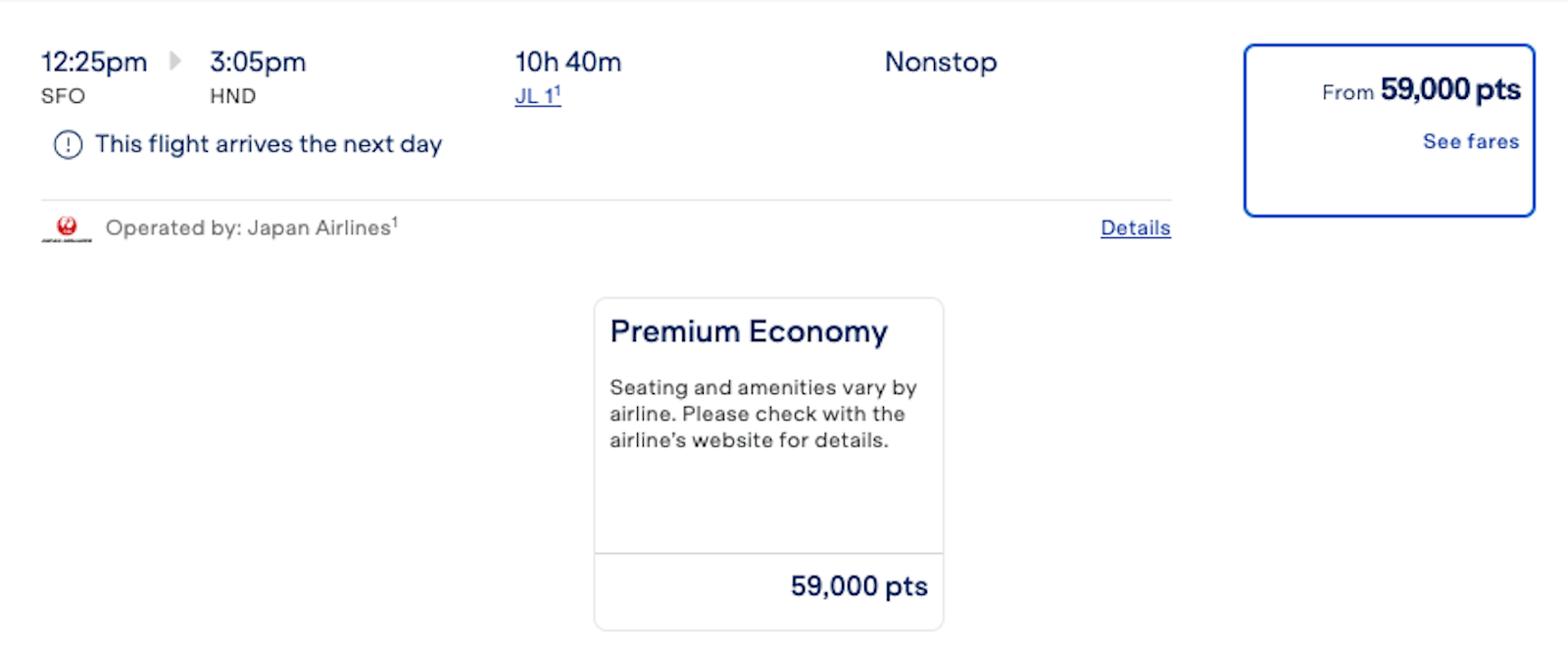

Meanwhile, here's a one-way premium economy redemption on the same route for 59,000 points.

Award space will certainly be a question, but it's worth watching how JetBlue's award pricing on JAL flights stacks up to alternative options for getting to East Asia, including in the higher-end cabins.

Where does Japan Airlines fly?

As of this month, Japan Airlines operates 11 routes between Japan and the continental U.S., per Cirium.

Those are:

- From Tokyo's Haneda to Chicago's O'Hare International Airport (ORD), Dallas Fort Worth International Airport (DFW), Los Angeles International Airport (LAX), New York's John F. Kennedy International Airport (JFK) and SFO

- From Tokyo's Narita International Airport (NRT) to Boston Logan International Airport (BOS), LAX, SFO, Seattle-Tacoma International Airport (SEA) and San Diego International Airport (SAN)

- From Osaka's Kansai International Airport (KIX) to LAX

JAL also connects Honolulu to four Japanese airports, including Tokyo's two largest hubs.

How to earn TrueBlue points

Beyond flying with JetBlue and earning points by spending on a cobranded credit card, you can transfer rewards from several major issuers to the TrueBlue program. Some good TrueBlue transfer partners include:

- Chase Ultimate Rewards — points transfer to JetBlue at a 1:1 ratio.

- Citi ThankYou Rewards points transfer at a 1:1 ratio for some cardholders, including those with the Citi Prestige (no longer available) and Citi Strata Premier® Card (see rates and fees), and at a 5:4 ratio for some other cardholders.

- American Express Membership Rewards points and Capital One miles transfer at a 5:3 ratio.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Before you transfer your points to JetBlue, we recommend reviewing our guide to the best ways to travel to Japan on points and miles to ensure you're getting the most mileage out of your credit card rewards.

Other JetBlue redemption partners

While JAL is JetBlue's first East Asia-based redemption partner, the carrier also has a few other international partners on which you can redeem points, including Qatar Airways, Etihad Airways, Icelandair and TAP Air Portugal.

As part of Wednesday's announcement, the carriers revealed members of Japan Airlines' Mileage Bank loyalty program can redeem their miles for select JetBlue flights, including trips to Latin America, the Caribbean, Canada and the U.S. East Coast.

Related reading:

- When is the best time to book flights for the cheapest airfare?

- The best airline credit cards

- What exactly are airline miles, anyway?

- 6 real-life strategies you can use when your flight is canceled or delayed

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- What are points and miles worth? TPG's monthly valuations

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.