Warnings issued for Carolinas, new airport announces closure as Hurricane Dorian turns north

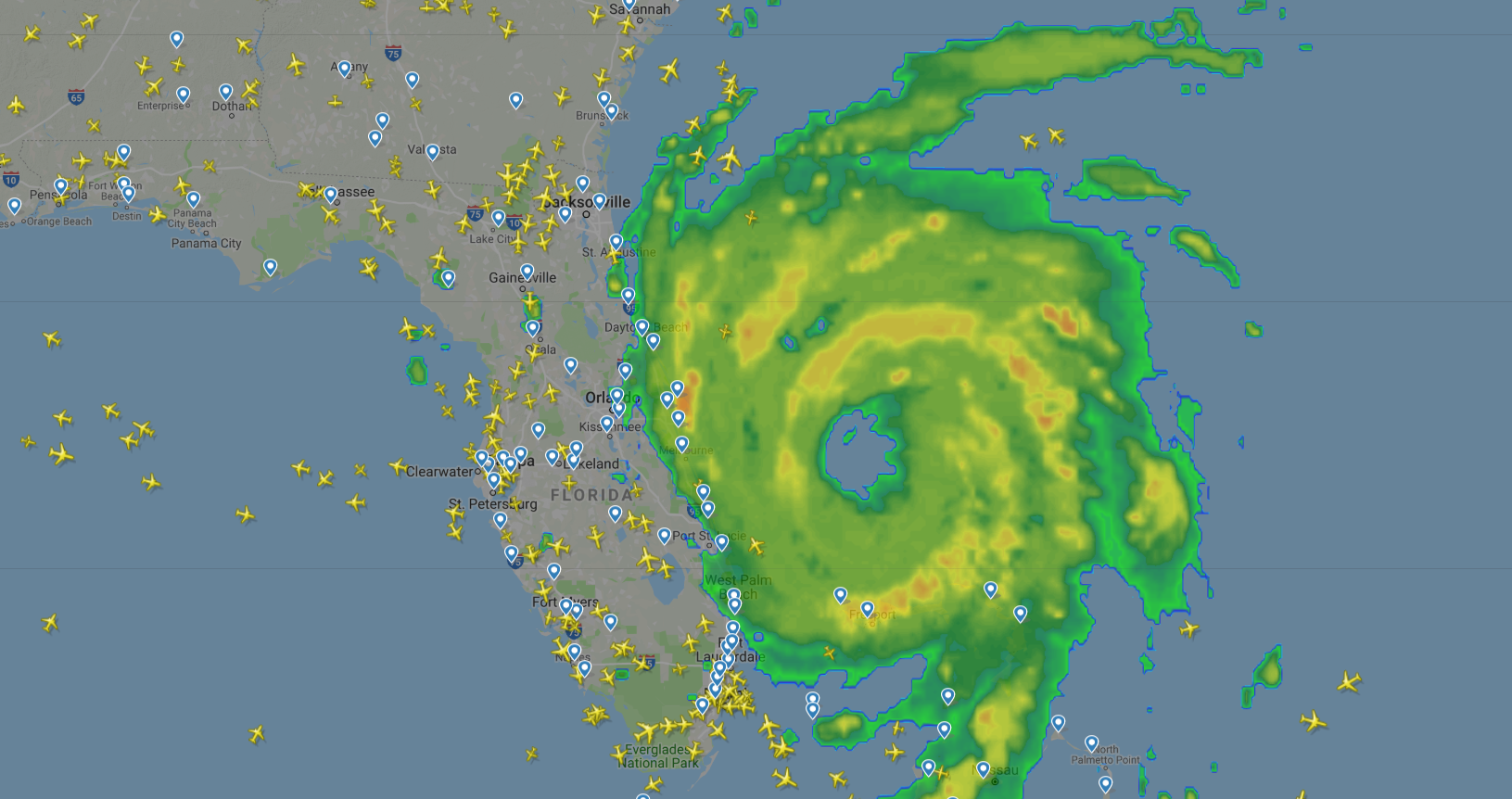

Hurricane Dorian has started its long-expected northward turn after devastating the northern Bahamas over the past few days. While that's good news for those in the Bahamas and South Florida, it's not good news for northern Florida, Georgia and the Carolinas.

Hurricane Dorian was always expected to make a close pass when heading north, but models now show the expected path shifted slightly west — increasing the chances of a landfall along the South Carolina or North Carolina coast. That's led to the first announced airport closure outside of Florida — Charleston, South Carolina — as the storm begins its march up the coast.

Airline weather waivers now stretch across 24 airports in Florida, Georgia, South Carolina and North Carolina as well as four airports in the Bahamas:

Forecast

As of Tuesday's 5 p.m. ET update from the National Hurricane Center, Hurricane Dorian's top sustained winds have decreased to 110 mph — a Category 2 hurricane. It's expected to maintain 110 mph wind speeds for the next 36 hours before weakening slightly on Thursday afternoon.

The center of the official track as of 5 p.m. ET keeps the hurricane from making landfall on the East Coast of the US. However, the center of the forecast track is closer to the coast than in the past few days, and the South Carolina and North Carolina coasts are very much in the cone of uncertainty.

Despite the decrease in wind speed, Dorian remains a powerful hurricane. The wind field has expanded considerably from when it made landfall on the Bahamas, with hurricane-force winds now extending 50 nautical miles (58 standard miles) and tropical storm winds reaching up to 150 nautical miles (173 standard miles) from the center.

While all models are now in agreement that the center of the storm will stay off of the Florida coast, the proximity to the Florida coast are expected to cause flooding and strong winds into Thursday. Tropical storm winds are likely to reach the Georgia coast early Wednesday and the South Carolina coast Wednesday evening.

Coastal Impact

Even with the eye staying off of the coast, both Florida and the Carolinas may still get hurricane force winds as the storm passes. Hurricane Warnings are currently in effect from Sebastian Inlet to Ponte Vedra Beach in Florida and from the Savannah River that separates Georgia and South Carolina to Surf City, North Carolina — indicating that hurricane force winds are expected within 36 hours.

In addition, a Storm Surge Warning is in effect from Jupiter Inlet, Florida, to Surf City, North Carolina with up to 7 feet of storm surge expected in parts.

Evacuation orders are in place up the coast of Florida — including St. Augustine, Jacksonville, Georgia (east of I-95) and the coastal areas of South Carolina:

Between 3 and 6 inches of rain are expected in Florida and Georgia. However, rainfall could reach up to 15 inches along the Carolina coast later this week.

Airport Closures

Check this post for the latest updates on what airports are closed and when they'll reopen

Charleston International Airport (CHS) has become the first US airport outside of Florida to announce its closure for Hurricane Dorian. The airport will close to all flights at 3pm local time on Wednesday:

Orlando International Airport (MCO) closed overnight Monday night. It's indicated to the FAA that it will reopen Wednesday afternoon. However, that reopen time could be delayed.

Palm Beach International (PBI) closed on Monday and planned to reopen Tuesday, but the reopening has been pushed back to sometime Wednesday:

Daytona Beach International Airport (DAB) closed at 6 p.m. on Monday and currently doesn't plan to reopen until Thursday night -- according to the FAA:

Further up the coast, Jacksonville International Airport (JAX) expects it will remain open through Wednesday:

Flight Cancellations

Through midday Tuesday, there have been over 3,000 flight cancellations across just six Florida airports due to Hurricane Dorian. Additional cancellations are expected in northern Florida, South Carolina and North Carolina as the storm passes.

Although it's generally held off cancelling flights until the last minute, Delta has announced 180 flight cancellations Tuesday and Wednesday due to airport closures at West Palm Beach, Orlando, Melbourne, Daytona Beach in Florida and at Brunswick in Georgia.

As of 2 p.m. Tuesday, American Airlines reports cancelling 350 flights on Tuesday, 180 flights on Wednesday and 40 flights on Thursday.

Fare Caps

American Airlines is capping fares from eight Georgia, North Carolina and South Carolina airports through Sept. 7. In addition, American Airlines has capped fares at $499 one-way nonstop in economy or $699 in domestic first class for flights out of Florida through Sept. 4.

Delta's fare cap on flights out of specified Florida and Georgia airports is only applicable for flights through Sept. 4. Flights are capped at between $299-$599 in Main Cabin and $499-$799 in the forward cabin based on the flight distance.

Fee Waivers

American Airlines and Delta are both waiving checked-bag and pet fees for certain airports covered by travel waivers.

American Airlines is waiving fees for two checked bags and in-cabin pets for flights to/from all cities covered under the travel alert in Florida, Georgia, North Carolina and South Carolina. These fees are waived through Sept. 7.

Delta's waiver only lasts through Sept. 4 from seven Florida airports.

Most US airlines have issued weather advisories for Florida, Georgia, South Carolina and North Carolina, allowing flexible travelers the chance to rebook away from the storm. Current waivers cover 24 airports on the US Southeast Coast and four airports in the Bahamas. Here are the latest waivers:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app