Two ways you can use hotel points to save big on summer travel, despite inflation

Have you noticed that the price for even budget hotels has become prohibitive?

I'm currently in Nashville — and staying for free in an $800 room thanks to Marriott points. If I didn't have hotel points, I'd be looking for a cheap cash rate. But even the nearest Red Roof Inn (a two-star hotel) is selling for $170 per night. In my experience, that's not normal.

But don't give up hope yet. One extremely effective tool to defeat extortionate travel prices is to redeem hotel points. And while collecting hotel points has always been a good idea, for many of us, they're now the only way we can actually afford to travel well in 2022.

Let's take a look at two of the best ways you can use hotel points to save big on summer travel, despite rising inflation and travel demand.

Use the Hyatt award chart to stave off inflation

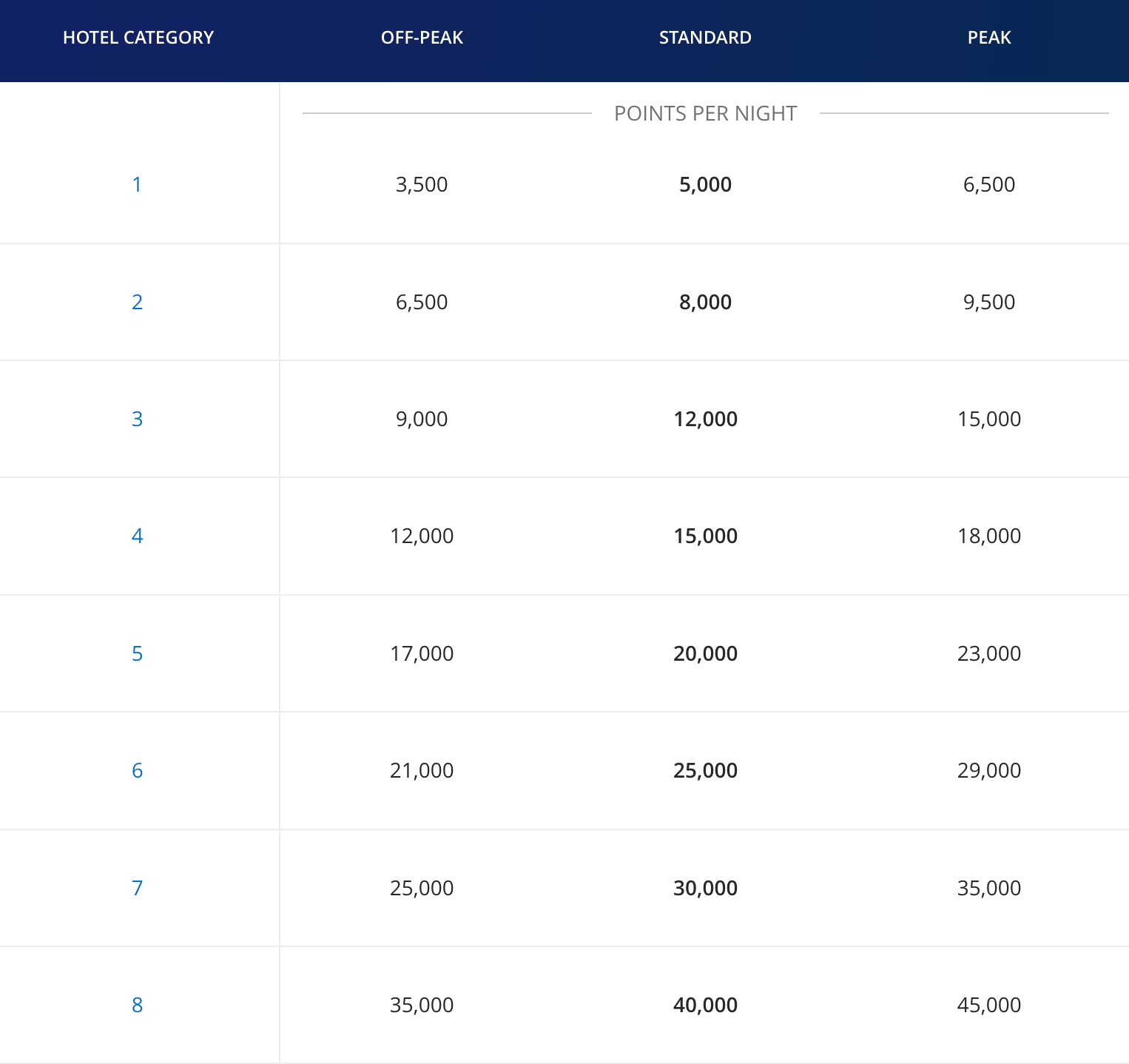

Hyatt is one of the only remaining loyalty programs to maintain a firm award chart. Hyatt groups its hotels into one of eight categories:

No matter the cash price of the hotel, the amount of points you'll pay for a room is confined to the hotel category's price range.

Related: Here's how to quickly stock up on Hyatt points for your next vacation

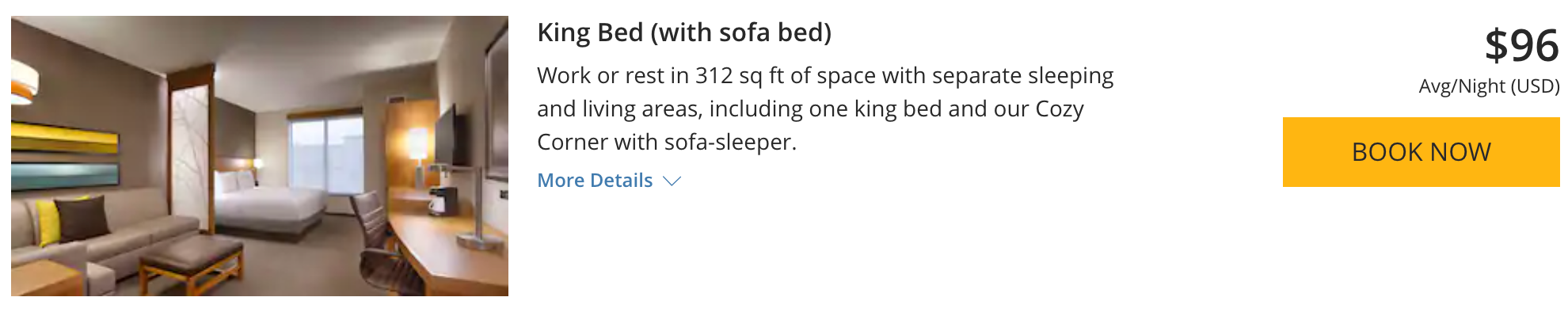

Let's look at an example. The Hyatt Place Park City is a Category 4 hotel, meaning you're guaranteed to pay between 12,000 and 18,000 points per night. You can find the hotel for less than $100 per night during the slow season around the fall.

The same room costs 12,000 Hyatt points.

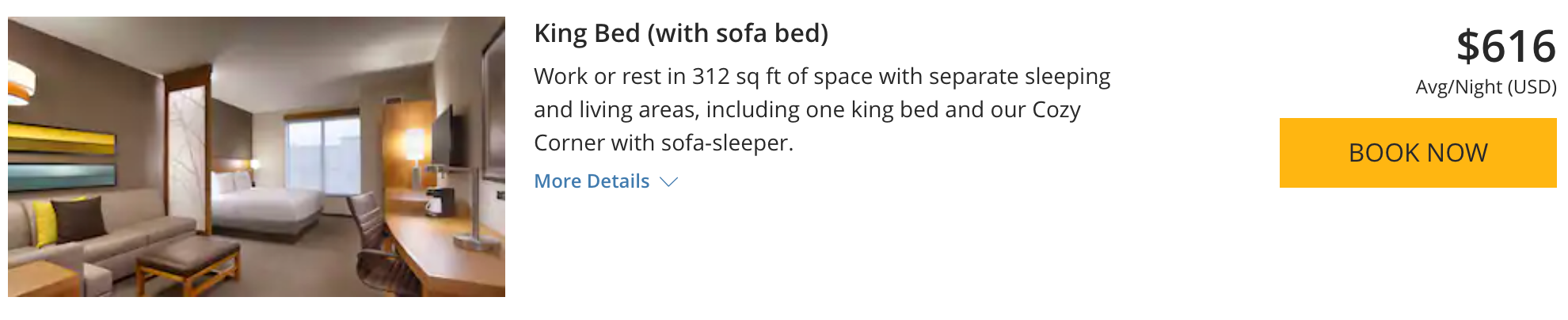

However, if you search during peak travel season — namely, ski season — the prices are much higher at over $600.

Again, because this is a Category 4 hotel, the most you'll be charged for a standard room is 18,000 points. This makes the hotel a steal during ski season.

All this to say, no matter how overpriced the room rates at Hyatt get, you can still reserve a room with a reasonable amount of points.

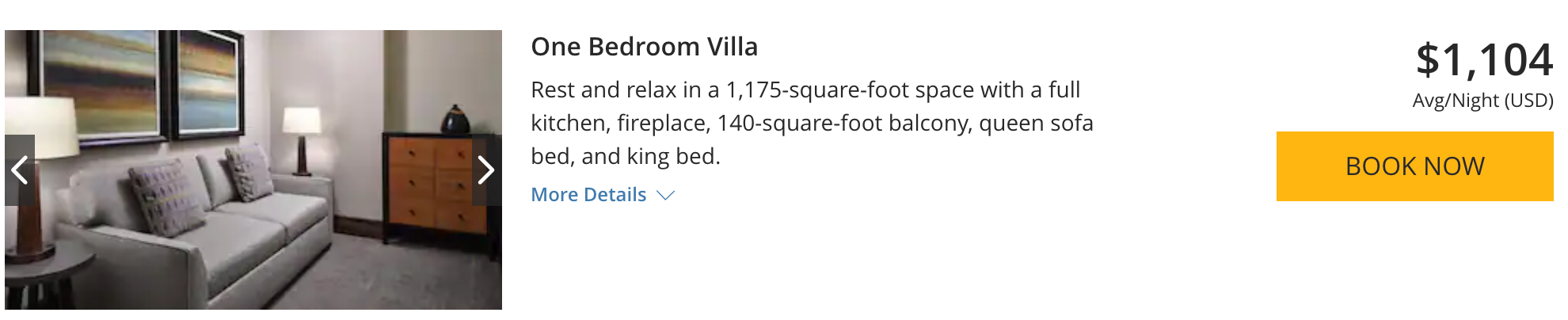

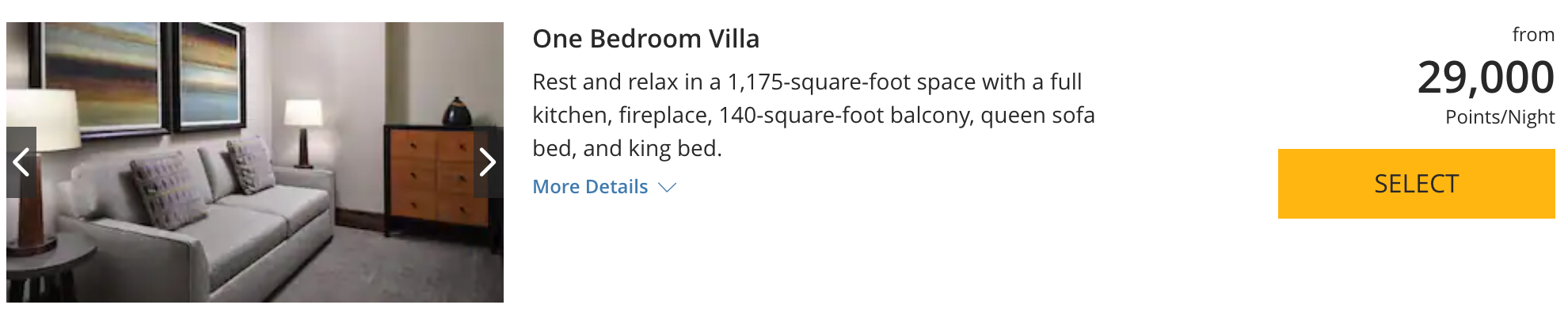

Here's another example: A super popular destination in the summer is Lake Tahoe. The nearby One Village Place is a Category 6 Hyatt hotel. For a night in mid-July, you'll pay over $1,200 (after taxes).

You can instead use 29,000 Hyatt points to stay for free. That would give you a value of 4.13 cents each — nearly 2.5x TPG's valuation for Hyatt points!

Marriott also uses an unspoken award chart

While Marriott no longer publishes an award chart, it keeps most hotels within a certain award price range, regardless of the going rate for a room. You can quickly discern a hotel's price range by clicking the "Use Points/Awards" checkbox and searching "Flexible Dates."

Related: How to earn lots of Marriott Bonvoy points

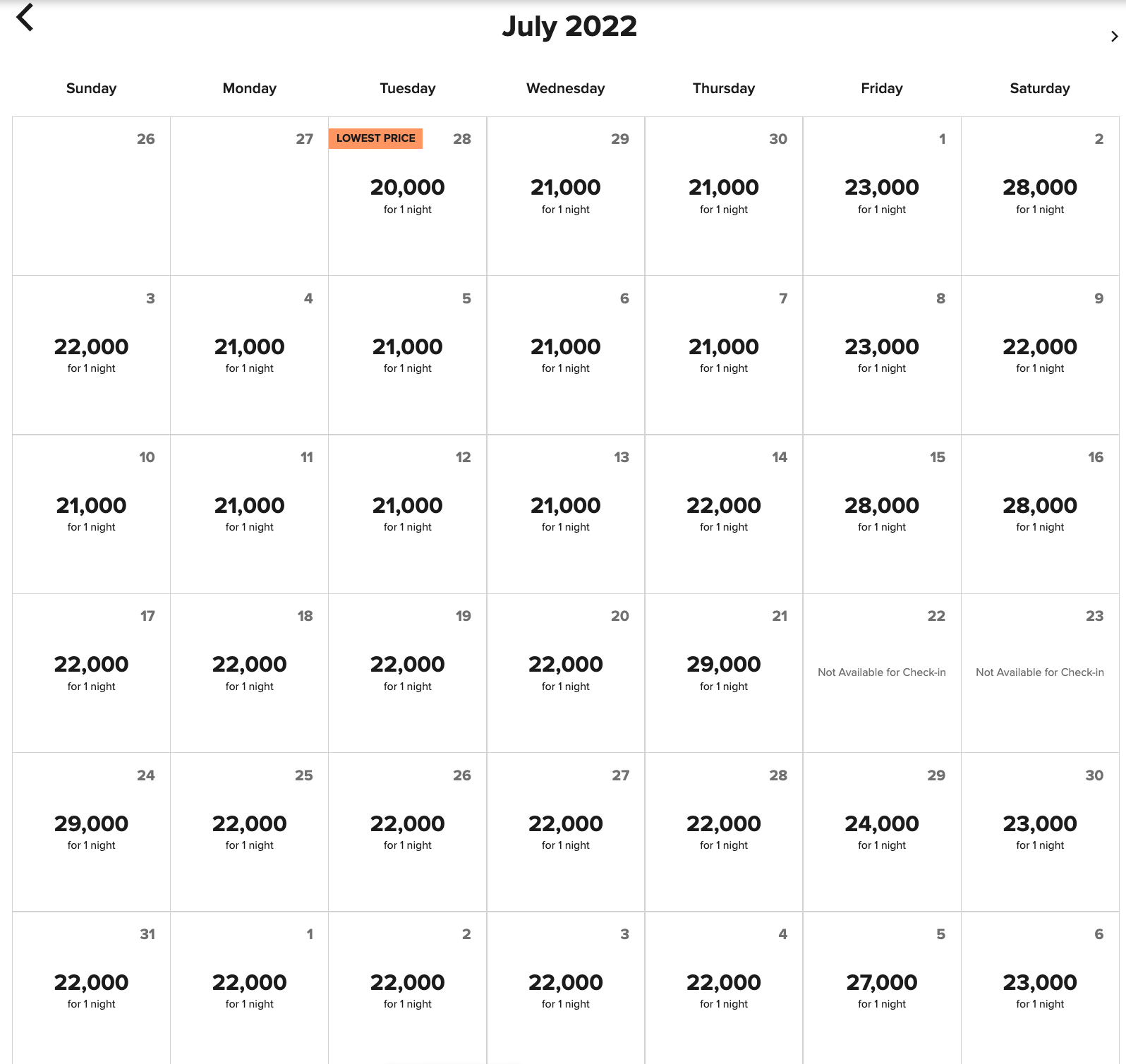

The Aloft Miami Brickell, for example, charges between 20,000 and 30,000 points for a room, no matter the cash price.

Here's another quick example: After a hasty scan, I've determined that the Fairfield Inn & Suites Key West costs between 40,000 and 60,000 points per night. This hotel's cash rates can get expensive, but no matter what, I know that I won't pay more than 60,000 points.

Related: Should you use points or cash to book hotels?

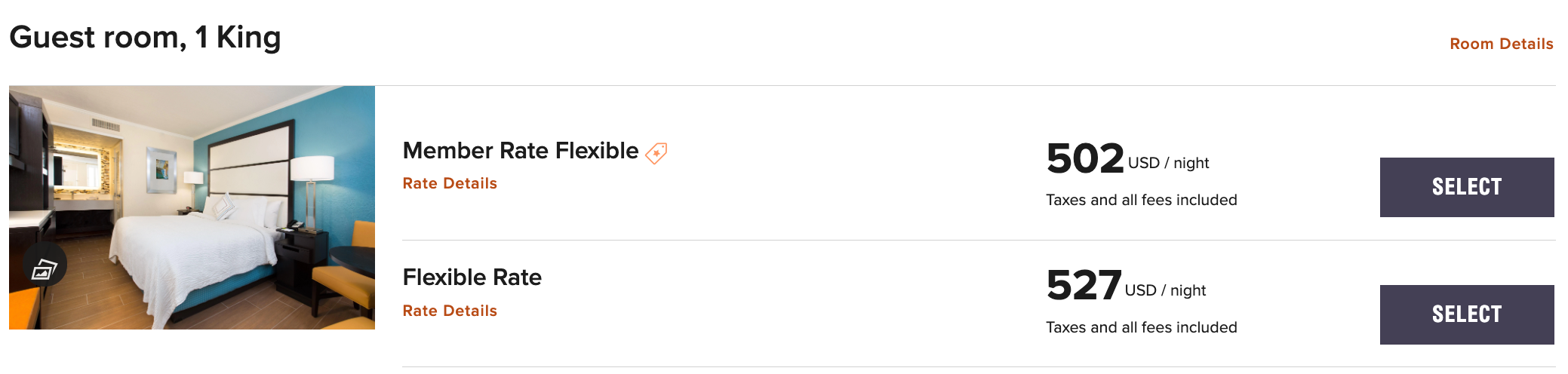

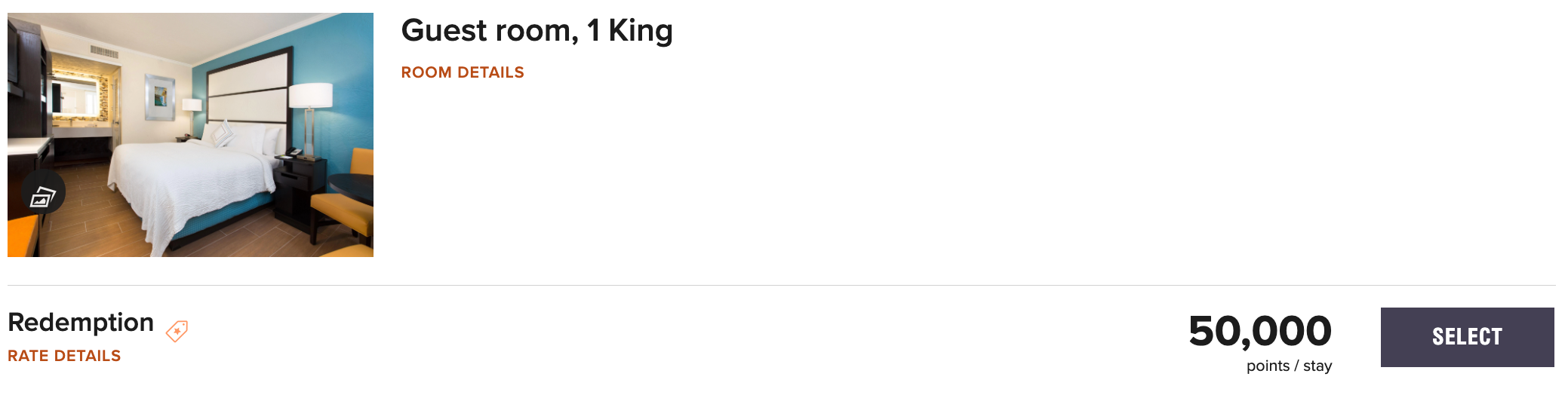

A night in early August costs over $500.

The same night costs 50,000 Marriott Bonvoy points. That amounts to a value of 1 cent per Marriott Bonvoy point. That's a good deal, as it's higher than TPG's valuation of Marriott Bonvoy points at 0.84 cents per point.

Bottom line

You can use Hyatt's award chart and Marriott's de facto award price bands to save big on your summer vacation — and beyond. Because of the exorbitant rates hotel rooms are selling for these days, you're practically guaranteed to get an excellent value for your points. Think of award prices as a form of rent control.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app