You Can Now Use CLEAR Biometrics to Pick up Your Hertz Rental Car

Update: Some offers mentioned below are no longer available. View the current offers here.

Car rental company Hertz and biometric identification company CLEAR have partnered to offer renters the ability to use their fingerprint or face to pick up a car. The partnership marks the first time a rental car company has teamed up with a biometric solution.

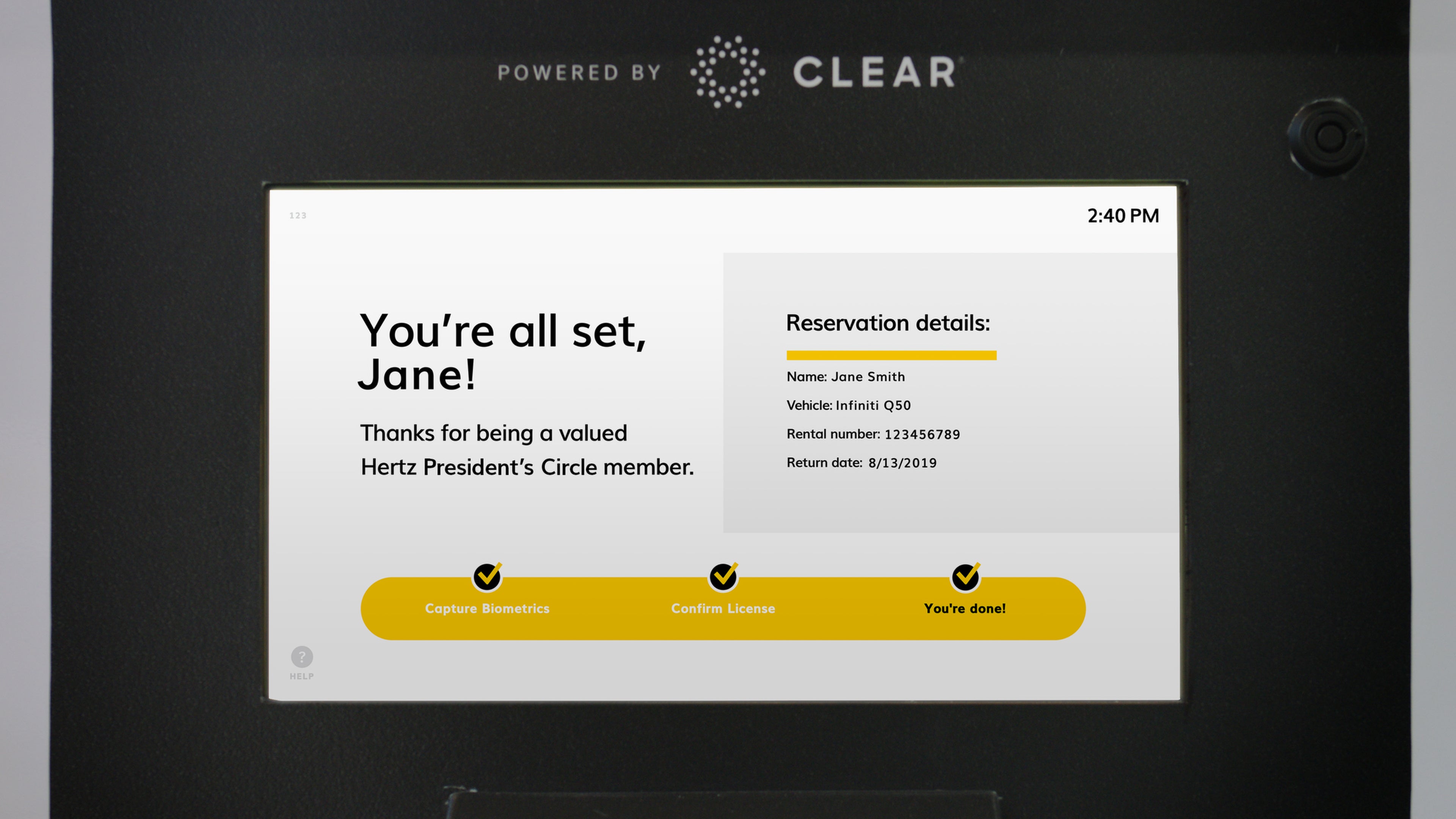

The Hertz Fast Lane powered by CLEAR, which launched on Tuesday, drastically reduces the time spent to pick up a car. In fact, according to Hertz, the biometric system will allow renters to get through the exit gate and on the road in 30 seconds or less.

CLEAR functionality with Hertz is now available at the Hartsfield-Jackson Atlanta International Airport (ATL). In 2019, Hertz will roll out the Fast Lane to more than 40 additional locations, including at airports like Los Angeles (LAX), New York (JFK) and San Francisco (SFO).

The partnership comes into play as soon as you've picked out a car and are ready to head off the lot and onto the road.

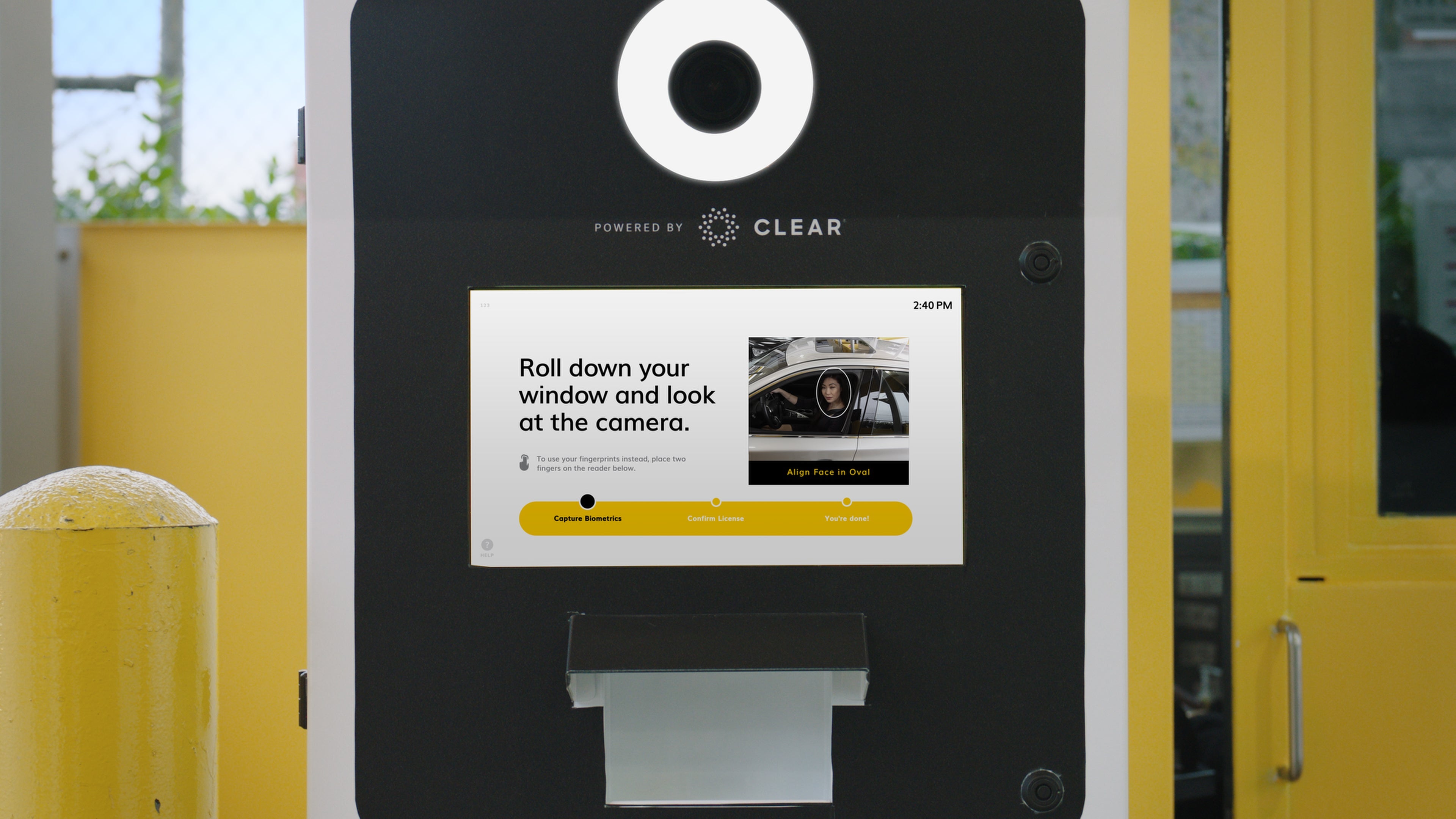

Once leaving the lot, Hertz locations where the Fast Lane is available will see specific exits with CLEAR integration.

Then, instead of being required to hand over documentation, such as identification, you'll verify your identity with just the scan of your eyeball or fingerprint.

Herz says that the process could save at least 75% more time than the traditional method. Once your identity has been verified by the CLEAR kiosk, you'll be able to drive off the lot and onto the road.

According to a press release, use of the Herz Fast Lane powered by CLEAR benefit is available for Hertz Gold Plus Rewards program members. Basic CLEAR members can use the kiosks at no additional cost. The two accounts must be linked, and you can do so by visiting this page. Some TPG staffers reported having issues linking their two accounts, such as requesting that they try later or go to an airport kiosk to reconfirm their fingerprints. A brand spokesperson confirmed to TPG that the issues only apply to people who have started their enrollment online, but have not yet completed it in person.

For Hertz members that don't have a CLEAR membership, you can score an airport membership at the following discounted rates:

CLEAR is a TPG favorite when it comes to making airport security a breeze. The membership-based service allows you to verify your identity via an iris scan or fingerprint. Then, you'll be escorted to the front of the security lane — whether that's the "standard" line or the PreCheck version. With CLEAR's expansion now entering another area (it already does airports and some large venues), the service has become even more valuable.

A CLEAR membership costs $179 annually, or $149 using promo code TPG149. However, if you're a Delta Diamond Medallion member, you can get your CLEAR membership for free. If you have Delta Platinum, Gold or Silver Medallion status or if you're a cardholder of the Gold Delta SkyMiles® Credit Card from American Express, the Platinum Delta SkyMiles® Credit Card from American Express, the Delta Reserve® Credit Card from American Express or any of their business versions, you can get a discounted membership for $79 annually. If you're a basic Delta SkyMiles member, you can get an annual rate of $99.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app