Get your caffeine fix with half off drinks at Capital One cafes

I have held Capital One cards for years now. Until recently, I had forgotten about one particular cardholder perk: the ability to get discounted drinks at Capital One Cafe locations.

I had just finished up a run and was walking back home when I stumbled across a Capital One Cafe in downtown Portland, Oregon. Thanks to being a cardholder, I was able to visit that Capital One Cafe and enjoy 50% off the handcrafted beverage I ordered.

If you need a daily caffeine kick, this generous benefit can save you more money than you might realize, especially when coffee and tea drinks routinely cost $6 to $8 each. All Capital One and Discover credit and debit card holders are eligible for this benefit, so you don't need to worry about having a particular Capital One card to enjoy this perk.

Here's everything to know to take full advantage of this perk.

What are Capital One cafes?

Capital One cafes serve as both banks and cafes. You can perform some small banking services, such as withdrawing money and depositing checks, at the ATMs within them. You can also ask questions to one of the Capital One advisers on hand. However, you won't be able to do everything you typically can at a full-service bank.

When visiting any of the 60-plus cafe-labeled locations available throughout the U.S., you'll also have the ability to order lighter meals, beverages and sweet treats. They have ample seating and fast Wi-fi as well for those looking to get some work done.

How to use the discount

Using the cardholder discount is quite straightforward. Simply place your order, and the barista will generally ask you if you have a Capital One or Discover card. If the barista doesn't ask you, simply mention that you have a Capital One or Discover card, and your beverage will be discounted. You will see signage throughout the cafe highlighting this cardholder perk.

You can use this discount at any Capital One Cafe nationwide. It can be applied to any drink purchase, with no limit on the number of beverages you can order and use the discount on. Food items are excluded.

How to maximize this discount

I've been on a matcha kick recently, so having the chance to get specialty beverages for under $4 in a major metropolitan area is a huge win for me. Drinks are similarly priced to those offered at Dunkin', Starbucks and most coffee shops in larger cities.

For a regular visitor seeking a daily caffeine fix, this can save you roughly $20 to $40 per month.

And since this discount can be applied to more than one drink — though it isn't stackable with any other discounts — it's a great way to treat your co-workers, friends or family to coffee and other beverages.

Remember, too, that these cafes host happy hours and daily specials that vary by location. At the time I visited, the downtown Portland location was offering $3 beverages every Wednesday from 3 p.m. to close until the end of the year.

Related: Best dining credit cards

What cards can I use?

You can use any Capital One or Discover credit or debit card to get half off beverages. If you don't currently have a card, here are a few of my top picks you could consider applying for:

- Capital One Savor Cash Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

Or, if you're not in the market for a credit card, you could opt for the 360 Checking Debit Card attached to a fee-free Capital One 360 checking account.

The information for the 360 Checking Debit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Why the Capital One Venture X could be the best option for your first premium card

What to order

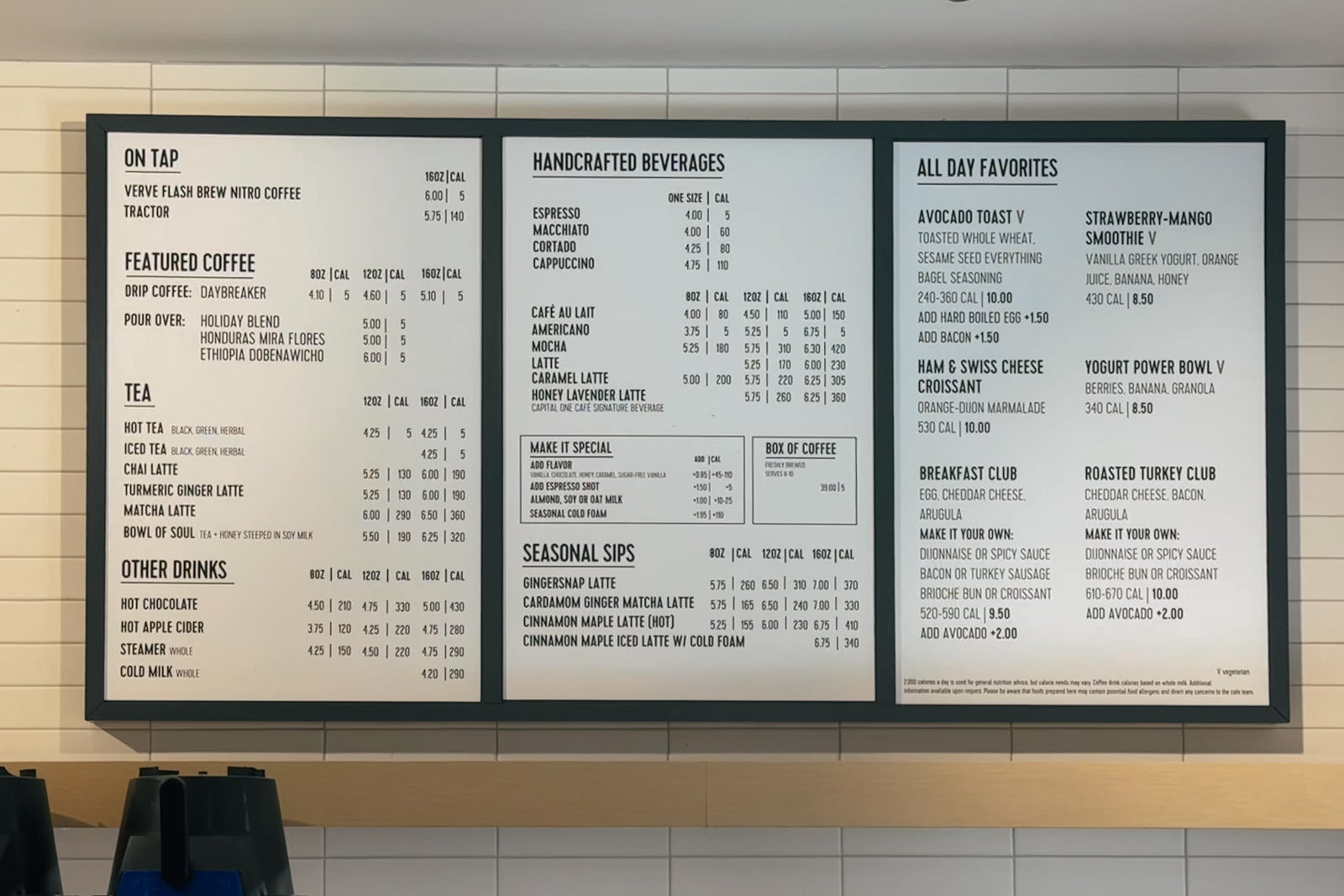

There are plenty of drinks and flavor combinations to choose from, and since you're only paying half price, it's easy to try a few. You can try different options until you find your favorite.

Some of my top drink picks are:

- Iced caramel latte

- Iced honey lavender latte

- Iced honey lavender matcha

- Iced vanilla matcha

The honey lavender latte is the signature drink at Capital One cafes, and it is quite tasty.

But if you're a coffee purist and not into flavored coffees, you can get a black coffee for just $2.00 with the discount. Additionally, for those who prefer not to consume caffeine, there are various decaffeinated drink options.

I've also tried the food a handful of times, and it is hit or miss.

Bottom line

Capital One and Discover cardholders shouldn't overlook this benefit. You can get your caffeine fix via lattes, matchas and more at 50% off just by stopping by your nearest Capital One Cafe.

Related: The best time to apply for these popular Capital One credit cards based on offer history

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app