Get 50% off Uber rides when you pay with Venmo

Update: Some offers mentioned below are no longer available. View the current offers here.

The weekend is coming up, and I'm sure many of you'll be taking an Uber at some point. Why not save some money while you're at it?

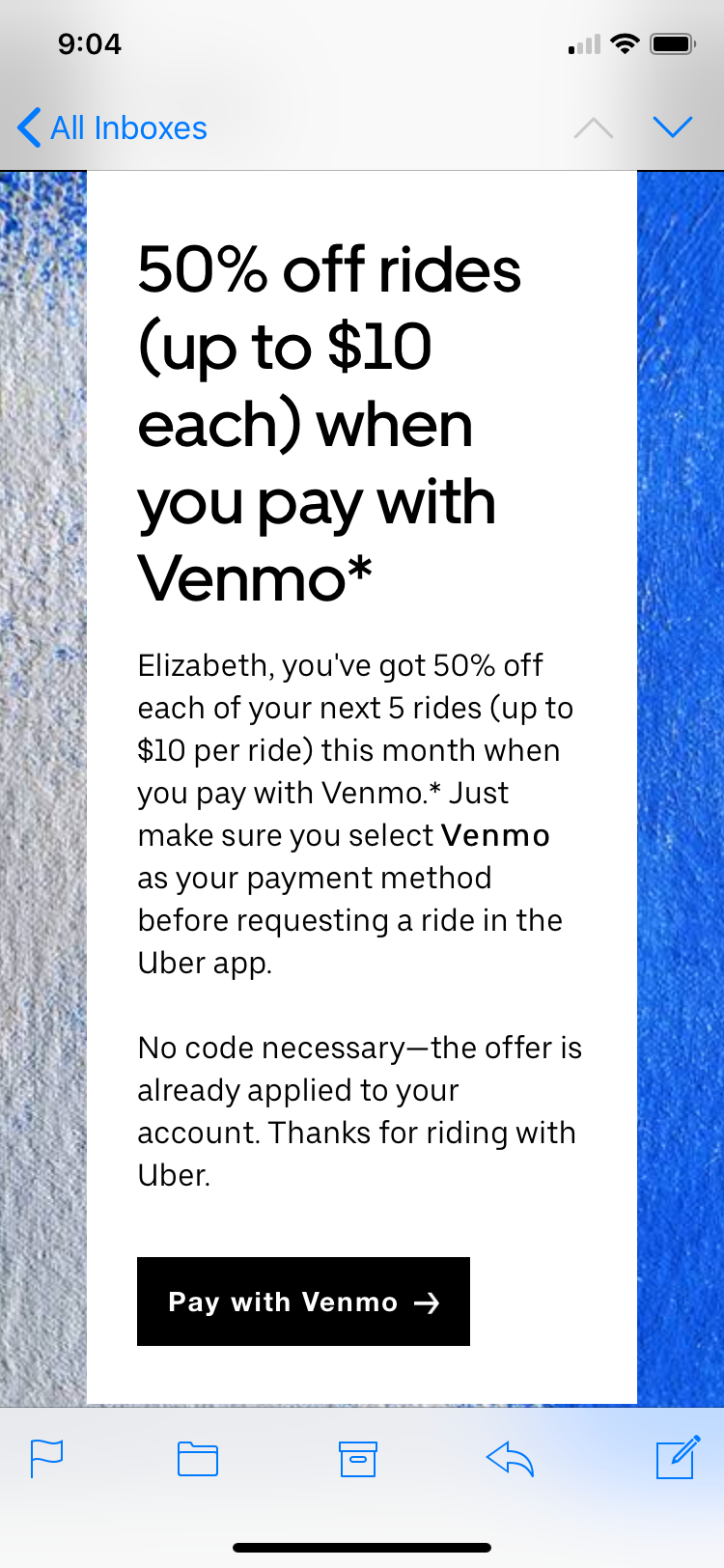

Uber is sending emails to targeted customers about a new promotion that could save you 50% on your next five rides. Here's what you need to know.

You'll score 50% off each of your next 5 rides when you pay with Venmo (up to $10 per ride). You'll just need to make sure you select Venmo as your payment method before requesting a ride in the Uber app. Even better? There's no code necessary as the offer is already applied to your account. Just make sure you're actually targeted for the offer, you should see an email like the one above if you were selected.

In order to make sure you're getting the most out of your Uber rides, make sure you're using the right credit card for each ride. To help you maximize the points earned on Uber rides or enjoy some credits toward free rides, check out this guide to see which cards you should add to your purse or wallet.

The Platinum Card® from American Express is one of the best options out there for Uber perks. As an Amex Platinum cardholder, you'll receive up to $200 in Uber credits to use annually. You'll get $15 to use each month, plus a $20 bonus in December. You'll also get Uber VIP status which matches you with highly rated drivers.

Just make sure to select your card as a payment option in the Uber app. The monthly credits will then be loaded into your Uber Cash account automatically at the beginning of each month. And if you don't want to use your Uber credit on your next rideshare, you can also apply it to your next food delivery order with UberEats.

The Chase Sapphire Reserve is also a solid choice for Uber. Chase classifies Uber as a travel expense, meaning you'll earn three Ultimate Rewards points for every dollar spent with Uber.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app