Expedia and HomeAway Launch Partnership: More Ways To Maximizing Points On Vacation Rentals

Update: Some offers mentioned below are no longer available. View the current offers here.

Expedia.com announced a new partnership with HomeAway that will mean their vacation rental properties will now be posted on Expedia. The pilot project is set to be launched early 2014 and will feature vacation rentals across the US and Mexico, and is an expansion upon HomeAway's current business relationship with BedAndBreakfast.com.

Under the new agreement, Expedia will expand travel options by posting over 10,000 HomeAway vacation rental properties along with hotels and bed & breakfast options on the site beginning next year. The aim is to give customers a greater selection of options to choose from.

Of course, what it also means for savvy points collectors is that now by booking vacation rentals on Expedia, you can earn even more points on them by taking advantage of Ultimate Rewards shopping portal bonuses, and these purchases will count as travel expenses and thus earn bonus points on cards like the Chase Sapphire Preferred 2.14X per $1 on travel, or be eligible for better-value redemptions on the Barclaycard Arrival World Elite Mastercard as well as the 10% redeemed miles refund for travel expenses.

As much as I love hotel points and elite status benefits, from time to time, staying in a hotel with a decent loyalty program just isn't possible for any number of reasons. Perhaps you might be staying for an extended period of time, room rates are simply too expensive, the destination you're interested in doesn't have any chains you have points with (or any hotels at all!) or you're staying with a large group. In those cases, services like HomeAway are increasingly popular.

As I have said many times, the Sapphire Preferred is among my all-time top travel credit cards because it offers really lucrative category spending bonuses including 2.14X points per $1 on travel (including the 7% annual points dividend) – which includes not only airline tickets, hotel rooms and things like that, but also parking garages and meters, taxis, metro transit like the Subway and a host of other transportation options as well as online travel agencies like Expedia. So with this new partnership, cardholders can rake in the points on vacation rentals. The card also has the other valuable benefit that if you are heading to a rental in Mexico since it waives foreign transaction fees, so it's a great card to get if you travel internationally.

Not only that, but if you log into the Ultimate Rewards shopping portal, you'll see that Chase often offers spending bonuses on OTA's including Expedia, so that's a way to earn even more points off your purchase. Right now, for example, Chase is offering 1 extra point per $1 (sometimes it's higher) when you click through to Expedia, meaning if you pay with your Sapphire Preferred, you can earn 3.21X points per $1 including the annual 7% dividend.

Another option paying for your rental on the Barclaycard Arrival World Elite Mastercard because you get a 10% miles refund on travel redemptions with the card. The version of the card with no annual fee earns 2X miles per $1 on travel expenses including at OTA's like Expedia, while the version with the $89 annual fee waived the first year earns 2X miles per $1 on all purchases. When it comes to redemption, this makes a big difference since when you redeem your Barclaycard Arrival miles for travel expenses, you redeem at a rate of 1 cent per point, and get 10% of your miles back. So, if you were to use either version of the Arrival to pay for your vacation rental stay, you'd earn 2X miles. Then if you redeemed Arrival miles for the purchase, you'd basically be getting 2.2% cash back based on the fact that it's a travel merchant – not a bad return on your spending.

The prices for vacation rentals currently on HomeAway vary widely depending on the size and location, but for example, this 7-bedroom mansion in Hollywood, California, sleeps 24 people and rents out for $4,480 a week off-season (now through December 14, 2013). If one person puts it on their Sapphire Preferred card then that would mean they would earn 9,587.20 points from the trip. With nice hotels in Hollywood easily going for $400-$500 just for one standard room, you are potentially getting a lot more space and amenities for your money while earning Ultimate Rewards at the same time.

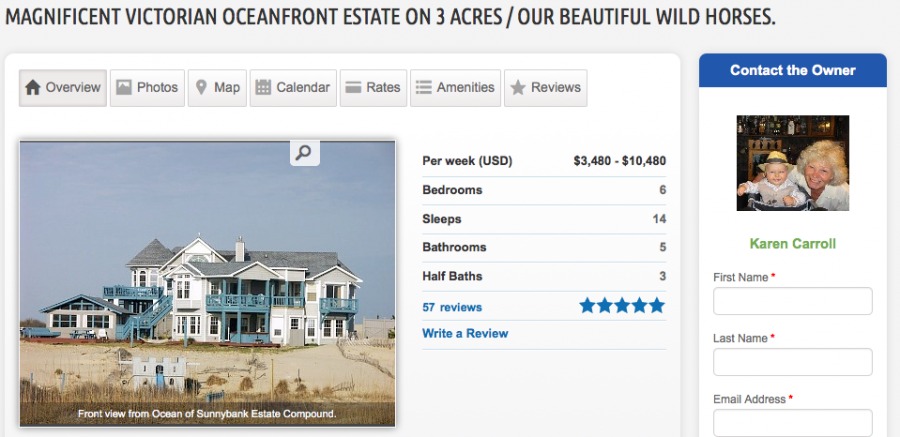

This oceanfront property in Corolla on the Outer Banks of North Carolina has 5 master suites plus a den and sleeps 14, and is located right on the beach where wild horses regularly wander past. Located 75 miles away from the nearest major city of Norfolk, VA, the Outer Banks is an idyllic spot on the Atlantic coast where you can't normally earn points on stays due to the lack of major hotels, so this is a great way to maximize your expense. Weekly rates start at $3,480 in the off season (November 15-March 13), which would earn you 7,447.20 Ultimate Rewards points.

HomeAway also owns VRBO (standing for "vacation rental by owner") and up until now many people have discounted both sites as a points-earning opportunity since they tend to be classified as a Real Estate and Rental merchant – so you would have been out of luck on any travel category spending bonuses. Plus, since you're renting directly from owners, many demand either payment by Paypal or by check, and credit cards are out (although some do accept credit card payment). However, this new partnership will open up a whole new world of doors - literally and financially - when it comes to earning points on stays.

I'd be curious to hear about if any of you have other strategies for maximizing vacation rentals, and your experiences with any or all of these services, so if you want to share, please leave a comment below.

For more information on Expedia and vacation rentals, read these posts below:

Maximizing Points And Miles On Vacation Rentals With AirBnB and VRBO

The Top 10 Credit Cards In My Wallet And What I Use Each For

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app