Riding an Electric Citi Bike Across the Brooklyn Bridge

Citi is a TPG advertising partner

Some of us laud the bicycle's dual purpose, as both a transportation and fitness tool. Others don't. Or they simply don't want to work up a sweat on the way to the office — and who can blame them for that.

Whatever your reason for wanting to cut back on the effort required to ride to work, Citi Bike's got your back with a new pedal-assist electric bike.

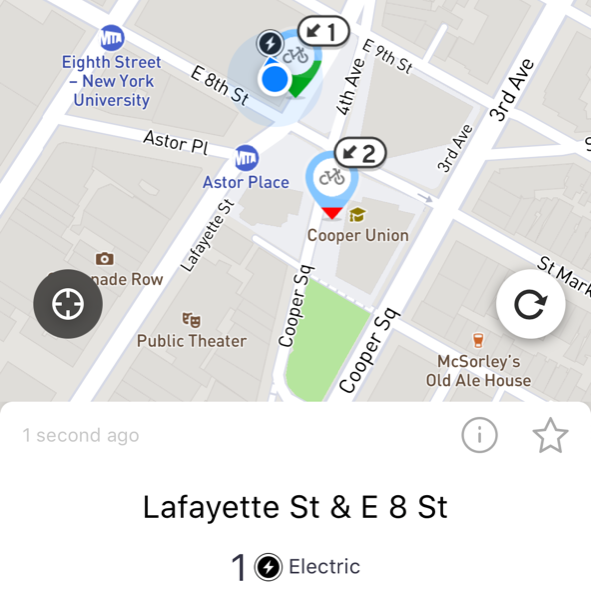

While these bikes are still few and far between, they've begun to pop up at Citi Bike stations in Manhattan and beyond. You can find one by pulling up the bike-share program's app and looking for a station with a lightning bolt icon attached — tapping will reveal the number of available e-bikes, including the current charge level, if available.

After one failed attempt — racing to a dock only to find that someone beat me to the only electric bike — I managed to grab one at 8th and Lafayette, not far from TPG's headquarters just north of Union Square.

It seemed that this particular station wasn't equipped with charging, so the app couldn't reveal the current power level. A tap of the battery button made it clear that my prized e-bike was running on fumes, but with no other options I still decided to give it a shot.

I felt the pedal-assist feature kick in right away — it was especially noticeable when I began pedaling from a full stop, or if I needed a burst of energy to make it through a yellow light. The bikes still top out at 18 miles per hour, so don't expect to be passing delivery people with a full-power electric version. Still, the e-bike was far easier to ride uphill, like when I cruised up the Brooklyn Bridge with my Galaxy Note 9 mounted to the handlebars.

The electric bikes look similar to their lesser-equipped siblings — they're painted blue, with the Citi logo, a black seat and handlebar and the new front-mounted basket that first popped up a few weeks back. A lightning bolt (electricity!) plus the word "electric" make a few appearances, too, and there's a large battery mounted on the frame.

Next time, I'll keep an eye out for a bike with a bit more juice — mine seemed to have some power, still, but another Citi Bike cyclist sped past me on the bridge, while clearly exerting far less effort. I imagine the experience will be even better with a full charge.

While I pay an annual fee for unlimited 45-minute rides, Citi Bike also sells single rides for $3, with up to 30 minutes of cruising, or you can get a full 24-hour pass (also with 30-minute rides) for 12 bucks. An annual membership like mine runs $169/year, but you can score a 10% discount by paying with a Citi card — I pay with Citi Prestige to get about $17 off of mine. Electric Citi Bikes don't cost a penny extra — if you see one docked nearby, don't hesitate to pick it up.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app