How a 10-minute call reversed $2,300 in fraudulent charges on my credit card

Editor's Note

On a recent Saturday morning, I was cozy on the couch with a blanket. Suddenly, my otherwise pretty monotonous online bill-paying routine was quickly and harshly interrupted as one of my credit card account balances was a few thousand dollars higher than I expected.

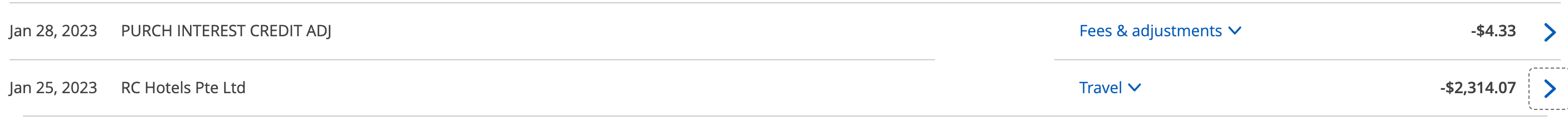

As I dug in to see what could have caused this huge discrepancy, I found a $2,314.07 charge for RC Hotels Ltd. that rang absolutely no bells for me. Some quick Googling revealed that this company was related to the Fairmont Singapore, which I'm sure is lovely, but isn't on my current list of past or future travel plans.

In other words, the charge wasn't mine and it seemed like my credit card had experienced a fraudulent charge for over $2,000 that went through and was pending as money I owed the bank.

A simple 10-minute phone call

Once I confirmed that the expensive charge was certainly not mine, I flipped my credit card over (a Chase-issued United card, for those curious) and called the customer service number on the back.

After a two-minute call explaining the situation to the first-line customer service representative, they got the fraud department on the line, which was briefed on the situation before I was transferred over.

My call with the fraud specialist was simple and straightforward, with them outlining several other international luxury hotel charges that had been attempted against my card that Chase had automatically declined. However, the large charge for the Fairmont in Singapore had gone through, but I was assured I would not be held responsible for the charges I did not make.

In total, I was on the phone for less than 10 minutes.

Related: Getting started with points, miles and credit cards

What happened to my card?

That credit card was canceled on the spot to prevent further fraudulent activity and a new card was on its way. I was told it would be about a week, though I was given the impression that if I needed or wanted a replacement card faster, that could have been arranged.

Later that same day, I received an email from Chase stating that the unauthorized charge was being investigated and I would not be held responsible for any fees or interest related to the charges until they confirmed the results of the claim. The note went on to explain that I did need to keep making at least minimum payments on the balance in the interim.

A few days after that, the original charge was now shown as credited back, as were the few dollars in interest that had accrued on it.

Bottom line

As you may have already experienced yourself, credit card fraud is, unfortunately, not unusual.

Even in a case such as mine, where the physical card is still safe and sound, there are many ways for fraud to occur, to the tune of hundreds of thousands of such events each year. Personally, I seem to deal with it at least once or twice a year, though usually for amounts much smaller than this.

And that's precisely why I'm profoundly grateful that I use a credit card as much as possible for my purchases. So when (what seems like) the inevitable happens and thieves find a way, I'm not on the hook for anything more than a 10-minute phone call and cutting up my credit card for a replacement. If I really had to pay that $2,314, my Saturday bill pay routine would have not just been briefly interrupted — my budget would have gone belly up, too.

Credit cards have many more protections for consumers than cash, checks and debit cards, so in addition to the points you can earn, they can help protect you and your cash, too. And for that, I'm extremely grateful.

A reminder: Credit cards offer far superior fraud protection than debit cards, so if you can manage your spend responsibly, opt for credit cards over debit cards.

Related reading: Credit card fraud vs. identity theft — How to know the difference

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app