Dirty money: Could ditching cash keep you healthier this season?

Editor's Note

Editor's note: This post has been updated with new information.

It's no secret that cash is dirty. Few things in this world retain their value despite being stored in sweaty, gross pockets, getting handed from person to person, or falling into sewers and filth. But cash is one of them.

In fact, numerous studies have found that cash often carries traces of cocaine, heroin, human waste, yeast, mold, E. coli and many other substances — especially when it comes to pocket change, which changes hands almost constantly.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

The case for contact-free payment

Knowing all this, it's no surprise that coronavirus-embattled China declared war on its paper currency, the yuan, early on in its war against the COVID-19 epidemic.

The People's Bank of China announced in mid-February that all banks would be required to disinfect any potentially contaminated cash, first with either ultraviolet light or heat treatment followed by seven to 14 days of storage before reissuing bills to the public.

Money from high-risk locations such as markets and hospitals underwent even more rigorous inspections: Bills had to be specially sealed, and delivered to the People's Bank of China instead of recirculated.

To replace the destroyed currency, the People's Bank of China distributed approximately $86 billion in fresh bills as of Jan. 17, 2020. The government also ordered a halt on cash transfers between provinces, hoping to limit physical transmission of the COVID-19 virus. The country has sped up testing of the first central bank-backed digital currency, known as DCEP, or "digital currency electronic payment," reports DW.com. The plan is for the country to eventually move to a digital yuan.

All that being said, China leads the world when it comes to cashless payment adoption (when you factor in population size as well as the percentage rate of cashless payment adoption), so avoiding hard cash isn't guaranteed to keep you healthy. In November 2019, eMarketer estimated that a whopping 577.4 million users representing approximately half of China's total population had made a proximity mobile payment within a six-month period.

SARS-CoV-2 (the virus that causes the disease COVID-19) can survive on surfaces like dollar bills, according to the state of New Jersey's COVID-19 information hub. How long the virus survives is dependent on the surface itself as well as environmental conditions. But at most, the virus will persist for two to three days under optimal conditions.

Preliminary findings suggest that COVID-19 may persist on money for a longer period of time than cardboard/paper-based products because cash in the U.S. is composed of 25% linen and 75% cotton, not paper, according to the hub.

Current research has shown that cash may be a potential vector of transmissible diseases, such as bacteria and viruses. However since there hasn't been specific research done on the COVID-19 virus, the World Health Organization (WHO) recommends thoroughly washing hands after handling money and moving towards cashless payment methods when possible.

How cash potentially contributes to the spread of coronavirus

Is destroying billions of dollars' worth of currency an extreme measure? Yes. But is the caution justified? Possibly, given the viral nature of the pandemic's spread.

Research on similar viruses suggests that this current strain of a coronavirus-type disease known as COVID-19 may be capable of maintaining infectiousness on inanimate surfaces — such as cash — for up to nine days at room temperature. (Coronaviruses can be destroyed by common disinfectants, however, and are known to dissipate in high heat.)

The New York Times lists four factors that likely contribute to coronavirus transmission between two people, beyond the obvious elements of age and health. They are:

- How close you get to each other;

- How long you stay in close contact;

- Whether the sick person projects viral droplets onto you by coughing or similar expulsion;

- And how much you touch your face.

What's that about your face, you say? Studies have shown that the average person touches their face 23 times an hour. And other research has proven that the coronavirus is most easily transmitted through facial mucus membranes such as the ones lining your eyes, nose and mouth.

Infection spreads when you come in contact with a contaminated surface, then transfer the virus to your body, often through your fingertips.

Related: Airport kiosks are germier than toilets

Human beings spew micro-droplets of saliva and mucus each time we breathe, sneeze, cough, talk, and go about our daily lives. Those bodily fluids serve as carriers for any microbes within our bodies, which rely on this process to pass from host to host.

The viral droplets contaminate any surface they land on, and fast-spreading diseases like the coronavirus spread quickly to the next host in high-traffic, close-quarter areas such as markets, hospitals and public transportation.

"The coronavirus is a respiratory disease, and transmission at this time is thought to be mostly droplet," Dr. Amy Faith Ho told TPG. "However, more information is constantly developing on how it is spread, so most [medical professionals] are recommending caution for contact as well."

This simple rule of transmission is why you keep seeing all the injunctions about thoroughly washing your hands during this high-risk time. High-traffic touchpoints such as elevator buttons or subway supports can increase your risk of exposure to a number of diseases, including the coronavirus and the common flu.

And since the average dollar bill passes through hundreds of hands during its lifetime, why not avoid touching cash if possible?

So if the threat of everyday germs (and the loss of rewards) wasn't enough to deter you from pulling out cash for payment wherever you go, let the coronavirus season guide you toward contactless payment.

How to pay the bills without touching your bills

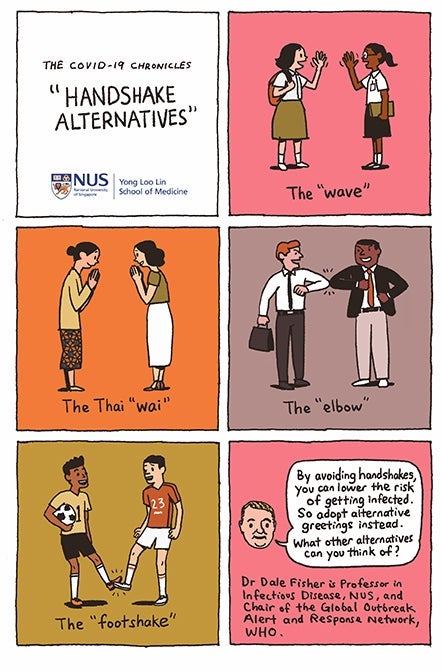

A helpful little graphic from the National University of Singapore's school of medicine illustrates some ways that people can avoid touching hands in social environments during this time, including friendly waves, bumping elbows and even a sporty foot-tap borrowed from athletes.

The novel coronavirus appears to have a particularly long incubation period, and some patients have been known to be almost asymptomatic despite testing positive for the disease.

Tools like contactless cards, Venmo, Paypal, Apple Pay, Google Pay or Samsung Pay similarly allow you to complete financial transactions while minimizing physical contact.

By limiting the amount of cash you handle — or by avoiding your physical credit card and wallet altogether — you're not just preventing yourself from coming in contact with someone else's germs; you're keeping others safe from yours as well.

Bottom line

As the pandemic continues, we can't guarantee that putting away your cash will keep you healthier. But we do know that limiting your physical interactions with other people can help. And, of course, you'll have a lot more points to show for it when you pay with credit cards — and fewer germs from your environment if you use a contactless card.

That being said, medical experts around the world are in agreement on one thing: The best coronavirus prevention comes from practicing healthy hygiene.

In addition to washing your hands long enough to sing "Happy Birthday" twice, the CDC also recommends regularly cleaning and disinfecting frequently touched objects and surfaces with disinfecting spray. Depending on your everyday lifestyle, these could include your wallet, credit cards and your cell phone, especially the screen, which comes in close contact with both your fingertips and your face each day.

So put away those dolla' dolla' bills — and maybe even wipe down your credit cards with some alcohol wipes. Instead, let technology do its thing to keep you as germ-free as possible this season.

Additional reporting by Benét J. Wilson.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app