You can sign up for a Clear membership at select Rimowa stores

If there's one thing all travelers can agree on, it's that we'd all like to spend less time in airport security lines. There are a few hacks to help expedite your process through check-in and security, from priority check-in lanes thanks to elite status to expedited screening programs like TSA PreCheck and Clear. And for New York City and San Francisco residents, signing up for a Clear membership just got a bit easier.

Want more travel news and advice from TPG? Sign up for our daily newsletter.

For those of you who are unfamiliar, Clear uses biometrics to verify your ID at the airport to help you get through security faster with dedicated lanes. While it isn't a replacement for TSA PreCheck (you'll still have to go through the TSA lines), it can reduce the amount of time you spend waiting in line at security checkpoints when you travel through one of the 39 U.S. airports that have Clear lanes. Clear has also been expanding to offer expedited security at large-scale events such as major sports competitions, so your membership could be useful beyond saving time at the airport.

While you can start the enrollment process online, you still have to head to a Clear kiosk to get your biometrics added into the system with the help of a Clear ambassador. Typically, that means spending some extra time (and potentially waiting in another line) at a busy airport terminal before your flight. But thanks to a new partnership between Clear and luxury luggage line Rimowa, you can now sign up in two select stores in New York City and San Francisco.

"This holiday season, we are excited to bring Clear's groundbreaking technology into our Rimowa stores as we provide our customers with an even more convenient way to access the Clear membership," said Dezaray Romanelli, general manager of Rimowa North America, in a press release. "Following the success of the Rimowa Passport Studio in Soho, New York, we continue to find new and innovative ways to elevate the entire travel experience from start to finish."

While this partnership is launching as a test in two specific stores — the Madison Avenue location in New York and the Grant Avenue location in San Francisco — a spokesperson from Rimowa did tell TPG that there's a potential for this to become a more permanent option for Rimowa shoppers at a broader selection of stores in the future.

At the Madison Avenue store in New York, Rimowa and Clear gifted me with a complimentary one-year Clear membership so that I could test out the process of signing up in the store. Overall, it was a great experience. The Rimowa store is much quieter and less hectic than any airport terminal I've ever been in, and the process for getting signed up was quick and painless.

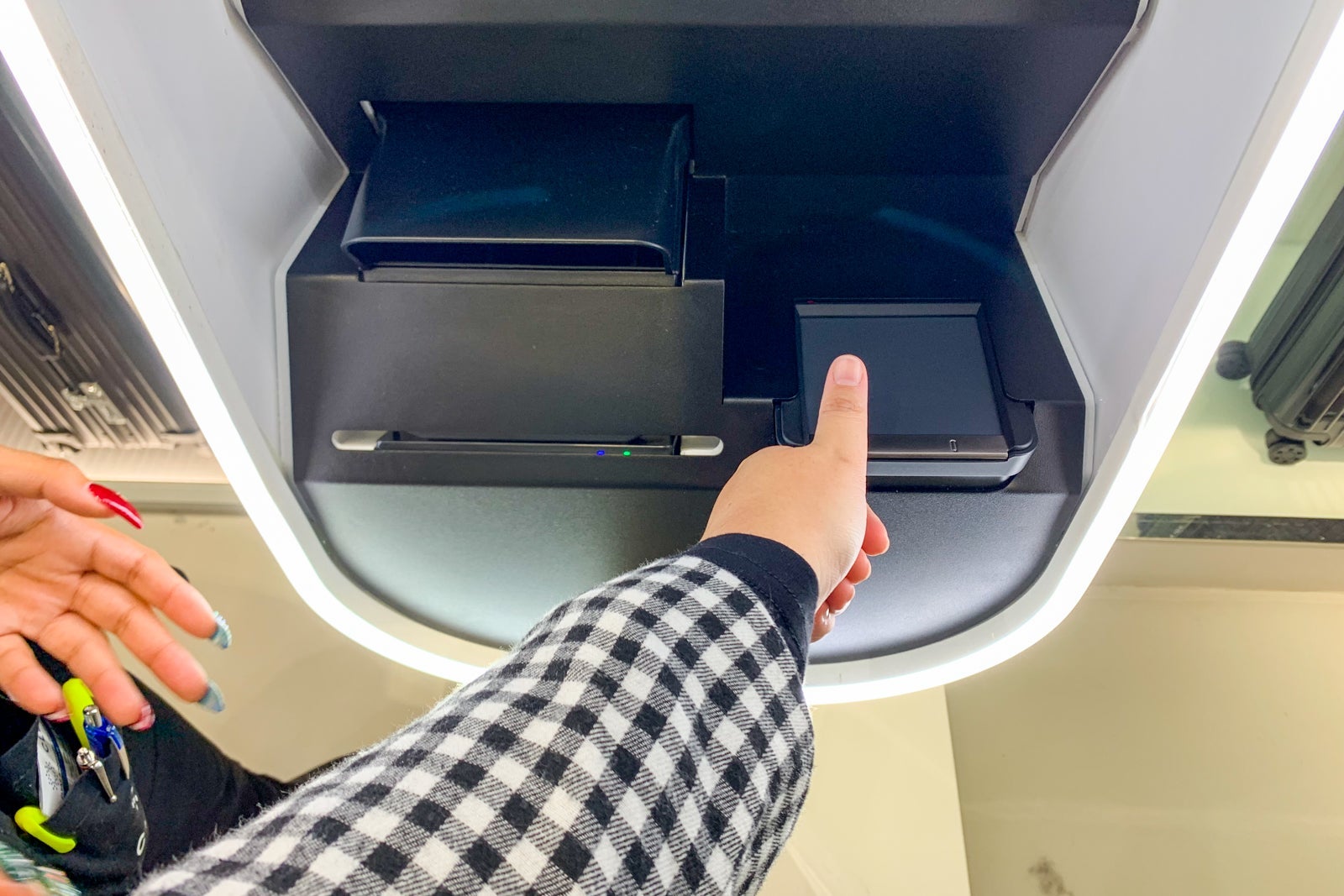

When you enter the store, there's a Clear kiosk located on the left-hand side. During Clear's staffing hours, which are listed at the end of the article, a Clear ambassador will be present to walk you through the process.

Signing up was easy. You'll need to bring an ID (I used my passport) and your preferred card for your membership dues.

There are a few cards that give you either a credit for your Clear membership or a discounted rate, so make sure you're bringing the right card with you when you sign up. Our guide to Clear walks through the ways you can use elite status, loyalty programs and credit cards to save money on your Clear membership.

You'll go through a retina scan, thumbprint scans and larger four-finger scans to get your biometrics recorded. The Clear ambassador helps you through the process to make sure your hands are situated correctly, you have your eyes open wide enough for the scan, etc.

Then, you'll give your ID to scan. I used my U.S. passport since that's what I use at the airport, but you can also use the following forms of ID: driver's license, U.S. passport card, U.S.-issued permanent resident card, state-issued ID or Global Entry card.

From there, you verify your information (full name, current address, email address and phone number) and put a card on file for the cost of the membership.

After, you'll see a screen welcoming you to Clear with a QR code you can scan to download the app. I perused the store for a bit before heading out — I've been debating whether I should give in and buy the Rimowa Never Still black backpack I've been eyeing as a Christmas gift to myself — but the actual process to sign up for Clear took less than 15 minutes.

If you live in one of the outer boroughs of New York City or in a suburb of San Francisco, trekking into the city to sign up for Clear at a Rimowa store may be more trouble than it's worth. But for those who live near one of the stores or who are planning a shopping trip for some new luggage, it may be worth taking advantage of these added locations where you can sign up for Clear.

I've been considering signing up for months, but I'm always in a rush when I get to the airport. Taking a break from work on a Monday afternoon to sign up at a store in Manhattan was less of a hassle, plus I got to check out some of the newer Rimowa products in person (I do most of my shopping online these days, so in-person shopping is a welcome rarity).

Here are the Clear staffing hours for each location where you can sign up.

New York City — Madison Avenue store:

- Monday: 2-6 p.m.

- Tuesday: 2-6 p.m.

- Wednesday: 2-6 p.m.

- Thursday: 3-7 p.m.

- Friday: 3-7 p.m.

- Saturday: 10 a.m.-6 p.m.

- Sunday: Noon-5 p.m.

San Francisco — Grant Avenue store:

- Monday-Friday: 2-6 p.m.

- Saturday: 11 a.m.-6 p.m.

- Sunday: Noon-6 p.m.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app