Citi ThankYou Rewards adds Preferred Hotels & Resorts as new hotel transfer partner

Adding to its already lengthy portfolio of hotel transfer partners, Citi ThankYou Rewards is now a transfer partner of Preferred Hotels & Resorts. Preferred Hotels & Resorts offers a collection of over 650 luxury boutique properties in more than 80 countries.

You can now transfer your Citi points to the hotel's loyalty program, I Prefer Hotel Rewards, at a 1:4 ratio. This means that for every 1,000 Citi ThankYou Rewards points you transfer, you'll get 4,000 I Prefer points.

Currently, Citi is also a transfer partner of four hotel loyalty programs (or five, if you count Virgin Red Airlines + Hotels), including:

- Accor Live Limitless (2:1 transfer rate)

- Choice Privileges (1:2 transfer rate)

- The Leading Hotels of the World's Leaders Club (5:1 transfer rate)

- Wyndham Rewards (1:1 transfer rate)

While I Prefer may not be on your radar, Citi is the first major credit card rewards currency to partner with the hotel loyalty program. But is it worth it to transfer to and redeem your hard-earned ThankYou Rewards points with Preferred Hotels & Resorts?

Transfer Citi ThankYou Rewards points to Preferred Hotels & Resorts

In 2023, Preferred Hotels & Resorts revitalized its I Prefer loyalty program, making it easier for members to track their rewards earnings and book future stays online with points. Though Preferred Hotels & Resorts, which is part of Preferred Travel Group, has a much smaller portfolio compared to World of Hyatt, Hilton and Marriott, award stays at some hotels start at just 15,000 points per night, per the loyalty program's website.

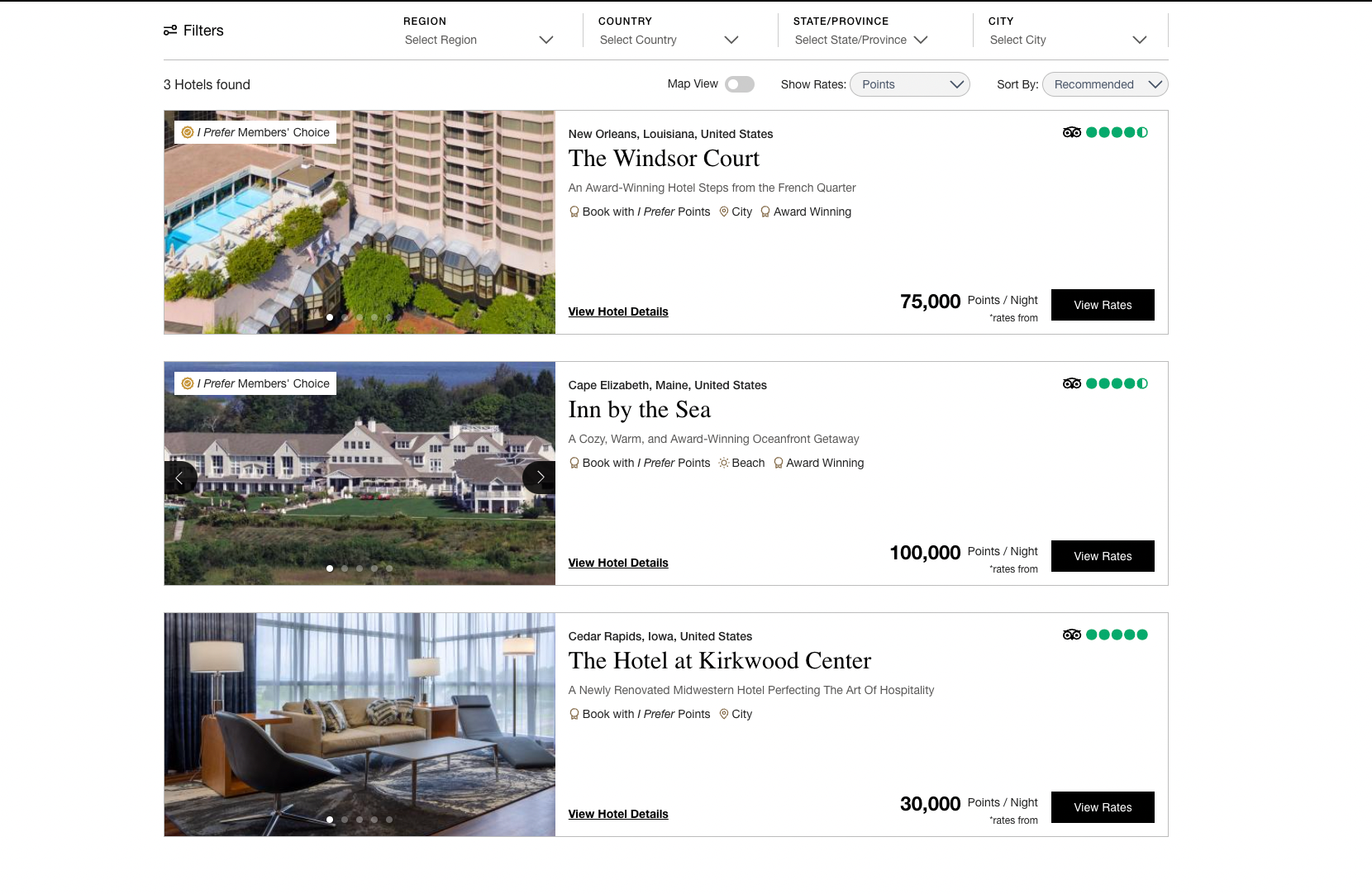

However, when searching for award availability on the Preferred Hotels & Resorts website, only three hotels displayed award prices, even though there are over 500 hotels participating in the I Prefer loyalty program. Whether it's a mistake on the website's end or not, a non-user-friendly experience is definitely something that would deter me from transferring my Citi points.

But is this a good transfer partnership, even when factoring out the tech issues? It depends on the room rate and the cost of points needed to book. For example, award prices for a stay at the Inn by the Sea, an oceanfront luxury property in Maine, start at 100,000 I Prefer points per night.

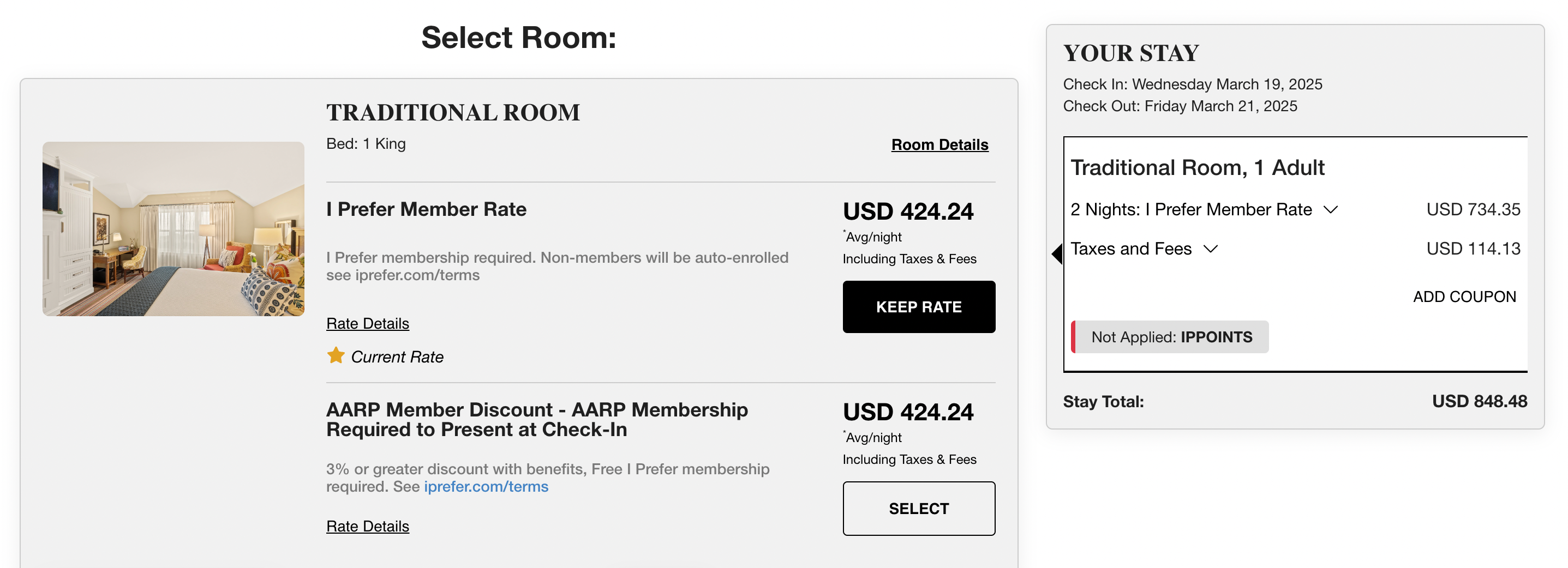

For a two-night stay in a traditional room in March, you would pay $848.48 (including taxes and fees). If I were to book this with points, I would pay 200,000 I Prefer points plus $68.38 in taxes and fees. Therefore, to book this two-night stay with Citi ThankYou Rewards points, I would need to transfer 50,000 points.

TPG values Citi ThankYou Rewards points at 1.8 cents per point, per our October 2024 valuations, which means we value 50,000 points at $900. Since the cash price for a two-night stay in a traditional room at this hotel is less than $900, this redemption would not be maximizing my Citi points.

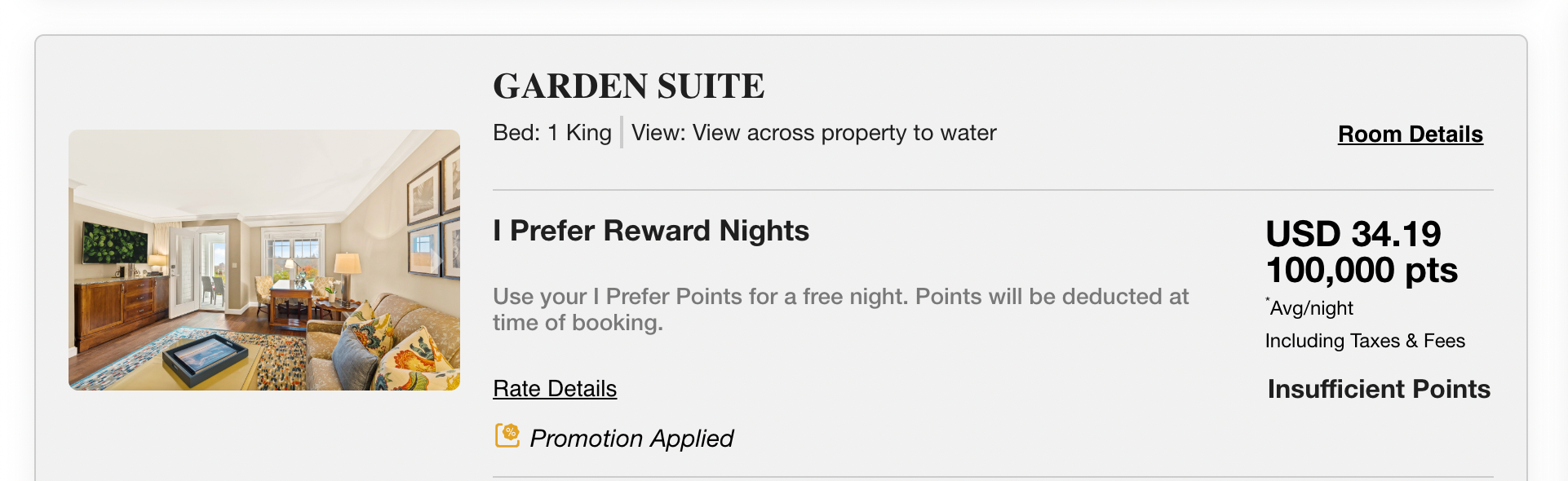

However, a garden suite at this property would cost $1,032.87 (including taxes and fees) for the same two-night stay. If I were to book this room with I Prefer points, it would cost the same as a traditional room: 200,000 points plus $68.38 in taxes and fees. Based on our valuations, transferring my Citi points to I Prefer for this redemption would give me a good value for my points.

Additionally, if you see a Preferred Hotels & Resorts property that catches your eye, you may be able to book that hotel using Choice points. Choice Privileges has a partnership with more than 300 Preferred Hotels & Resorts that allows Choice members to book award nights starting at 20,000 points.

Though this partnership underwent a bit of a devaluation this summer, you can still find some good deals. Plus, Citi is a transfer partner of Choice Privileges at a 1:2 rate; therefore, for every 1,000 Citi points you transfer, you'll receive 2,000 Choice points.

Related: How to choose a hotel credit card

Best credit cards to earn Citi ThankYou Rewards points

If you're wanting to earn Citi ThankYou Rewards points, here are the cards offering lucrative welcome bonuses:

- Citi Strata Premier® Card (see rates and fees): Earn 60,000 bonus ThankYou Rewards points after you spend $4,000 on purchases within the first three months of account opening.

- Citi Strata℠ Card (see rates and fees): Earn 20,000 bonus points after spending $1,000 on purchases within the first three months from account opening.

If you hold the Citi Prestige® Card, you can also transfer your ThankYou Rewards points to Citi's airline and hotel transfer partners. However, this card is no longer accepting new applications.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

While Citi continues to expand its transfer partner portfolio, adding I Prefer to its list, the hotel loyalty program's website is not super easy to navigate, with award prices only showing a list of three hotels. That has to be a tech mistake, right? Either way, a 1:4 transfer ratio is pretty decent, but it's best to compare cash rates versus how many points you'll need for your award redemption.

As always, TPG does not recommend transferring points without a specific redemption in mind and without finding availability on the hotel's and/or airline's website first. Points transfers are irreversible, so the last thing you want to do is to be stuck with a bunch of points that you can't use.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app