Chase Is Sending Customers New Tax Forms Reporting Points as Income

Over the past couple of weeks, Chase has sent letters to some cardholders informing them that the bank will soon be sending Form 1099-MISC for their 2018 tax return. Some cardholders are getting an amended 1099-MISC form while others are receiving a form for the first time — despite the January 31, 2019 due date for filing this form. IRS Form 1099-MISC is used to report "miscellaneous income" paid by one taxpayer to another.

The letter from Chase doesn't indicate the reason for reporting this income. However, it seems that Chase is reporting income to cardholders who received points as compensation for successful credit card referrals.

If Chase previously sent you a 1099-MISC but is providing a corrected form, the letter starts:

We reported an incorrect income amount on the IRS Form 1099-MISC (Miscellaneous Income) we sent you in late January. We apologize and will mail you the appropriate corrected form with the correct amount for tax year 2018 by July 30th.

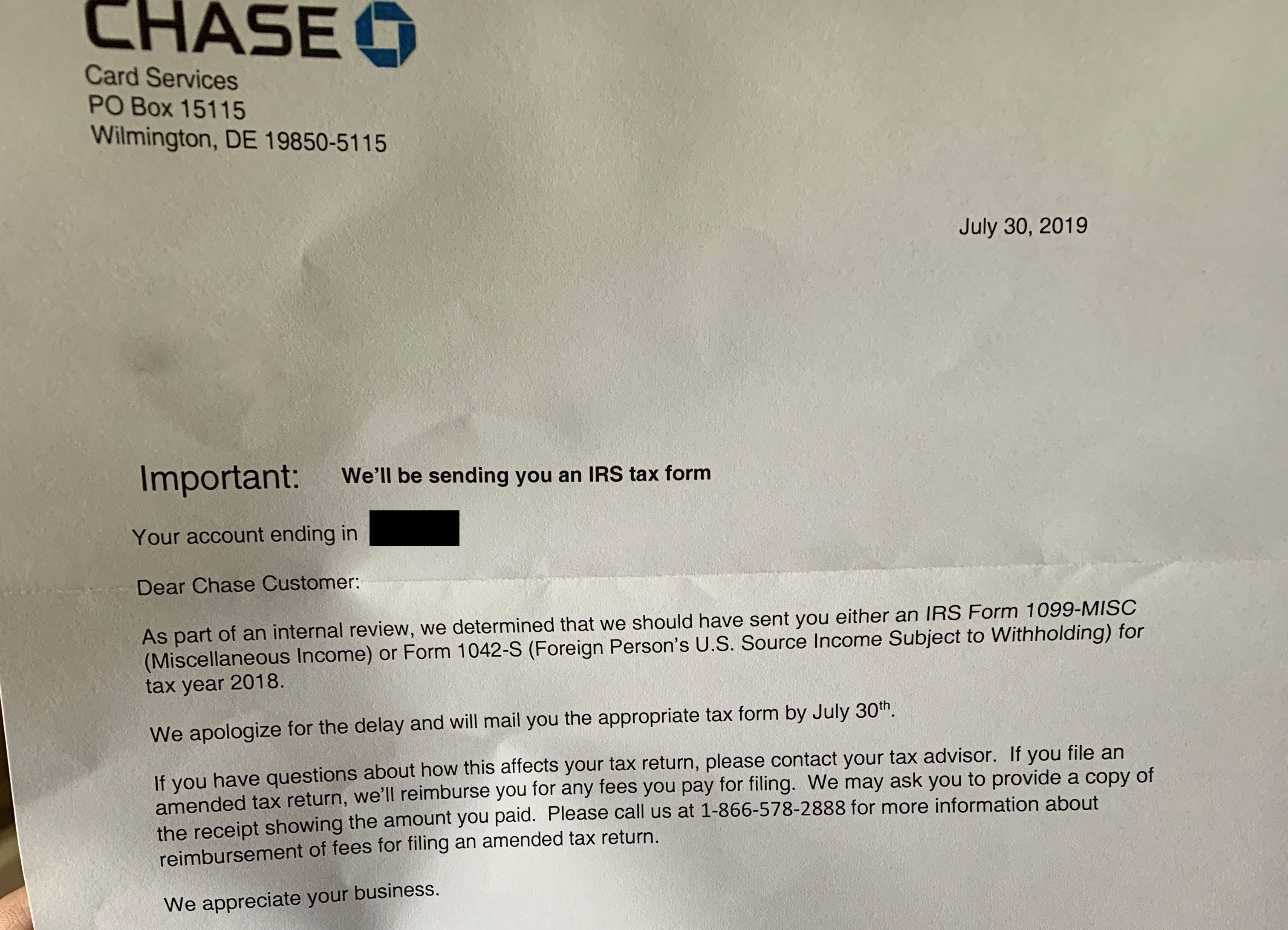

Cardmembers who didn't receive a 1099-MISC in January — but Chase has now determined that they should have received one — are getting letters saying:

As part of an internal review, we determined that we should have sent you either an IRS Form 1099-MISC (Miscellaneous Income) or Form 1042-S (Foreign Person's U.S. Source Income Subject to Withholding) for tax year 2018. We apologize for the delay and will mail you the appropriate tax form by July 30th.

Both letters conclude:

If you have questions about how this affects your tax return, please contact your tax advisor. If you file an amended tax return, we'll reimburse you for any fees you pay for filing. We may ask you to provide a copy of the receipt showing the amount you paid. Please call us at 1-866-578-2888 for more information about reimbursement of fees for filing an amended tax return.

TPG's Summer Hull was one of the cardholders who received a letter saying that Chase "should have sent" her a form. The letter is dated July 30, 2019, yet the letter indicates that Chase will mail her "the appropriate tax form by July 30th":

If you also received one of these letters, here's what you need to know:

Why Am I Getting This?

Technically, you've received compensation (points) for work (referral), and the tax law says that "income from whatever source derived" is taxed unless there's law that excludes it from being taxed. As the payee of compensation, Chase is required by law to report to the IRS the amount of income paid to you, and could face significant penalties for failing to file such forms. For practicality sake, the IRS doesn't require payments under $600 to be reported on a Form 1099-MISC.

Why Are These Points Taxable When Others Aren't?

Credit card sign-up bonuses have historically been excluded from income. The argument is that the bonus is treated as a rebate of the amount you paid to earn the bonus. While that argument breaks down for credit cards that offer a bonus after just making one purchase, the IRS hasn't chosen to wade into this potential minefield.

However, there's no rebate argument that can be made for bonuses earned through bank account sign-ups and credit card referrals. There's a prolonged tax law explanation on why these points probably aren't actually taxable yet. But, in the absence of solid guidance from the IRS, it seems that Chase wants to be conservative and file the form now rather than risking large penalties for failure to file.

What if I don't agree with the valuation of the points?

It's probably not worth fighting the valuation for this small amount of income. If you want to go down that path, you'll want to talk with a tax professional about how to do so without prompting a notice from the IRS.

What This Means If You've Filed Your 2018 Tax Return

You're going to need to amend your tax return by filing a Form 1040X to report the additional income. Chase says that it will "reimburse you for any fees you pay for filing." However, you're going to be responsible for the additional taxes, as well as any interest that's charged on the additional taxes.

What This Means If You Haven't Filed Your 2018 Tax Return

If you filed an extension for your 2018 tax return and haven't filed yet, you should wait until you receive the Form 1099-MISC from Chase before filing. Again, although Chase is claiming that it "will mail you the appropriate tax form by July 30th," cardholders are just now receiving these notification letters in August. Hopefully, the corrected or original 1099-MISC form will be mailed soon, so it won't hold up the filing of your tax return.

Can I just ignore the 1099?

You could, but I wouldn't recommend it. As this form will be filed with the IRS, you're expected to report this income on your personal tax return. Ignoring it will almost certainly net you a "matching notice" letter from the IRS noting the discrepancy.

What This Means for Chase

Chase is substantially late in sending out these forms. It's legally required to provide these forms to both the payee and the IRS by January 31, 2019. The bank is going to be subject to fines from the IRS for this flagrant violation. There's a reason that Chase is claiming that it "will mail you the appropriate tax form by July 30th." It's surely trying to meet the August 1 cutoff before the IRS penalties will substantially increase:

- By August 1: $100 per return or statement, up to $1,637,500 maximum

- After August 1: $270 per return or statement, up to $3,275,500 maximum

This penalty is collected by the IRS and unfortunately the taxpayer getting the late form doesn't receive any compensation for the late filing.

The author is a Certified Public Accountant (CPA) in Georgia. However, information in this article has been prepared for informational purposes only, and is not intended to provide — and should not be relied on as — tax advice. Please consult your tax professional.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app