3 things to know about your CDC vaccine card

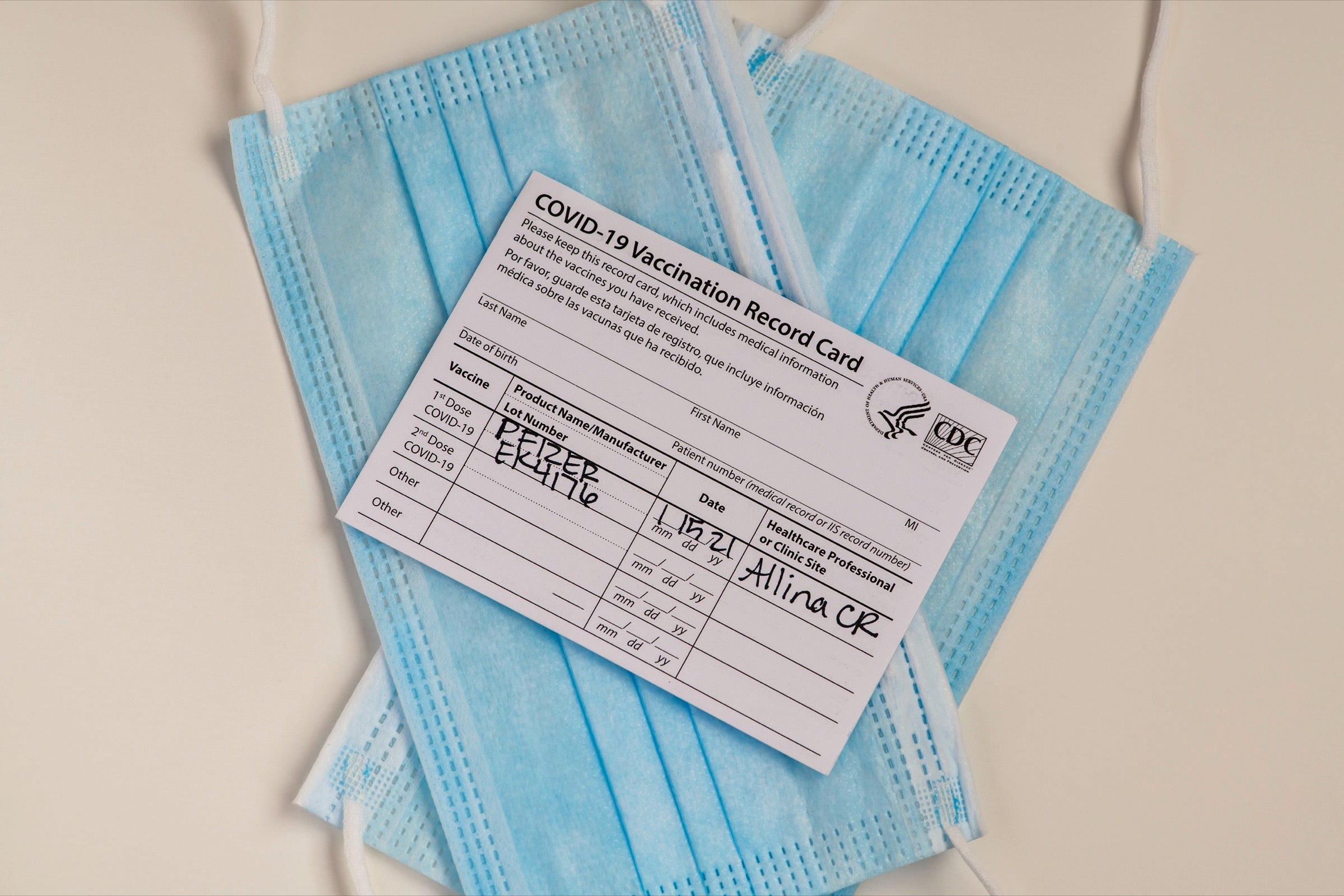

As you may know if you've already been vaccinated, the only way to confirm that someone has been vaccinated against COVID-19 in the United States right now is a physical paper card from the U.S. Centers for Disease Control and Prevention (CDC).

This card includes medical information such as the type of vaccine you received, the date you received it and where you were vaccinated. We're not yet close to a standardized global system that tracks this information, so this small card is one of the most valuable assets you can have right now -- especially as travel restarts.

Wondering what to do with your vaccination card until it's time to travel? Here's what we know.

What should I do with my vaccine card?

First things first: Put your vaccination card in a safe place. If you haven't already done this, do it now. It's an extremely important document and the only way to easily verify that you've been vaccinated against COVID-19.

That means you should give it the same kind of treatment you would your credit cards, driver's license or passport and store it in a secure location, such as a wallet, safe or a desk drawer, at all times.

Do I need to keep my vaccine card if I use a vaccine passport?

You will want to keep your vaccination card handy, but you may not have to travel with it in the future if you're using a digital health (vaccine) passport.

Certain destinations, tour operators and travel providers may require proof of a COVID-19 vaccination, or accept proof of vaccination as an alternative to strict testing and quarantine requirements. Streamlining those processes is something the travel industry has been working on in the form of digital vaccine passports.

A digital health passport will host verified test and vaccine information. They are expected to be optional, but experts say they will be widely used in the travel industry and at large public gatherings, such as sporting events.

Digital health passports have already been rolled out on several popular routes on various airlines, such as Clear's Health Pass feature for Delta and United flyers traveling to Honolulu International (HNL).

American Airlines and British Airways introduced a mobile health passport called VeriFLY. Copa Airlines and the Panamanian government are also partnering with IATA Travel Pass to create a health passport. If you are traveling to a destination or with a provider that allows you to present digital verification of your vaccination status, that may suffice in place of the paper vaccination card.

Related: Your guide to digital health passports

What if I lose my vaccine card?

We shouldn't have to say this, but you don't want to lose or damage your vaccination card.

"Even though it's a low profile, small piece of paper, it's an extraordinarily high value for you as a person to be able to travel," said Steve Swasey, the vice president of communications at Healthline, in an interview last month. (Healthline is also owned by TPG's parent company, Red Ventures).

Until there's a universal verification tool, Swasey says he'll laminate and wear a sticker he received after being vaccinated when he hits the road. Other travelers I've spoken to have said they plan to laminate their vaccination cards to prevent damage -- and Staples will even do it for free.

If you do lose or damage your card, don't panic. All COVID-19 vaccination providers are required to report data within 72 hours in their state's immunization system. That means there will likely be a back-up record of your vaccination status.

The CDC recommends contacting the immunization information system (IIS) in your state to see if they have records (but not to contact the CDC since they do not keep a record of COVID-19 vaccines). You can also contact the place where you got your shot or your state's health department. And, don't forget, you have these options with all vaccines — not just the COVID-19 shots.

Recently, a friend who got vaccinated in Brooklyn accidentally got her card wet before receiving a second dose of the Pfizer vaccine, and workers at the facility happily exchanged it with a new card. So, depending on where you are in the vaccination process, you may be able to easily get a new card, too.

Related: You finally got vaccinated: Here's what you'll need for a digital health passport

Bottom line

The world hasn't found a standardized system for COVID-19 vaccination verification, so keep track of your vaccination card is extremely important.

However, as more digital health passport apps are rolled out this year, you may be able to keep your card at home in your drawer and use a digital version instead of the original paper copy. And if you lose your card, you can try and get a replacement through your local immunization site or state health department.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app