Why renting a car may now be the hardest part of your journey

In the hierarchy of necessary tasks to plan and book a trip, securing the rental car isn't usually the top action item. But this year, like with so many other things, the tables have turned -- dramatically. In fact, myriad factors have led to a world in which securing a rental car may, in fact, be the toughest (or most expensive) part of your journey.

Here's what is going on and how to increase the odds you get the rental car you want.

For more TPG travel news and tips delivered each morning to your inbox, sign up for our free daily newsletter.

Rental cars may be completely sold out

TPG's Richard Kerr was recently in Austin, and after a few days working and playing at a resort just outside of Austin, he was ready to rent a car and head to the Houston area to see some family. The problem, by the time he went to rent a car, there wasn't a single car for rent that weekend in all of the greater Austin area.

This phenomenon is not unique to Austin or limited to any one particular weekend. TPG's Clint Henderson rented cars several times during the summer across many states and found that many airport locations were sold out if he waited until the last moment. In particular, Milwaukee was completely out of cars when he wanted to travel.

Solution: While it's not a revolutionary suggestion, a good plan is to book your car rental out as far in advance as you can. If that fails, try off-airport lots, call locations directly and lean into your top-tier car rental elite status if you have any to speak of. But mostly, just don't assume there will be a car available until you book one.

Related: Best credit cards to use for rental cars

It may cost you -- a lot

While there are exceptions, your next car rental may cost more than you wish. When TPG's Henderson was able to book cars over the summer, he found that the rates were very expensive compared to the prices he was paying for flights and hotels.

Looking at an upcoming weekend in Denver at the start of the ski season for some mountains, SUVs are renting from multiple car rental companies for $200+ per day.

Car rental rates in the NYC area are notoriously expensive and right now is no exception. A standard car weekend rental from JFK starts at $75 per day next week. Over the summer, prices were sometimes even higher. In fact, that's what led to TPG's Scott Mayerowitz booking a car for a month at a time, and eventually deciding that purchasing was a better overall deal.

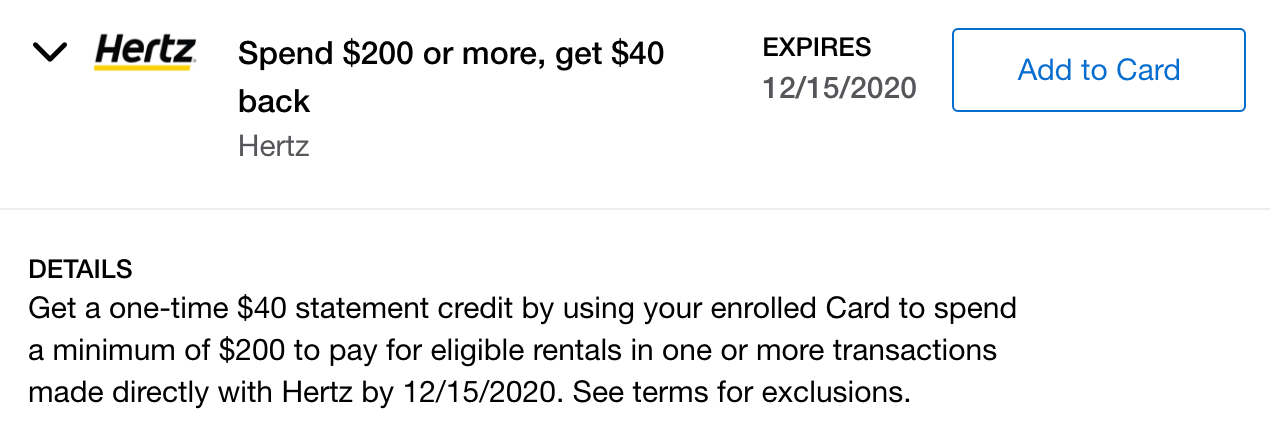

Solution: TPG has an entire guide on how to never pay full price for a car rental, which is good because you may need every trick in the book right now. Be sure and check for discounts on your credit cards, too, such as this new Amex Offer.

Limited lot selection

Remember the days your Five Star row, President's Circle Status or Emerald Aisle choices were ... well, choices?

In many cases right now, you're lucky there's a car at all, and don't count on having any actual choices or upgrades. In fact, the type of car you reserved may not even be available.

On a recent October trip to Orlando, my Hertz rental was the very last one available for pick-up on the Five Star row. A few months earlier, in Panama City, I overheard renters with reservations being told that their large SUVs that had been reserved were unavailable. In some cases, that meant their family could no longer fit in one vehicle.

Solution: Don't hope or count on any type of upgrade. Worse still, realize you may not even get what you paid for. While this may or may not be realistic in your area, I've personally turned to Silvercar when I want to increase the odds I get the car type I need since they have significantly fewer car types than the big chains. On the flip side, even Silvercar has been pulling out some of its previous airport locations so there's no sure-fire solution.

Beware the pick-up line

In both of my previously mentioned recent car rental experiences, there was another constant beyond a shortage of cars -- extremely long pick-up lines at some counters. While I didn't have a terribly long wait to pick up my rental cars thanks to having a free Hertz Gold account set up in advance, I saw others in lines that were undoubtedly at least an hour long and sometimes with very mixed mask usage.

The pick-up lines I saw for Payless, Budget, Alamo and the like were not a place I'd like to be if I could avoid it.

Solution: Join your car rental agency's program and complete all paperwork and verifications in advance. I would give a strong preference to programs that allow for touchless rental car pick-up experiences, if possible.

Bottom line

Rental cars are rarely an exciting part of the travel process, but in 2020, they are a very important part to travel autonomously with your own space. And with travel patterns being shifted a fair bit from the norm for the foreseeable future, you may be shocked at how scarce or expensive car rentals may be on your next trip, especially if you don't plan for those potential realities well in advance.

Featuerd image by by alexfan32/Shutterstock

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app