Audit your mileage run: How Delta's miscalculation almost cost me Diamond Medallion status

Last week I flew from New York's John F. Kennedy International Airport (JFK) to Copenhagen Airport (CPH) on Delta Air Lines.

The trip wasn't a mileage run per se — I was meeting my cousin and a friend for a short trip — but I needed the Medallion Qualification Dollars to keep my Diamond Medallion status. After flying this trip and factoring in my other year-end travel, I will be at just more than 15,200 MQDs for the year.

However, a miscalculation in Delta's system shorted me 273 MQDs. If the mistake had gone unnoticed, it would have cost me my status for 2023.

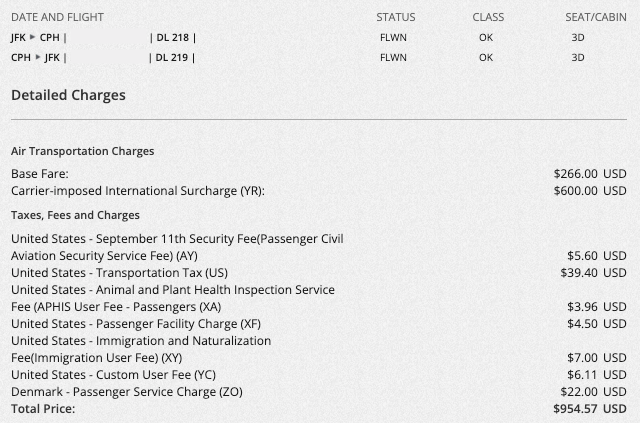

See, when I landed back in New York, Delta credited my account 593 MQDs even though my ticket cost about $954. I wasn't expecting to earn MQDs on all of that spending — MQDs are only earned on the ticket's base fare and carrier-imposed surcharges, commonly dubbed "YR" — but I knew something was off.

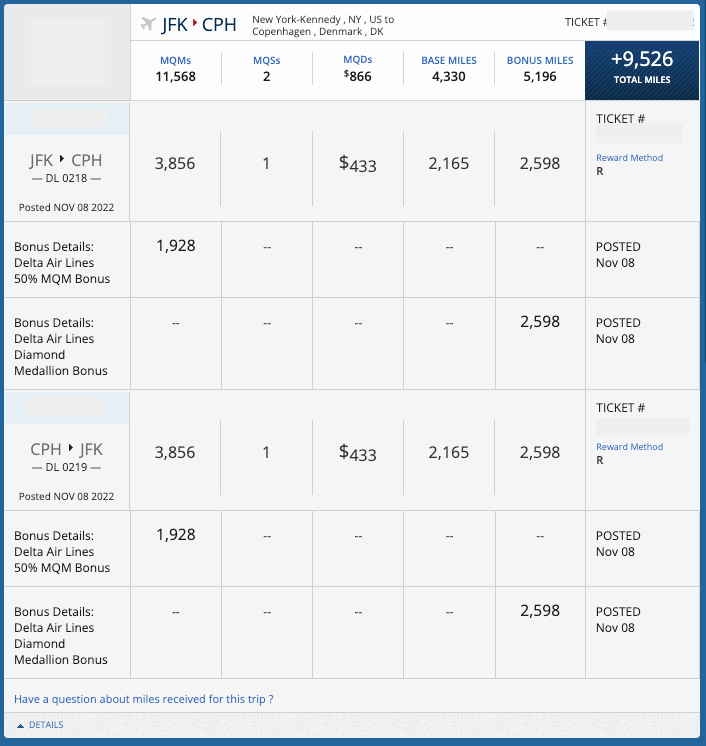

I checked an elite status tracking spreadsheet I maintain and quickly confirmed I should have received 866 MQDs for my JFK-CPH-JFK itinerary. According to my receipt, the ticket had a base fare of $266 and $600 in carrier-imposed surcharges. This brings me to my missing 273 MQDs. In turn, I was also shorted just more than 3,000 redeemable SkyMiles too, as my redeemable mileage earnings were calculated on the incorrect $593 base fare plus carrier-imposed surcharge.

Thankfully, this story has a happy ending. I called the Diamond Medallion line and explained the situation to the representative. He called the SkyMiles department, they noticed their error and the representative told me they'd recalculate earnings with the correct fare and surcharges.

Roughly an hour later, my account was credited with the correct 866 MQDs and 9,526 redeemable miles, worth about $134 per TPG's valuations.

If I hadn't noticed this error, I could have lost my Diamond benefits over a simple mistake in Delta's system. Or, I would have had to panic-book a flight after finishing my holiday flights home and realizing I hadn't qualified for my status. Needless to say, that would not have been a cheap (or fun) endeavor right after the holidays.

Related: Quick Points: How and why you should regularly audit your loyalty accounts

Take my experience as a reminder to always check your loyalty account after you fly. Then, recalculate your earnings and ensure you received the proper number of redeemable miles and elite metrics. If you don't, you could leave miles and elite status on the table.

I also encourage you to build a spreadsheet that logs your flights throughout the year. I add all of my flights to this spreadsheet as I book them, alongside their Medallion Qualification Miles, MQDs and redeemable SkyMiles earnings. Then, I have a running number that adds all of them up and adds them to my current MQD balance. This helps me plan and audit my account quickly as I travel throughout the year, and it keeps me in the loop on how close I am to the next elite status tier.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app