How Andaz Maui Makes it Difficult to Redeem Points for Stays

One of the greatest perks of loyalty programs is that you'll earn points that you can redeem for a free stay. So, for example, a consultant spending 20 nights a month at a Hyatt House can use the points they earned from a work trip to book an incredible three-night family trip to, say, the Andaz Maui at Wailea. Except they can't, because the Andaz Maui is currently using an inventory trick to make most shorter stays impossible. Let me explain...

As you may already know, hotel points can typically be redeemed for only the base level room type. Sometimes you can use extra points to book a higher-category room, but that isn't an option with the Andaz Maui. For this property, you can redeem 25,000 points per night to stay in a "Garden View" room. The 297-room hotel has 9 Garden View rooms with king-size beds and 8 Garden View rooms with two queens, so at any given time there are 17 rooms available on points. (Note that award nights earned with the Hyatt Visa card also book into this category.)

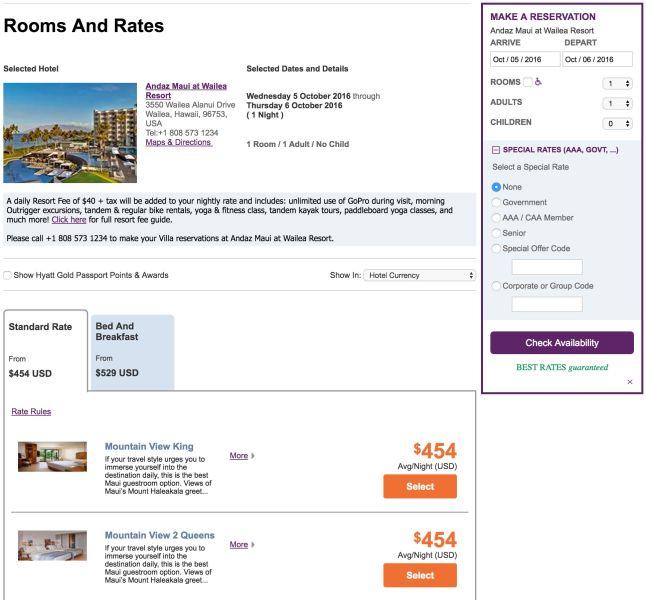

But as TPG reader Jay W. pointed out, the Andaz Maui only makes these rooms available for extended stays, for cash bookings as well. For example, for a one-night stay in October, there are nine different room types available, though the lowest is a "Mountain View King," as you can see below:

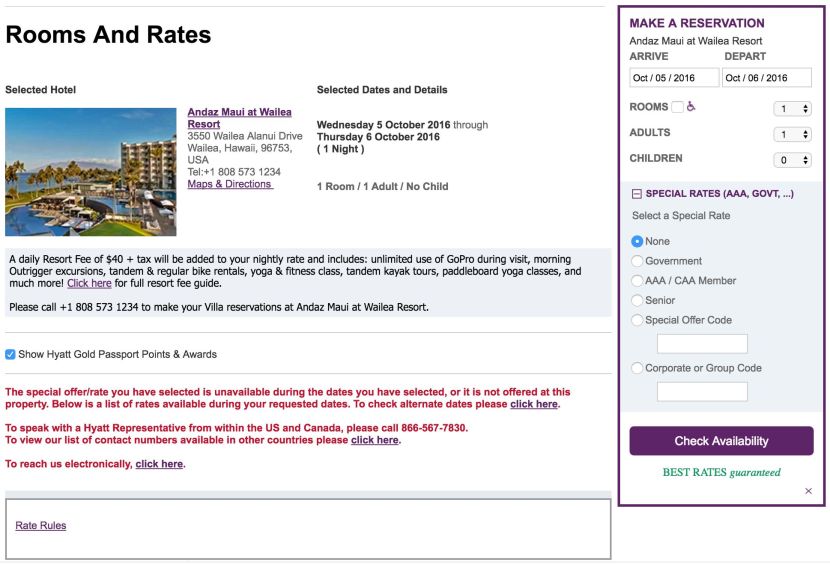

If you click to redeem Hyatt points for a stay, this is what you'll see:

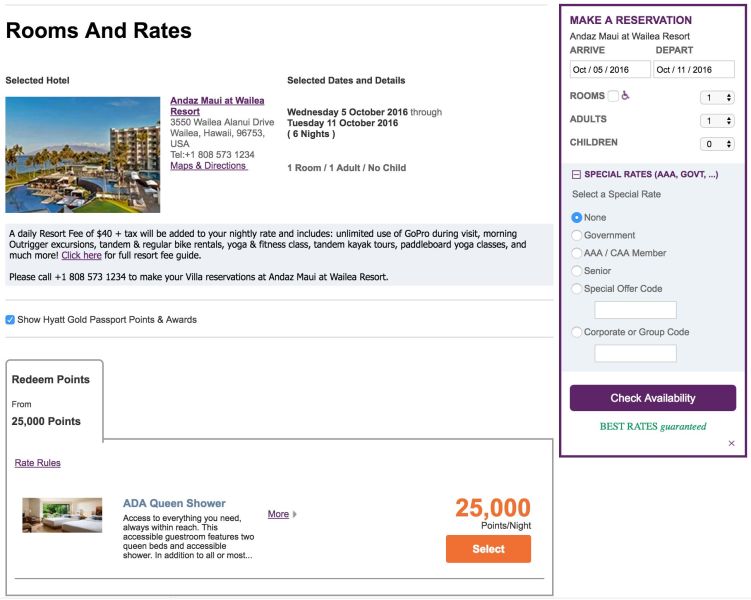

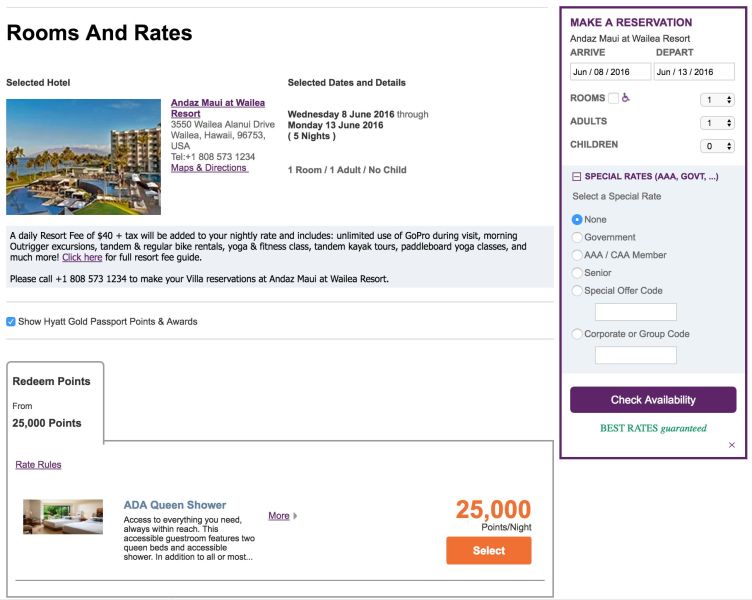

However, if you extend the stay to a total of six nights, an "ADA Queen Shower" room magically appears, which you can then book for either $433 or 25,000 points per night:

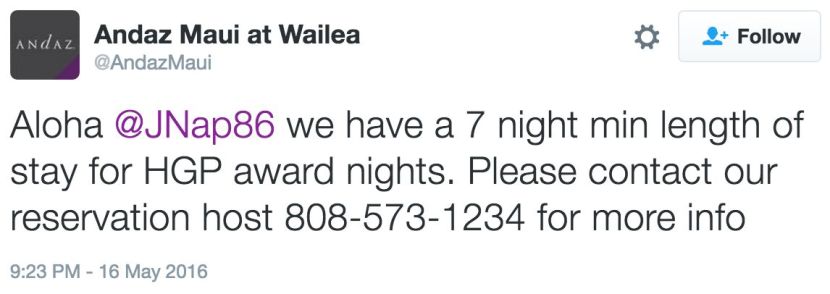

Even though those dates required "only" a six-night stay, according to a recent tweet from the hotel, you'll need to book for at least seven nights if you're looking to use your points:

Fortunately, I was able to find some dates where only a five-night stay is required:

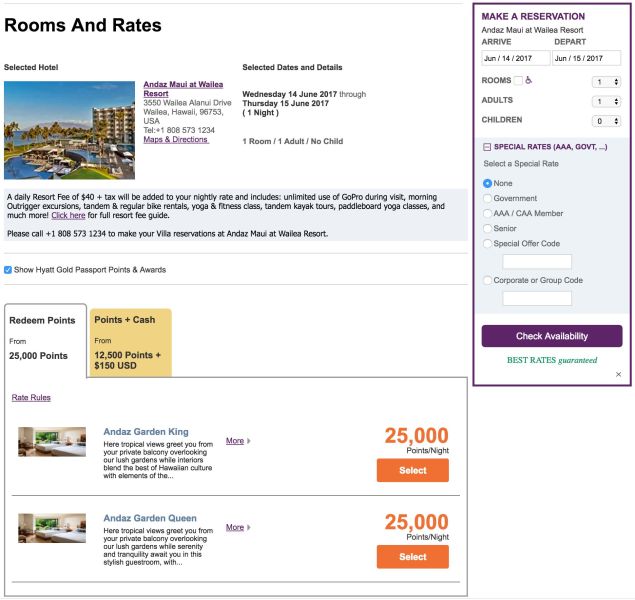

And I was even able to find a few nights with awards available for just one night at a time (in June 2017):

Clearly the Andaz Maui is applying a minimum-stay requirement only to this base room type, since even the very next category can be booked for a single night. If the base room isn't available for sale, then it can't be booked with points. I called the hotel to confirm my findings, and a reservations agent acknowledged the policy. The agent explained that as the Andaz Maui is a "boutique hotel" (in that it has only 297 rooms, plus some villas), it's often fully booked.

The agent explained that minimum stay requirements range from two to six nights, depending on your dates. Theoretically, the shorter requirements should apply outside of peak dates (which seem to include December through April travel), but conferences, weddings and other special events can throw a wrench in the works there. The hotel does allow you to skirt this requirement in a way by booking some nights with points and others with cash — a reservations agent will process this booking manually — but otherwise you're stuck with the minimum-stay requirements, and exceptions are very rarely made, even for Diamond elites.

A Hyatt Gold Passport representative confirmed that the Andaz's approach is in line with program guidelines:

At Andaz Maui, the standard guest room is the garden view room. Consistent with our policy, the length of stay requirements at this hotel for a paid room are consistent with the length of stay requirements for redemption. Award space will be available at this hotel if standard room space is available.

Unfortunately the same requirements apply to suites. The hotel's "Pool Side Suites" are available for 40,000 points per night, but there are only three available at the property, and a minimum stay applies there as well, although there do appear to be a few dates where suites are available for stays as short as one night.

What's a bit confusing about this policy is that Hyatt generally reimburses hotels for award redemptions. So, in theory, if the hotel is fully booked, it'll receive the same amount of revenue from an award booking as it would when a guest pays cash, in which case the property isn't really at a disadvantage by letting guests use points to book whenever they'd like.

Of course, a guest with hundreds of thousands of points to spare may be more willing to book a longer stay than someone paying $500 for each night, so award customers are (in theory, at least) less price sensitive. By setting these minimum-stay requirements, the hotel can sell more room nights, even if that means a frequent guest ends up "throwing away" points by booking their stay for a few extra nights, to end a day or two after they've already checked out.

Have you noticed a similar practice at any other properties?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app