Save up to $100 on your next flight with these new Amex Offers

Amex Offers are a fantastic way to save money on everything from hotels to streaming services and everyday shopping. According to American Express, cardholders earn an average of $130 back via statement credits when they utilize Amex Offers (based on 2022 data). But, it's possible to save much more.

Currently, there are some lucrative Amex Offers that allow you to earn cash back on flights with Frontier Airlines, JetBlue and Delta Air Lines.

Most Amex Offers are targeted, so you'll need to sign in to your Amex account and navigate to "Amex Offers" on your online account page or click on the "Offers" tab on the Amex app to see if you've been targeted for these discounts. There are a lot of offers to scan through, but filtering for the travel category can make the search process a bit easier.

Once you find an offer you are interested in, you must enroll in the offer by clicking "Add to Card" before you make your purchase. Read the fine print before you make a purchase because the stipulations vary by offer. For example, the airline offers mentioned below are only eligible for flights originating in the U.S.

Related: Frontier offers 1st month free for $149 all-you-can-fly monthly pass — is it worth it?

If you are one of the lucky American Express cardholders eligible for these flight offers, here is everything you need to know to redeem cash back on your next flight.

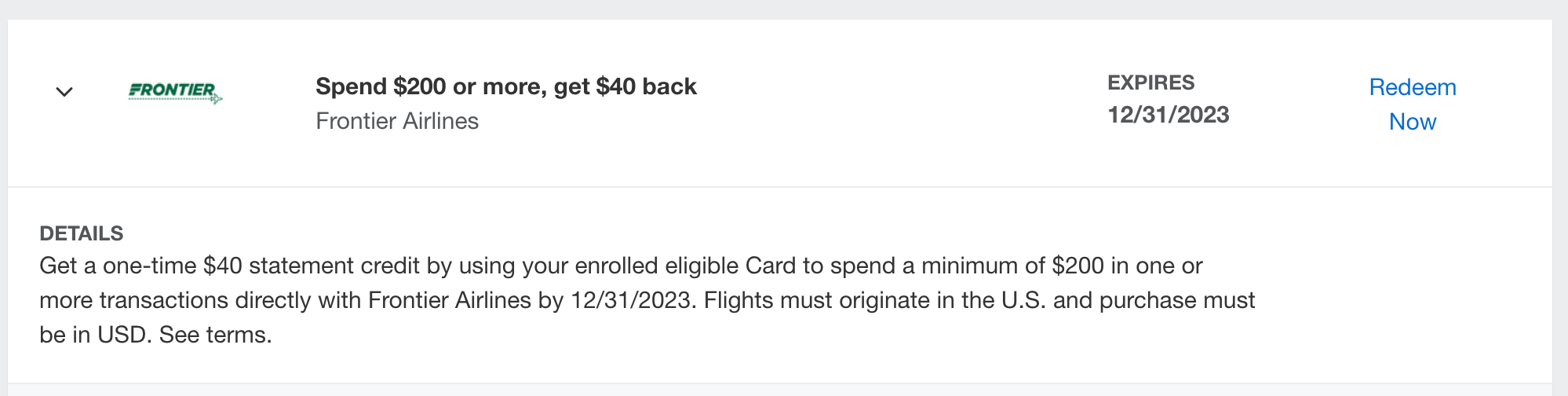

$40 off Frontier Airlines flights

With fares starting as low as $15, Frontier Airlines is already one of the leading choices for ultra-low-cost flights. With this money-saving Amex Offer, you can earn $40 cash back in the form of a statement credit when you spend $200 or more with Frontier Airlines.

Airline: Frontier.

How to book: You must first add the offer to your card via these instructions and then use the same card to purchase a Frontier Airlines flight of $200 or more directly on Frontier's website or app.

Book by: Dec. 31.

Eligible purchases: This offer is eligible for U.S.-originating flights, baggage, pets, cancellation and change fees, and business or group travel.

Restrictions: You may only use this offer once per American Express account, and flights must originate in the U.S. After earning the statement credit, it will appear on your billing statement within 90 days after the offer expires (Dec. 31).

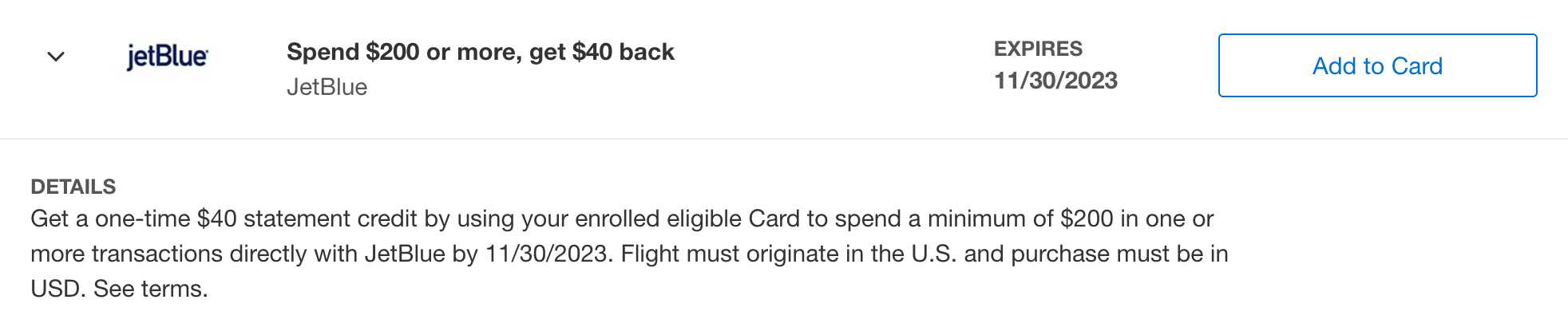

$40 off JetBlue flights

JetBlue is a favorite among TPG staffers. We love the free snacks, the TrueBlue rewards program and the carrier's generous family seating policy.

If you love JetBlue as much as we do, you can save $40 via a statement credit when you spend $200 or more on your next flight. This could be the perfect opportunity for disaffected Delta Medallion members who initiated a Mosaic status match to test the waters with JetBlue.

Airline: JetBlue.

How to book: You must first add the offer to your card via these instructions and then use the same card to purchase a JetBlue flight or JetBlue Vacations package that costs $200 or more directly on JetBlue's website or app.

Book by: Nov. 30.

Eligible purchases: This offer is eligible for U.S.-originating flights on valid JetBlue and JetBlue Vacations purchases. Inflight purchases, baggage, pets, cancellation and change fees, and business and group travel are also included.

Restrictions: You may only use this offer once per American Express account, and flights must originate in the U.S. After earning the statement credit, it will appear on your billing statement within 90 days after the offer expires (Nov. 30).

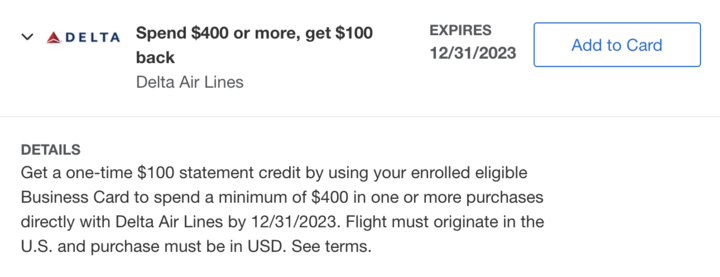

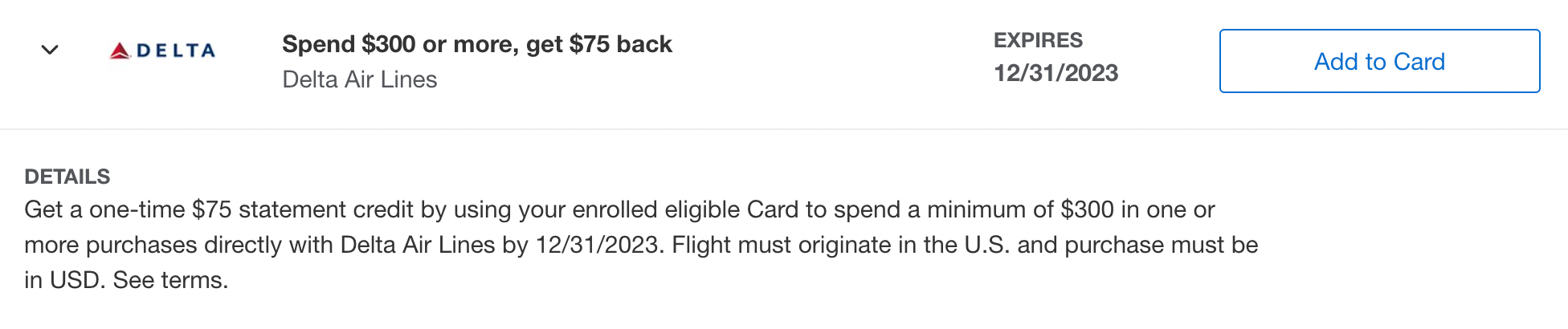

$75 to $100 off Delta flights

Delta has been in the news a lot lately, but most of the news has not been good. The airline recently announced major changes to its SkyMiles program (starting in 2024) and who can access Delta Sky Clubs in airports worldwide (starting Feb. 1, 2025). In addition to Delta admitting it may have gone a bit too far with these changes, all hope is not lost for Delta's frequent flyers.

Here's how you can save $100 on your next Delta Air Lines flight of $400 or more.

Airline: Delta.

How to book: You must first add the offer to your card via these instructions and then use the same card to make a $400 minimum Delta Air Lines purchase on Delta's website or mobile app.

Book by: Dec. 31.

Eligible purchases: This offer is eligible for U.S.-originating flights, as well as add-on purchases such as fare upgrades, seat selection fees, baggage fees, standby fees and Delta Sky Club memberships.

Restrictions: You may only use this offer once per American Express account, and flights must originate in the U.S. This offer is valid only for purchases where Delta Air Lines is the merchant of record. After earning the statement credit, it will appear on your billing statement within 90 days after the offer expires (Dec. 31).

You may also be eligible for a similar offer for a $75 statement credit when you purchase $300 or more with Delta. All other restrictions and eligibility requirements are the same.

Maximize these offers

You can already save up to $100 with these valuable cash-back offers, but you can save even more by using the right Amex card to make your purchase. If you have multiple Amex cards, you may see these offers available on each card; you'll want to use the one that provides the highest rewards or travel-related perks, like trip delay reimbursement.

For example, you can earn 5 Membership Rewards points per dollar spent on flights booked directly with airlines or through Amex Travel when you use The Platinum Card® from American Express (on up to $500,000 of these purchases per calendar year). If you use this card to make your eligible flight purchase, you can get a combination of bonus points and statement credits.

Before making your purchase, you'll also want to ensure you are enrolled in the airline's rewards program. These programs are free to join, and because these Amex Offers require you to purchase directly with the airline, you can essentially "double dip" by earning Amex points and airline miles.

Bottom line

Here at TPG, we are already deep into holiday travel planning. There are still ways to save on holiday travel, including these exciting cash-back offers from Amex.

Related reading:

TPG featured card

at Bilt's secure site

Terms & restrictions apply. See rates & fees.

| 1X | Earn up to 1X points on rent and mortgage payments with no transaction fee |

| 2X | Earn 2X points + 4% back in Bilt Cash on everyday purchases |

Pros

- Unlimited up to 1 Bilt Point per dollar spent on rent and mortgage payments

- Elevated everyday earnings with both Bilt Points and Bilt Cash

- $400 Bilt Travel Portal hotel credit per year (up to $200 biannually)

- $200 Bilt Cash annually

- Priority Pass membership

- No foreign transaction fees

Cons

- Moderate annual fee

- Housing payments may include transaction fees, depending on the payment method

- Designed primarily for members seeking a premium, all-in-one card

- Earn points on housing with no transaction fee

- Choose to earn 4% back in Bilt Cash on everyday spend. Use Bilt Cash to unlock point earnings on rent and mortgage payments with no transaction fee, up to 1X.

- 2X points on everyday spend

- $400 Bilt Travel Hotel credit. Applied twice a year, as $200 statement credits, for qualifying Bilt Travel Portal hotel bookings.

- $200 Bilt Cash (awarded annually). At the end of each calendar year, any Bilt Cash balance over $100 will expire.

- Welcome bonus (subject to approval): 50,000 Bilt Points + Gold Status after spending $4,000 on everyday purchases in the first 3 months + $300 of Bilt Cash.

- Priority Pass ($469/year value). See Guide to Benefits.

- Bilt Point redemptions include airlines, hotels, future rent and mortgage payments, Lyft rides, statement credits, student loan balances, a down payment on a home, and more.