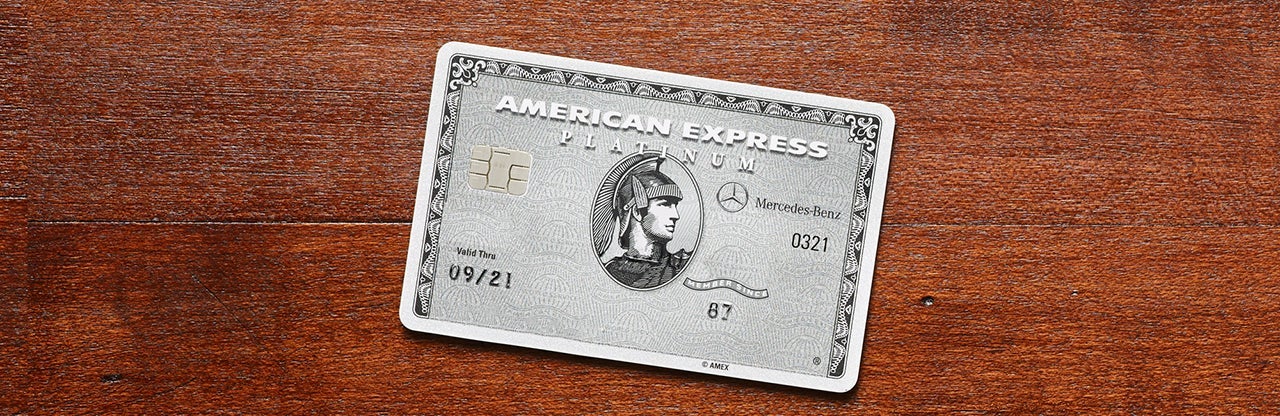

American Express to Discontinue Mercedes-Benz Platinum Card

Update: Some offers mentioned below are no longer available. View the current offers here.

American Express will be discontinuing one of its premium charge card products next year. In January 2019, the Platinum Card from American Express Exclusively for Mercedes-Benz will no longer be available.

The Mercedes-Benz Platinum card is similar to the standard version of the The Platinum Card® from American Express. It offers the same benefits as the personal Platinum like the $200 airline fee credit, $200 in Uber credits, SPG Gold status, lounge access and more — but also adds the following benefits for Mercedes-Benz purchases:

- A $1,000 certificate each year you charge $5,000 in purchases on the card, good toward the future purchase or lease of a new Mercedes-Benz.

- Up to 2,000 excess miles waived at lease-end on leases through Mercedes-Benz Financial Services.

- $100 certificate at renewal of your Card account, good toward Genuine Mercedes-Benz Accessories.

- 5x points on select Mercedes-Benz purchases

When you reach the application page for the Mercedes-Benz Platinum card you'll see the following message:

Please note that the American Express and Mercedes Benz Card program will end in January 2019. Applicants can continue to apply for the Platinum Card from American Express exclusively for Mercedes-Benz, but, if approved, the Card will be replaced with a different American Express Card at the time when the Card program ends.

The Mercedes-Benz Platinum Card is currently offering a 60,000-point sign-up bonus after spending $5,000 in the first three months of cardmembership. Past history indicates you can still get the bonus on the Mercedes-Benz version of the Platinum even if you've already gotten bonuses for other versions of the Platinum card.

The Mercedes-Benz Credit Card from Amex, a non-premium card, will also be discontinued in January 2019. It's currently offering a 10,000-point sign-up bonus after spending 1,000 in the first three months of cardmembership.

Fortunately you still have nearly a year to apply for the either of the cards before they're gone. It's unclear what card you'll be converted to once Amex shuts down these products, but the Mercedes-Benz Platinum would likely become the standard personal Platinum Card® from American Express.

We've reached out to American Express for comment but they didn't respond by publishing time of this story.

H/T: Frequent Miler

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app