AA is Charging Up to 420,000 Miles for a (Mostly) Economy Award Flight to Australia

Airlines are known for devaluing their frequent flyer programs all the time. They do this by increasing award rates, requiring you to pay more miles to book an award flight. However, sometimes award prices reach a rate that's simply unreasonable, as I discovered while searching flights on American Airlines' website for an upcoming trip to Australia.

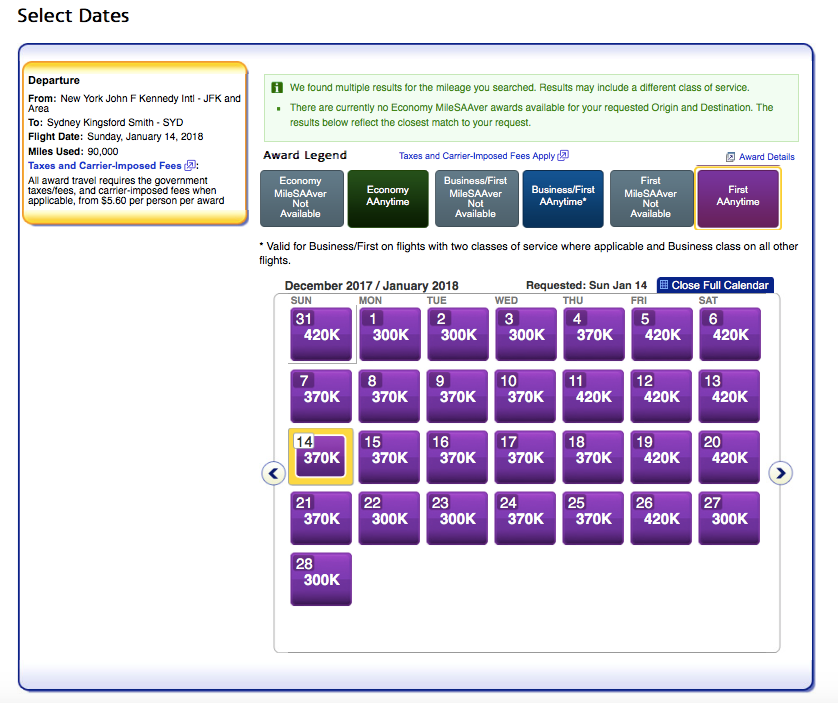

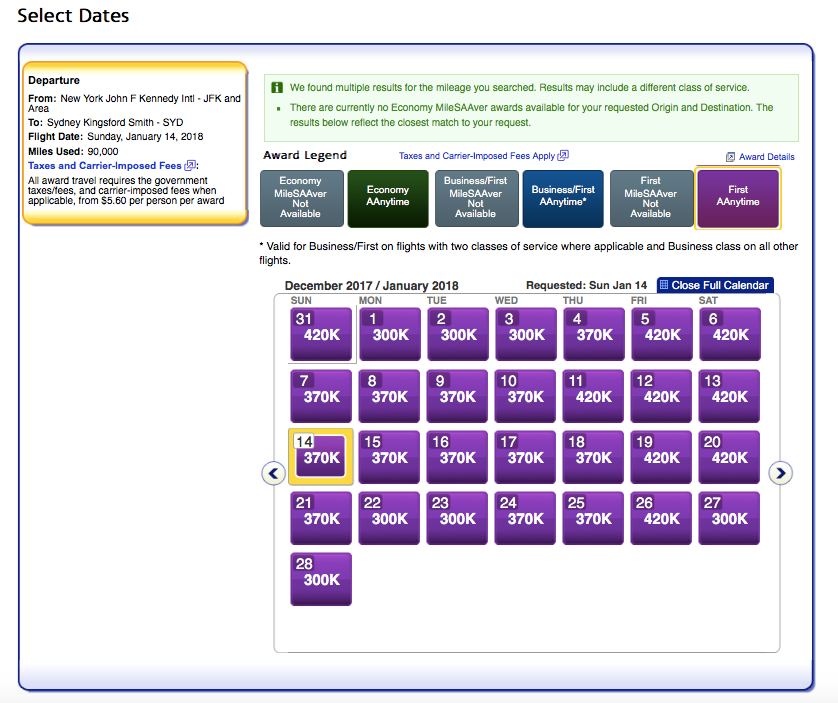

While there are only three official levels of awards between the US and Australia (MileSAAver, AAnytime Level 1 and AAnytime Level 2), American Airlines unofficially has up six award rates between these regions:

| US-Australia One-Way | Coach | Business | First |

|---|---|---|---|

MileSAAver | 40,000 | 80,000 | 110,000 |

AAnytime Award Level 1 | 70,000 | 175,000 | 220,000 |

AAnytime Award Level 2 | 90,000 | 195,000 | 260,000 |

AAnytime Award Level 3 | 120,000 | 250,000 | 300,000 |

AAnytime Award Level 4 | 150,000 | 325,000 | 370,000 |

AAnytime Award Level 5 | N/A | 375,000 | 420,000 |

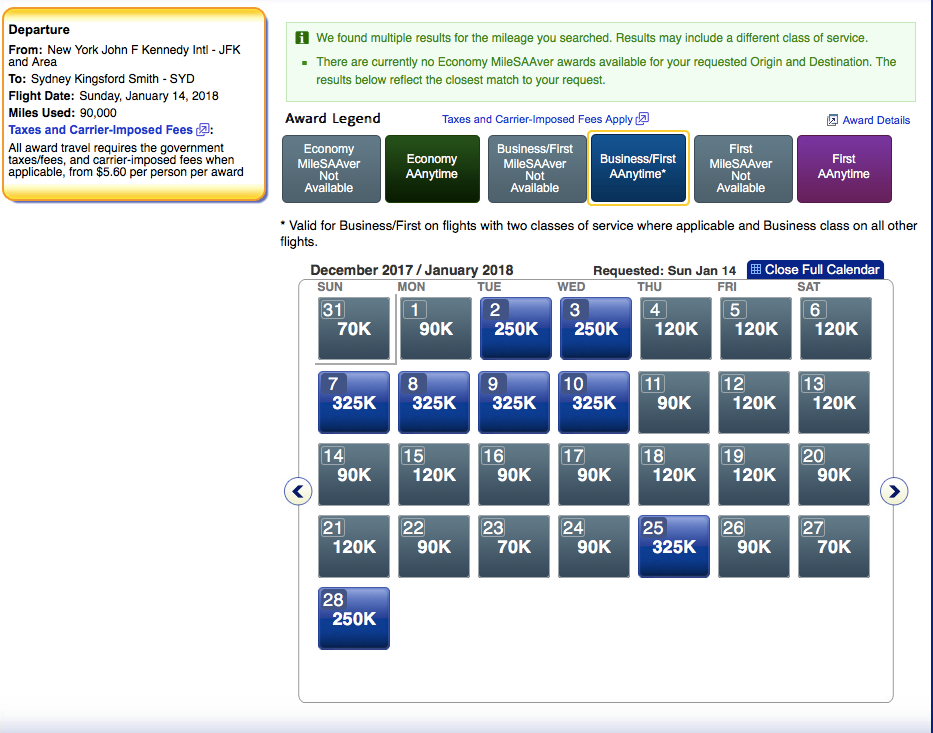

Usually, you'll see award rates somewhere in the MileSAAver to Level 2 range, but I stumbled across AA selling flights for 420,000 miles, at the AAnytime Award Level 5.

In a normal situation, any sane person would avoid spending that many miles for a flight. There are other options, via American's Oneworld partners or through other alliances. However, this was my first stop while shopping for the best value for my award flight.

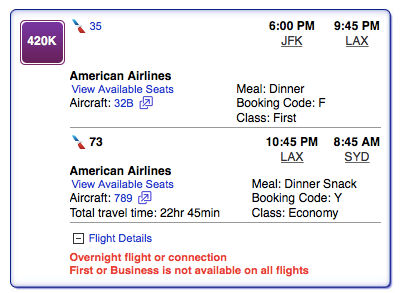

Luckily, I took a closer look before pulling the trigger. When I examined the flight options, it showed that the segment from JFK-LAX would be in first class on AA's premium-focused A321T aircraft, which features lie-flat seats in a 1-1 configuration with direct aisle access. However, the long-haul segment from LAX-SYD would be in economy aboard the 787-9 set up in a 3-3-3 configuration.

See the red note at the bottom that says "First or Business is not available on all flights?" That's right: You could fly in economy for 15 of the 21.5 hours of flying for 300,000 to 420,000 miles per person, one-way, depending on your travel dates. What a terrible deal!

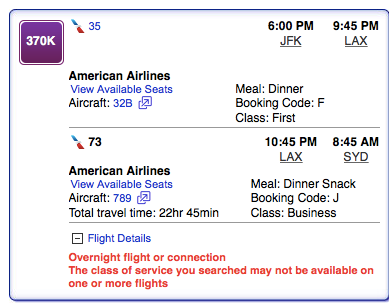

Turns out that AAdvantage is charging the highest fare possible because the one segment from JFK-LAX is in first on an in-demand date. There are certain days when this fare does have the flight from JFK-LAX in first and LAX-SYD in business — and there's a simple way to tell if you'll get seated in business or economy.

If AA has business/first AAnytime award space available, then your flight from LAX-SYD will be in business. You can see the days when the blue and purple overlap below. Additionally, the notes at the bottom are different; they say "The Class of service you searched may not be available on one or more flights" instead.

Currently, this egregious fare can be found on awards originating in JFK as well as other East Coast cities that route through JFK-LAX-SYD.

In my opinion, American simply shouldn't offer these types of awards, as they're incredibly misleading. Thankfully these aren't your only options to fly to Australia in a premium cabin on an award ticket. You can try searching for Qantas awards via AA's website like I did, but no flight appeared available for an entire month around my required travel dates, and they've yet to appear.

In the chart below, you can see the cost of a one-way ticket using the American Airlines Partner Award Chart. Each of the rates below is technically two separate award costs combined, as you need to book one award from your starting point to the specified departure city and then another award from the departure city to Australia.

| US-Australia AA Partner Award Cost | Coach | Business | First |

|---|---|---|---|

Cathay Pacific - via Hong Kong | 67,500 | 110,000 | 160,000 |

Japan Airlines - via Tokyo | 65,000 | 100,000 | 140,000 |

Etihad Airlines - via Abu Dhabi | 82,500 | 150,000 | 215,000 |

Qatar Airways - via Doha | 82,500 | 150,000 | 215,000 |

LATAM Airlines- via SCL and AKL | 75,000 | 140,000 | 197,500 |

Malaysia Airlines + British Airways - via Europe and Asia | 90,000 | 142,500 | 200,000 |

With this option, you can also mix and match class award types. For example, if there's only one seat in business on one leg and one seat in first on the other, you pay for each leg at cost rather then pay the higher fare the entire way, which will save some miles.

The best part is that these mileage costs are fixed unlike the rates when flying on American Airlines' tiered chart, at least for now. To search for availability for these awards, use BA.com or check out our article on how to search for Oneworld awards.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app