Alaska Airlines' valuable points — and award chart — survive Atmos Rewards: 'Not trying to hoodwink anybody'

Alaska Airlines announced a wide range of changes last month when it unveiled its new Atmos Rewards loyalty program. But one of the biggest wins for frequent travelers was the thing the airline didn't change at all: its popular award chart.

Going forward, redemptions via Atmos Rewards will look much like they did with the carrier's former Alaska Airlines Mileage Plan program.

That news was welcome to the scores of loyalists who have long prized Alaska's fixed, predictable redemption prices — a structure that consistently unlocks some of the best award deals of any U.S. airline, both on Alaska and its network of partners.

Today, using Atmos Rewards points (formerly Alaska miles), you can book a short domestic flight on Oneworld alliance partners like American Airlines for as little as 4,500 points one-way — a deal that personally saved me hundreds of dollars, thousands of points and more than a few hours sitting in traffic on Interstate 95 this summer.

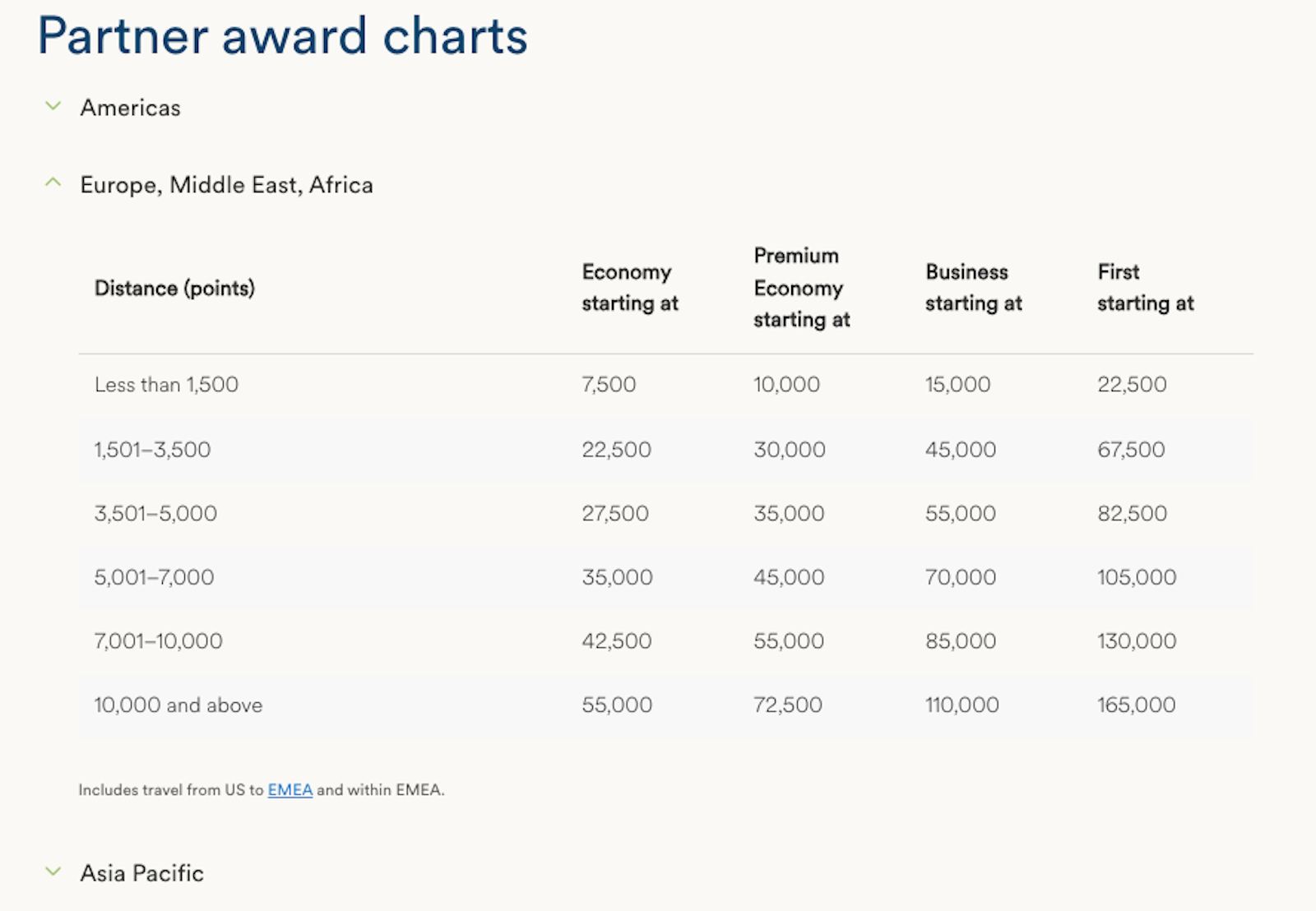

You can also use Atmos Rewards points to book a transatlantic flight from the U.S. to Europe for as little as 22,500 points, including on days when competitor award pricing can run tens of thousands of points pricier.

Alaska's program can unlock the swankier seats, too: Earlier this year, some TPG staffers used Alaska's program to fly to London for 55,000 points in American's new Flagship Business suites.

Bucking an industry trend

Alaska's award pricing edge comes, in no small part, from its award chart — a distance-based system that prices flights by miles flown, not by unpredictable factors like demand or travel dates.

That approach, once more common throughout the industry, makes Atmos Rewards a bit of an outlier. Many airlines have moved to dynamic award pricing, where the points or miles you need can fluctuate much like a cash fare — and take a bite out of your frequent flyer account balance in the process.

Industry pundits and points and miles enthusiasts feared Alaska might do the same as it launched a new loyalty program with merger partner Hawaiian. Those fears lingered even after the carrier last year promised it wouldn't devalue its miles (now points) — a pledge that helped secure Biden administration approval of the acquisition.

Then came Aug. 20, when Alaska Air Group unveiled Atmos Rewards and executives made it clear that the company would keep its promise — and its award chart.

"I get that, as an industry, we've conditioned guests to expect the worst anytime there's a loyalty program change," Alaska's top loyalty executive Brett Catlin told me, alluding to the myriad of airline (and hotel) program pivots that, all too often, have led to customers needing more points for a flight or hotel night than before. "That's not the way we're wired."

Partner award charts got a refresh in 2024

Beyond that ethos, we should also point out: Alaska just refreshed its partner award chart in April 2024, about a year and a half ago.

Since then, the airline's setup has routinely led to its loyalty currency ranking among the most valuable of any U.S. carrier in TPG's data-driven points and miles valuations updated each month (though American Airlines AAdvantage miles narrowly led the way in September 2025).

The value of those points — and the growing amount of award space Alaska offers on partners — has, in turn, raised the profile of the program, from its credit card lineup to its 1:1 transfer partnership with Bilt Rewards. And that's even among East Coast flyers who seldom fly with the Seattle-based carrier.

"We've created a proposition that resonates with guests. We've seen [program] usage go up dramatically over the past year," Catlin said.

Lingering concerns?

Of course, how strongly Atmos Rewards resonates with travelers in the long term will depend heavily on the airline's future plans for its points. And while executives aren't making pricing promises (no carrier or ... company ... ever would), Catlin offered this broad assurance:

"We have no plans, at this point," he said, "to radically change how we're structuring redemptions."

Those assurances haven't quite erased all concerns; my colleague, TPG senior writer Zach Griff, still fears pricing hikes could ultimately be on the horizon — at least, for some flights.

"If I were a betting man, I'd say that Alaska's existing award rates aren't here to stay for the long haul," he wrote in his analysis of the new Atmos Rewards program. "They're already lower in many cases than the competition; Alaska likely can't sustain these rates forever."

The airline isn't ruling out some pricing adjustments down the line. That includes potential changes to its own (nonpartner) award chart to account for its increasingly global route network.

"And there's always nuances, and you have to revisit from time to time," Catlin added.

Bigger-picture, though?

"We're not trying to hoodwink anybody," he said. "And so I think that mentality continues."

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app