Inside the Hidden World of Aircraft Maintenance With Lufthansa Technik

Anyone who has ever owned a car knows that certain routine maintenance procedures are recommended by the vehicle manufacturer in order to keep it running well and safely. Airliners have a maintenance schedule as well, but it's required by the aviation authorities of the countries in which the planes are operated.

I recently toured two of Lufthansa's large maintenance bases, in Germany and Malta. Most travelers don't think about the things planes go through, along with the normal — and perhaps scary — wear and tear. The maintenance division at Lufthansa is known as Lufthansa Technik (LHT). Lufthansa Technik's website defines each of the routine maintenance procedures that are performed on its aircraft.

A-Check

The A-check is carried out every 350 to 750 flying hours and, depending on the requirement, will take between 45 and about 260 man-hours. In addition to general inspections of the interior and the aircraft hull, it also covers service checks as well as engine and function checks. At the same time, the technicians replenish consumables such as oil, water and air and eliminate defects whose rectification has been postponed on the grounds that they did not impair flight safety. If any extensive seat repairs are required, these are also carried out in this interval inspection. These checks can be accomplished overnight, with the plane returning to service the following morning.

C-Check

This entails thorough inspections inside and outside, along with meticulous examination of structures (load-bearing components on the fuselage and wings) and functions. For example, the technicians use ultrasonic techniques to look for cracks in critical components. For the C-check, which can take between 1,500 and 2,000 man-hours of work, an aircraft will spend up to five days in the maintenance hangar.

D-Check

The D-check is the general overhaul of an aircraft and hence the most extensive of all aircraft-related service events. This check is carried out every six to ten years and entails 30,000 to 50,000 man-hours of labor over a period of four to six weeks. Leading up to the overhaul, a wide-body aircraft may have logged some 30,000 flying hours and 25 million kilometers.

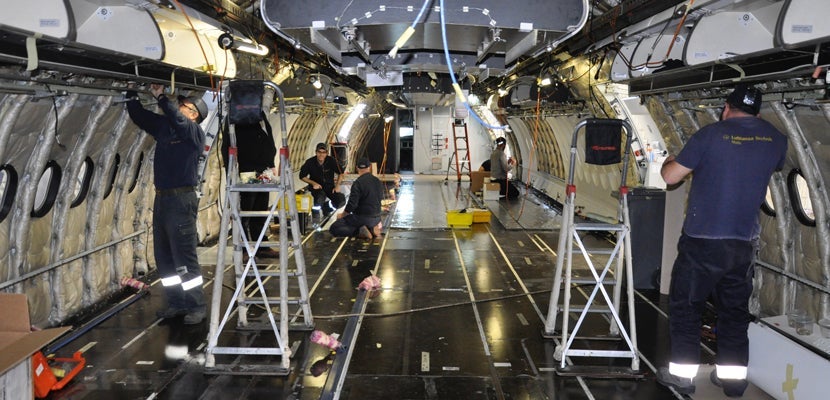

During a D-check, the entire structure is inspected down to the smallest detail. After that, the engines, the landing gear and the high-lift devices are dismantled, along with the cabin interior and the wall and ceiling panels. This is followed by removal of the instruments, the electrical systems, electronics and hydraulic and pneumatic equipment. All equipment is dismantled, taken apart and closely scrutinized, and technicians carry out any necessary repair work.

Let's get back to that mention of scary stuff for a moment. When the planes are stripped down, sometimes cracks are found. Yes. Cracks in the metal of your airplane. But this is why these checks are done, to discover tiny problems before they become big problems. Airplanes have certain stress points, especially in the corners around doors and windows. The expansion and contraction caused by pressurization of the fuselage during each cycle can cause some tiny fractures in the aluminum skin of the fuselage. But these things are known and expected. That's why these periodic inspections are scheduled. As long as the airline you're flying sticks to the maintenance regimen, you have no need to worry.

Lufthansa Technik refurbishes aircraft interiors and performs upgrades as well. It may be new seats, entertainment systems or cabin fixtures, which are internally known as monuments. LHT refurbishes bulkhead walls, galleys and even lavatory sinks and toilets.

LHT performs maintenance, repair and overhaul (MRO) work for over 800 airlines around the world. In 2016, its staff accumulated over 6,000,000 man-hours of work, at 10 facilities in eight countries. In addition to Malta and Germany, LHT also operates in Bulgaria, Hungary, Ireland, Malaysia, Philippines, and Puerto Rico.

Disclosure: The author's travel and accommodations in Malta and Germany were covered by Lufthansa Technik, though all accounts and descriptions belong to the author.

All photos and videos are by the author.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app