American Airlines' Joint Venture With Qantas Has Been Tentatively Approved

After years of trying to tie the knot, American Airlines and Qantas' proposed joint venture received tentative approval Monday morning. The US Department of Transportation released a Order to Show Cause -- which is a first step toward approval. This filing starts the clock for other airlines and the general public to file comments about whether the joint venture shouldn't be approved.

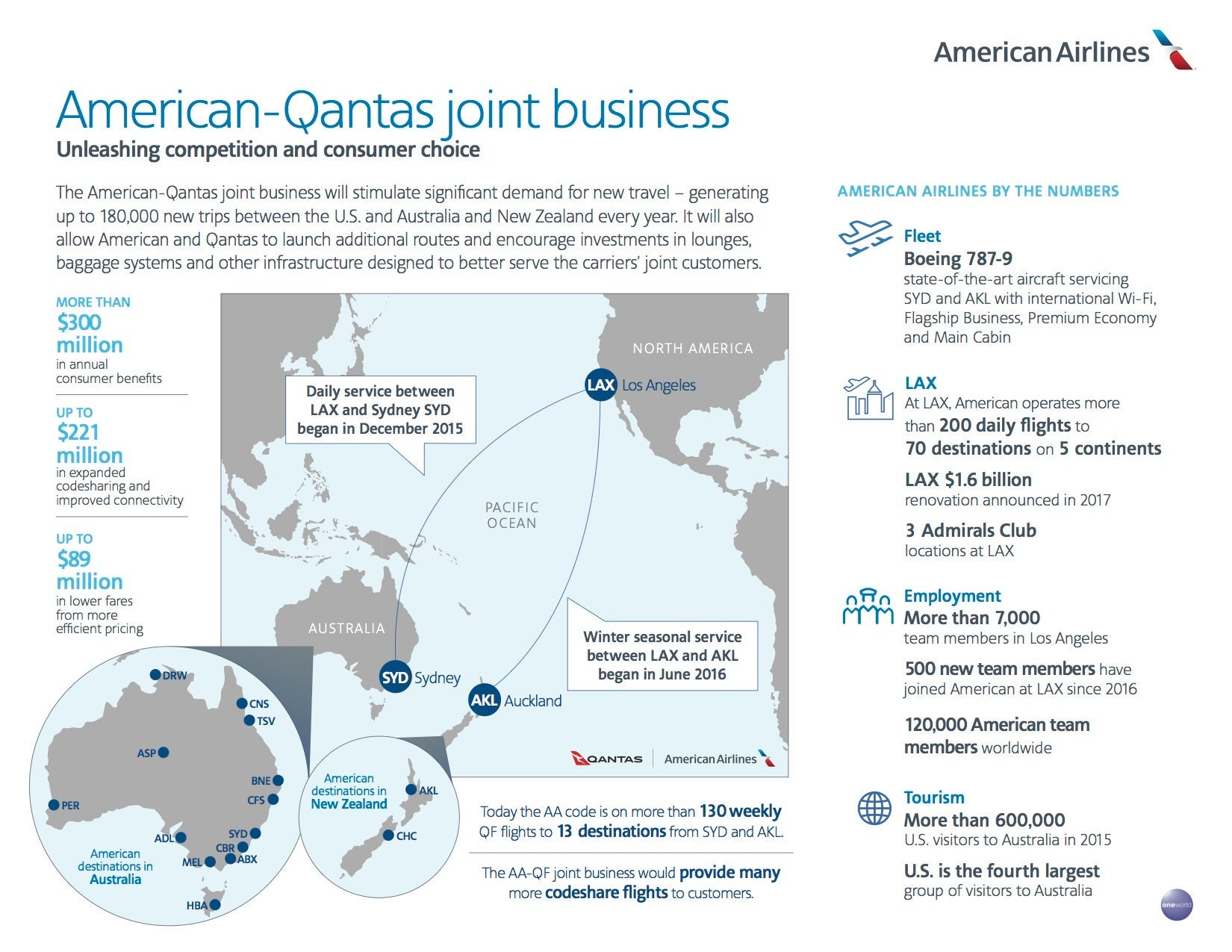

This joint venture would allow the two airlines to act as one business for flights between the US and Australia and New Zealand. AA and Qantas would be able to coordinate flight schedules, expand codeshare routes -- as well as coordinate pricing.

The tie-up between these two Oneworld airlines would join existing joint venture agreements between United Airlines and Air New Zealand (Star Alliance) and between Delta Air Lines and Virgin Australia.

In November 2016, the AA-Qantas joint venture (JV) request was rejected by President Obama's administration on grounds that the move would hurt competition. Opposing airlines included Hawaiian Airlines and JetBlue. Hoping for a different ruling under the Trump administration, the two Oneworld carriers re-filed a JV application in February 2018.

In public comments since re-filing this application, the two airlines have said that they'd use smaller planes and cut back codeshare flights if it wasn't approved. However, if the JV application was to be approved, the airlines promised to launch additional routes between the US and Australia and New Zealand.

In a press release announcing the re-filing of the application, American Airlines predicted that the JV would "stimulate significant demand for new travel" and generate "more than $300 million in annual consumer benefit" and "up to $89 million in lower fares from more efficient pricing" -- without going into detail how this would be generated.

Speaking at an event in Los Angeles (LAX) in October 2018, American Airlines CEO Doug Parker noted additional flights would be added because "there will be more and more demand created." He didn't explain how allowing the two airlines to coordinate pricing and schedules would create more demand. However, he did confirm that the JV would help the airline be more profitable from LAX.

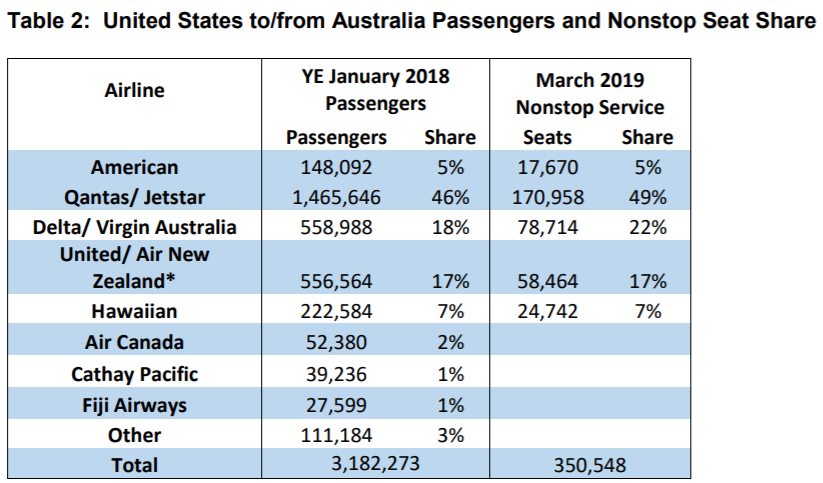

Qantas is the largest airline for flights between the US and Australia, while American Airlines is a much smaller player. According to DOT statistics included in the order, Qantas accounted for 46% of the passenger traffic between the two countries in 2018 and has a 49% share of March 2019 nonstop service. Adding in American Airlines 5% share of those numbers, the AA-Qantas JV would account for more than 50% of the passenger traffic between the US and Australia.

In the filing, the DOT directly addressed the fact that it's reversing a decision made just a couple of years earlier by the same department. Rather than focusing on the anti-competitive aspect of the rejection, the DOT pointed out that the 2015 filing "provided insufficient evidence of the Joint Applicants' ability to execute their proposed capacity plan."

In addition, the DOT noted that "market conditions have evolved since 2016 to mitigate any competitive harm that an American/Qantas joint venture could cause."

One condition of the approval is that American Airlines and Qantas will need to conduct a "Self-Assessment" in seven years. If the DOT's review of the assessment finds that the joint venture is anti-competitive, the "Department would be in position to take appropriate action."

This tentative approval is subject to public comment. The order directs "any interested parties to state why we should not adopt in a final order the findings and conclusions set forth below." Parties have just 14 calendar days to do so. After an answer period, the DOT will then review any comments and prepare a final decision.

A request for comment from American Airlines wasn't provided by the time of publishing.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app