Where to Sit When Flying Korean Air's 787-9: Business Class

Update: Some offers mentioned below are no longer available. View the current offers here: Chase Sapphire Preferred Card

Korean Air is the latest international carrier to begin operating flights with the 787-9 Dreamliner, and while the airline's decision to add the same seats to both of its premium cabins isn't ideal for first-class travelers, it's great news for those flying in business class. The reason? If the APEX seats Korean Air's selected are good enough for long-haul first class, they're certainly sufficient for biz.

Before you continue with this post, I recommend taking a moment to catch up on this aircraft's peculiar seat configuration by reading this post first: Korean Air's 787-9 Dreamliner Has the Same Seat in Business and First Class.

[table-of-contents/]

So, while the APEX seat is far from the airline's most luxurious first-class offering, it's definitely among the best options for biz, as I experienced on a JAL 777-300ER flight back in 2015.

Business-Class Cabin

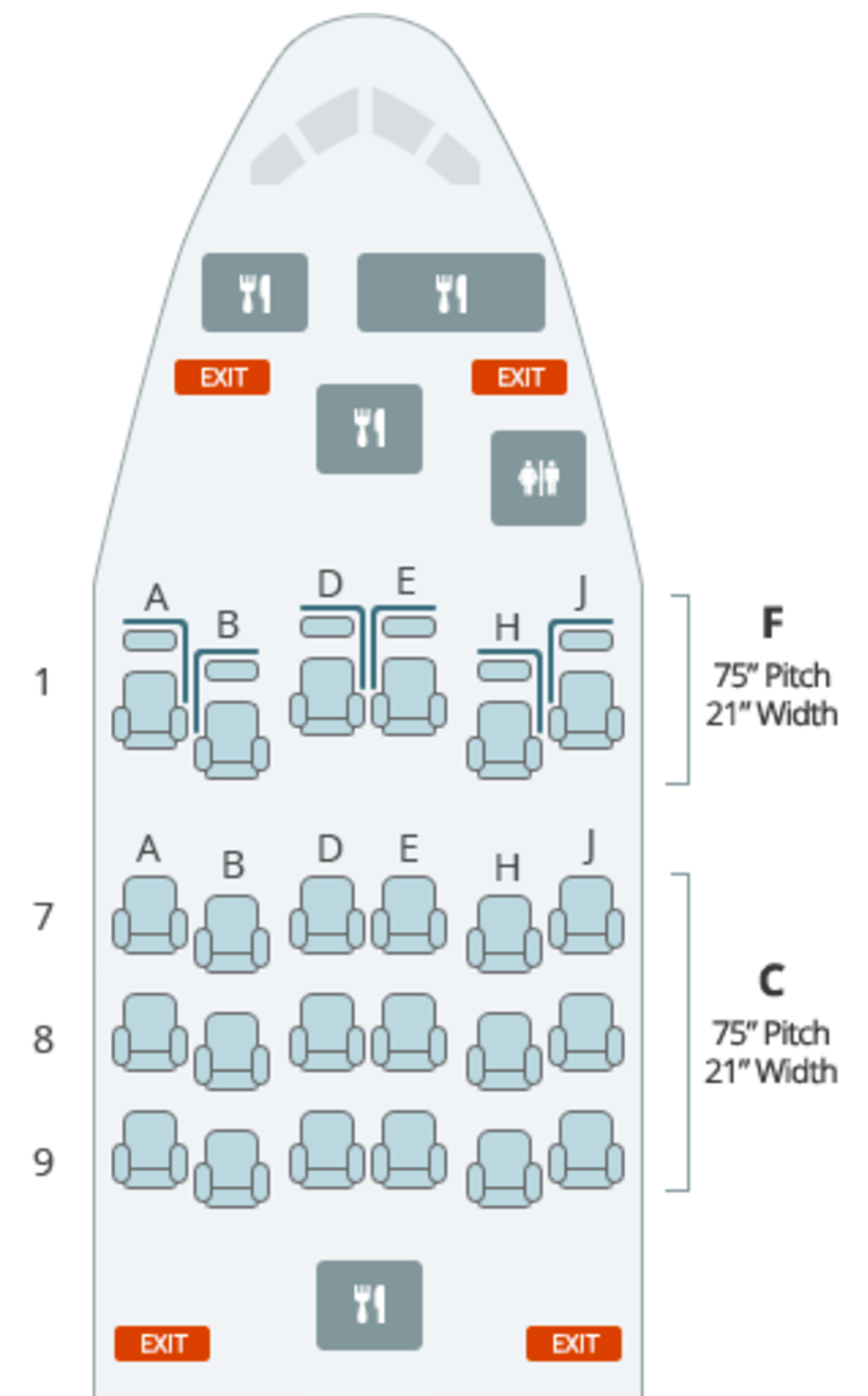

First, let's take a look at the premium-cabin seat map. Seats marked "F" are first class, while those marked "C" are in the business cabin. There are 24 seats in total — six in first class an 18 in biz. While they look a bit different on the map, rest assured that you'll indeed find the "first class" seat in the business cabin.

Like those in first class, business-class seats are arranged in a 2-2-2 configuration — however all seats have direct aisle access due to the unique design.

These seats offer excellent privacy for a business-class cabin (though not quite enough for first class). So regardless of where you end up, you should have a pretty comfortable ride.

Which Seats to Pick

Just as in the first-class cabin, my first pick would be the window seats — but, well, not all of them. 7A, 7J, 9A and 9J are the best seats in the cabin, in my opinion, since they offer the most privacy and have three windows each (TPG's pointing to seat 9J below).

The displays are a bit smaller than those up front (17 inches vs. 23), but that alone isn't a good enough reason to book first class over biz.

Notice the (fairly) narrow access aisle — it's a bit tighter in business than first, so keep this in mind if you typically have trouble getting in and out of your seat.

Which Seats to Avoid

Again, just as in first class, I'd avoid the aisle-facing seats on each side of the plane — 7B, 7H, 8B, 8H, 9B and 9H — since these are much more exposed than the ones up against the window. They're definitely easier to get into and out of, though.

Additionally, all D and E seats are located in the center, and they're a bit close together. You might want to avoid these unless you're flying with a companion (though you can raise a partition to close off the space between seats).

Finally, there are two window-facing seats that have two windows instead of three. While this probably isn't a deal breaker, you might as well grab one of the seats with three windows, right? In this case, you'll want to avoid 8A and 8J.

Flying Korean Air's Dreamliner

Korean Air's first 787-9 will initially enter service with 3x daily domestic flights between Seoul (ICN) and Jeju (CJU). A flight to Tokyo will follow before Korean Air later adds the plane to its Seoul-Toronto (YYZ) nonstop route on June 1. Eventually, the aircraft will also operate a third daily flight to Los Angeles (LAX), and will enable daily service between Seoul and Seattle (SEA), with increased frequency scheduled to begin in May (with a 777 for the time being).

We dug into the carrier's paid and award rates in this post, but to recap, here's what you can expect to pay for round-trip flights from the US to Korea (note that rates may be higher on certain dates):

- Economy: 70,000 miles + $245

- Business Class: 125,000 miles + $245

- First Class: 160,000 miles + $245

Award availability tends to be excellent on most routes, with two or more seats open in all cabins on many dates. Fortunately, Korean Air is an instant transfer partner of Chase Ultimate Rewards, so you can transfer points earned with cards like the Chase Sapphire Preferred and book these seats instantly.

Additionally, the airline will let you put award seats on hold until a few days before departure, so if you're planning a trip far in advance, you'll have plenty of time to earn the required points before the hold expires. Korean Air awards can be a bit complicated to book, though, as outlined in our post, How To Book Award Flights with Korean Air SkyPass. You can also book business-class awards (but not first-class awards) using Delta miles, though availability is usually much more limited.

Bottom Line

While I'd hesitate to book first class on this plane, given that Korean Air's 787 offers the tightest first-class configuration of any 787-9 operator, the APEX seat is fantastic for business class, offering a very comfortable (and semi-private) ride across the Pacific. Additionally, Korean Air's award availability tends to be fantastic, and with points so easy to earn (via cards like the Chase Sapphire Preferred), this is a product you'll very likely be able to fly.

Have you flown in the APEX business-class seat?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app