Video SRQ: Can You Buy A Roundtrip Ticket And Not Take The Return Flight?

Update: Some offers mentioned below are no longer available. View the current offers here.

TPG reader Cathrine is looking to take a trip to Paris and has enough points to get herself there, but not enough points for the flight home:

"I have enough points to redeem for a first class ticket to Paris from LAX. But I don't have enough points for a return flight to the US, so I'll have to purchase a return flight. I researched the price of a one-way ticket Paris-LAX in coach, but noticed that a roundtrip ticket Paris-LAX-Paris is much cheaper.

Is there any reason I can't buy the roundtrip ticket and just throw out the "return" part of that ticket? It's worth it to me to travel first class on the way out even if I have to purchase the return flight."

Cathrine has pointed out one of those counter-intuitive quirks of the airline industry, which is that it is oftentimes more expensive to buy a one-way ticket than a roundtrip itinerary. Shouldn't it be cheaper if you're only taking one flight instead of two? But that ends up being the case a lot, especially with overseas destinations.

For example, this one-way non-stop from CDG-LAX in April is nearly $4,000!

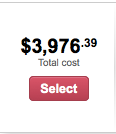

While the roundtrip is $2,000 less (though still very expensive!):

So Cathrine has two options. The first, as she mentions, is to buy a roundtrip ticket and just take the outbound flight but not the return. That's what's called throwaway ticketing. It's technically against the rules, but if you're not doing it all the time, most airlines won't flag you as a system abuser and you shouldn't have any issues.

It's not my first choice, though, since it's a little bit wasteful buying an extra ticket that no one is going to end up using. So instead of buying the roundtrip, if you have a little time to plan, why not try to accrue enough miles for your return ticket as well?

There are so many great credit card offers out there at the moment, that you should be able to take advantage of any number of them to get the points you need to travel home in style as well.

The Premier Rewards Gold Card from American Express is currently offering a 50,000-point bonus when you spend $1,000 in 3 months and the first year's annual fee is waived.

The Chase Sapphire Preferred bonus is at 50,000 points when you spend $4,000 within the first 3 months, which is more than enough for an economy one-way ticket back to North America from Europe, and almost enough for a business class ticket.

Even buying miles outright might be a better option. Some airlines, such as US Airways, only allow roundtrip awards, so you'd have to buy double the miles you'd actually need for your one-way award ticket, which I obviously wouldn't suggest.

But United, for example, allows one-way awards and just had a sale on miles that equated to buying them for about 2 cents apiece, and since one-way awards on United are 30,000 miles for economy from Europe to North America, that would only have cost you $600, which could be cheaper than buying even the best-priced roundtrip ticket you can find.

If you have an Amex Platinum Card, they'll let you advance up to 60,000 points per year - you just have to earn them back within the year.

If you do end up buying the roundtrip flight for your return flight, you might be able to salvage some of that value by booking the second flight at a time of year when weather is an issue (like around the holidays) and if the airline changes it you could get some of your money back. Or you could change it yourself and just suck up the change fee, which will probably be around $250 and use the rest of the value of the ticket for some other future travel.

My advice is to be creative and consider some credit cards or buy-miles bonuses if they come up in time for you to take advantage of them since I am positive you can get back home from Paris in business class for cheaper than what you'd end up paying for a coach ticket.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app