Quick Points: Use a shopping portal aggregator to maximize your online purchases

Editor's Note

It's no secret that online shopping portals are an easy way to earn extra rewards.

But with so many loyalty programs offering shopping portals, it can be difficult to know which portal has the best earning rate for a particular purchase without checking each portal individually. Luckily, several popular shopping portal aggregators can help.

In this article, I'll discuss how to use an online shopping portal aggregator to maximize rewards when shopping online.

What is a shopping portal aggregator?

A shopping portal aggregator collects and displays the current earning rates for popular online retailers across various shopping portals.

Searching your retailer on a shopping portal aggregator will show you the earning rates across various shopping portals. Then, you can initiate your online purchase through the shopping portal that makes the most sense.

Related: The beginners guide to airline shopping portals: How to earn bonus points and miles

Which shopping portal aggregator is best?

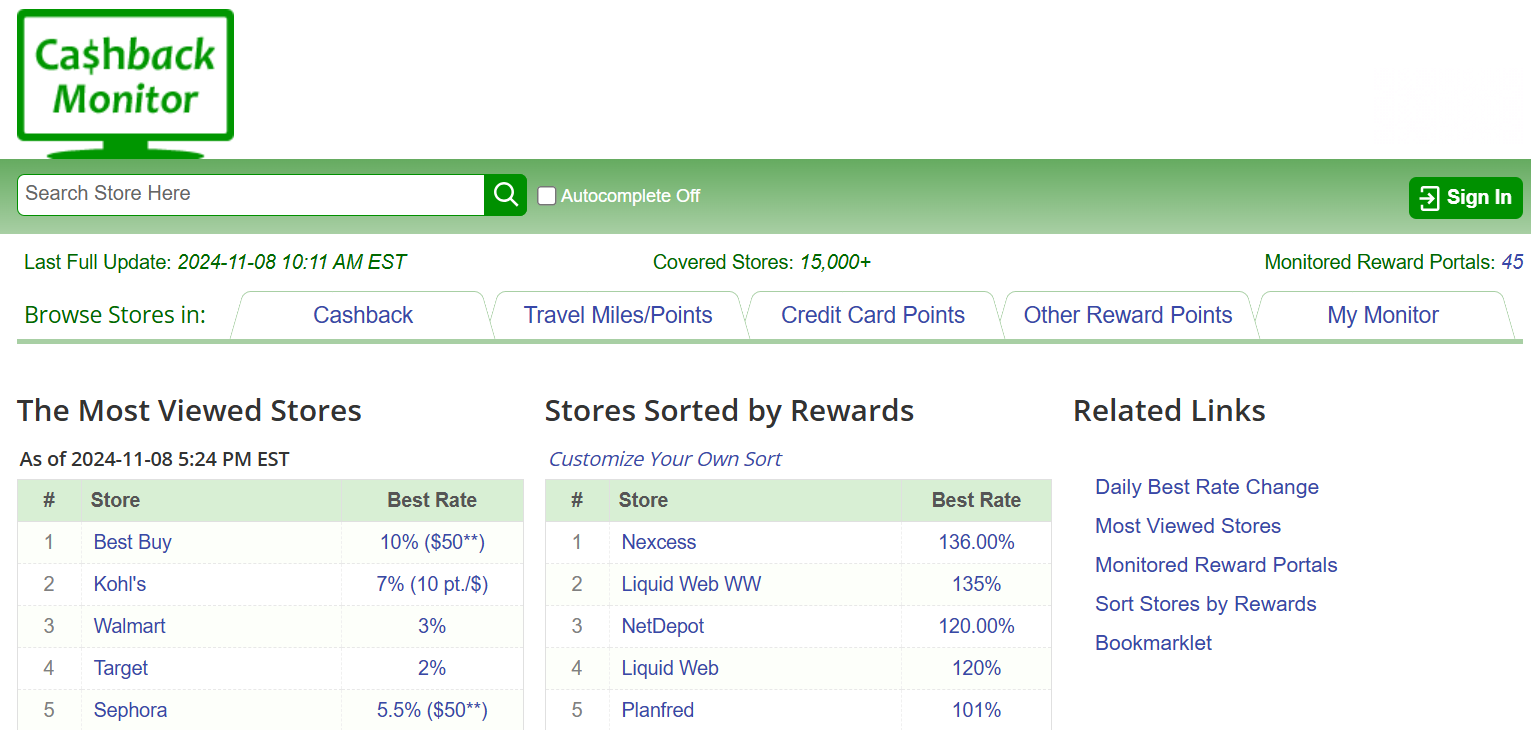

I use Cashback Monitor to compare shopping portal returns, but some TPG staffers prefer Evreward. The sites largely operate the same.

If you use Google Chrome, another option is to download a shopping portal aggregator extension like Cashback Comparison. These extensions use the URL of the site you are browsing to find and compare online shopping portal rates for the site.

Related: How to use price trackers to get the best deals on holiday shopping

How do I use a shopping portal aggregator website?

To use a shopping portal aggregator website, go to the site and enter the name of the merchant with which you want to make a purchase. You can then quickly compare your potential earning rates across various online shopping portals.

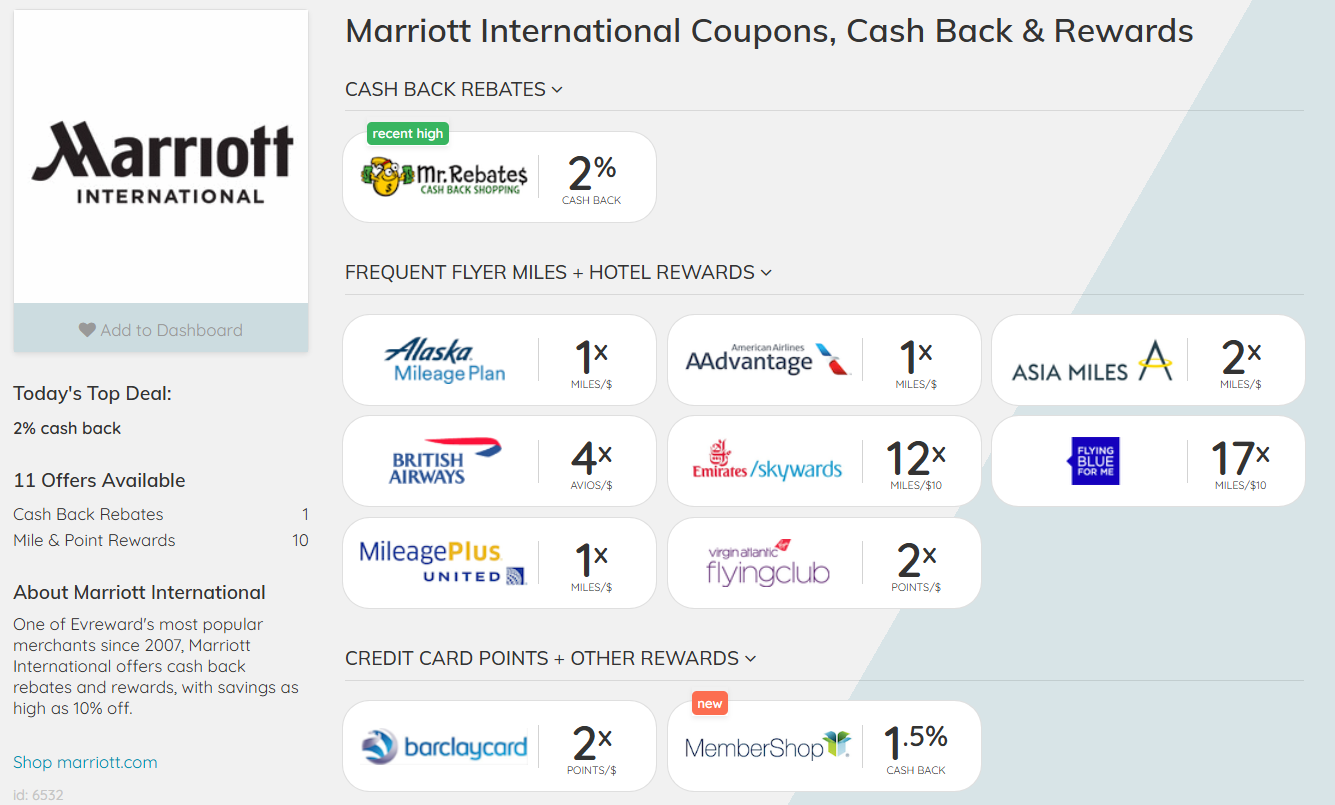

For example, here's what Cashback Monitor returned for Marriott as I was writing this article:

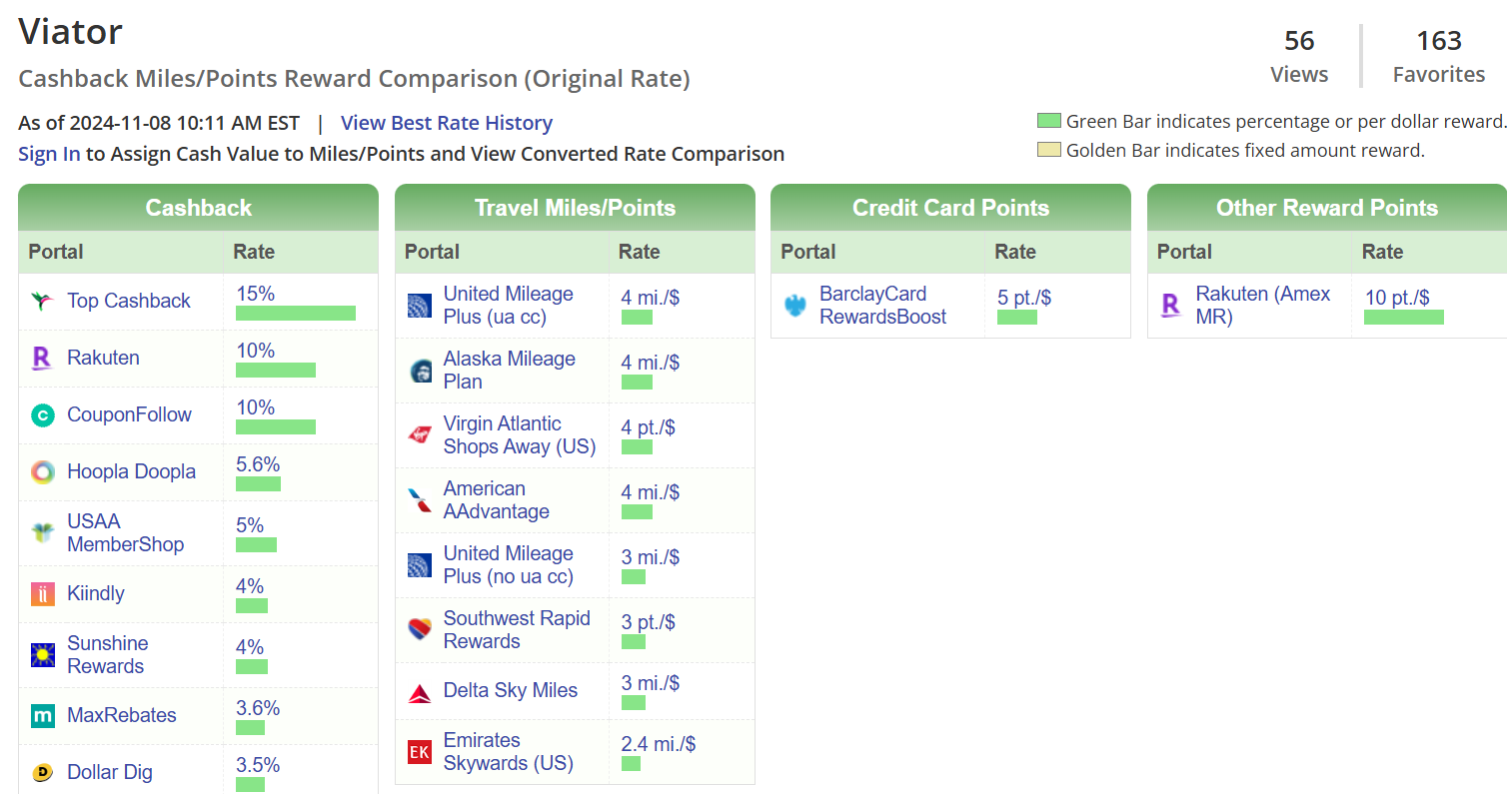

And here's what Evreward returned for Marriott International as I was writing this article:

Once you've decided which online shopping portal to use, click on the portal name, which will take you to the online shopping portal's website. Here, you can log in, confirm earning rates and check the fine print for exclusions. After you initiate a shopping session, you can complete your purchase.

Related: The best credit cards for online shopping

Why should I use a shopping portal aggregator?

Shopping portals can help you build a diversified points and miles portfolio. For example, a Delta Air Lines flyer may opt to earn Membership Rewards points through the Rakuten shopping portal if it earns more for a specific purchase than the Delta SkyMiles Shopping portal.

You might also have multiple loyalty programs with which you're willing to earn rewards through shopping portals. For example, I usually use the AAdvantage eShopping portal, Top Cashback or Rakuten when making online purchases. I can quickly compare current earning rates across these portals by using a shopping portal aggregator like Cashback Monitor.

Earning rates change frequently for most merchants, and not all shopping portals partner with every merchant. Starting with a shopping portal aggregator when you're ready to make an online purchase can help you find the best portal for your preferred merchant.

Related: How one Chrome plug-in can earn you extra points or cash back

Bottom line

Unless you're committed to just one shopping portal, starting with an online shopping portal aggregator is worthwhile.

Of course, rewards earned through online shopping portals are on top of what you'll earn from your credit card purchase. So, when you combine online shopping portals with one of the best credit cards for online shopping, you can earn more points and miles by double dipping.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app