Maximizing Ultimate Rewards With The Chase Ink Credit Cards

Update: Some offers mentioned below are no longer available. View the current offers here.

Today, TPG contributor Jason Steele takes a close look at the Chase Ink family of cards and how you can maximize their huge earning potential by educating yourself about their category spending bonuses and annual limits.

As readers know, the Chase Ink family of cards – including the Ink Bold, Ink Plus and Ink Cash and Ink Classic – represents one of the most outstanding arsenals of travel credit cards to earn free travel because the points are earned into Ultimate Rewards, which offers many redemption opportunities like transfers to Hyatt and United (for Plus and Bold cardholders). But since the withdrawal of certain prepaid products from a particular office supply store, where the Ink cards earn you 5x points per $1, it has become more challenging than ever to earn as many points as possible from these cards.

With so much at stake, here are the basics towards maximizing the amount of Ultimate Rewards points you can rake in with this family of products:

1. Maximizing the sign-up bonuses: You can get them for all four Ink cards. Ink is available in four flavors: Ink Plus, Ink Bold, Ink Cash, and Ink Classic. Of course, the Plus and the Bold are currently offering 50,000-point sign-up bonuses when you spend $5,000 in 3 months (it used to be $10,000 and may go back to that level at some point) and have $50,000 annual limits on 5x and 2x category purchases. With Ink Classic and Ink Cash the sign up bonuses are 20,000 points each when you spend $3,000 in 3 months, and the 2x and 5x category limits are $25,000 per year. These are business cards, but you can apply with your social security number as a sole proprietor if you have or are planning to start a small business of your own (see this post for more information). Even though these are business cards, each application will be a hard inquiry on your credit, so it is critical to make sure your score is strong and you pay off your bills on-time and in-full every month, or else you'll be hit with finance charges that will easily negate the value of the points earned- especially on the charge card products, like the Ink Bold.

While the returns diminish with the Ink Classic and the Ink Cash cards, it still may be worth the effort to sign up for these cards. For one, these cards have no annual fee, so you can hold these for the long term with no costs. And although the Ink Classic and the Ink Cash cards do not, by themselves, offer point transfers to hotel and airline programs, cardholders can transfer Ultimate Rewards points earned on these cards to other the Ultimate Rewards accounts of their other Chase cards that offer this option, Ink Bold, Ink Plus, Sapphire Preferred, and Palladium.

Additionally, it is also possible to get the same product more than once for multiple businesses. You would need to have a separate Employer Identification Number, or at least a separate business name, but it is possible. The advantage here is both the additional sign-up bonuses as well as the ability to spend beyond annual limits of a single card on purchases in both the 5x and 2x bonus categories.

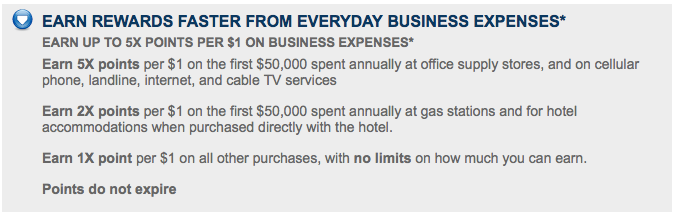

2. Understanding and maximize the annual bonus category limits. The Ink cards all have two separate annual limits on bonus spending categories. Ink Bold and Plus have $50,000 annual limits on qualifying purchases with the 5x categories and a separate $50,000 annual limit on eligible purchases within the 2x categories so if you maxed both out, you'd be spending a cool $100,000 and earning 350,000 points total on each card. The bonus limits are separate for each account.

Likewise, the Ink Classic and Ink Cash cards have $25,000 limits for 2x and 5x purchases, so if you were to spend a total of $50,000 maxing out both bonus categories, you'd earn a total of 175,000 points. With all cards, once these limits are met, purchases continue to earn one point per dollar spent.

Most importantly, these limits are based on the account anniversary, not the calendar year. So if you received approval for your Ink card in July, that account's annual limit will reset on the first statement closing date of the following July.

3. Play by the rules, but don't be afraid to maximize bonus categories. People are a little freaked out that Chase will consider it abuse to earn hundreds of thousands of points with the 5x categories on their Ink cards, just as they cracked down on those who used automated scripts to generate 10 points per transaction on the Freedom card when that benefit was still available via the Chase Exclusives program.

I have read countless people proclaim in forums and on blogs that spending only in the 5x category might also be considered abuse that can get your account shut down. In contrast, I have searched far and wide to find any documented case of this and I have found none.

Furthermore, this passive observation is consistent with both my experiences and several firsthand accounts of those making the vast majority of purchases in the 5x category. Our experiences show that this behavior will not, by itself, cause you to run afoul of Chase. For example, one person told me that he had made $50,000 of mobile phone purchases for his business without problems (Yes, I know that the terms exclude equipment purchases but bonuses are computed based on merchant category codes, not the specific items purchased and it worked for him). I also have firsthand knowledge of others who have maxed out the $50,000 annual limit on purchases from office supply stores and Internet services.

I am a big fan of Chase and make many purchases across multiple Chase cards. Yet I also maximize my earning of Ultimate Rewards points by making qualifying 5x and 2x purchases on my Ink cards while putting other spending on my Sapphire Preferred in its bonus earning categories, and other cards as is optimal to earn rewards. Even though the vast majority of purchases on my Ink cards were in the 5x and 2x categories, I have never had a problem. Chase places annual points earning limits on these products for a reason, and cardholders are well within the terms of these products, even when they reach these limits.

By understanding the nuances of the Ink family of reward cards, you can earn as many Ultimate Rewards points as possible. Stay tuned for my next post in which I'll be discussing various facets of the Ink cards including specific strategies on maximizing those bonus categories.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app