2 tricks I used to avoid inflated award prices on a trip to Florida

Earlier this year, my family began contemplating a trip to Florida. Since I've got an obscene amount of airline miles from earning all these giant credit card welcome offers recently, I told them I'd cover their flights.

Unfortunately, the dates they chose to visit were really expensive — both in cash and in miles. Instead of what I thought might be a drop in the horse trough that is my travel rewards stash, I was now staring at a big depletion.

But with some creative booking strategies, I was able to reduce the points cost of my trip without changing my dates. I just had to get creative in how I booked. Let's take a closer look.

[table-of-contents /]

Being flexible on departure and arrival airports

When faced with fixed dates and high points costs, there are two big things you can do to increase your likelihood of finding a cheap award:

- Keep your origin and destination flexible.

- Remember that many large cities are serviced by multiple airports.

When you search for flights (especially if your travel dates are inflexible), you can save a small fortune if you're willing to inconvenience yourself slightly by flying to or from airports that are near your destination — instead of at your destination.

For example, I live in Dayton, Ohio. To visit Universal Studios in Florida, my most convenient route is between Dayton International Airport (DAY) and Orlando International Airport (MCO). If tickets are pricey, many would-be travelers simply abandon their plans. However, there are plenty of other route permutations to try.

I'm willing to fly from the following airports:

- Dayton International Airport (DAY).

- Cincinnati/Northern Kentucky International Airport (CVG).

- John Glenn Columbus International Airport (CMH).

And I'm willing to fly to the following airports, which have a reasonable drive to Orlando's theme parks:

- Orlando International Airport (MCO).

- Orlando Sanford International Airport (SFB).

- Melbourne Orlando International Airport (MLB).

- Daytona Beach International Airport (DAB).

- Tampa International Airport (TPA).

- St. Pete-Clearwater International Airport (PIE).

- Sarasota Bradenton International Airport (SRQ).

That leaves me to search the following routes for cheap fares.

Note: In this case, SFB and PIE are airports that service low-cost airlines — in other words, I wouldn't be able to use airline miles to book flights.

Of course, you can also fly home from a different airport than where you arrived. For example, I could fly into TPA and return home from MCO.

When you're searching for flights, be it for award seats or cash rates, this is a crucial trick. An airport an hour away from your destination may cost half the price. If you're traveling with a large family, you could quite easily save 100,000-plus miles with this technique.

Related: How to use Google Flights to maximize your next travel booking

Leveraging a diversified stash of points and miles

Going hand in hand with a flexible flight route is the importance of a diverse stash of points and miles.

While it can be time-consuming, it's worth checking each potential route with multiple airlines, as the prices are almost guaranteed to be different.

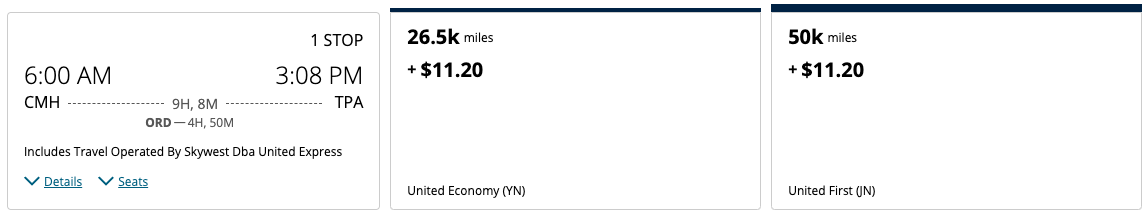

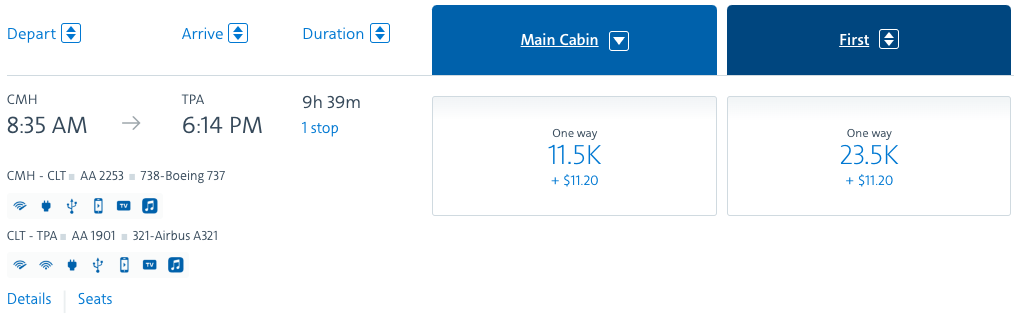

Let's look at an example. A one-way flight in November from Columbus to Tampa costs 26,500 miles in economy through United MileagePlus.

Through American AAdvantage, you'll pay 11,500 miles one-way in economy.

And booking with Delta SkyMiles, you'll pay as little as 7,000 miles one-way in basic economy.

If you've only got United miles, you may decide against planning the trip — 26,500 miles is a lot for a quick hop to a destination just a couple of states away. But if you've got Delta miles, you could potentially book two round trips for roughly the price of a one-way with United miles.

Remember, one of the best ways to diversify your miles is by earning transferable points. For example, if you have American Express Membership Rewards points, you can transfer to Delta, British Airways (to book American award tickets) or a handful of other airlines.

Related: How (and why) you should earn transferable points

Bottom line

Summer travel prices are through the roof. Whether that's because of rising gas prices or blatant extortion by the airlines is up for debate; but if you're flexible with your travel routes and have a healthy mix of airline currencies at your disposal, you can almost certainly find a great award seat that meets your needs.

To easily diversify your airline miles without opening lots of different airline credit cards, consider collecting transferable points like Chase Ultimate Rewards points. These points transfer to a handful of different airlines, giving you numerous options. Then you can transfer your points to whichever airline best suits your needs.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app