Do I Earn Points if I Don't Pay My Credit Card Bill?

Update: Some offers mentioned below are no longer available. View the current offers here.

Reader Questions are answered twice a week by TPG Senior Points & Miles Contributor Ethan Steinberg.

With credit cards serving as the fastest way to earn points and miles these days, award travelers are caught in a game of tug and war between spending more to earn more points while still trying to stay financially responsible. TPG reader Kayla wants to know if she needs to pay her credit card bill in order to earn points...

[pullquote source="TPG READER KAYLA "]If I have a large balance on my credit card, I won't receive my points until I pay the balance in full, right?[/pullquote]

Before we address this question, it's important to reiterate that carrying a balance on your credit cards ignores one of the most important rules of travel rewards. The interest charges you'll pay from month to month will quickly erase the value of any points you're earning, especially since travel rewards cards tend to have higher interest rates. If you find yourself carrying a balance on your cards or are working on getting out of debt, it might be prudent to clean up your financial situation before you start pursuing travel rewards.

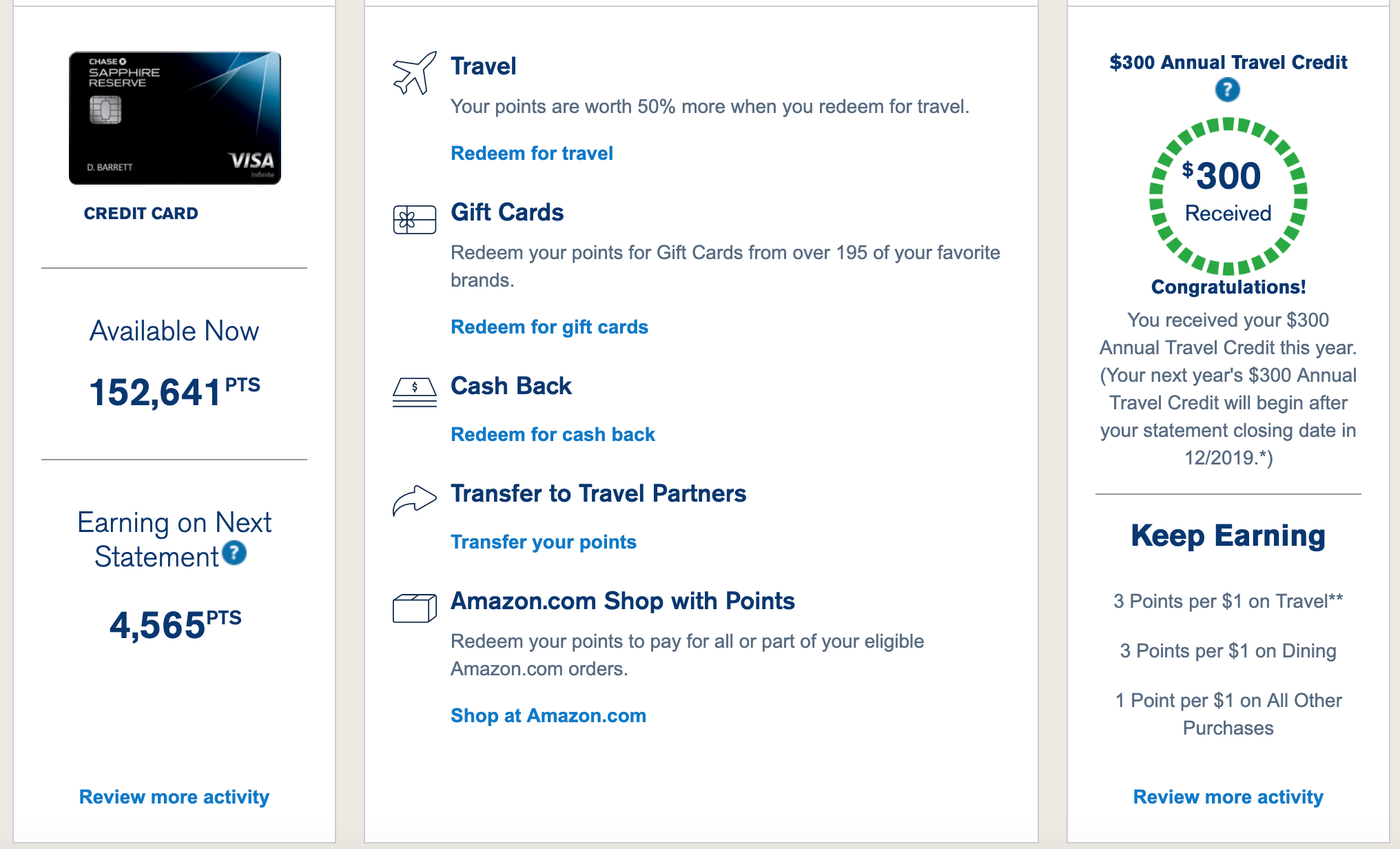

Now to get to Kayla's question. With a majority of credit cards, you earn your points based on the purchase and not when you pay your bill. If you look at my Chase Ultimate Rewards account for my Chase Sapphire Reserve, you'll see that I'm set to earn 4,565 points on my next statement. Chase will deposit these points into my account at the same time that my bill for this month becomes available, and I'll earn these points even if I haven't yet paid my bill.

This is how most credit cards operate, although there are a few exceptions to note. One that jumps to mind instantly is the Citi® Double Cash Card, which effectively offers 2% cash back on all purchases. You'll earn 1% at the time of purchase and another 1% when you pay your bill.

Another exception involves cards that earn American Express Membership Rewards points. Here's how this is described on the issuer's FAQ page:

When you earn Membership Rewards® points from spending with your Card, they initially appear on your billing statement as "pending." These are available for use a full monthly billing cycle after you pay the amount due on your billing statement, as long as your account remains current.

In essence, American Express delays the regular points you earn for a month, and you must pay the amount due before they're actually posted to your account.

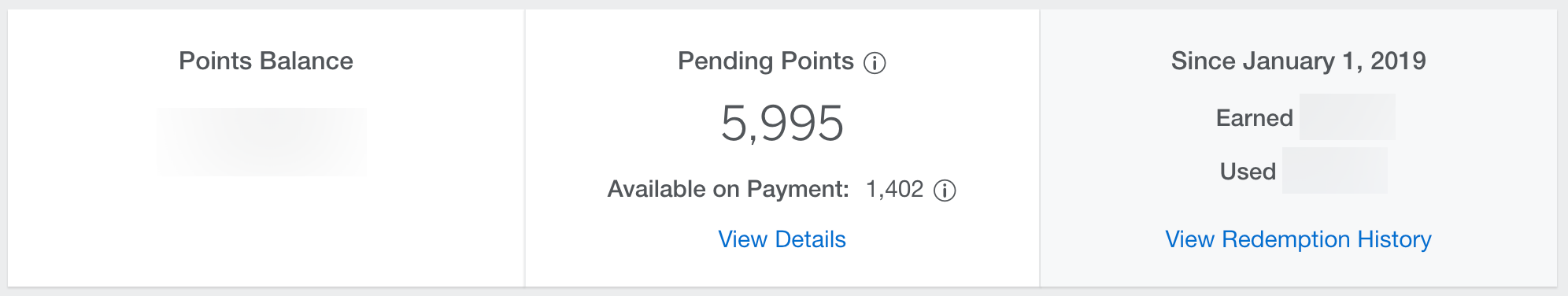

Here's a snapshot from TPG Editor Nick Ewen's Amex account that shows this in action:

The 1,402 points designated as "Available on Payment" are from his statement that most recently closed. Once he makes his payment on that statement, the points will post to his account within 24-72 hours.

However, the 5,995 "Pending Points" will take a bit longer. Those correspond to purchases made since his last statement closed. Once that statement closes, they'll shift into the "Available on Payment" category and will then post when he submits a payment, and it's worth noting that even a minimum payment on an Amex account will result in the points posting.

When it comes to welcome bonuses, the terms typically state that it can take a month (or even three) for those points to post, but the terms typically don't require full payment to earn those bonuses. Again, though, not paying your balance in full and on time could result in interest charges that far outweigh the value of those points, so keep that in mind before you add a new travel rewards card to your wallet.

Bottom Line

Kayla should rest assured that the points she earns on her rewards cards will almost always be connected to the purchases she makes and not her payment activity, but that isn't a license to exercise poor financial judgement and start carrying a balance from month to month. There's a reason that "thou shalt pay thy balance in full" is the first commandment of travel rewards.

Thanks for the question, Kayla, and if you're a TPG reader who'd like us to answer a question of your own, tweet us at @thepointsguy, message us on Facebook or email us at info@thepointsguy.com.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app