Hotel Review: W Santiago Marvelous Suite

Last month on my Mother's Day excursion to Easter Island, my mom and I made pit stops in Santiago on the first night and the final night of our trip before returning back to the States. I've been wanting to check out the W Santiago for a while now since I'd heard such great things about the property and I wanted to experience it for myself.

Located just a few miles outside the very center of Santiago in the upscale Las Condes neighborhood, the W Santiago was surrounded by other skyscrapers but adjacent to a park and in a quiet area with great views of the Andes. Although it's not in the very center of the city, which is usually pretty busy during the day and dead at night, it's still close enough that it's quick and easy to get to some of the city's most famous attractions like the Barrio París-Londres, Parque Forestal and Mercado Central.

Rates

When I booked rooms for my mom and myself, I decided to use Cash & Points option. On the first night of our stay which was a Wednesday, the room rate for a standard room with a king-size bed was $429 per night. The second night was a Sunday and the rate was a$299 per night for the same room type. The Cash & Points option was $110 and 6,000 Starpoints each night. Normally you can redeem anywhere between 12,000 to 16,000 Starpoints for a free night so I thought Cash & Points was a better deal and I was getting about 5.32 cents per point for that first night.

Your24

After flying into Santiago overnight on LAN business class, we arrived at the hotel at 6:30 am. Luckily I had been notified a few days prior that my Your24 request had cleared and I would be able to check into my room at 7am. I had attempted to request Your24 check in for my mom's reservation as well, but my Starwood ambassador informed me that Your24 requests only clear for the Platinum member. We kept our fingers crossed and luckily the hotel really pulled through, letting both of us check into our rooms upon arrival and upgrading one of the rooms to a larger Marvelous Suite for the two nights that we stayed at the property.

In the past I haven't had much luck with Your24 and only have gotten approved about 50% of the time. To get 2 rooms approved at such an early hour was an unexpected, and much appreciated perk. The check-in staff was so friendly and helpful, I was very grateful that they could accommodate us and they seemed accustomed to situations like this given the flight schedules from the US.

W Marvelous Suite

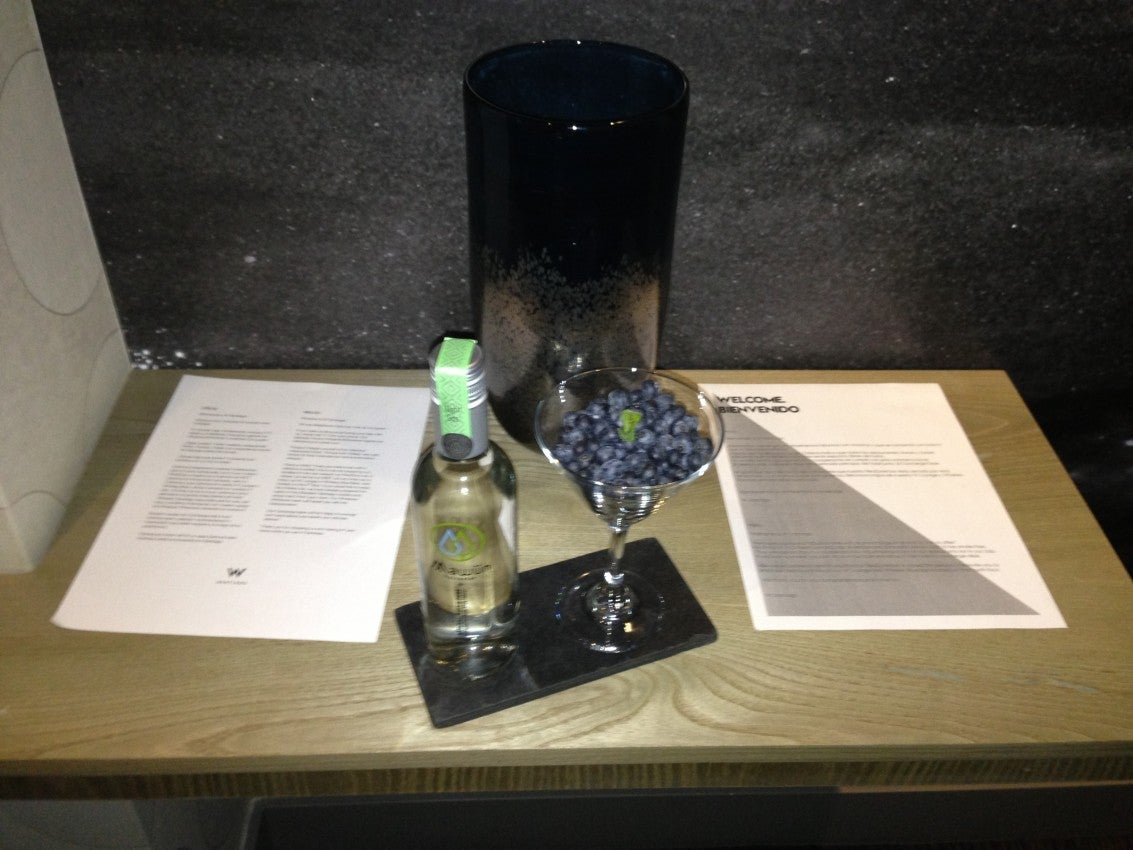

Getting upgraded when checking into a hotel is always a nice way to begin your stay, so you can imagine how happy I was when I was given the keys to a Marvelous Suite and was able to immediately go to the room to relax for a few hours. Aside from that, I was greeted by a nice Platinum Amenity of wine and blueberries.

This suite type can range from about 818 to 1,076 square feet with a large bathroom, living area, work space, bedroom and private balcony. Standard amenities that come with all rooms include a 42-inch LCD TVs, DVD players, alarm clocks with docking station, mini bars, and in-room safes. High-speed Internet access in the room is free for Platinum members, but will cost $15 per day otherwise.

Keeping up with the theme of the hotel, the furniture and decor of the room was very modern with shades of gray and certain pops of color like the yellow chairs seen above in the living area. While sitting in the living room you can enjoy the views of the city through the floor-to-ceiling windows that line the wall. Behind the sitting area was an oversized work desk with two phones.

My favorite place to sit was on the long private terrace right outside my room. Since there were two chairs out there my mom and I were able to enjoy a nice glass of wine and watch the sunset on our first night in Santiago.

The king-size W bed was comfortable as always, and had a pillow-top mattress, white-on-white 350-count thread sheets, a white goose down comforter and a gray overthrow - your typical stark W furnishings.

I thought the layout of the bathroom was interesting since there was a standalone deep-soaking tub in an alcove of the bedroom. To the right of the bathtub was an doorway into the actual bathroom where there was a walk in rain shower, large double vanity and two super comfortable signature W robes. The glass shower is exposed to the room, so it wouldn't be ideal for sharing with family or friends.

Standard King Room

Although much smaller than the suite, the standard room was still very nice and roomy. With the same type of decor, it had a signature W king size bed with the same white linens that I had. In the corner of the room was s small chaise lounge where you could pull back the window shades and take in the views of the snow-capped Andes mountains.

The bathroom also had an oversize glassed-in rain shower and a separate deep-soaking tub, though these were in the same room and not the bedroom! Like most W's, the bathrooms were stocked with Bliss Spa products. There was just a single vanity in this bathroom and it was pretty dimly lit- an issue I often have at W hotels.

Features of the Hotel

During our stay, there were a few things that were a bit disappointing. It was discouraging to find out that the resort wasn't fully functional because of renovations that were going on at the time. While there is a beautiful WET rooftop pool with amazing views of the city and surrounding mountains, the area was closed off. We managed to sneak our way up there to quickly film some Sunday Reader Questions, but I would have liked to be able to spend more time there.

Besides the pool being closed, many of the hotel restaurants weren't open for service. I always enjoy being able to get a bite to eat within the hotel instead of having to trek out into the city so it was inconvenient to not be able to take advantage of some of the great restaurants on the premises. Normally you can dine at Osaka, Terraza, Whiskey Blue, and NoSo Restaurant. There are also a few lounges like the Red2One which is right by the rooftop pool, the W Lounge, and the Tea Library. My mom and I ended up eating at the bar at the W Lounge and really enjoyed our drinks and fresh fish but I would have liked to have tried out some of the other restaurants.

Another downside to our trip was when we checked into the hotel my mom realized she had left her iPad on the plane. At first the concierge just gave my mom a phone number to call and wasn't being of much help otherwise. I went down to the concierge and told them we needed help and asked them to please call for us to help resolve the situation. They were hesitant, but once I pushed back, they agreed to help us out, got in touch with the airline and we were able to pick up the iPad at the airport that morning. While theme of the W hotels is to go above and beyond for their customers - after all, their phones have a "Whatever, Whenever" button - I thought they could have been more helpful right off the bat, though thankfully they did get it under control.

We didn't have too much time either of the nights we stayed to check out all the features of the hotel but there are quite a few. At El Mundo del Vino you can scour a twelve foot wall of wine and buy a bottle to bring home and drink if you are staying in the hotel. At the Tierra Paraiso Spa and Wellness center you can relax in the treatment cabins, sauna, steam room, and therapeutic showers. The O2 Balance and Wellness Club is a state-of-the-art workout facility open 7 days a week and has treadmills, elliptical machines, stationary bikes, free weights and weight machines. The hotel also has a car service which we did end up using a couple times and the rates weren't much higher than normal taxis. It was extremely easy to make reservations with the concierge and the price was reasonable to get back and forth to the airport when we needed to go, and of course I earned Starpoints on the spend since the cost of the taxis was added to my room charge.

Although there were a few negative aspects to our trip, in the grand scheme of things they were minimal issues, and the hotel came through on the big ones like early check in and an upgrade. Overall we really enjoyed our two nights there, and after staying on Easter Island at the Taha Tai hotel for three nights it was nice to return to the W Santiago and enjoy the amenities of an upper-tier Starwood hotel.

[card card-name='Citi ThankYou® Preferred Card – Bonus Point Offer' card-id='22145660' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app