Hotel Review: Four Seasons Gresham Palace Budapest

Update: Some offers mentioned below are no longer available. View the current offers here.

I spend a lot of time on the road, so I really value unique hotel experiences. While a majority of my stays are in chain hotels that give me great elite perks, once in a while I like to splurge on a luxury hotel. While I usually use points to bring down the cost of expensive hotels or get really good advance/discount rates, once in a while I get the urge to throw caution to the wind and indulge at a non-points earning luxury hotel. While I sometimes feel guilty for doing it, travel is my passion, hobby and full-time job, so at a very minimum I consider it necessary to understand the full spectrum of the hotel industry.

When I decided to go to Budapest, I decided my splurge would be on the Four Seasons Gresham Palace, which is the hotel in Budapest. The location is unparalleled - right on the Danube on the Pest side of the city, but within easy walking distance to the historic Buda side. It's also right near top shopping and dining and having only opened in 2004, it's still relatively new and in pristine condition.

What also sealed the deal was that it participates in the American Express Fine Hotels & Resorts program, which is offered to all Platinum and Centurion cardholders. I've never used this benefit, so I decided to give it a whirl. The daily rates were comparable to what was being offered on Fourseasons.com and the benefits I would receive were: 12pm check-in, 4pm checkout, in-room amenity of wine and fruit, free breakfast and a space-available upgrade.

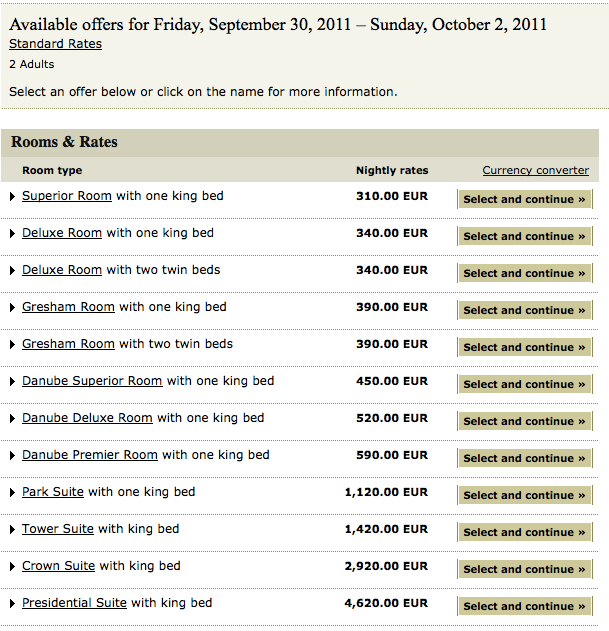

I ended up booking a mid-level Gresham Room for 390 euros per night (for 2 nights - my third would be spent at Le Meridien Budapest on a heavily discounted advance rate of 129 euros).

Upon check-in the agent greeted me by name and explained my Gresham room was ready and it was on the first floor with a courtyard view, which wasn't really what I was expecting. At a minimum, I thought we'd get a room with a nice view of the river on a higher floor. I had checked online and the hotel was selling every room type, so I knew it wasn't a soldout weekend.

When I inquired about upgrades due to booking via American Express FHR, she seemed put off and told me they were soldout of all upgradeable rooms. Interesting since I knew that wasn't true. I pushed back a little bit and she offered to look into it and mentioned that suites were available for an upgrade fee. I decided to check out my room before making any decisions and told her I'd call her back. To be honest, Lori and I both thought she was being a little shady, though I don't know if it was just the language barrier.

The Gresham Room was spacious and nice, but it had a terrible view of the inner courtyard. It was decent, but not really what I was expecting for 390 euros. I decided to call back and see what my options were - but before doing so I loaded up Fourseasons.com to confirm that rooms were still for sale and indeed they were in every category. (At this point I started feeling like I was at an SPG hotel arguing for a Platinum upgrade!).

She finally gave in and said I could have a Danube view room, but mentioned that it wouldn't be available for 2 hours and it was smaller than the Gresham Room. She also said if I paid for the Danube View room, she would upgrade me to a suite with a balcony and great views. She quoted me an upgrade of 300 euros per night, which was more than I wanted to spend. I cross referenced the price of the Danube View room on Fourseasons.com and it was only 200 euros more (590) than what I was currently paying and she agreed to do it for that price.

I felt guilty for spending 590 euros ($788) per night, but I'd rather have an awe-inspiring spacious suite for $788 than an unmemorable regular room for $521. The Park Suite was going for 1,120 euros per night ($1,497) so I still felt like I was getting a decent deal. My motto in life is "go big or go home" and this was definitely one of those moments.

The third floor suite was indeed gorgeous, though it wasn't really a suite - more like an oversized room with a living area. However, the mini-balcony and views of the city were just incredible. On Saturday night I hosted a group of friends who live in Budapest for drinks, so the extra space definitely came in handy.

I'll let the pictures speak for themselves, but overall the Four Seasons Gresham Palace experience was flawless once we got the room situation sorted out. We used the gym/sauna and got spa treatments which were actually done in converted hotel rooms because the spa is under construction.

After I blogged about using FHR, several friends who are Four Seasons Preferred Partner travel agents scolded me for not booking through them, because apparently they can get better rates and the amenities are better. I'll have to try them out next time to compare, because I don't think I'll use FHR again anytime soon. The most important benefit to me is a nice, spacious room which is why I highly value top-tier hotel elite status. While Four Seasons are nice, I'm not in the position to be able to pay $800 a night every time I want a hotel suite! Though I have to admit, it was fun to splurge and the Park Suite was the perfect staging grounds for a quick and most definitely memorable weekend trip to Budapest.

[card card-name='Premier Rewards Gold Card from American Express ' card-id='22035076' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app