Verizon Visa Card review: A decent cash-back option for Verizon customers

Verizon Visa Card overview

The Verizon Visa is a no-annual-fee card that offers up to 4% back on purchases. While the welcome bonus isn't super lucrative, Verizon customers with the card can unlock discounts on autopay, which may make the card a good fit — especially for families with multiple lines on their accounts. Card Rating*: ⭐⭐½

*Card Rating is based on the opinion of TPG's editors and is not influenced by the card issuer.

Many credit cards associated with store brands don't offer a great value proposition, but the Verizon Visa Card may be an exception for some. The card has no annual fee and rewards customers with up to 4% back on purchases. Perhaps most importantly, you can enjoy discounts of up to $10 per line on your account just for activating autopay and enrolling in paperless billing.

When my wife and I switched from AT&T to Verizon a couple of years ago, we realized that this card would save us $240 every year, just by using it to pay our wireless bill. It also has some other perks we could use, so my wife added the card to her wallet — and she's been charging our monthly bill to it ever since.

The Verizon card typically requires a good or excellent credit score, so you'll likely need a score of at least 700 to get approved.

Here's everything you need to know about the Verizon Visa Card.

The information for the Verizon Visa Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Store vs. cash-back credit cards: Which one should I get?

Verizon Visa Card pros and cons

| Pros | Cons |

|---|---|

|

|

Verizon Visa Card welcome offer

The Verizon Visa Card currently offers new cardholders a $150 statement credit after making a purchase in the first 90 days. This is noted as a "limited-time offer" on the card's website, though no end date is provided.

Note that you must be the owner or an authorized manager on a Verizon wireless account to apply for the card, though you can see if you prequalify (without affecting your credit score) through this link.

$150 is decent, but it's not as great as many welcome offers on TPG's favorite cash-back credit cards. For example, the Wells Fargo Active Cash® Card (see rates and fees) offers a $200 cash rewards bonus after spending $500 in purchases in the first three months.

As a result, be sure to crunch the numbers and make sure that you aren't better off with a different cash-back card.

Related: How to choose a cash-back credit card

Verizon Visa Card benefits

Despite having no annual fee, the Verizon Visa card features some notable benefits.

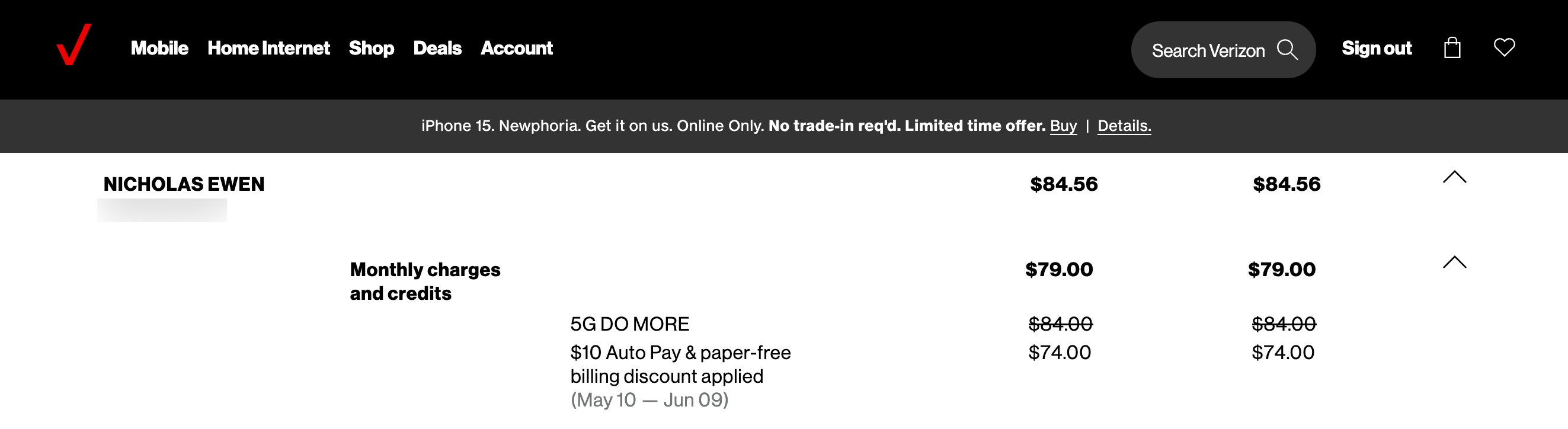

The first one led my wife to apply for the card: monthly discounts on select cellphone plans for enrolling in paperless billing and setting up autopay using the Verizon Visa Card. This posts as a $10 discount for every eligible line on your account, and it applies to both the current slate of Verizon plans as well as those no longer offered to new customers:

- Current eligible plans: Unlimited Ultimate, Unlimited Plus or Unlimited Welcome plan

- Old eligible plans (no longer available): 5G Get More, 5G Do More (our plan), 5G Play More, 5G Start, Welcome Unlimited, One Unlimited for iPhone, Get More Unlimited, Do More Unlimited, Play More Unlimited, and Just Kids

To enjoy this discount, simply enable paper-free billing and set up autopay with your Verizon Visa Card. After enrollment, you'll see the $10 monthly discount per line beginning your next billing cycle (up to 12 lines max, depending on the plan).

Note that you can also access this discount by enrolling in autopay with a debit card or bank account, but then you aren't earning rewards on your purchases. And if you're already receiving the discount, you can't switch your payment method to the Verizon card and get another $10 discount per line.

The Verizon Visa also offers interest-free financing for eligible accessory purchases. When you spend at least $100 online or at Verizon-operated stores in a single transaction using your Verizon Visa, you can pay those purchases off with 12 equal monthly payments and no interest. This can be a decent option if you're shopping for a bunch of new accessories at once — maybe ahead of the holidays for your family members.

In addition, cardholders receive two free TravelPass days per calendar year, a $20 value. Each one is valid for a 24-hour period and allows you to use your standard text, talk and data allowance when visiting over 200 destinations around the world (view full details at this link). Our plan already includes one per month on each line, but the extra two give us added flexibility to stay connected when traveling abroad.

Finally, the Verizon card can be issued as either a standard Visa or Visa Signature card, depending on your qualifications. If you're approved for the Visa Signature, that'll unlock additional benefits — including some newer perks added in 2022.

Earning and redeeming rewards on the Verizon Visa Card

The Verizon Visa Card earns rewards at the following rates:

- 4% on grocery store and gas purchases

- 3% on dining purchases, including takeout

- 2% on Verizon purchases

- 1% everywhere else.

These rewards are earned as Verizon Dollars, which can be put toward your phone bill, used for accessories, or even redeemed for travel. However, the travel and gift card portals will no longer be available as of Aug. 22, 2024, per an email to cardholders.

You can access those rewards through your online Verizon wireless account or by downloading the Verizon Visa Card mobile app. And you can even set up auto-redeem, which will automatically apply any available rewards (or a specific amount of rewards you designate) to your Verizon account every month.

While these rates weren't the primary reason my wife applied for the card, it's nice to enjoy at least some monthly rewards on our bill. However, we typically use other cards for our groceries, gas and dining purchases.

Which cards compete with the Verizon Visa Card?

When it comes to benefits specific to Verizon, there aren't many other cards that compete with the Verizon Visa Card. However, if you're looking to save money or unlock additional perks on your cellphone bill, there are a handful of other great options:

- If you want more valuable rewards: Go for a card like the Ink Business Preferred® Credit Card (see rates and fees). Wireless phone services fall into the eligible categories to earn 3 Chase Ultimate Rewards points per dollar spent (on up to $150,000 in purchases each year). The card also features a massive sign-up bonus, though it does incur a $95 annual fee.

- If you want cellphone protection: Opt for a card that includes coverage for damage or theft of your phone(s) when you charge your wireless bill to it. Sacrificing a monthly autopay discount for this peace of mind may make sense. Some top options here include the Chase Freedom Flex® (see rates and fees) or Capital One Venture X Rewards Credit Card.

For more information, check out our guide to credit cards with cellphone protection — and be sure to link an eligible card to your Verizon account to access that coverage.

Related: How to submit a cellphone insurance claim for the Ink Business Preferred

Is the Verizon Visa Card worth it?

Like most credit cards, deciding if the Verizon Visa Card is worth it depends on your individual situation. For my family, it made sense. We aren't prone to accidents with our phones (knock on wood), so cellphone protection has never been critical for us. And the ability to put a minimum of $240 back in our bank accounts every year via the card's autopay discount was too much to pass up.

On the other hand, many of you may want coverage for damage, or you may want to earn more valuable rewards on your monthly wireless bills. And (of course) this card only makes sense if you're a Verizon customer. If you're not, consider one of the other cards listed above to maximize your cellphone purchases.

Bottom line

The Verizon Visa Card can be an attractive cash-back card option for Verizon customers, though it's not the right solution for everyone. If you currently have a Verizon wireless account, crunch the numbers to see if you'll benefit from the card's autopay discounts and other perks.

If not, consider a more general rewards credit card to make the most of your monthly cellphone bill.

For Capital One products listed on this page, sone of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app