How to maximize the new statement credits on the Delta Amex cards

In early February, American Express introduced new statement credits to six of Delta Air Lines' seven cobranded cards:

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

These new perks with Delta Stays, on ride-hailing services and at restaurants are designed to offset increased annual fees (see rates and fees for the Gold, Gold Business, Platinum, Platinum Business, Reserve and Reserve Business).

Receiving statement credits can be tricky; however, based on accounts from TPG staffers and data points on other sites, I'm here to guide you on what purchases trigger the statement credits and how to maximize them.

Ride-hailing statement credit

Both the personal and business versions of the Delta Platinum and Delta Reserve offer statement credits for ride-hailing services. These cardmembers receive up to $120 in ride-hailing credits annually (up to $10 in monthly credits).

Regardless of which of the four Delta Amex cards you have, the terms and conditions state:

...used to make eligible purchases in the U.S. with the following rideshare services: Uber, Lyft, Curb, Revel, and Alto, which are subject to change. However, each enrolled Card Account is only eligible for up to $10 in statement credits per month, for a total of up to $120 per calendar year per Card Account.

This means that only the five listed ride-hailing companies are eligible to earn statement credits and that the purchases have to be in the United States. Uber purchases outside the U.S. will not trigger the statement credit, nor will purchases with any other ride-hailing company, such as Grab (popular in Southeast Asia) and FreeNow (in Europe). Reddit users have reported that loading Uber Cash does not trigger the statement credit as it does not code as a ride purchase.

Several TPG staffers have had success in using their ride-hailing credit. TPG travel news reporter Tarah Chieffi used her Delta Reserve and, within two days, received an email confirming she had earned a $10 statement credit on her Lyft ride. Similarly, senior SEO manager Hannah Streck earned her statement credit on a Lyft ride a day after her transaction posted. Senior director of product management Gabe Travers also successfully earned a statement credit on a pre-scheduled Uber ride the day after he completed his trip, while director of content Nick Ewen had luck in getting a statement credit for purchasing Lyft Cash (but found he had to load at least $25 to trigger the credit using this method).

The monthly credit is use it or lose it — meaning it doesn't roll over — so cardmembers should aim to use it every month to maximize the perk.

It's important to note that the new statement credits on the Amex Delta cobranded cards only work after you enroll in the benefit. Go to your online account or the Amex mobile app, select your eligible Delta card and navigate to the "Benefits" section to activate the ride-hailing credit. Any purchases made before enrolling in the benefit will not earn you a statement credit.

Related: Frequent Uber or Lyft user? These are the best credit cards for you

Resy statement credit

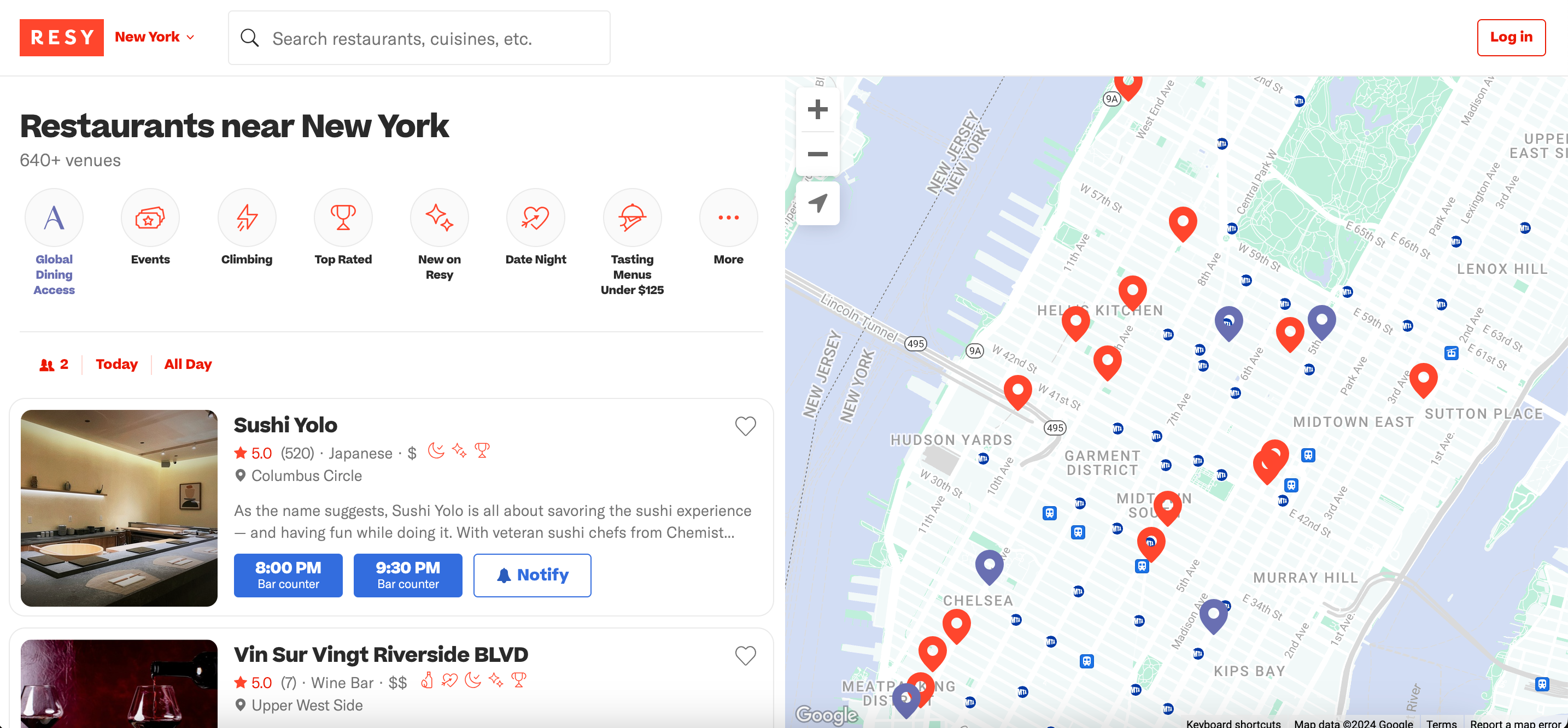

The personal and business versions of the Delta Platinum and Delta Reserve receive statement credit on purchases made with Resy. Platinum cardmembers receive up to $120 Resy credits annually (up to $10 monthly); meanwhile, Delta Reserve cardmembers receive a higher allowance of up to $240 annually (up to $20 monthly).

The terms and conditions for the personal and business versions of the Delta Platinum state:

...the total amount of statement credits for eligible Resy purchases will not exceed $10 per month, for a total of $120 per calendar year in statement credits, per Card Account. Eligible Resy purchases include purchases at U.S. restaurants that offer reservations on Resy.com and the Rsy app, and purchases made directly on Resy.com or in the Resy app. Restaurants must be live on Resy.com or the Resy the app at time of purchase to be eligible for the statement credit and are subject to change at any time. Purchases made via Resy Pay and purchases of Resy OS restaurant management software are not eligible.

Data points found online at FlyerTalk and Reddit paint a mostly positive picture of how the statement credits are applied. Simply put, cardmembers will earn the statement credit if they dine at a restaurant that uses Resy to make reservations. However, you don't actually need to make a reservation through Resy; you'll receive the statement credit just by paying with your eligible Delta Amex card (even without a reservation).

According to this logic, it doesn't matter if you pay for the whole bill or a part of it; as long as you use a personal or business version of the Delta Platinum or Delta Reserve, you will receive the statement credit. That said, Resy is a well-known restaurant booking platform with more than 9,000 restaurant partners. If you live in metropolitan areas such as New York, Chicago or Miami, you will definitely have Resy-affiliated restaurants in your area.

As a reminder, cardmembers must enroll before utilizing the statement benefit perk, so go to your online account or the Amex app to do so.

Related: Do you have a Delta Amex card? Here are 9 things you need to do

Delta Stays statement credit

Delta Stays is a new online platform powered by Expedia to book hotels and vacation rentals. The statement credit can range from up to $100 to up to $250, depending on which cobranded Delta you carry.

The terms and conditions for the statement credit validity period and eligible charges are as follows:

Eligible Delta Stays Booking does not include interest charges, cancellation fees, property fees, resort fees, or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise). For example, if an eligible purchase is made on December 31, but the merchant processes the transaction such that it is identified to us as occurring on January 1, the January statement credit would be applied.

Senior director of product management Gabe Travers used his Delta Reserve card for a Delta Stays booking and received the statement credit four days later. Data points from Reddit users paint a similar picture, with users stating it has taken anywhere from two to six days from the date of purchase for their Delta Stays credit to post to their accounts.

To maximize the statement credit, avoid last-minute prepaid bookings at the end of the year because if a transaction posts to your account after Dec. 31, you will lose out on the statement credit for the year. Regardless of when the transaction posts, Amex states receiving the statement credit can take up to 90 days.

Unlike the ride-hailing and Resy statement credits, cardmembers do not need to enroll for this benefit. Simply visit the Delta Stays website and make a prepaid booking with your eligible cobranded Delta card.

Related: Delta Vacations enhances earning rates and redemption value for SkyMiles members

Bottom line

The newly added statement credits on several Delta cobranded Amex cards provide solid value to cardmembers. Ride-hailing and Resy statement credits require you you enroll in the benefits before using them. To maximize these two credits, try your best to use them on a monthly basis. And book your prepaid Delta Stays accommodation before the end of the year to avoid missing out on the savings you're entitled to.

Related: New Delta credit card welcome offers

For rates and fees of the Delta SkyMiles Gold, click here.

For rates and fees of the Delta SkyMiles Gold Business, click here.

For rates and fees of the Delta SkyMiles Platinum, click here.

For rates and fees of the Delta SkyMiles Platinum Business, click here.

For rates and fees of the Delta SkyMiles Reserve, click here.

For rates and fees of the Delta SkyMiles Reserve Business click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app