How to earn the most points and perks when you book a cruise

Update: Some offers mentioned below are no longer available. View the current offers here.

Perhaps you're a cruise lover who wants to spend less on travel by using points and miles. Or, maybe you're an avid points collector looking to book your first cruise vacation. Either way, you're likely wondering how to leverage your points stash, credit cards and loyalty status to get the most value from your cruise booking.

You might assume your best bet is to save cash by booking a cruise using points and miles, but this method does not always yield the most advantageous redemption options. A better bet would be to use your cruise booking to earn you things like more points and miles, status or even free onboard perks.

Here is our expert advice on the most effective strategies for maximizing the rewards from your cruise bookings.

Pay with a travel credit card to earn extra points and miles

You will generally get the most out of your cruise booking by using the expense as an opportunity to earn points and miles toward a future trip, rather than by redeeming points for a free or discounted sailing.

In most cases, cruise purchases are coded as a travel expense by your credit card. A good strategy for maximizing your cruise purchase is to pay for your sailing with a travel credit card that earns more than 1% or 1 mile per dollar spent on travel purchases.

Once on board, your basic expenses will be covered as part of your cruise booking — including meals in select restaurants and entertainment — but there always will be some opportunities to splurge. You'll need to register a credit card with your cruise ship to pay for drinks and cocktails, meals at one of the fancier restaurants on board, shore excursions and spa treatments.

Again, you'll earn the most points on your onboard expenses by paying with a credit card that offers extra incentives for a broad range of travel purchases. Check out TPG's best credit cards for cruises to find the one that works for you.

To get you started, here is a quick reference chart of the current best credit cards for general travel-related expenses and their earning rate with TPG's valuation on travel purchases:

| Card | Annual fee | Earning rate on cruises | What the points are worth (based on TPG's valuations) | Rewards return |

|---|---|---|---|---|

American Express® Green Card | $150 | 3 Membership Rewards points per dollar | 2 cents per point | 6% |

Bank of America® Premium Rewards® credit card | $95 | 2 points per dollar (up to 3.5 points per dollar with Bank of America's Preferred® Rewards) | 1 cent per point | 2% to 3.5% |

Capital One Venture Rewards Credit Card | $95 (see rates and fees) | 2 Capital One miles per dollar | 1.85 cents per mile | 3.7% |

Capital One Venture X Rewards Credit Card | $395 (see rates and fees) | 2 Capital One miles per dollar | 1.85 cents per mile | 3.7% |

Chase Sapphire Preferred Card | $95 | 2 Ultimate Rewards points per dollar | 2.05 cents per point | 4.1% |

Chase Sapphire Reserve | $550 | 3 Ultimate Rewards points per dollar (after using your $300 annual travel credit) | 2.05 cents per point | 6.15% |

The Platinum Card® from American Express | $695 (see rates and fees) | 1 Membership Rewards point per dollar | 2 cents per point | 2% |

U.S. Bank Altitude Reserve Visa Infinite® Card | $400 | 3 points per dollar | 1.5 cents per point | 4.5% |

The information for the American Express Green Card and U.S. Bank Altitude Reserve Visa Infinite Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Earn airline or hotel elite status

A large purchase, such as a cruise booking, is also a great way to get closer to airline or hotel elite status if you use a cobranded airline or hotel credit card that contributes to your stash of elite-qualifying points.

For example, American Airlines bases its elite status on AAdvantage Loyalty Points accrued through multiple channels, including purchases made with its cobranded credit card. The Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) earns 1 AAdvantage Loyalty Point per dollar spent. So, by paying for a $10,000 cruise on the card, you'd earn 10,000 Loyalty Points, a quarter of the 40,000 Loyalty Points needed for entry-level AAdvantage Gold status.

Similarly, most cobranded United MileagePlus credit cards let you earn 1 Premier qualifying points for every $15 or $20 you spend (depending on the card) toward the PQP and Premier qualifying flight requirements for United Airlines Premier status. The United Quest Card and the United Club Card earn 2 miles per dollar and up to 18,000 and 28,000 PQPs, respectively. The United Quest earns 1 PQP for every $20 spent and the United Club earns 1 PQP for every $15 spent. So, by paying for your cruise fare on either of these cards, you could earn redeemable miles and PQPs toward status.

Finally, Delta's credit cards earn 1 mile per dollar spent on travel purchases, but starting Jan. 1, 2024, the Delta SkyMiles® Reserve American Express Card and the Delta SkyMiles® Reserve Business American Express Card earn 1 Medallion Qualification Dollar for every $10 spent. As a cardholder, you'll earn 2,500 MQDs per calendar year.

On the hotel side, the World of Hyatt Credit Card earns 2 World of Hyatt points per dollar spent on travel and two qualifying night credits toward your next tier status every time you spend $5,000 on your card. You'll also earn a Category 1-4 free night certificate if you spend $15,000 in a calendar year. A large cruise purchase can put you on track for both of those bonuses.

Also, the Marriott Bonvoy Boundless Credit Card earns 2 Marriott Bonvoy points per dollar spent on travel and an elite-qualifying night for every $5,000 you spend on the card. Spend $35,000 on the card in a calendar year, and you'll receive Gold Elite status.

Related: A beginners guide to picking a cruise line

Meet a welcome bonus

Even if you only earn 1% or 1 mile per dollar spent on travel purchases, you can still use your cruise fare to earn a welcome bonus. If you have a big cruise expense coming up, consider applying for a new credit card so your payment not only earns you redeemable points but also helps to meet the minimum spend requirement to earn the large welcome bonus.

As a new cardholder of The Platinum Card® from American Express, for example, you can find out your offer and see if you are eligible to earn as high as 175,000 Membership Rewards points after you spend $8,000 in eligible purchases on your card within the first six months of card membership. Welcome offers vary and you may not be eligible for an offer.

One high-end cruise could get you all the way to that bonus with one purchase.

Refer to this post for the best credit card offers currently available.

Final payment is typically due three months prior to sailing, so you might be able to meet the spend minimum and receive the welcome bonus points in time to book flights or hotels for travel before or after your cruise. (Alternatively, you could pay the full cruise fare early.) This allows you to leverage your points for additional travel expenses that would otherwise require out-of-pocket expenses.

Or, you can save those points to use on flights and hotels for a subsequent cruise or vacation.

Related: Last-minute cruises: Should you book the deal?

Get extra cruise perks through credit card offers

Booking a cruise with the right credit card can earn you more than points. When you book through your credit card's portal, you might also be eligible for extra perks or discounts on your vacation at sea.

If you have The Platinum Card® from American Express, you're eligible for additional perks and benefits under the Amex Cruise Privileges Program.

Whether you pay in cash or use your Membership Rewards points to defray your cruise expenses, you'll receive up to $300 in cabin credit on cruise lines such as Norwegian Cruise Line, Holland America Line, Princess Cruises and Royal Caribbean International.

Additional Amex Platinum perks vary by cruise line. While Amex doesn't generally publish its official benefits, reports indicate that previous benefits included a $200 shore excursion credit on Crystal and a bottle of premium Champagne or wine on Royal Caribbean.

Additionally, American Express frequently provides rewarding Amex Offers on cruises. Earlier this year, for instance, Amex offered a bonus of 20,000 Membership Rewards points when you spent $1,000 or more on a Royal Caribbean voyage.

The number of bonus points, 20,000, is quite substantial. With our current valuation of Membership Rewards points at 2 cents apiece, these 20,000 points would be worth $400 based on our evaluation. That means if you use an American Express card to spend $1,000 on a Royal Caribbean cruise, you receive 40% of that amount back in Membership Rewards points.

It's worth noting that these offers are targeted, meaning they are not available to every cardholder. Additionally, you must enroll in the specific Amex Offer to take advantage of it.

There are a few other considerations as well. Cardmembers can only enroll in the offer using one American Express card, and it is essential to review and adhere to the terms and conditions to receive the bonus points.

I recently booked a Celebrity Cruise when I was offered a 35,000-point bonus for spending $1,000 on my American Express® Gold Card. Since my mom had the same offer on her Amex Gold, I called Celebrity to split the payment for the cruise between the two cards. To get 72,000 Amex points for a $2,000 cruise is a fantastic maximization strategy.

Other credit cards don't offer cruisers nearly as many perks as the Amex Platinum does. However, the Chase Sapphire Reserve does offer an annual $300 statement credit toward any travel-related purchase, including cruise bookings, made through its booking portal.

Book cruises via an airline portal for extra miles

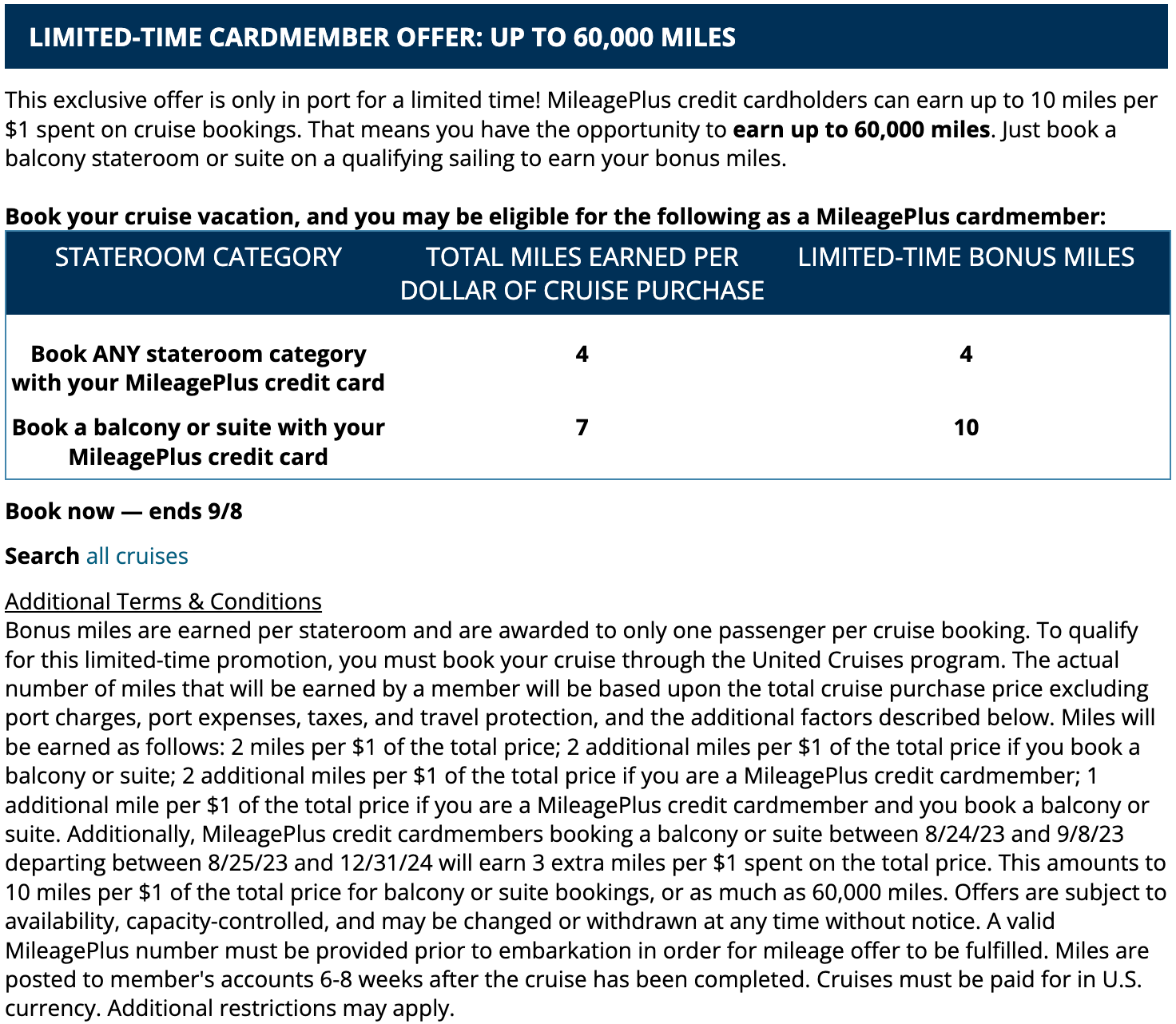

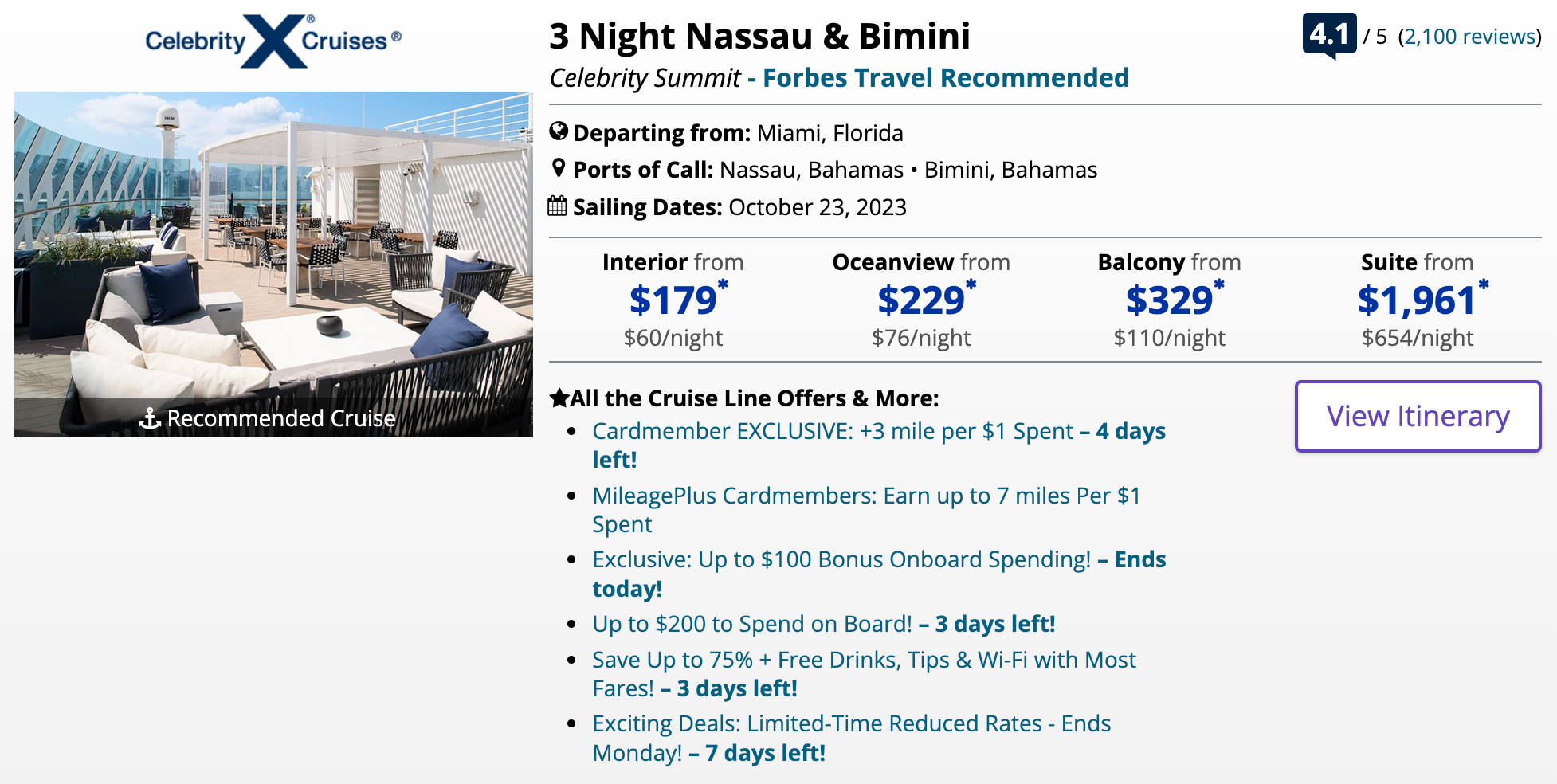

Several airlines allow you to earn bonus miles by booking cruises via their websites. Airline-affiliated online cruise sellers include United Cruises, American Airlines Cruises and Delta SkyMiles Cruises.

The cruises we priced out via United Cruises were largely the same price as booking directly with the cruise lines. The only difference is that you would earn bonus United miles per dollar spent for booking via the United site.

On our Royal Caribbean cruise booking test, United credit card holders can earn up to 10 miles per dollar spent on the cruise cabin's base rate for booking via the airline's cruise portal. These increased accruals are only for balcony and suite rooms. Your United Cruises earnings are capped at 60,000 MileagePlus miles per purchase, and there's a one-time bonus of 2,500 miles per cruise booking.

You'll also earn 1 or 2 miles per dollar more by paying for the cruise on your cobranded United MileagePlus credit card. Or, double dip by paying with any credit card that gives you extra points for travel purchases.

Remember that these bookings are considered third-party purchases, so cruise lines are not obligated or might not be inclined to allow you to make changes.

For this Celebrity sailing for a family of two, that could mean picking up 6,580 United MileagePlus miles, valued by TPG at around $92.

Plus, travelers with United elite status receive extra onboard perks when booking through United Cruises. Bonuses vary by cruise line and are based on your elite status tier, but you could get anything from relaxing spa treatments to complimentary wine to up to $300 to spend on board.

Related: Get up to 200,000 AAdvantage bonus miles with this limited-time cruise offer

Use casino loyalty to get perks and free cruises

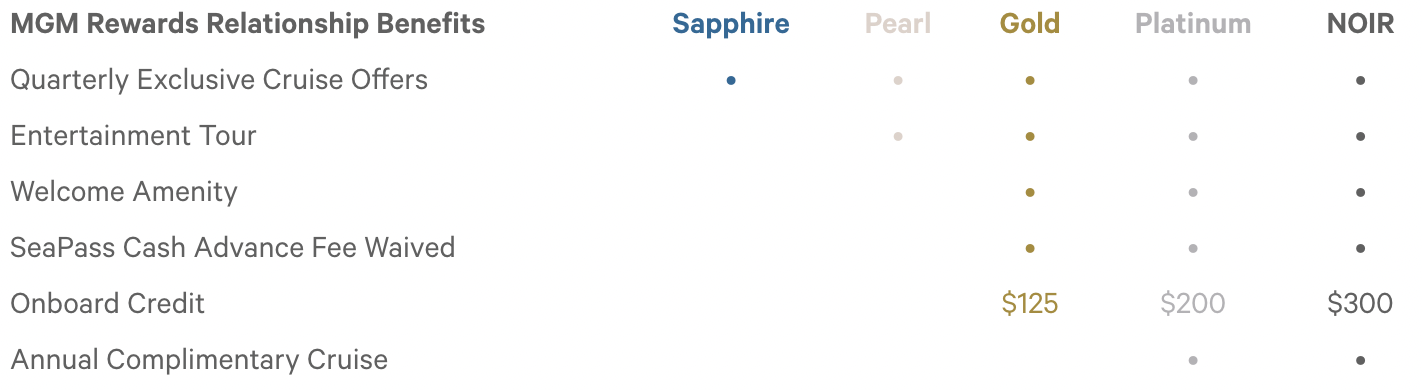

Your casino loyalty status can also earn you cruise perks. If you have status with MGM Rewards, for example, you might have access to cruise perks or even free cruises.

Gold members and above are eligible for onboard credit on Royal Caribbean or Celebrity Cruises, plus a welcome amenity and an entertainment tour. You will need to validate your loyalty status with the cruise line prior to departure to access your perks.

Even better, once you hit Platinum status with MGM, you can book one free cruise annually with either of the sister cruise lines. To book your free cruise, you'll need to contact the MGM Rewards elite reservations department.

The terms indicate that you must earn Platinum or Noir status by gameplay to get the free cruise.

Related: 13 best all-inclusive cruise lines

Leverage Marriott's cruise partnership to earn points and status

Most cruise lines have their own loyalty programs that are exclusively focused on onboard perks when sailing that line. However, one cruise line is connected to a hotel loyalty program, so a direct booking will earn you points usable outside the cruise world.

The Ritz-Carlton Yacht Collection participates in the Marriott Bonvoy loyalty program. This allows members to earn and redeem points on Ritz-Carlton cruises and enjoy various perks associated with elite status during their voyages.

When booking through The Ritz-Carlton Yacht Collection, you will earn 5 Marriott Bonvoy points for every dollar spent on the cruise fare. Your cruise fare will contribute toward the $23,000 spending requirement for Marriott's Ambassador Elite status. Additionally, you will earn elite nights for your cruises.

Buy cruise gift cards strategically to earn more points

You can use credit cards strategically to maximize earnings on your cruise purchases, beyond extra points for travel purchases. One way is by purchasing gift cards.

Some cruise lines offer gift cards for sale at retailers such as grocery stores and office supply stores. Depending on which credit cards are in your wallet, you might be able to earn more points per dollar when picking up cruise (or Disney) gift cards.

For example, with a card like the American Express® Gold Card, you can earn 4 points per dollar spent at U.S. supermarkets, up to $25,000 in a calendar year (then 1 point per dollar). Use this card to purchase cruise gift cards at your preferred grocery store, and you will effectively categorize your cruise expenses as grocery purchases. In this way, you can accumulate more credit card points than if you paid for your cruise purchase with a card that only gives double points for travel purchases.

Related: A beginners guide to cruise line loyalty programs

Bottom line

Paying for a cruise can be a significant purchase. You'll definitely want to get the most bang for your buck in points, miles, status advancement or perks when you pay that bill.

When it's time to plan your next cruise, choose the strategy or strategies that make sense based on the credit cards and loyalty status you have (or wish to have). Even if you're not getting a free cruise this time around, smart spending decisions will maximize the value you get from this purchase to discount or ease your travel in the future.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- A beginners guide to picking a cruise line

- The 8 worst cabin locations on any cruise ship

- The ultimate guide to what to pack for a cruise

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- Top ways cruisers waste money

- The ultimate guide to choosing a cruise ship cabin

Updated 12/6/23

For rates and fees of the Amex Platinum Card, click here.