Why Hyatt Elite Status Is So Valuable in Las Vegas

Update: Some offers mentioned below are no longer available. View the current offers here.

The World of Hyatt is a favorite among award travelers. Despite its small geographic footprint, it's taking steps to expand with the addition of Two Roads Hospitality (including brands like Thompson, Joie de Vivre and Alila) and the rapidly-expanding partnership with Small Luxury Hotels of the World. These terrific luxury properties allow the program to go toe to toe with competitors Hilton and Marriott — and it often comes out ahead due to its generous rewards program and valuable partnerships.

This is especially true when it comes to Las Vegas, where its presence looms large thanks to a relationship with MGM plus its own branded hotels. More importantly, Hyatt elites can make excellent use of their status here, with tons of opportunities to maximize their benefits. Today we'll go through exactly why Hyatt elites can get so much from a trip to Sin City.

Hotels

First things first — though this isn't necessarily a benefit of being an elite member, all World of Hyatt members can use their points to book stays at participating MGM hotels. As MGM owns and operates a whopping 12 hotels on the strip — 11 of which are bookable with points — you're spoiled for choice when staying in Sin City.

While this may not be the best use of your Hyatt points given the low cash cost of hotels in Vegas, it's certainly an option to be considered. If you're looking to build your stash, remember that Hyatt is a transfer partner of Chase at a 1:1 ratio. There are currently several cards that offer sign-up bonuses to help with this endeavor, allowing you to earn a large amount of points in a relatively short amount of time:

- Chase Sapphire Reserve: Earn 50,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. Earn 3x points on all travel and dining purchases.

- Chase Sapphire Preferred Card: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. Earn 2x points on all travel and 3x points on dining purchases.

- Ink Business Preferred Credit Card: 100,000 bonus points after you spend $15,000 on purchases in the first 3 months. Earn 3x points on the first $150,000 spent on travel and select business categories each account anniversary year.

Status Matching

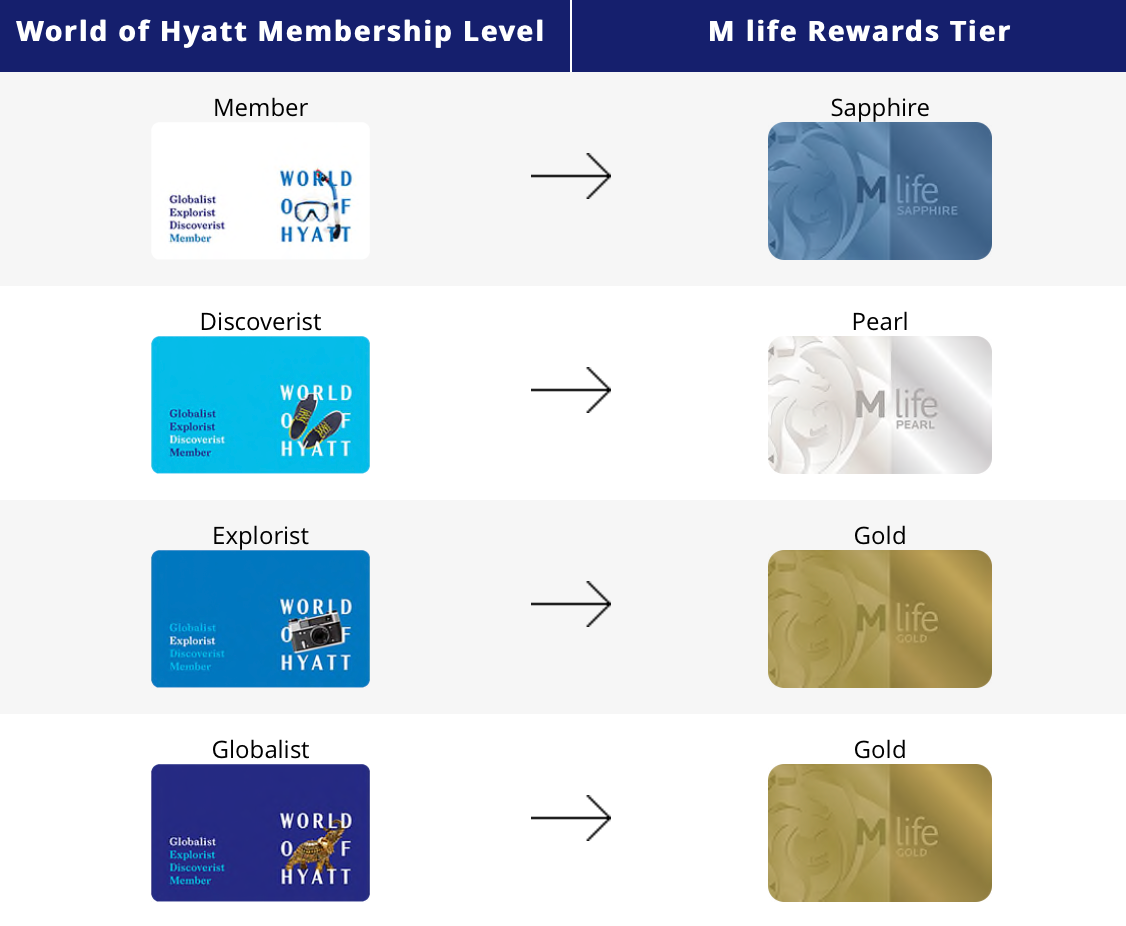

This is where Hyatt really starts to shine. Due to its partnership with MGM, the two companies have agreed to tier reciprocity, meaning that if you've got elite status with Hyatt you can match yourself over to gain elite status at MGM or vice versa.

This process can be repeated, so if you have Hyatt elite status and match yourself to MGM, you can then use your MGM status (received from Hyatt) to renew your Hyatt status before it expires, granting you indefinite status with both programs.

So, you can be a Hyatt elite, book your stay with Hyatt points, and then receive M life elite status/benefits once you match yourself over.

Status Matching: Pearl

Hyatt elite status is incredibly easy to get. Holders of the World of Hyatt Credit Card receive automatic Discoverist status plus the ability to spend their way to higher tiers. With just a $95 annual fee — and a free night certificate valid at Category 1-4 properties — you're easily coming out ahead.

Using the reciprocity program, Discoverist members become Pearl elites at MGM, which includes many benefits, most notably:

- Increased bonus points (10%) on slot play and express comps

- Extended expiration for points and express comps

- 10% discount on shopping at MGM retail shops

- Dedicated line at the buffet

- Complimentary self parking

Considering parking in Las Vegas is around $20/night, you can save quite a lot of money over the course of your stay.

Status Matching: Gold

Even better, if you're a Hyatt Explorist or above, you qualify for M life Gold, which grants you quite a few more perks:

- Room upgrades (not including suites)

- Complimentary valet and self-parking

- Priority lines at check-in, restaurants and nightclubs

- Priority access to fine dining reservations

- Increased bonus points (20%) on slot play and express comps

However, the most valuable aspect of M life Gold is its ability to match to Caesars Diamond. We've written a guide on how to use a single credit card to match across multiple hotel chains, starting with Wyndham and ending with Hyatt, but this also works in reverse.

If you've got Hyatt Explorist status, you can use that to match to M life Gold. You can then use that to get Caesars Diamond status, which includes such benefits as waived resort fees (saving over $40/night), complimentary valet and self parking, a $100 annual dinner credit and free show tickets every month.

Once you've got Caesars Diamond status, you can then match over to Wyndham Diamond, which is most notable for offering suite upgrades on all stays, paid or not. Caesars and Wyndham share the same matching program as Hyatt and MGM, which means you can match yourself back and forth between the two.

All told, if you're an Explorist or Globalist member, you're getting three additional (and effectively permanent) elite memberships from your single Hyatt status.

Bottom Line

Hyatt has long been known as an especially generous program for its reward members, from club upgrade certificates to confirmed suite upgrades. Additionally, its members can see some extraordinary value with their membership in Las Vegas, by leveraging tier reciprocity and status matches to maximize their benefits.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app