How Families Can Afford to Travel (Without a Trust Fund)

Update: Some offers mentioned below are no longer available. View the current offers here.

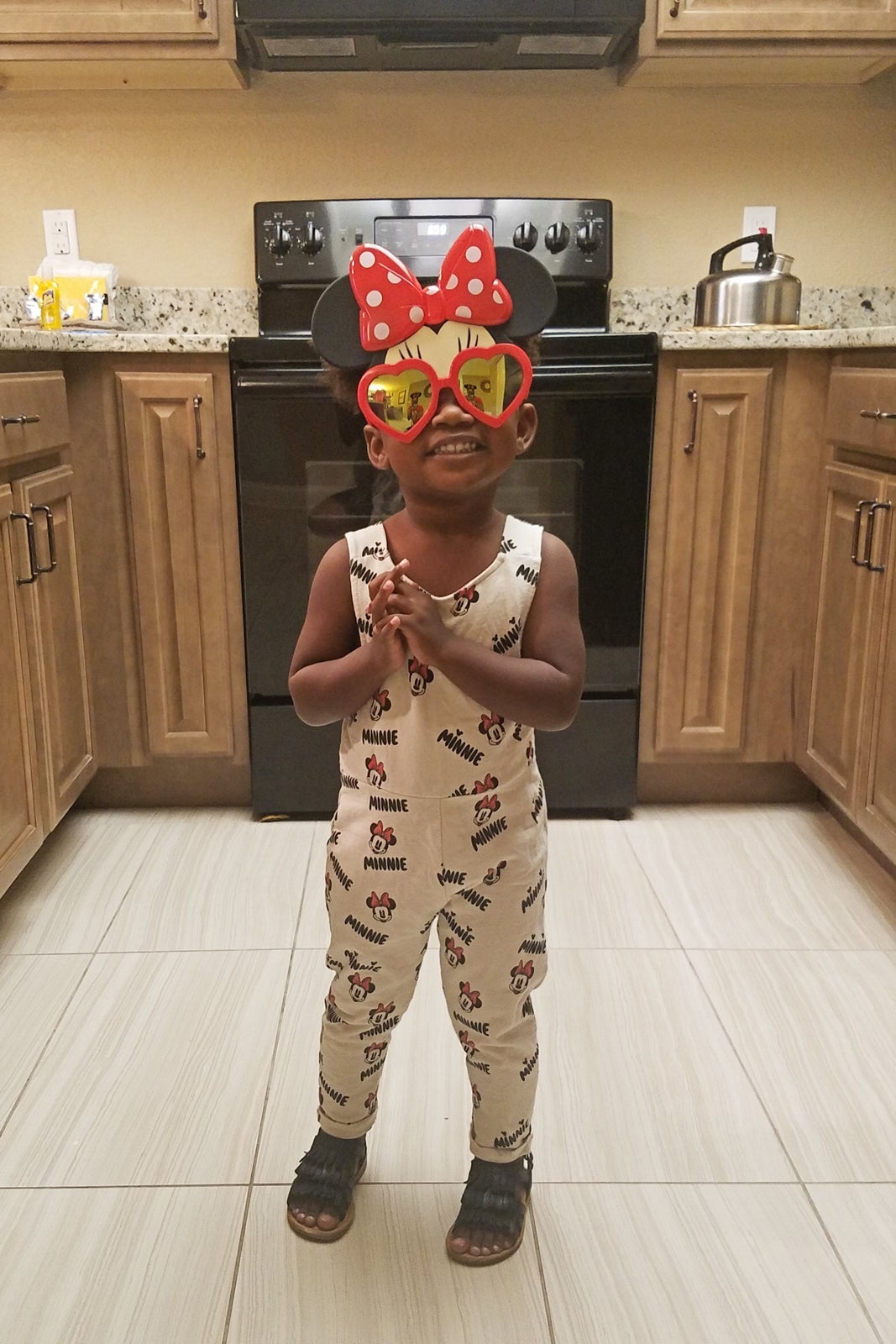

Our family of four manages to travel together five to six times a year. Last year this included trips to Costa Rica, Chicago, Hawaii, Fort Myers and Sanibel Island, Kenya, and a Southwest RV road trip. When most people hear about these adventures, they assume we're rich. However, as a middle-class family without a trust fund to lean on, that is far from the truth. Here are seven ways we can afford to travel without a trust fund -- and how your family can, too.

1. Have a Dedicated Vacation Savings Account

What’s that phrase, “If you don’t see it, you won’t miss it”? We have an agreed upon amount of money that goes directly into our vacation savings account each month. Having that separation from your regular savings account or checking account makes a huge difference. You’ll always know what you can and cannot afford when it comes to travel based on what you have in this account or how much will be in there when your trip arrives.

2. Be Willing to Sacrifice and Have Strict Budgets

Let's be real: A dedicated vacation savings account means nothing if you don't have the funds to deposit into it. Frequent travel as a middle-class family takes a lot of sacrifice. Since we prioritize travel, we made significant changes to our lifestyle to have the money to put into our dedicated vacation savings account. Our family decided to give up cable, limit our eating out budget to $100/month, use Groupon to purchase fun things for us to do as a family and more. You know your budget better than anyone, as well as what you’re willing to give up. Whether that’s your daily Starbucks coffee, designer clothing, hair and nail appointments, or watching movies in the theater versus Netflix, you'll need to decide what works best for you.

3. Use Credit Card Bonuses and Miles for Flights and Hotels

At least one of our trips each year is covered directly by miles earned from credit card sign-up bonuses. When the Chase Sapphire Reserve first came out years ago, we were able to get 100,000 bonus points, which equaled to $1,500 in travel. (TPG currently values Chase Ultimate Rewards points at 2 cents, or $2,000 if you utilize transfer partners.) (The card is currently offering 60,000 bonus points after you spend $4,000 in the first three months from account opening.). We coupled that with a flight deal and were able to cover all four of our plane tickets to Thailand plus two nights of hotel accommodations with that one bonus. Many credit cards have a minimum spend of $1,000 to $3,000 in the first 90 days, which is easy to meet as a family of four. To meet the minimum spend, we put our gas, groceries, day care and other expenses on the card and pay it off in full before the month ends.

While we do make exceptions when it is really worth it (like the Sapphire Reserve), usually we prefer credit cards without an annual fee to avoid any additional expenses. Whenever we do get a card with an annual fee, because the bonus is just too good to pass up, we often downgrade the card to a no annual fee option after we’ve used our miles and before paying the fee at the first anniversary. This way, there is no negative impact on our credit, as opposed to canceling the card outright.

Here are some current card offers that currently have welcome bonuses of 100,000 points and up!

4. Be Flexible With Travel Dates and Destinations

Instead of choosing where you want to travel with specific dates, be flexible. Our family travels strictly based on flight deals. So instead of saying we’re going to Amsterdam in June, we see what deals are available in June and book those instead, or look for the cheapest time to travel to Amsterdam if we are set on a destination.

Traveling this way has saved us a lot of money. We’ve purchased round-trip tickets to Denver for $60, Brazil for $314 and Aruba for $175 -- just by allowing flight deals to dictate when or where we travel. There are flight deals throughout the year, so even if you have school-aged kids and don’t want them to miss school, you’ll have plenty of options. In August 2017, we flew to Amsterdam for $200 round-trip each, thanks to a $400 flight deal on Delta coupled with using some miles to reduce the cost.

Another opportunity to explore are the reduced mileage awards that American Airlines offers its cobranded credit card holders to different destinations each month saving you between 1,000 and 7,500 miles per round-trip award ticket (depending on the route and the type of cobranded credit card you have).

5. Book Hotels With Free Breakfast and/or Kitchens

When using your points to book hotels, book those with free breakfast and/or kitchens. (Here's a list of the best hotel chains for families, according to Mommy Points.) Hotels that provide free breakfast and/or happy hour snacks in the evenings will save you a lot of cash. The same goes for hotels with kitchens, allowing you to cook some meals in your hotel. In pricy locations, it can cost close to $100 to take a family of four out for a full dinner, so think about all the money you’ll save.

6. Travel With Friends and Family

Traveling with friends and family can significantly reduce the cost of travel. Renting a vacation home or Airbnb and splitting the cost among multiple households can save a lot. On our family trip to Hawaii, hotels were running $1,400 per week. Instead, we booked a two-bedroom vacation rental with my parents for $1,400 total. Since we split the cost, our final bill was just $700.

7. Book Cruises With Kids Sail Free Promotions

Cruising is already a vacation that most families find affordable since your accommodations, most food and nonalcoholic drinks and entertainment are all included in the fare. To make it even cheaper, we only book cruises with "kids sail free" or "third and/or fourth guest sail free" promotions. All the major cruise lines offer these deals and instead of paying full price for your kids, you’ll just pay taxes and gratuities.

Sometimes you can increase your savings further by looking for one-way repositioning cruises that happen certain times of the year. And of course, be sure you are earning as many points or cash back as possible when you book the cruise.

Bottom Line

With some advance planning and leveraging fare sales and miles and points, our family is able to travel extensively while living on a budget, and decidedly without a trust fund. We're proud to make it a priority to introduce the world to our kids and make special memories with them as we travel the globe.

Monet Hambrick is the mom and writer behind The Traveling Child blog where she shares tips on traveling with kids and how to afford travel as a family. Her motto is “if kids live there, kids can visit” and she and her husband have taken their 2 and 4 year old to 21 countries on six continents. You can follow along their family adventures on Instagram.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.