The State of the Hotel Best Rate Guarantee

Where do you book your hotels rooms? Directly on a hotel website, through an online travel agency (OTA) like Priceline.com, through a members-only outfit like Club1 or with a traditional travel agent? Hotel chains are trying their hardest to get you to answer that question with "directly on the hotel website."

Between offering free internet, free breakfast, promising lower rates than booking through OTAs and even running expensive ad campaigns, hotel chains are investing significant amounts of money to get you to book directly. The reason behind this is simple -- when you don't book directly through the hotel, it has to pay your preferred booking channel a commission that can get as high as 10–15% of the room rate. Booking directly saves the hotel chains money, which they can then use to pass along savings. It also benefits you, the points-traveler, by allowing you to earn and use elite status perks, as well as hotel points.

Best Rate Guarantee Programs

To further incentivize direct bookings, all the major hotel chains offer best rate guarantees just in case you find a better deal somewhere else. Here's a look at their offerings.

IHG will match the lower competitor's rate and then give you five times the IHG Rewards Club points, up to 40,000 maximum, worth $200 according to TPG's latest valuations.

Hilton's price-match guarantee program is one of the most generous. If you find a lower rate, Hilton will match that rate and then offer 25% off the matched room rate. Hilton's claim form is also the most robust, since it pre-populates your reservation information for you.

Hyatt's best rate guarantee gives you a choice. Should you successfully submit a best rate guarantee claim, Hyatt will match the lower rate and then give you a choice: an additional 20% off the matched rate or 5,000 World of Hyatt points, worth $85 according to our latest valuations.

Like Hyatt, Marriott's best rate guarantee also gives a choice. After filing a valid claim, you can choose either an additional 25% off the matched rate or 5,000 Marriott Bonvoy points (worth $40).

Related: The Best Credit Cards for Family Vacations

Terms and Conditions

Like many good things in life, the various hotel best rate guarantee comes with lots of conditions. Each chain has different language around the best rate guarantee but some of the key terms and conditions are shared across the chains.

- You must have already booked the room directly through the hotel chain (except for Hilton).

- The lower rate must be found on a valid competitor website.

- This excludes sites that don't tell you the hotel brand until the reservation is completed, sites that offer membership prices, sites that don't offer immediate confirmations and some others.

- The lower rate must have the exact same conditions as the rate booked directly through the hotel chain:

- same booking dates

- same room type

- same cancellation policies

I recently made 14 hotel bookings to test whether the hotel chains stuck to their words. Of my 14 best rate guarantee claims, only six were approved. What can you learn from my ~50% success rate?

1. Be Careful With Cancellation Policies

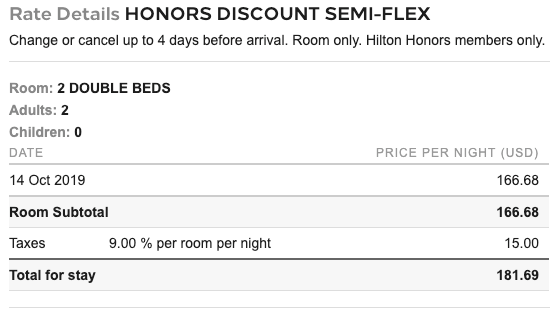

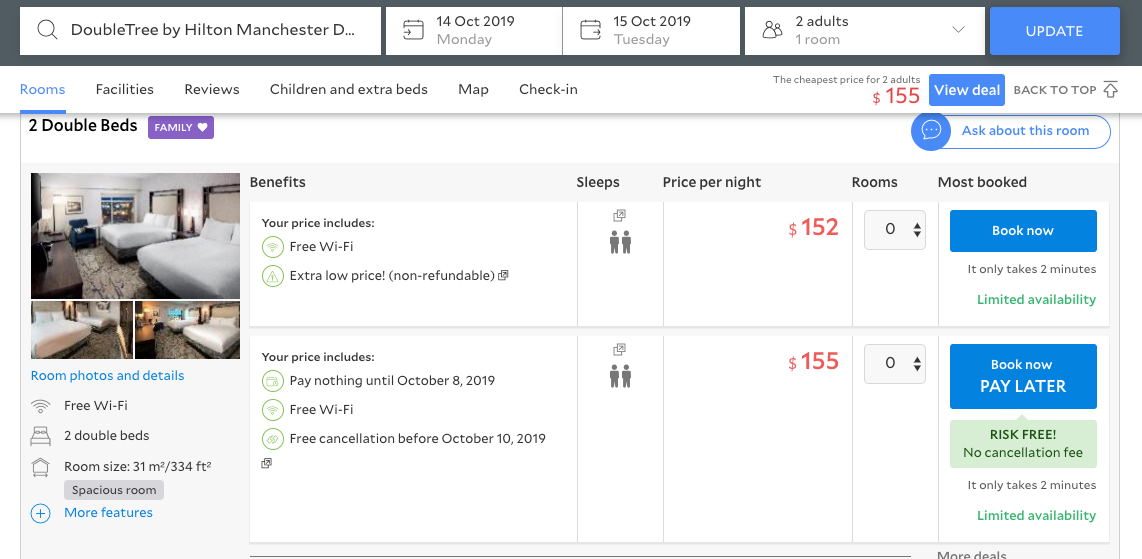

In my research, many of the lower rates I found had slightly different cancellation policies than the policy offered directly with the hotel. When I went to submit a best rate guarantee claim for the DoubleTree by Hilton Manchester Downtown, my claim was denied because the cancellation policies were different. But you tell me, how different are these cancellation policies?

- Doubletree's cancellation policy: Change or cancel up to four days before arrival (up to 10/10/2019)

- Agoda.com cancellation policy: Free cancellation before Oct. 10, 2019

Clearly, the ambiguous language of "before Oct. 10" and "up to four days before arrival" was enough to invalidate my best rate guarantee claim.

2. Don't Forget to HUCA

Even though most best rate guarantee claims need to be submitted online (Hilton and Hyatt can be done over the phone), that doesn't mean you can't apply the principles of one of the best tricks in the book: Hang up, call again (HUCA).

In the previous example, I received an email from Hilton denying my claim. Nowhere in the denial email did it say I could contest the decision, but I simply replied to the email stating that the two cancellation policies are, in fact, the same. A few hours later, I received an update that my claim had been approved. It never hurts to ask!

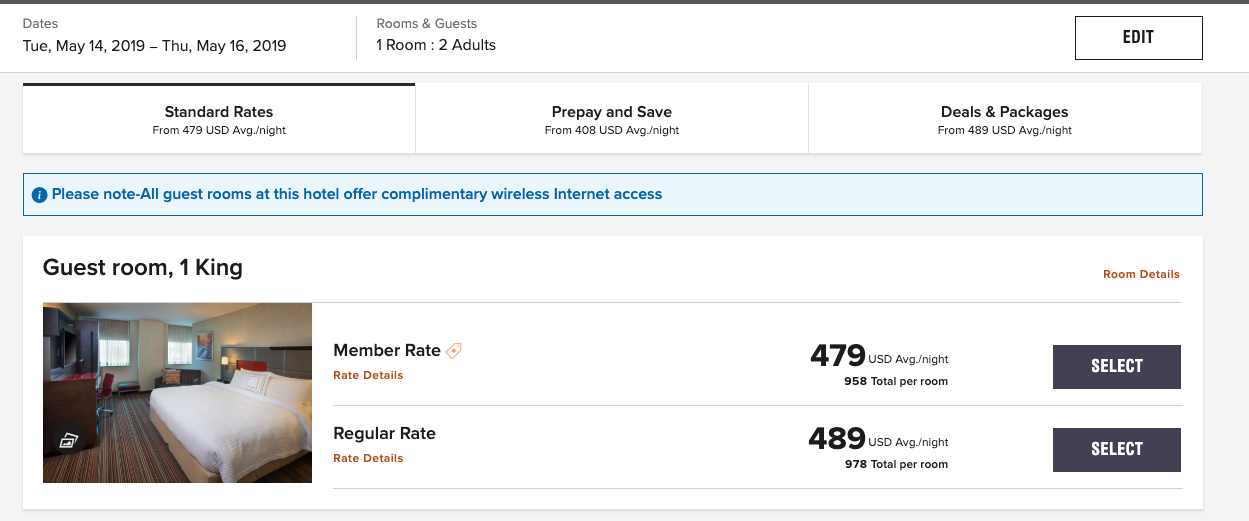

3. Book the Absolute Lowest Rate

Another three of my claims were denied because I didn't book the "lowest available rate" directly through the hotel chains. In those three cases, I had booked the lowest publicly available rate, which was a bit higher than the rates the hotel chain offers to its loyalty members. Upon further inquiry, I needed to book the "Member" rate in order to satisfy the condition of booking the lowest available rate.

Beware: Although the hotel chains don't let you price match to an OTA's member rates, they hold you to a double standard by requiring you to book their absolute lowest rate, even if that rate requires you to be a member of the hotel's loyalty program.

4. Good Luck With the Math

Only two of my six successful best rate guarantee claims matched the exact competitor rates that I originally sent in. The other four approvals ranged from being 10% lower to 10% higher than the competitor rate that I sent in.

Hotel | Direct Rate | Competitor Rate | Matched Rate | % Difference |

|---|---|---|---|---|

Courtyard New York Manhattan/Herald Square | $1,175.16 | $458.00 | $458.00 | None |

DoubleTree by Hilton Manchester Downtown | $181.69 | $172.03 | $162.62 | -5% |

Grand Hyatt New York | $199.90 | $197.10 | $179.10 | -9% |

Hilton Boston Back Bay | $498.46 | $388.36 | $431.03 | 11% |

Hyatt Place Charlotte Airport/Tyvola Road | $122.00 | $119.26 | $119.26 | None |

Sheraton Old San Juan Hotel | $217.55 | $183.00 | $185.60 | 1% |

My assumption is that the rate discrepancies can be attributed to how the hotel chains calculates taxes and fees in the competitor's rate. While it was hard to pinpoint exactly how the chains figured the matched rate, one thing was clear: Don't expect to understand what's going on in the calculation.

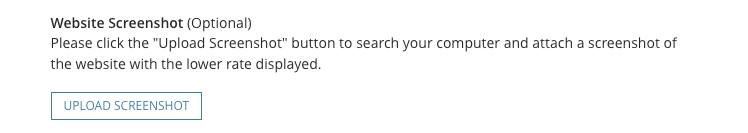

5. Upload a Screen Shot

To streamline the claims process, take advantage of Hyatt's optional "Upload a Screen Shot" field. Take a screen shot of your web browser showing the OTA's lower rate and upload it to the Hyatt's claim form.

For the other chains, make sure to fill out the optional comments section, describing exactly how one could replicate your search for a lower hotel rate. Two of my OTA rates couldn't initially be verified during the claims process, so I had to explain by email exactly how I found the rate I submitted.

6. Patience Is a Virtue

After you've submitted your best rate guarantee claim, take a deep breath and wait. And then wait some more.

All the hotel chains promise an answer within 24 hours, but in my experience, Marriott and Hyatt take up much of their 24-hour allowance. In fact, I've still yet to hear back from Hyatt for one of my claims. Hilton took the award for quickest response, with an average response time of an hour or less.

Bottom Line

Hotels are trying their hardest to get you to book direct. By taking them up on their best rate guarantees, you can beat hotels at their own game when you find a cheaper rate on a competitor website. Book direct, find a better rate elsewhere and then get the hotel to match the rate and give you a further 20–25% off the matched rate. Just know what to expect when you submit that best rate guarantee claim and you'll be set for success.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app