Hilton Honors Experiences: How to redeem points for activities, VIP events, concerts and more

If you're a regular TPG reader, you know we believe that the best use of hotel points is for hotel stays — other uses are almost always a bad idea. This is because you typically lose value on your hotel points when you redeem them for other things outside of booking a hotel.

However, Hilton Honors Experiences is determined to prove that there are other ways to redeem your Hilton points that won't yield an offensive return. While not all options are good deals, we'll show you how to determine which are winners.

What are Hilton Honors Experiences?

Hilton Honors Experiences are a fun, non-hotel-stay way to redeem your points. There are four main categories for Hilton Honors Experiences:

- Culture

- Food

- Music

- Sports

This concept is not unique to Hilton; other hotel loyalty programs, such as Marriott Bonvoy Moments and Hyatt Find Experiences, also offer the ability to book exclusive events and adventures with points. But Hilton's got a handful of excellent value propositions.

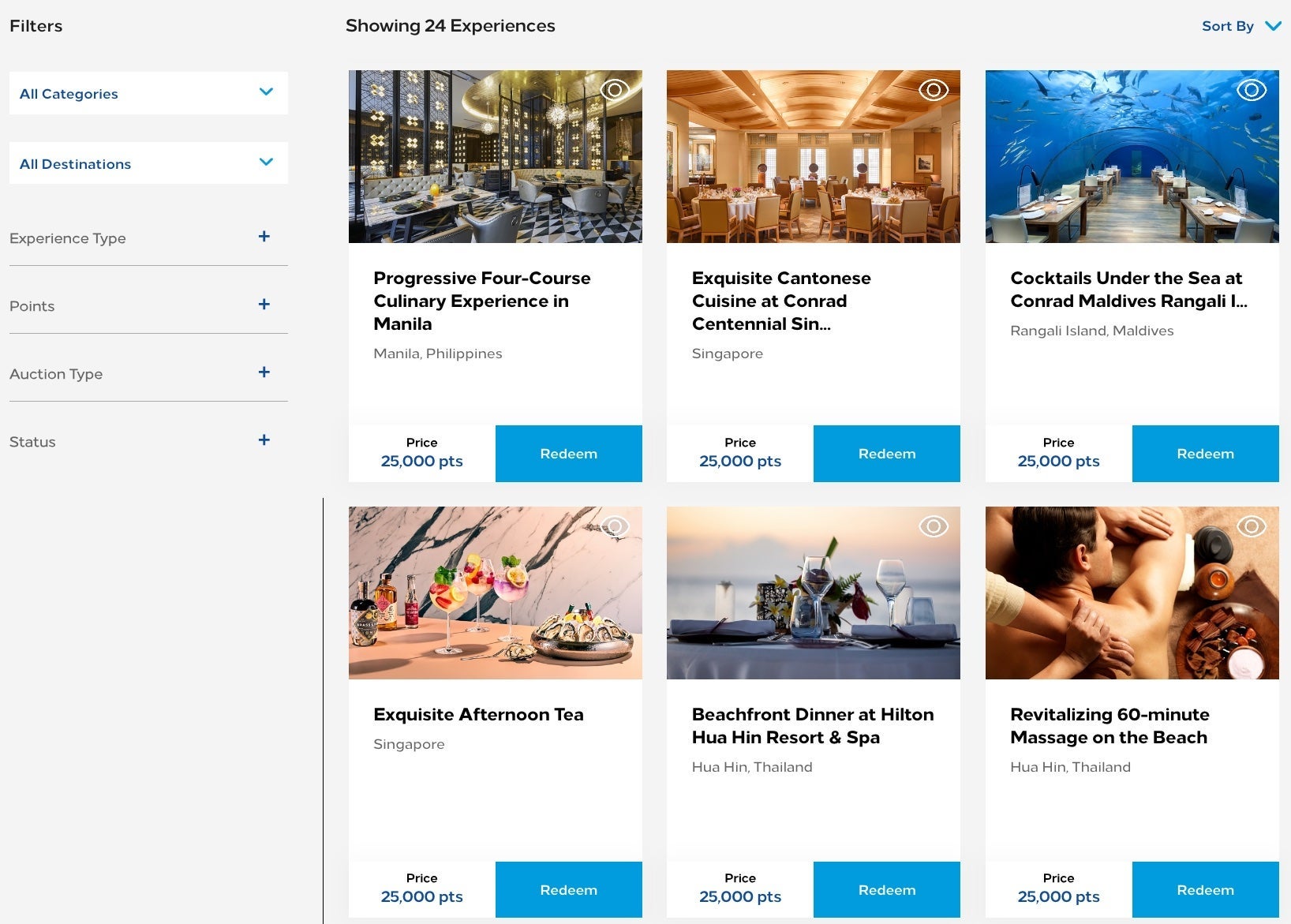

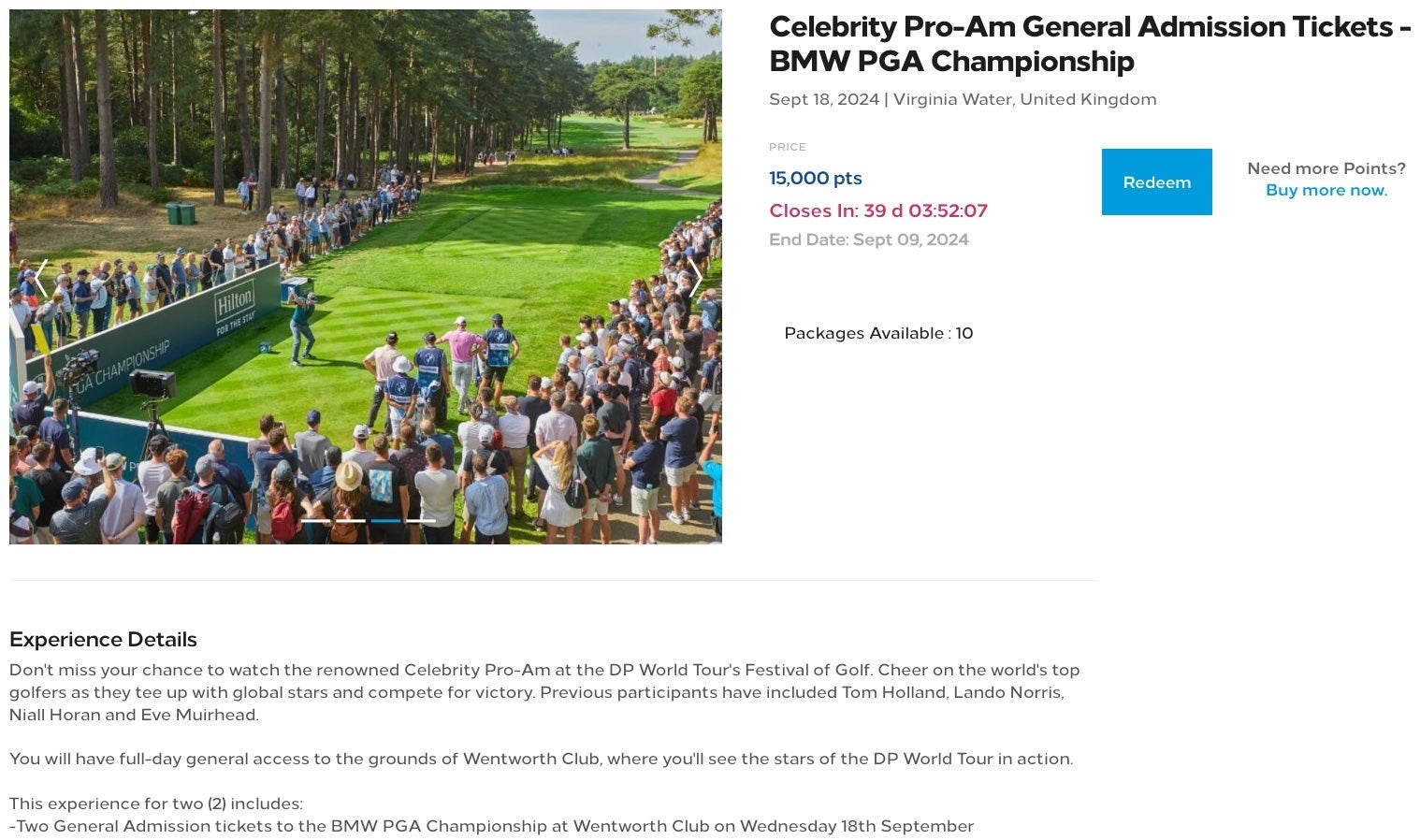

You can book things like PGA Championship tickets (both general admission and VIP), an evening meet-and-greet with various celebrities, Formula One passes and even an activity during your stay at a Hilton property.

In 2022, TPG Senior Writer Katie Genter redeemed 20,000 Hilton points through Hilton Experiences for a 60-minute couples massage and a four-course dinner for two.

While Experiences aren't exclusively hotel-related, some may include a Hilton hotel stay. For example, when you book the "Ultimate Thanksgiving Parade Viewing Experience," you'll receive three nights at the New York Hilton Midtown along with various credits, welcome amenities and access to a VIP parade viewing area.

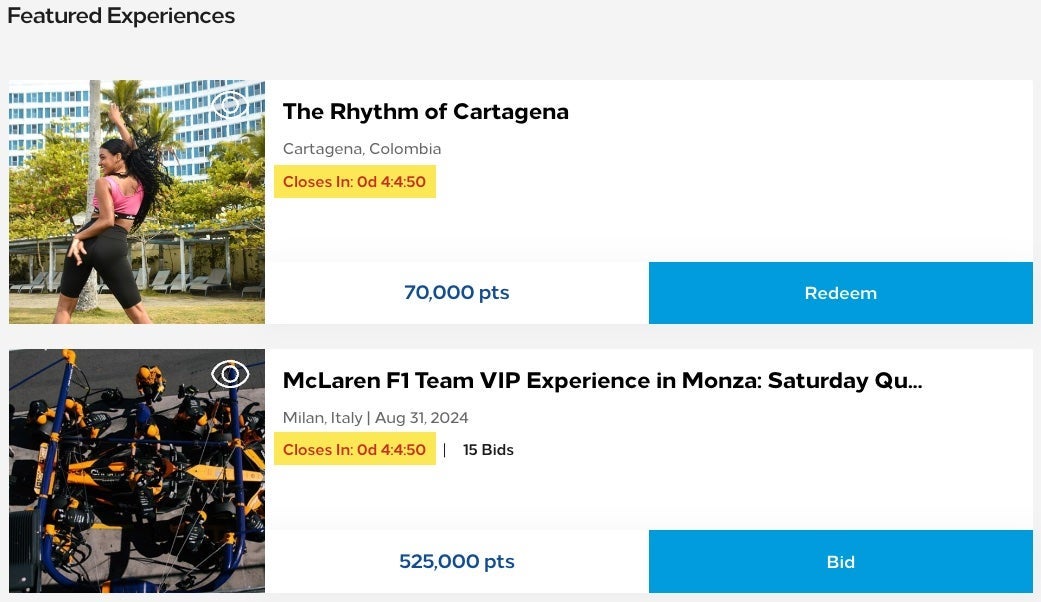

Some are auctioned, while others can be "purchased" instantly with points. The ones that require bidding have a definite expiration time, at which point the highest bidder will win the experience.

You can also link your Hilton account to Ticketmaster to redeem points for concerts and other events.

How to book Hilton Honors Experiences

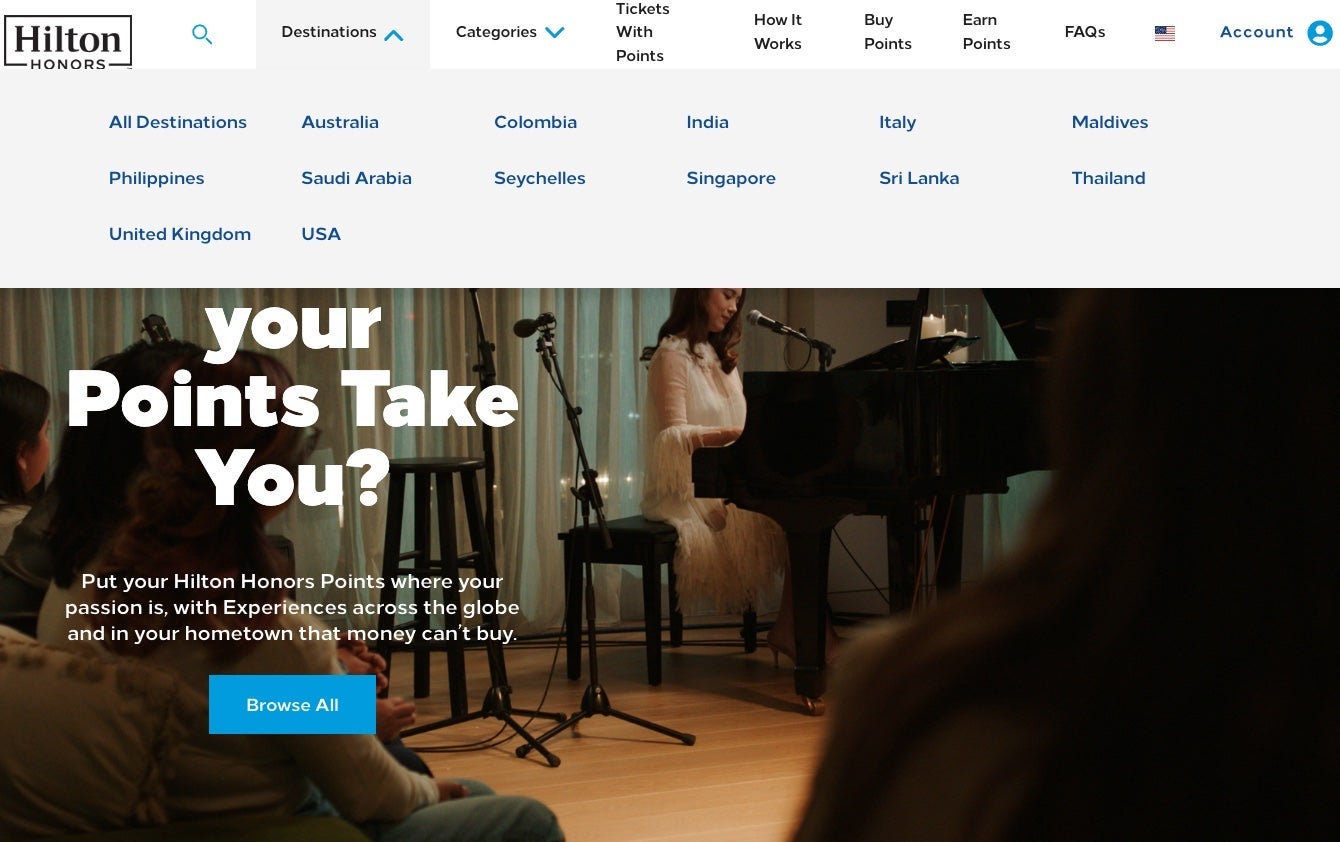

Booking Experiences with your points is simple. Just head to the Hilton Honors Experiences website and begin poking around. At the top of the page, you can choose from specific destinations and Experience categories. You can also choose to see all Experiences at once.

You can sort Experiences by bid count, current bid and time left. You can also filter your search by the number of points required and whether an Experience is an auction or available for immediate redemption. If you're looking exclusively for an on-property Hilton experience, there's a filter for that, too.

Once you find an intriguing Experience, click on it to read more details. You'll see everything that comes with the purchase (hotel stay, food, etc.), as well as the number of guests it includes. If you're willing to part with the points, you can redeem your rewards and Hilton will contact you within a couple of days with more details.

Are Hilton Honors Experiences worth it?

Hilton Honors Experiences can absolutely be worth it. In some cases, they provide excellent value for an activity you would have otherwise paid for.

For example, a yacht transfer to the Waldorf Astoria Maldives Ithaafushi regularly costs over $1,000 per adult (after taxes and fees). But you can reserve the trip for just 100,000 points per adult. That means you'd get a value above 1 cent per Hilton point. According to TPG's January 2025 valuations, Hilton points are worth 0.6 cents each, making this an excellent redemption deal.

On the other hand, redeeming Hilton points through Ticketmaster will net you an abysmal value of 0.2 cents per point. Just remember, as long as you're getting a value at or above TPG's estimated reasonable redemption value for your rewards, you're golden.

Alternatively, you may simply want to book something that you can't reserve with money — such as an intimate dinner prepared by a celebrity chef. This is something you might not be able to book otherwise, as it's only available through Hilton Honors Experiences. If you stumble upon an event like this, you're the only one who can decide if it's worth the points.

It's also worth noting that you can routinely buy Hilton points for 0.5 cents each or wait for a promotion to buy Hilton Honors points with a bonus.

Best credit cards to earn Hilton Honors points

Hilton offers many cards that typically come with massive welcome bonuses and high return rates for Hilton purchases:

- Hilton Honors American Express Card: Earn 80,000 Hilton Honors bonus points after spending $2,000 on purchases in the first six months of card membership. This card has no annual fee (see rates and fees).

- Hilton Honors American Express Surpass® Card: Earn 130,000 Hilton Honors bonus points after spending $3,000 on purchases in the first six months of card membership. This card has an annual fee of $150 (see rates and fees).

- The Hilton Honors American Express Business Card: Earn 130,000 Hilton Honors bonus points after spending $6,000 on purchases in the first six months of card membership. This card has a $195 annual fee (see rates and fees).

- Hilton Honors American Express Aspire Card: Earn 150,000 Hilton Honors bonus points after spending $6,000 on purchases in the first six months of card membership. This card has a $550 annual fee (see rates and fees).

Additionally, American Express Membership Rewards points transfer to Hilton at a 1:2 ratio (1 Amex point equals 2 Hilton points). By earning the welcome bonuses on cards like The Platinum Card® from American Express and the American Express® Gold Card, you can opt to transfer your Amex points to Hilton and book a Hilton Honors Experience.

Bottom line

Hilton Honors Experiences give you another worthwhile outlet to redeem your Hilton points. Some activities are an excellent value, and some can't even be reserved with money, meaning that a healthy stash of Hilton points can open up fun opportunities that most other folks don't even know exist.

Let us know if you've ever used Hilton Honors Experiences for a unique adventure!

For rates and fees of the Hilton Amex Card, click here.

For rates and fees of the Hilton Amex Business Card, click here.

For rates and fees of the Hilton Surpass Card, click here.

For rates and fees of the Hilton Aspire Card, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app