TPG success story: How I earned $550 in Southwest credits during the airlines' winter meltdown

As millions of travelers took to the skies at the end of the holiday season, major snowstorms hit the Northeast, the Mid-Atlantic, the Southeast, Colorado and the West Coast from the Sierra Nevada region to Washington state. Those storms, in turn, led the U.S. airlines to cancel thousands of flights, leaving passengers scrambling.

One of those passengers was me. Here's how I handled one cancellation, avoided another and ended up with hundreds of dollars in Southwest flight vouchers as a result.

Rescheduling a canceled Southwest flight

I was scheduled to take a nonstop flight on Southwest Airlines on Tuesday, Jan. 5, from San Antonio to Baltimore. I checked the flight status before I left home, but by the time I arrived at San Antonio International Airport (SAT), the flight was canceled.

There was a long line at the gate for re-accommodation, but thanks to my Southwest A-List status, I could skip the queue and call the dedicated line to reschedule. (I first checked the app, but it didn't have any good options for me.) After a 49-minute wait, I was not better off than when I started; the agent wasn't able to find me a flight until the evening of Friday, Jan. 8, which was a no-go.

Related: Why I’m scrambling to make Southwest A-List status

Giving up on Southwest, I went on the Delta app to see if it had any flights to Baltimore on Tuesday, Jan. 5, my original departure day. I found one, but by the time I hit the payment page, that seat was gone. A second search showed no availability until Thursday, Jan. 7, which did not work for my timeline.

I ended up buying a United Airlines fare for a morning flight via George Bush Intercontinental (IAH) on Wednesday, Jan. 6, which was the earliest I could get. I paid $502 one way, almost double what I initially paid on Southwest for the first leg of my trip. Southwest automatically refunded the $254.79 SAT-BWI part of my fare.

Surprise vouchers

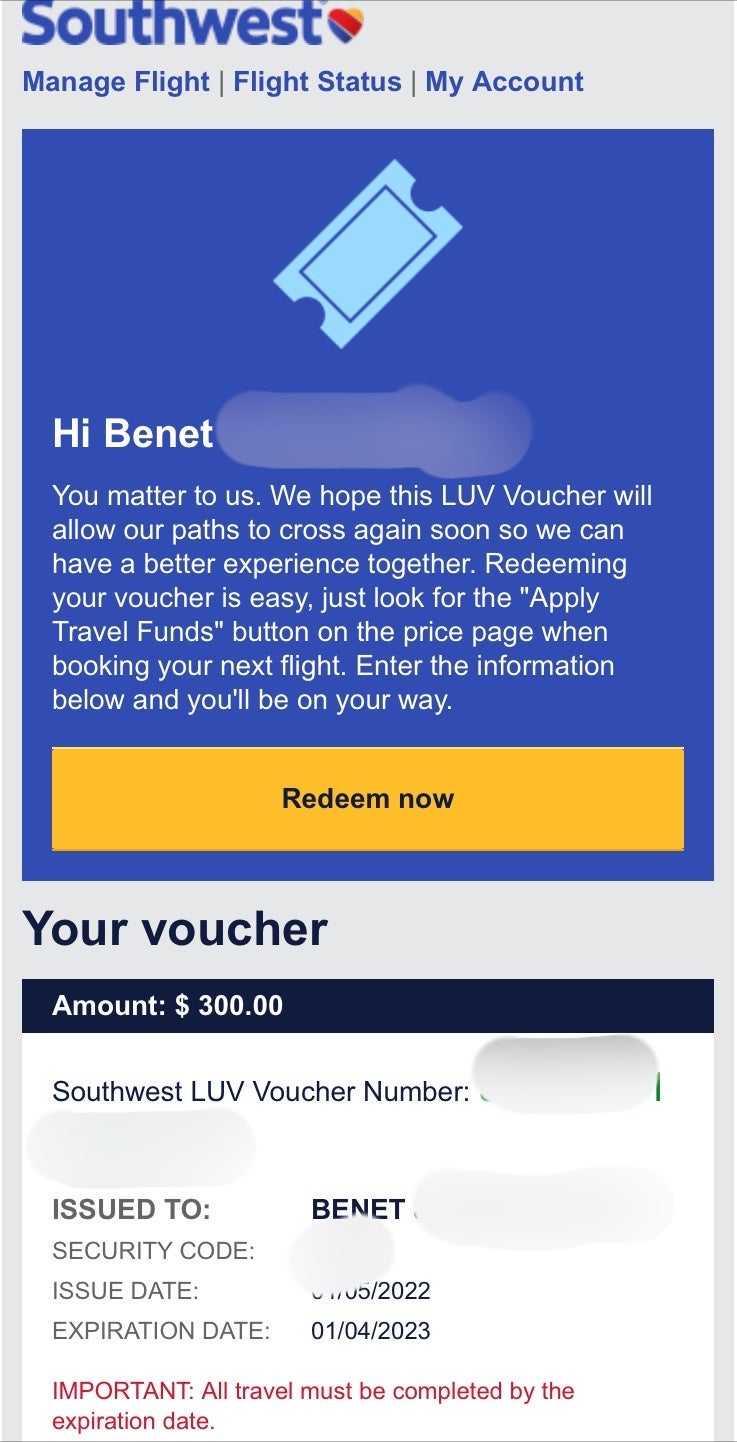

After I arrived in Baltimore on Jan. 6, I called the A-List line to make sure my Saturday return to San Antonio wasn't canceled as well. The agent was very apologetic about the cancellation, and I assured him I knew it was a weather issue. He replied that it wasn't good enough and the next thing I know, I had a $300 LUV voucher for the inconvenience. Sweet!

This was amazing for two reasons. One, I hadn't asked for any compensation. Two, it was a weather-related cancelation and the airline's own contract of carriage states that:

"In the event Carrier cancels or fails to operate any flight according to Carrier’s published schedule, or changes the schedule of any flight, Carrier will, at the request of a Passenger with a confirmed Ticket on such flight, take one of the following actions: Transport the Passenger at no additional charge on Carrier’s next flight(s) on which space is available to the Passenger’s intended destination, in accordance with Carrier’s established re-accommodation practices; or

refund the unused portion of the Passenger’s fare in accordance with Section 4c."

Southwest had fulfilled its commitment to me by refunding me the cost of the unused ticket. It had no obligation to offer me an additional voucher.

I continued to live my happy life in Baltimore, closing down my apartment and running errands on Jan. 6-7. Then on Friday morning, Jan. 8, I was alerted to another slew of airline cancelations through the weekend by Ethan Klapper, TPG's new senior aviation reporter. This was not welcome news because I had a flight home scheduled for Saturday, Jan. 9.

Sure enough, when I checked the Southwest Airlines app, I found a winter weather warning and an offer to reschedule my Jan. 9 flight for free. I decided to be proactive and took the carrier up on the offer, booking a nonstop flight to San Antonio early on Sunday, Jan. 10. I booked another night at the Hyatt Place hotel that had been my home for the week and spent the evening binge-watching episodes of "The Love Boat" (don't judge me) on Paramount+.

As I was relaxing, I checked my email and -- surprise -- Southwest had sent me another voucher, this time for $250, for the Saturday flight I rebooked. Together the two vouchers totaled $550 and were very welcomed, especially since the airline was under no obligation to offer them.

Related: The 9 best credit cards with travel insurance

Tips for handling flight cancellations and rebooking

Should you ever find yourself in a similar situation, here are some tips to make the rebooking process a little less stressful.

First, make sure to download your airline's app, which can be invaluable if you need to rebook your flight. If your flight gets canceled, or if the airline is apprehensive about winter weather and is encouraging travelers to make itinerary changes in advance, the app will not only alert you but also suggest flight alternatives you can book right on your phone.

If you hear about bad weather, start checking the app the day before your flight, which will give you more time to rearrange your plans and let you rebook before everyone else does, when more flights have open seats. You will not be charged a change fee if the airline is asking you to rebook a flight that's likely to be disrupted by weather.

Should the airline proactively offer to reschedule your flight, say yes if you can make the new flight fit your schedule. You're much more likely to be accommodated if that rebooked flight gets canceled because the airline knows you changed your plans on their advice and will give you priority in getting you where you need to go.

In situations where your original or rescheduled flight is canceled, do not stand in line at the check-in counter. Again, check the app to see if the airline has proactively rescheduled your flight.

If they have, but the times don't work, call the airline -- and be ready to wait. If you have elite status, call the dedicated phone line.

As you're holding, get on a website or app such as Kayak or Orbitz to find flights on other airlines, so you have a Plan B.

The more initiative you can take, the better chance you have of making it to your final destination in a reasonable timeframe. You might not always luck out with additional travel vouchers as I did, but after all your trip delay bad luck, you might be rewarded with an unexpected surprise.

Related: Here’s what to do if your flight is delayed or canceled

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.