Disney Visa card offers: Earn up to $600 toward your next vacation

Editor's Note

At first glance, the three Disney credit cards may seem like they're only for Disney superfans.

But anyone who has a Disney vacation on the calendar or makes frequent Disney-related purchases can potentially benefit from the discounts, the perks and — most importantly — the elevated welcome offers on these cards.

The current bonuses on these cards are worth noting if you're planning a trip soon. So, if you've been eyeing a card, now is an excellent time to apply. Here's what you need to know.

Comparison of Disney Visa card welcome offers

| Card | Welcome offer | Annual fee |

|---|---|---|

Earn up to $600 in a tiered earning structure:

| $149 | |

Earn up to $300 in a tiered earning structure:

| $49 | |

Earn up to $150 in a tiered earning structure:

| $0 |

Disney Inspire Visa Card welcome offer

The top-tier Disney Inspire Visa provides the highest level of benefits in the Disney Visa suite. It also comes with the most lucrative welcome bonus, in exchange for the highest annual fee.

Annual fee: $149

Welcome offer: Earn up to $600 in a tiered earning structure:

- Receive an instant $300 credit in Disney gift cards

- Earn a $300 statement credit after spending $1,000 on purchases in the first three months from account opening

Is it worth it?

This is a solid welcome bonus for Disney fans, especially if you plan on booking a trip to one of their parks or properties soon.

If you're booking Disney vacations often, this card could make a lot of sense. It has the highest annual fee of the Disney Visa trio, but it also offers the most perks.

This premium option provides:

- 10% off select merchandise purchases at select locations and select dining locations on most days at Disneyland and Disney World

- Exclusive photo opportunities at the theme parks that are only available to Disney Visa cardholders, plus complimentary downloads of your photos

- Special vacation financing on select Disney vacation packages

- 200 Disney Reward Dollars after spending $2,000 in purchases on the card on U.S. Disney Resort stays and Disney Cruise Line annually

- Earn a $100 statement credit after spending at least $200 on Disney theme park tickets annually

And in addition to the high-value welcome offer, this card will earn:

- 10% back in the form of Disney Rewards Dollars on card purchases made directly at DisneyPlus.com, Hulu.com and plus.espn.com

- 3% back at most U.S. Disney locations and gas stations

- 2% back at grocery stores and restaurants

- 1% back on all other purchases

These rates are potentially lucrative if you spend frequently on Disney-related purchases.

You can redeem Disney Rewards Dollars toward select Disney vacation purchases, at DisneyStore.com or by using Chase's Pay Yourself Back feature to redeem Disney Rewards Dollars for a statement credit toward airline purchases made with the card.

Apply here: Disney Inspire Visa Card

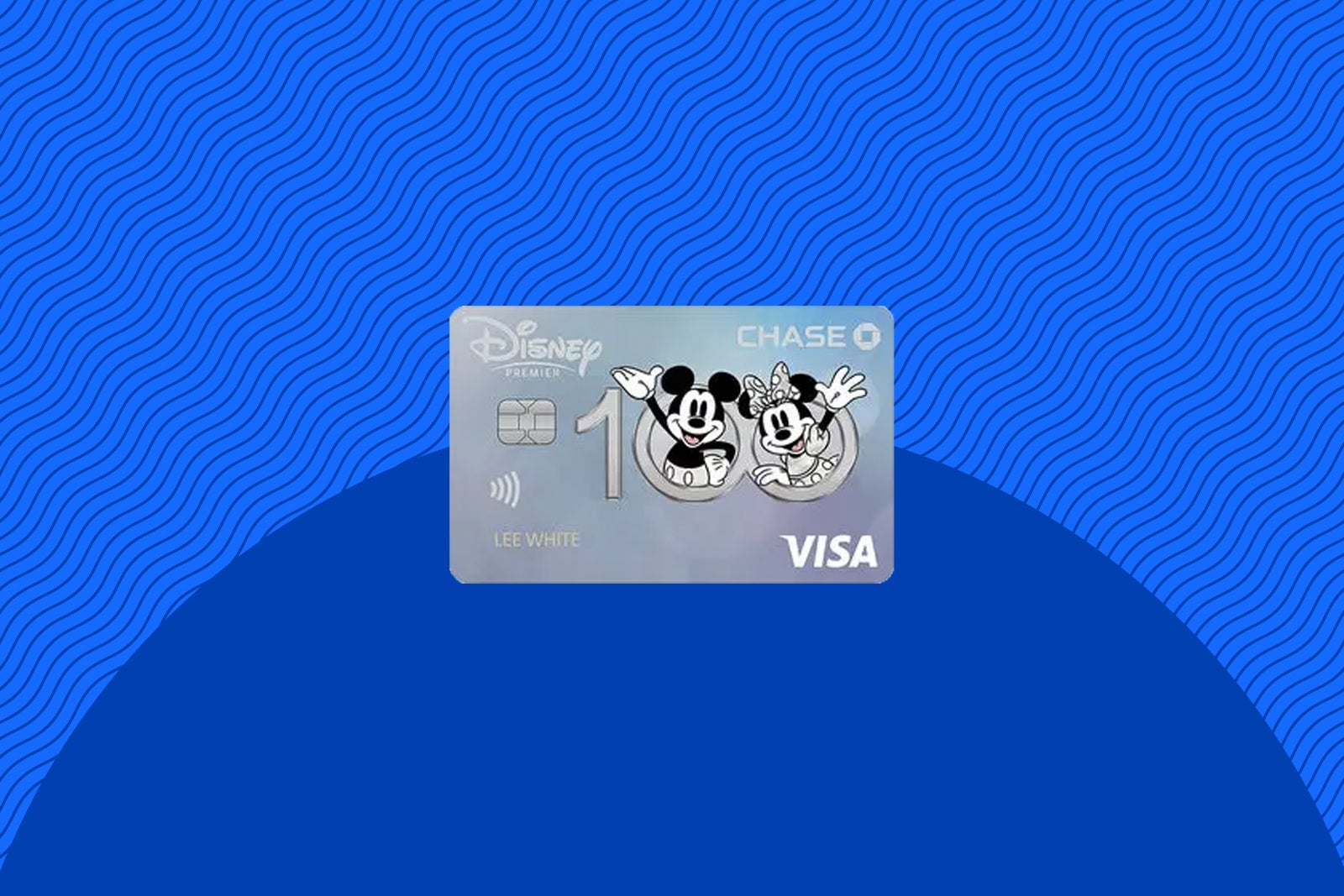

Disney Premier Visa Card welcome offer

The Disney Premier Visa Card provides mid-tier perks in the middle of the Disney card lineup.

Annual fee: $49

Welcome offer: Earn up to $300 in a tiered earning structure:

- Receive an instant $200 credit in Disney gift cards

- Earn a $100 statement credit after spending $500 on purchases in the first three months from account opening

Is it worth it?

When you use this card to pay for a Disney vacation, the statement credit from this welcome offer can offset a portion of your trip. If you've been considering applying for this card, now would be a good time to add it to your wallet.

This card also offers theme park discounts and perks, including:

- 10% off select merchandise purchases at select locations and select dining locations on most days at Disneyland and Disney World

- Exclusive photo opportunities at the theme parks that are only available to Disney Visa cardholders, plus complimentary downloads of your photos

- Savings for select onboard purchases when using the card on Disney Cruise Line

- Special vacation financing on select Disney vacation packages

At home, you'll also get a 10% discount on select credit card purchases at DisneyStore.com.

In addition to the elevated welcome offers and special discounts, you'll earn:

- 5% back in the form of Disney Rewards Dollars on card purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com

- 2% back at gas stations, grocery stores, restaurants and most U.S. Disney locations

- 1% back on all other purchases

These earning rates are not as high as other low-annual-fee cards, and the redemption options are limited compared to cards with more flexible options. However, the discounts and theme park perks associated with this card could prove beneficial for Disney vacations.

To learn more, read our full review of the Disney Premier Visa Card.

Apply here: Disney Premier Visa Card

Disney Visa Card welcome offer

The Disney Visa Card offers theme park discounts and benefits and has no annual fee.

Annual fee: $0

Welcome offer: Earn up to $150 in a tiered earning structure:

- Receive an instant $100 credit in Disney gift cards

- Earn a $50 statement credit after spending $500 on purchases in the first three months from account opening

Is it worth it?

The Disney Visa Card provides the same theme park and shopping discounts as the other cards, including:

- 10% off select merchandise purchases at select locations and select dining locations on most days at Disneyland and Disney World

- Exclusive photo opportunities at the theme parks that are only available to Disney Visa cardholders, plus complimentary downloads of your photos

- Savings for select onboard purchases when using the card on Disney Cruise Line

- Special vacation financing on select Disney vacation packages

The Disney Visa earns 1% back in Disney Rewards Dollars on all purchases. While earning any rewards is good for a no-annual-fee card, other cards with no annual fee can offer a higher rate of return and better redemption options.

To learn more, read our full review of the Disney Visa Card.

Apply here: Disney Visa Card

Bottom line

The Disney Visa cards are best suited for those who plan Disney trips frequently and will use the benefits, earning rates and solid welcome bonuses on their trips.

If you don't fall into that camp, you may be more interested in a general travel rewards card or one of our other favorite cards for Disney vacations.

Considering these are higher welcome offers than what we typically see on the cards, if you're set on applying, you can get even more value if you apply now.

Apply here: Disney Inspire Visa Card

Apply here: Disney Premier Visa Card

Apply here: Disney Visa Card

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app