What you need to know about direct versus third-party travel bookings

When you're planning a trip, there are several ways to make reservations for your flights, hotel and rental car. Two of the most common options include booking directly with the provider and using a third-party service, such as an online travel agency. But is one method better than the other?

Let's go over each method's benefits and everything you should consider before booking a trip.

What is a direct booking?

A direct booking involves paying for and reserving your travels through the airline, hotel or car rental agency itself. For example, if you want to book a stay at a Hilton hotel, you can use the Hilton website to make your reservation. Or, if you want to fly on United Airlines, you can book your reservation through the airline's website.

What is a third-party booking?

A third-party booking encompasses any sort of travel that's reserved with a separate provider (such as OTAs like Expedia and Priceline) and not directly through an airline, hotel or car rental agency. Other examples of third-party providers include travel agents and credit card travel portals (like Chase Travel℠ and Amex Travel).

Benefits of booking directly

At TPG, we often recommend making direct bookings for travel. Here are some of the top benefits of booking directly:

Direct bookings cut out the middleman

If there's an issue with your travel, such as a flight delay or cancellation, you can deal with the airline itself and not a third party. Or, if the airline makes changes to your flight times and the new schedule doesn't work for you, you can reach out to the carrier to switch your flight to a more appropriate time — or even cancel it altogether.

Dealing with an airline directly can be much more efficient than trying to navigate reservation changes with a third party. It can mean the difference between having several rebooking options or having none at all because other travelers (who likely booked directly with the airline) got first priority.

The same goes for hotels and rental car agencies. Let's say you decided to revise your travel dates, so you want to make a voluntary change to your reservation. You may not be able to easily do this with a third-party booking site, especially if you used an OTA.

Oftentimes, third-party reservations have more restrictive policies regarding changes or cancellations. Or, you may be charged a fee to make changes. For example, if you contact JetBlue to make a ticket change on a travel agency booking instead of one made via JetBlue's website, you'll be charged a $50 service fee per person. If you can't self-manage your reservation on JetBlue's website and you want to avoid the service fee, the airline advises contacting the third party that booked your ticket for assistance.

However, the third-party booking site itself may also impose change fees. For example, Priceline's website states that "if your flight's fare rules allow a change, a per ticket exchange processing fee may apply." Similarly, Hotels.com's terms and conditions disclose that it may also charge for reservation changes.

You can earn rewards and qualify for elite status

Typically, airline bookings have been eligible for miles-earning progress that counts directly toward elite status whether you book directly or via a third party. This means that if you book a flight through a third party and include your loyalty program number on the reservation, you should earn miles that adhere to the airline's fare class rules. If you have status with that airline, you will be eligible for status perks, such as seat selection or a free checked bag.

Related: When you will (and won't) earn miles on your flight

The same is not true for third-party hotel bookings, though. When you book a hotel reservation through a third party, you typically do not earn points or qualify for any status benefits through loyalty programs.

If you're booking with an independent travel agent or travel adviser, be sure to ask whether your reservations will qualify for status-earning metrics like points, nights or stays. In some cases, your travel agent may be booking a package deal that won't earn hotel rewards, but you may still be able to include a frequent flyer number to get airline miles or status benefits. In other cases, you may be able to book through a program like Hyatt Prive or Hilton Impresario that does qualify for points and elite night credits.

Promotions or perks are often available to frequent guests

Direct bookings are more profitable to the airline, hotel or rental car agency, as these companies do not have to pay a commission to a third party for your reservations. Thus, you can reap benefits that encourage you to continue booking directly.

For airlines, hotels and rental car agencies, there may be discounts or promotions available to customers who book directly. Additionally, loyalty program members often receive targeted offers and coupon codes that can only be redeemed when you book directly.

When it comes to hotels, you may get a better room by booking directly, even if you don't have elite status. Hotels often give the worst rooms (think: ones with no view, that are small, that are not as updated, that sit next to a service elevator, etc.) to people who book via a third party.

Of course, there are exceptions to this. For example, hotels booked via programs like American Express Fine Hotels + Resorts often offer an upgraded room type.

If the hotel happens to be oversold, booking directly means you're less likely to be "walked" (or moved to another hotel because the property you booked is full). However, loyalty program members who book directly, even those with top-tier status, can still be walked. It's just more likely that the hotel will prioritize customers with status over those who booked with a third party.

If you find a lower price for your hotel from a third party, you may be able to price match or take advantage of a "best rate guarantee." This allows you to book directly but pay a lower price by providing proof of the OTA's price. Keep in mind that your proof has to be for the exact same room type; some hotels may classify a room one way on their websites and differently with an OTA, making it harder to request a price match.

Benefits of third-party bookings

Third-party bookings can make sense for lots of travelers for several reasons. Here are some of the top benefits of third-party bookings:

It is easier to quickly compare prices between different options

Sometimes, when you're planning a trip, you want to compare your options for flights, hotels or rental cars. Instead of going to several different airline, hotel or rental car websites, you can use one third-party site or a travel agent to shop and compare prices.

If you don't have a lot of time to do research but want to stick to a set budget, third-party bookings can be a quick way to book a trip within your budget parameters. They also typically allow you to package airfare, hotel and a rental car into one booking, which can help simplify planning.

You'll often find lower prices and discounts

While you may sometimes find promotions and discounts when making direct bookings, third parties frequently offer steep discounts as well, especially on last-minute hotel stays. Many hotels would rather sell the room via a third-party company and pay the commission instead of the room going unsold. Just keep in mind that you may get the smallest room with a view of a brick wall, as the hotel has no incentive to upgrade you to anything nicer.

Additionally, some of the lesser-known OTAs may offer bigger discounts compared to the more mainstream OTAs. However, buyer beware: They may also be harder to deal with if you run into any problems on your trip or your booking needs a modification or cancellation. Programs like these include brands like HotelTonight.

Some OTAs have their own rewards programs

If you frequently book travel through an OTA, it can be worthwhile to join its rewards program.

Members of One Key, the loyalty program for Expedia, Hotels.com and Vrbo, receive 2% in OneKeyCash for every dollar spent on eligible hotels, vacation rentals, activities, packages, car rentals and cruises. They also get 0.2% in OneKeyCash for every dollar spent on eligible flights.

Similarly, Priceline has a VIP program that offers benefits and discounts based on your status level. Status is earned through completed trips or from having the Priceline VIP Rewards™ Visa® Card.

The information for the Priceline Rewards card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

In some cases, you have a travel advocate

Booking trips through an independent travel agent or travel adviser (rather than an OTA) can actually work to your advantage, especially if you find yourself needing to pivot during a delay or cancellation.

When you need to contact an airline or hotel, it can sometimes be difficult to navigate time zones. But if you book with a travel agent, you can be sleeping in the middle of the night while they handle the rebooking logistics for you.

Travel agents also often have insider information about specific destinations and can recommend activities based on your interests. As an added bonus, they can help you pick activities that fit within your set vacation budget.

Related: Is it better to book a cruise through a travel agent? We say yes

Should you avoid third-party bookings?

The biggest reason to avoid third-party bookings is that these sites function as middlemen, which can cause problems if you have delays or cancellations. It may be difficult to reach a human to speak to if you book a trip with an OTA or credit card travel portal. A lot of communication and customer service for these services is done through email or online chat. When you're trying to rebook travel, time is of the essence, and most people usually don't want to deal with long waits or extensive conversations.

Having travel insurance that covers you for delays and cancellations, either through your credit card or a separate policy you purchased, is always smart, especially if your bookings are through a third party.

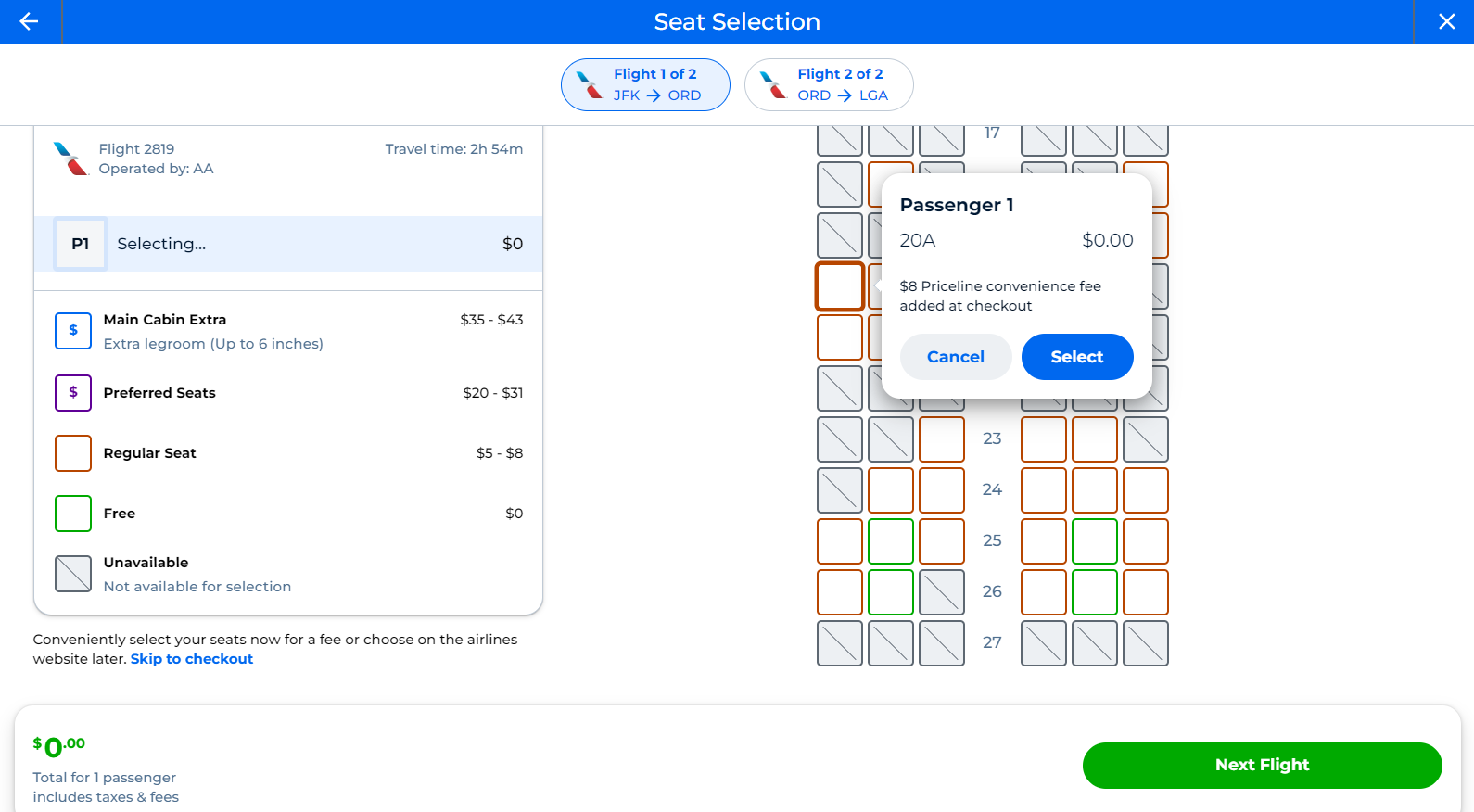

Also, be sure to watch out for fees with third-party bookings. For example, Priceline adds a convenience fee when selecting a seat for a flight, even when the airline itself doesn't charge one. Change and cancellation fees are also common with third-party companies.

That being said, there are several instances when third-party bookings might be the best way to book your travel.

For a last-minute reservation when your plans are unlikely to change, a third-party booking may be a smart choice if it saves you money rather than booking directly. However, if you think you may need to cancel or reschedule your travel, changes are much easier to make when trips are booked directly. It's important to read the fine print, as third-party reservations may be nonrefundable with no options to book a refundable rate (unlike direct bookings, which often offer both refundable and nonrefundable options).

Another instance when you may want to book with a third party is when using credit card benefits that require reserving travel through the card issuer's travel portal. Such benefits may include the annual $50 hotel credit from the Chase Sapphire Preferred® Card (see rates and fees) or the $300 annual travel credit from the Capital One Venture X Rewards Credit Card. The only way to use these benefits is to make your bookings via Chase Travel℠ or the Capital One travel portal.

Third-party bookings can also be a great option when you want to reserve a hotel that isn't part of a major chain, so earning rewards or having status doesn't matter as much.

Bottom line

If being able to easily reach a live customer service representative and seamlessly rebook travel (if needed) is important to you, skip the OTAs and stick with direct bookings. Spending a little more to have those safeguards in place can be worth it.

That said, there may be times when it makes sense to book via a third party. If you've determined the benefits (like a potential deal) outweigh the drawbacks, making a third-party booking may be the best way to go.

Related reading:

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app